Research and Analysis Project

advertisement

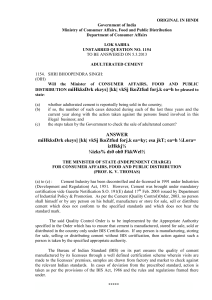

Research and Analysis Project An Analysis of Financial and Business Performance of a Company Over Three Years Lucky Cement Company Limited Name ACCA Registration Number Words: 7498 Content Table 1. 2. 3. Pg RAP INTRODUCTION 1.a Reasons for choosing the topic and company 3 1.b Project objectives 4 1.c Research questions 4 1.d Overall Research Approach 5 INFORMATION GATHERING AND ACCOUNTING/ BUSINESS TOOLS 2.a Secondary sources of information 6 2.b Limitations of information gathering 7 2.c Ethical Considerations 7 2.d Accounting/Business tools and their limitations 8 RESULTS AND ANALYSIS 3.a Overview of the Company, Competitor and Industry 11 3.b Ratio Analysis 12 Sales 13 Profitability 15 Current Ratio 19 Debtors’ Collection Period 21 Creditors’ Collection Period 22 Debt to Equity 23 Earnings per Share 24 3. c SWOT Analysis 25 3. d PEST Analysis 27 4. CONCLUSIONS and RECOMMENDATION 28 Appendix Referencing and Bibliography 30 2 RESEARCH AND ANALYSIS PROJECT 1. RAP Introduction As soon as, I have completed my fundamental examinations of ACCA (Association of Chartered Accountants), I decided to get a BSc honors degree in Applied Accounting and for that I have to submit RAP (Research and Analysis Project). The selection of the topic for RAP was very important. I had gone through all the topics provided on OBU (Oxford Brookes University) info Pack 2014, I selected the topic 8 for my Research and Analysis Project and that is “An analysis and evaluation of the business and financial performance of an organization over three year period”. 1. a. Reason for the selection of the Topic, Industry and the Company My keen interest in carrying out the financial analysis of an organization was the main reason behind my choice for this topic. Being the student of ACCA, the ratio analysis and its interpretation remained a vital part of my accounting curriculum and it developed a special interest of mine towards it. Secondly, I know that an accounting student must be well aware of the key skills of accounting, must be realized with the interpretation of financial statements and must recognize the performance measurement as these are integral parts of ACCA studies. After selecting the topic, the next task was to select the company and Industry. I selected Cement Industry of Pakistan and Lucky Cement Limited as a company for the RAP. I decided to select an industry and a company in which data could be easily accessible. Lucky Cement Limited is a public company and is listed on all three Stock Exchanges of Pakistan. Its financial statements and other information regarding the company and Cement Industry were easily accessible. 3 1. b. RAP Objectives This section is about to describe the aims and objectives of Research and Analysis Project. The main objective of this project is to analyze and evaluate the business and financial performance of Lucky Cement Limited over a three year period. The selected period for the analysis was June 2010 to June 2013. Some other objectives of my Research and Analysis Project are the following: To develop an understanding of the effects of a company’s performance on its business strategy. To identify the factors behind the good or bad performance of the company. To become aware of the overall economy of the country. To measure the performance of cement industry of the country over three years. To evaluate the financial performance of Lucky Cement Limited with the use of Ratio Analysis. To judge the company’s strengths, weaknesses, opportunities and threats using SWOT Model. To examine the environmental factors affecting the company’s performance using PEST analysis. To make a clear comparison of Lucky Cement Limited with D G Khan Cement Limited, to summarize the performance of Lucky Cement Limited and to suggest some recommendations. 1. c. Research Questions I created the following questions so that my RAP can achieve the above mentioned aims and objectives. How the company has financially performed during the selected period? What are the strengths, weaknesses, opportunities and threats of Lucky Cement Limited? What are the environmental factors that affected the company’s performance? What are the ethical issues I have to face during my research? Who will be the competitor of Lucky Cement Ltd and how the competitor has performed during the defined period? What are the required interpersonal and communication skills for interaction with my mentor for making the project successful? 