Supervision of Groups: Case Study Solution

advertisement

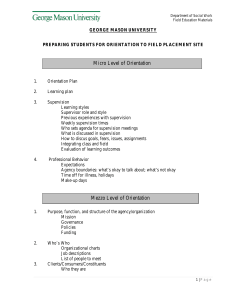

Supervision of Groups: Case Study Solution Keith Pooley Workshop on Cross-Border Supervision and Consolidated Supervision June 2-4, 2015 Beirut, Lebanon Supervision of Groups: Case Study Solution 1 Define the scope of the banking group for consolidated supervision purposes Jordan Industries Banking Group Middle East Bank MEB Holdings Jordan Motors AB Bank Jordan Trading 25% MEB Consumer loans MEB mortgages AB Corporate Finance 40% AB Derivatives Supervision of Groups: Case Study Solution 2 Summarise your view of the group and supervisory issues, including: – whether the banking group has adequate capital at the group level; – the extent of intra-group exposures • Banking group capital is inadequate - consolidated CAR only 7%: • there is limited capital at the holding group level • the Group’s capital is highly geared: Tier 1 52% Tier 2 48% • there is a high level of risk weighted assets in the Consumer Loans and Mortgages subsidiaries (which are unregulated and not subject to solo level capital requirements) • AB Bank includes pro-rated RWAs from AB Corporate Finance and Derivatives • MEB has converted sub-debt into equity for Middle East Bank and AB Bank Supervision of Groups: Case Study Solution • Distribution of capital across regulated entities: – Capital adequacy of Middle East Bank is only 8% on solo basis: if MEB Consumer and MEB Mortgages are consolidated, the CAR would be 3.6% – AB Bank appears comfortably placed at 11% – There is no provision for Pillar 2 risks either at the level of MEB Holdings or Middle East Bank • Intra-group exposures of Middle East Bank within the consolidated group are very high – 300 is 7.5 times capital base (40). • Middle East Bank has 10 (25% of capital) in exposures to companies not subject to solo supervision. - but in both cases we can see through to the risks through consolidated supervision Supervision of Groups: Case Study Solution 3 List the main supervisory work you would expect to undertake on the group over the next year • Review of the governance of the banking group: - Is the board sufficiently independent of the management of Jordan Industries – can they challenge the decisions of the Jordan Industries group where these may conflict with sound management of the banks? - Would the banks benefit from more independent directors, their own finance and internal audit functions? - Why are major credit decisions referred to the Jordan Industries? - Does Middle East Bank Group have a fully constituted Board ? - Does the Middle East Group have a Governance and Risk Management framework that applies across the consolidated banking group? - What is the process for preparing a Consolidated Banking Group ICAAP? Supervision of Groups: Case Study Solution • Review of the intra-group funding: - Is there a documented policy on intra-group funding? - Is intra-group funding conducted at arm’s length? • Review policy on funding entities connected to Jordan Industries? Place restrictions? • Steps to improve overall group capital adequacy within a short timeframe? • Steps to establish a policy on group liquidity management?