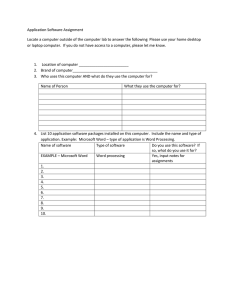

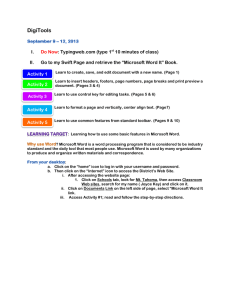

- Microsoft

advertisement