4 1. d. Research and Analysis Project Approach Before starting my Research and Analysis Project, I had a meeting with my college professor Mr. Ahsan Zafar and I told him about my decision. He advised me to have a detailed reading of OBU info pack for 2014. Further, he also told me that the mentoring is the foremost requirement of the RAP. I examined the list of topics available for RAP and I decided to go for topic 8 as I could see that I have much affiliation with this topic. Then I selected that company on which data could be found easily, because my approach of collecting data and information for my report is solely secondary. I requested Mr. Ahsan Zafar to be my mentor for this project. I had some research on the topic and organization before my first RAP meeting, but my research was haphazardly done and when I had my meeting with my mentor I came to know that I should follow the appropriate approach for the project, which is its fundamental requirement. I adopted an organized approach by collecting relevant information and data from secondary source. And the information collection is done by using different mediums of secondary source like books, journal articles, newspaper articles, financial statements and related magazines. I decided the key ratios for financial analysis and SWOT and PEST models for business analysis of the company. Graphs and tables were used for presenting the accounting figures and values so that te analysis could be performed in better way. As soon as, I made a draft of my Research and Analysis Project, I read my objectives and research questions in order to ensure that the draft of my RAP is meeting the set objectives and research questions. Finally, I made a conclusion and suggested some recommendations for the company. The second part of RAP, Skill and Learning Statement describe how effectively I have used my interpersonal and communication skills. 5 2. Information Gathering and Accounting/Business Tools The second part of my project provides a description of the Information Collection and the use of recourses for information gathering, the limitations of my information gathering, ethical issues that arose during the collection and the ways I had resolved them, and an explanation of the Accounting and Business tools and their limitation, that I have used for business analysis of Lucky Cement Limited. Accuracy of collected information is very important; however, data sources determine its precision. The primary source of information is a document or an original work that provides direct evidence of an event, object or person. Primary sources include the interviews from concerned authorities, audio and video recordings,surveys, questionnaire, speeches, email conversations, etc. (Ithaca College Library, n.d.) My research project is solely based on the use of secondary sources after ensuring their authenticity. 2. a.Secondary source of Information secondary source of information interpretes, evaluates and dicusses the information collected from primary sources. Secondary sources include articles, newspapers, magazines, books, internet, DVDs, television and many more. (Ithaca College Library, n.d.) The following is a list of secondary sources that I have used during my research. Annual Reports: Annual reports of Lucky Cement Limited and DG Khan Cement Company Limited were collected from the websites of the respective companies, which provided me the information of financial and business performance for the identified period. ACCA Books: ACCA books were used in order to improve my knowledge related to the accounting and business models, used for financial and business analysis. Internet: ACCA website was used to get the RAP guidelines and to refer to the technical articles written about the BSc Research and Analysis Project. While using internet medium, I visited the website of the Lucky Cement Limited in order to get the information about the company’s history, its market shares and financial reports. Moreover, other websites were also used to find out the competitors’ performance, country’s cement industry trends and global economic conditions. 6 Newspapers: I have collected different newspapers, including trade journals and company’s related articles for the defined period. The newspapers used were Express Tribune, Daily Times, Business Recorder and The Nation in order to gain the most up to date and authentic information about the country’s economy, its effects on the cement industry and the economists’ views of the company’s performance. Magazines: I also studied related magazines that helped me a lot to gather authentic information. Journal Articles, eBooks, PDF: Different online journal articles, eBooks and PDF files were also consulted in order to enhance my knowledge and my ideas by studying different research methodologies, so that I could be able to produce a successful project. 2. b. Limitations of Information Gathering I had to face certain difficulties during the collection of information by using secondary sources. While using the internet, the accuracy, completeness and authenticity of the information were most considerable things and I had to be more careful about them. The newspapers I have collected were not in good positions, most of the related articles were missing and I had to search the related articles from an unorganized huge stockpile. I also had to visit in different libraries so that I could get the updated versions of reference books. 2. c. Ethical Consideration Ethics are defined as “what is right and wrong and how conduct should be judged right and wrong, it is about”.(BPP, P1) All ACCA members, affiliates and students are bound to follow the Code and Ethics and Conduct and its set principles. The principles are:Integrity, Objectivity, Confidentiality, Professional competence and Due Care and Professional behavior. These principles are defined as follows: 1. All members of ACCA should be honest and straightforward in all business and professional relationships. 2. ACCA members should not compromise their professional and business judgment through undue influence of others and conflict of interests. 3. Members must keep all the information confidential that they acquire in their professional and business career. 4. Members must keep their knowledge and professional information up to a certain level that ensures that all clients and business partners get the adequate services. 5. Their behavior must be highly professional following all the rules and regulations and must not conduct any activity that discredits their profession.(Code of Ethics and Conduct, 2011) 7 The main ethical issue that I faced during the execution of my research was the academic integrity. As most of the information which I received was through online medium, true and fair information was a point of consideration and I need to be more careful about unintentional errors and outright falsification of the collected information. Secondly, I also had to face the plagiarism issue, that is to copy someone others work as my own and I had to be very careful in this regard. I used Harvard Referencing System in order to reference the others work. Moreover, to overcome this issue I had installed plagiarism software “Viper” and passed my research report through it. 2. d. Accounting and Business Tools The following is the detail of the accounting and business tools that I have used during my research. Ratio Analysis Ratio Analysis is described as the interpretation of the financial health of a company by studying the relationship of key accounting variables. Ratios are basically used to recognize that how a company has performed over a defined period and to compare with the ratios of other organizations and the industry in order to evaluate the performance of the company.(LSBF ACCA P3: Introduction to Ratio Analysis, 2014) Limitation of Ratio Analysis Despite of the advantages of ratio analysis, the following are the limitations: The ratios can be found distorted if they are used to compare the companies that practice different accounting policies. If the selected two companies from two different industries are compared using ratios, the comparison might be misleading. Ratios are used to explain the past information about the financials of companies, however; the users are more concerned with the cuurent and future aspects affecting the company’s performance. (Accountingexplained, 2014) 8 SWOT Analysis The most common model used for the strategic formulation and planning is SWOT Model. SWOT analysis is used to evaluate a company’s strengths, weaknesses, opportunities and threats. The SWOT techniqueis valuable as it provides an in depth analysis of internal as well as external factors. Strengths The strengths of a business are its capabilities and resources that are considered to develop a competitive advantage for the company over competitors in the market. Human capitals, patents, strong reputation of the company, effective sales strategy and cost advantages are some examples of the strengths of a business. Weaknesses The weaknesses are the absence of strengths in the business or the limitations and such aspects present in the company that lead to the shortcomings against the opponents. High cost structure, high prices of products, weak brand name, poor reputation in the market and lack of best human capital in the company are some examples of weaknesses. Opportunities New opportunities can always be revealed for increasing profits and growth of the company while analyzing the external environmental analysis. Examples of opportunities are arrival of new technologies and removal of international trade barriers etc. Threats External environment also contains certain aspects that could lead to adverse factors or threats to the company. For example: shifts in the customers taste away from the company’s products, advancement, entry of new firms in the market, new regulations, changes in economic conditions and the introduction of substitute products etc.(Quickmba, 2014) Limitation of SWOT Analysis The SWOT technique is limited because of the following factors: The use of internal factors as the strengths and weaknesses and external factors as the opportunities and threats of a company is a subjective decision. Another limitation with the use of SWOT is that there are no understandable limits as to what is and what is notrelevant. The determination of external factors as an opportunity or a threat is not distinguished by SWOT analysis. The same factor can be simultaneously characterized both for opportunities and threats. (Free-management-ebooks, 2014) 9 PEST Analysis The macro environmental factors which affect the business performance of a company can be analyzed by using the acronym PEST. Political The political factors like the change of a government, political instability, change in tax policies, environmental law, and foreign trade policy etc of a country have significant impacts on the company’s performance. Economic The economic factors of a country like inflation rates, interest rates, economic growth and exchange rates etc have also noteworthy influence on the organization’s profits and economic growth. Social Social factors also affect the company’s performance as they indicate the customers’ interest and attitudes of the population. Some important social factors are the customers’ choiceof the products, age distribution, population growth rate, education and career attitudes, relidious belief, cultural and social conventions and health consciousness etc. Technological Technological factors like the advancements in technology, updated versions of installed programs and new concepts have impacts on producing, marketing, distributing goods and services and communicating with target markets.(Team FME, 2014) Limitations of PEST analysis The limitations of PEST Analysis are the following: The external factors which affect the organization are usually dynamic and the change occurs at very fast speed. It is a matter of concern that how these fast changes will affect the future or present concerns of the company. So the PEST analysis has to be conducted regularly to make it effective. The collection of relevant external information from reliable resources and in proper time becomes a little bit difficult for the company. Moreover, the process also restricted by the companies because of cost considerations.(Free-management-ebooks, 2014) 10 3. Research and Analysis 3. a. Overview Lucky Cement Limited Lucky Cement Limited (LCL) is the Pakistan’s largest manufacturer of dry cement and is considered to be the first exporter of a sizeable quantity of loose cement, which has also dominated the local market with its network of 200 dealers across the country. The company was formed in 1996 by “Abdul Razzak Tabba”the founder of “Yunus Business Group”, the Pakistan largest business groups. The group consists of the LCL, the holding company of the group, and its subsidiary companies, LAL Holding Limited, ICI Pakistan Limited and ICI PowerGen Ltd. LCL is a public limited company, listed on all stock exchanges of Pakistan and its shares are also traded on the London Stock Exchange. Currently, the capacity production of LCL is 25000 tons per day of dry cement.(Lucky-cement, 2014) Competitor “DG Khan Cement Limited” I selected DG Khan Cement Limited as a competitor company for the analysis. DG Khan Cement Limited is one of the Pakistan largest cement producer with the annual production capacity of 42 million tons. The company was established in 1978 as a private limited company, under the management of the State Cement Corporation of Pakistan Limited. However, Nishat Group of Companies, a largest business group of Pakistan, has acquired the company in 1992. After the privatization, DG Khan Cement Company was listed on all stock exchanges of the country. (Dgcement, 2014) Cement Industry of Pakistan Cement Industry is the most important segment of the industrial sector of Pakistan, and is playing an essential role towards the economic development in the form of exports, employment and investment. Besides of the facts, that the cement industry has witnessed multiple challenges because of the unrest conditions of Pakistan since 2001 and increasing oil and other commodity prices in the global market, the cement industry has recovered from last six years and has afloat once again. 11 The cement sector of Pakistan is on the way of coverage because of the compelling valuation, improving domestic demand outlook, easing cost pressure and better pricing power. (Rizvi, 2012) All Pakistan Cement Manufacturers Association in its reports states that, the cement industry is based on 29 manufacturers and most of them expanded their operations after year 2002. The cement industry has invested 1.5 billion dollars in capacity expansion since 2008. The domestic market remained stagnant between FY2011 and FY2012. However, FY2013 proved to be a good year with the increase of 22% in exports and marginal growth in domestic cement dispatches. (Apcma, 2014) Acording to the Pakistan Economic survey 2011-2013, after the eruption of the global financial crises after 2008, the world economy is still struggling for its recovery. In 2012, global economic growth has deteriorated further. Pakistan’s GPD was 3.70 during FY2011-FY2012, considered to be the lowest in the region. However, with the strong prospects of economic revival GDP rate has increased to 4.3 during FY2013. Cement sector of Pakistan contributes its due share of 3.5% annually in GDP of the country in the form of tax revenue. The cement sector has grown in recent years because of the increase of investments in smaller scale construction, rapid implementation of PDSP (Pakistan Development Sector Program) schemes and other development projects of Federal and Provincial Government. (Ministry of Finance, 2013) The cement industry has unfortunately suffered from the last few years because of the rapid increase in raw material costs, high cost of energy, rising of transportation costs, upsurge in inflation rates, fluctuating interest rates, political instability and energy crises of the country. However, with the incentives and relief provided in federal budget 2012-2013 like the reduction of excise duty by 200 per ton and 1% of GST, trend in domestic sale is expected to rise in the future. (Siddiqi, 2012) 12 3. b. Ratio Analysis Sales Turnover: (All figures are in thousands and in Pak Rupee) Lucky Cement Limited Years Sales Revenue Volumetric Sales DG Khan Cement FY11 FY12 FY13 FY13 31,767,053 39,123,147 43,738,002 24,915,924 5,891 5,971 6,059 4,008 Sales Revenue 50,000,000 40,000,000 30,000,000 20,000,000 Sales Revenue 10,000,000 FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement In FY11 (financial year 2011), the net sales of Lucky Cement Limited, registered a growth of 6.61%. The net sales were reported at 26,081 million as compared to 24,509 million in FY10.The local sales volume registered at 3.46 million tons with the growth of 11% as compared to 3.12 million tons in FY10. The export sales volume was declined sharply by 32.9% from 3.51 million tons in FY10 to 2.36 million tons in FY11. (Annual Reports, 2011) According to the directors’ report of FY11, the sharp decline in export sales was mainly due to the decrease of clinker and loose cement sales in Middle East countries with slack cement construction and over supply of cement. (Directors’ Report, 11) 13 The financial year 2011 proved to be a tumultuous year for the cement industry of Pakistan. Sluggish demand in local markets, the increase of competition in international markets, disruption of distribution channels due to floods, and increase in raw material cost added up to the bad performance of the industry. The sales growth of the cement industry was declined by 8.2% due to the cut ddown of Governments spending in public infrastructure and other projects.(Khan, 11) The sales of the company were augmented in FY12 to 33,332 million from 26,081 million in FY11, with the increase of 28%. The volumetric sales increased by 3% and achieved the sales of 5.97 million tons in FY12 from 5.81million tons in 2011. The domestic sales volume of the year has registered a handsome growth of 7% in FY12; however the export sales volume has declined slightly by 4% to 2.25 million tons in FY12 from 2.36 million tons in FY11. The company has reported that 62% of the sales revenue was derived from its domestic sales, whereas export sales only contributed to 38% during the financial year 2012.The main reason behind this growth rate in sales was19% increase in selling prices of cement bags. The other factor contributed to the phenomenal performance of the top line figure is the highest bottom line figure of 6,782 million in FY12 as compared to 3,970 million in FY11. The cost of sales has increased by 20%, which was attributable to the increase of 21% in fuel and energy cost, 21 % in raw material cost, and other manufacturing cost, thus pushing the prices upwards. (Annual Reports, 2012) According to the directors’ report, the FY12 was considered to be a milestone year for the cement industry of the country. The domestic sales volume of the cement industry has showed 23.95 million tons, which was the best achievement in the history of cement industry of the country. (Directors’ Report, 12) The reason for the strong sales reported by the cement sector was the 26% increase in cement prices by the cement companies.(The Express Tribune, 2012) FY13 was another excellent year for Lucky Cement Limited. The company has registered massive sales revenue of 37,810 million in FY13 as compared to 33,322 million in FY12, representing an increase of 13.5%. The domestic and export sales also increased by 1.3% and 1.7% respectively during the year 2013. The volumetric sales were up surged by 1.4% in FY13 as compared to the increase of 3% in FY12. The increase in the sales revenue was mainly attributed to higher sales volume and sharp increase in cement prices by the compay in order to off set increases in input costs. (Annual Reports, 2013) The year under review was also the best performing year for the cement sector of the country as the sales for the year were settled at 25.1 million tons with an increase of 4.6%, despite of the fact that elections were held during the year, fuelling a lot of uncertainty for corporate of Pakistan and the economy in general. According to the CEO of Lucky Cement Limited, the consumption of cement is expected to increase in the coming years because of the Government’s allocation of funds towards Public Sector Development Program.(Zaheer, 2013) 14 In FY13, the competitor, DG Khan Cement Limited registered the sales of 24,915 million against 43,738 million of Lucky Cement Limited. The volume sales of DG Khan Cement Limited were 4,008 million tons as compared to 6,059 million tons of Lucky Cement Limited. Moreover, DG Khan Cement Limited produced 4,031million tons of cement while the Lucky Cement Limited produced 6,150 million tons. The lower sales revenue of DG Khan was due to the smaller units of sales and lower production capacity as compared to the Lucky Cement Limited.(Annual Reports, 2013) Profit Margins Lucky Cement Limited Years DG Khan Cement FY11 FY12 FY13 FY13 Gross Profit 8,711,119 12,721,214 16,721,097 9,326,007 Net Profit 3,970,400 6,782,416 9,713,948 5,502,169 Gross Profit Margin % 34 38 44 37 Net Profit Margin % 15 20 26 22 ROCE % 14 22 26 10 Profitability 20,000,000 15,000,000 10,000,000 Gross Profit 5,000,000 Net Profit FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement 15 Gross Profit for the FY11 was 8,711 million against 7,978 million of FY10, represented an increase of 10%. Cost of sales also increased by 4% during FY11, comprised of the increase of fuel and power cost by 23%, increase of internationally coal prices by 40% and increase of packing material cost by 15%. The gross profit margin was reported at 33.5% as compared to 32.6% achieved during the same period last year. Profit after tax (PAT) was improved by 26% at 3,970 million in FY11 as compared to 3,137 million of FY10. The rise in PAT was mainly attributed to the decrease of distribution cost by 5% because of the decline in export sales volume, upsurge of other income by 26% due to increase in domestic sales and the decline of finance cost by 9%. Profit after tax margin was augmented to 15.2% in FY11 from 12.8% in FY10. (Annual Reports, 11) Higher local retention prices primarily contributed in increasing the overall profitability of the company.(The Nation, 2011) FY12 was the best year for the Lucky Cement Limited, as the company showed an impressive growth in the gross profit which has increased by 46.05% (from 8,711 million in FY11 to 12,721 million in FY12). The gross profit margin of the company recorded at 38% in FY12, representing an increase of 13.5% from 33.5% in FY11. The rise in gross profit predominantly attributed to the massive increase in sales. The profit after tax earned by the company was 6,782 million in FY12 as compared to 3,970 million in FY11, showed a gigantic increase of 70.82%. The net profit margin for the year under review was reported at 20.35%, representing an increase of 33.35% with the preceding year net profit margin of 15.26%. (Annual Reports, 2012) The Lucky Cement Limited’s excellent performance of FY12 was highly attributable to the strong sales revenue by the exorbitant cement prices and reduction in cost of sales due to falling coal prices in the international market. The hefty profits of 109.3% from other income and lower finance charges of 51% during the year, with the repayment of loans also improved the earnings of the company during the FY12. (Zaheer, 2013) Being the largest market player in the cement sector of Pakistan, Lucky Cement Limited hasregistered highest profits for the FY13. The gross profit has augmented to 16,721 million in FY13 from 12,721 million in FY12, representing an increase of 34.4%. The Gross profit margin for the FY13 was reported as 44.2% as compared to 38% in FY12. Although the company has paid 42% more tax than last year, the profit after tax has swelled by 43% to 9,731 million in FY13 from 6,782 million in FY12. This was due to the drastic growth of sales and the gigantic increase of other income. The other income was enhanced to 247 million in FY13 as compared to 5 million in FY12. The drastic increase was mainly due to the sale of surplus electricity to HESCO (Hyderabad electric supply company) and PESCO (Peshawar electric supply company) through its power generation units, and the gain on disposal of its property, plant and income.The profit after tax margin was reported at 25.69% with the improvement of 26% from last year. (Annual Reports, 13) 16 DG Khan Cement Limited is considered to be the second largest company of cement industry of Pakistan and the company revealed massive results than preceding years; however, compared withLucky Cement, DG Khan showed lower profits.During FY13, gross profit was registered at 9,326 million against the huge gross profitof 16,721 millionof Lucky Cement. GD Khan gross profit margin was 34% against 44% of Lucky Cement.Thisis because of the fact that DG Khan has much smaller revenue than LCL. Profit after tax was reported at 5,502 million against 9,713 million and PAT margin was 22% against 26% of Lucky Cement.(Annual Reports, 13) Profit Margins 50 40 30 20 Gross Profit Margin 10 Net Profit Margin FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement 17 Return on Capital Employed ROCE 25 20 15 10 5 - ROCE FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement The company showed an increasing trend of return on capital employed ROCE increased from FY2010 11.55% to 13.39% in FY2011, further increased to 18.3% in FY2012 and then reached at 20.97% in FY2013. The increasing trend of ROCE shows the company’s good profitability using its capital recourses in an effective and efficient way. Because of better performance in the domestic market, Lucky Cement recorded huge increase in profits before tax, and growth of capital employed resulted the ROCE to upsurge during the period under review. The ROCE was augmented in FY12 by 39% as compared to 19% rise in FY11.In FY13, ROCE was further improved by 16% because of better profits capitalized into reserves. The ROCE for the FY13 reported by DG Khan Cement, the competitor was10% as compared to the 21% of Lucky Cement.The lower value of ROCE was due to lower profits (Lucky: 9,713 and DG Khan: 5,502) and higher capital employed (Lucky: 46,349 and DG Khan: 54,218).Capital employed of DG Khan Cement mainly due to degree of leverage which is higher than Lucky Cement. DG Khan revealed long term finances of 2,899 million as compared to 127 million of Lucky Cement. 18 Current Ratio Lucky Cement Limited Years DG Khan Cement FY11 FY12 FY13 FY13 0.88 2.64 3.38 2.79 Current Ratio % Current Ratio 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 - Current Ratio FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement In FY11, current ratio was recorded at0.88 against0.71 of FY10. The increase of 23% of current ratio was mainly due to fact that current assets were increased in greater proportion than the increase of current liabilities. Current assets increased by 37% from 6,871 million in FY10 to 9,444 million in FY11;however, current liabilities increased by only 10% from 9,641 million to 10,696 million. The increase of current assets was mainly due to the increase of stock in trade figure from 608 million to 1,248 million; company raised its stock in trade in order to meet the increasing domestic demand of cement. In FY12, the company’s current ratio was enhanced by more than 200% and reported at 2.64. The major reason behind the improvement of current ratio was that short term borrowings of 6,302 million were paid during the yearcaused the decrease of 96% in current liabilities.The value of current liabilities declined from 10, 696 million in FY11 to 3,624 million in FY12. However,current assets were increased only by 1% from 9,444 million to 9,555 million. 19 Current ratio continued to increase and was reported at 3.38 in FY13. Current assets up surged again from 9,555 million in FY12 to 13,013 million in FY13, represented an increase of 36%. The major portion of the current assets was the investment of 110 million in financial assets. These investments not only helped the company to better use of extra reserves, but also enhanced its current ratio by 28%. Moreover, the increase of a company’s cash and balance figure from 844 million in FY12 to 2,805 million was due to better operating performance. Whereas the slight increase of current liabilities was fueled by the 7% increase of trade and other payables.(Annual Reports, 11-13) Company’s illustrated negative working capital and a current ratio of less than one over the years. In FY12 and in FY13, current ratio was 2.64 and 3.38 respectively, which signaled towards impressive and improved liquidity position. This is attributable to the fact that the company has trimmed down its current liabilities which demonstrates that the company is on the strong liquidity avenue. (Business Recording, 2013) By analyzing liquidity condition of the competitor, it is represented that during FY13, DG Khan’s current ratio stood at 2.79:1 against 3.38:1 of Lucky Cement.This difference was because of the massive difference between current assets and current liabilities of both companies.Current assets of DG Khan Cement were higher than Lucky Cement, recorded at 25,983 million as compared to 13,013 million of Lucky Cement because of the gigantic investment of 17,862 made by the competitor during the year. However, the value of current liabilities of competitor was also higher than Lucky Cement, which has offset the difference of current assets, illustrating lower current ratio. (Annual Reports, 13) 20 Debtors Collection Period Lucky Cement Limited Years Debtors Collection Period (Days) DG Khan Cement FY11 FY12 FY13 FY13 9 9 13 4 Debtors Collection Period (Days) 15 10 5 Debtors Collection Period (Days) FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement Debtors’collection days of the Lucky Cement Limited remained constant for FY11 and FY12 at 9 days; however, in FY13 the days were increased to 13 days.In FY11, trade debts decreased from 779 million in FY10 to 620 million; while in the next two years trade debts were increased. In FY12, trade debts were increased by 70% to 1,050 million and further increased in FY13 to 1,668 million. Theincreasing trend for debtor collection days of the company over the yearsdepicts that the company is increasing its investment in trade receivable, resulting not only in the increase of sales but also allowing its customers with a relaxed credit policy.(Annual Reports, 11-13) On the other side, DG Khan, the competitor’s debt collection period was 4 days for FY13. This shows that the competitor has better management policy regarding its collection of debts as compared to LCL. Despite of the fact that competitor has squatter receivable days; Lucky Cement Limited has shown larger sales revenue for the period under review because of better operating performance.(Annual Reports, 13) 21 Creditors Payment Period Lucky Cement Limited Years DG Khan Cement FY11 FY12 FY13 FY13 85 59 62 53 Creditors Collection Period (Days) Creditors Collection Period (Days) 90 80 70 60 50 40 30 20 10 - Creditors Collection Period (Days) FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement The creditors’ payment period of the Lucky Cement Limited fell from 85.2 days in FY11 to 59 days in FY12 but increased to 61.8 days in FY13. The fluctuating trend of the creditor payment period indicates that the company is not having an effective creditors’ payment policy and care must be taken in order to pay its suppliers promptly. The current erratic policy may not only damage the company’s repute, but can also make the suppliers reluctant to supply the goods in future. Creditors’ payment period of the competitor, DG Khan Cement Limited for financial year 2013 was 53 days as compared to 62 days of Lucky Cement Limited The efficiency condition shows that competitorcompany has potential to manage its debtors and creditors better than the Lucky Cement Limited. 22 Debt to Equity Lucky Cement Limited Years Debt to Equity DG Khan Cement FY11 FY12 FY13 FY13 0.02:1 0.01:1 0.00:1 0.06:1 Lucky Cement Limited’s debt to equity ratio was declined over three years, becoming zero percent in FY13.This represents the strong leverage position of the company and that the company is trying to finance its operations entirely by equity. This was helped because of the decline in long term debtfrom 652 million in FY11 to 392 million in FY12, further declined in FY13 to 127 million.(Annual Reports, 11-13) Compared with DG Khan Cement leverage position, the competitor’s longterm debt was relatively higher in FY13, representing a higher debt to equity ratio. Longterm debt was recorded at 2,899 million as compared to 127 million of Lucky Cement Limited. DG Khan showed a high leverage position over the years. However, in FY13 company saw its finance cost declined by 41% compared to FY12. Interest and mark-up on long term loans as well as long term borrowings were reduced by 50%, signaling that the company is on the way to retire long term debts made for expansion in previous years.(Business Recording, 2013) 23 Earnings per Share Lucky Cement Limited DG Khan Cement Years FY11 FY12 FY13 FY13 Earnings per Share % 12.28 20.97 30 13 There was a gigantic increase in LCL’s earnings per share during the period under review Earnings per share was reported at 12.28 in FY11 from 9.7 in FY10. EPS earned a growth of 75% in FY12 and was documented at 20.97. It was further increased in FY13 by 43% and reached at 30.04. The growth in earnings per share was due to huge jumps around on earnings during three years (due to reasons mentioned above). The company did not issue shares during reviewed three years and the upsurge of EPS was solely because of better operating performance of the company revealing highest profits. By analyzing the performance of LCL with competitor DG Khan, competitor’s EPS was too low as compared to the LuckyCement Limited. In FY13, earnings per share of DG Khan were 13 against 30.04 of LCL.The competitor also did not issue shares during the year and this was solely due to the low profits earned by the competitor. Earnings per Share 35 30 25 20 15 Earnings per Share 10 5 FY11 FY12 FY13 Lucky Cement Limited FY13 DG Khan Cement 24 3. c. SWOT Analysis Strengths Lucky Cement Limited is a part of one of the largest business group of Pakistan, Yunus Brother Group, is the leader of cementindustry acquiring 20% of market share in the year 2013.(Zaheer, 2013) Lucky Cement is the largest cement producer of the country;its profits are high and a healthier balance sheet in the cement industry of Pakistan. (Annual Reports, 13) Lucky Cement has the advantage of being the only company that sells cement across the country.(Annual Reports, 12) The company was declared as the brand of the year 2012 in category of cement.(Annual Reports, 12) The company has diversified its business during the year 2012 into four well established segments of soda ash, life science, polyester fiber,and chemicals with the acquisitionof 75% stake in ICI Pakistan.(Dawn, 2012) Lucky is the only manufacturer in Pakistan, which has its own loading and shipping terminal and exclusive supply chain management system, helping the company to receive and deliver the products in a timely manner.(Business Reorder, 2013) Moreover, the company is also the largest cement exporter of Pakistan, meeting the quality standards of more than 22 countries of South and Middle East Asia and African countries including South Africa.(Abduhu, 2012) Weakness Lucky Cement Limited’s inconsistent payment period depicts that the company has not efficient policies of managing its creditors and suppliers, despite having enough resources to manage them in an appropriate way. 25 Opportunities Due to the rise in infrastructure expenditures on the back of Government allocation of funds for the Public Sector Development Program, it is expected that the domestic demand will rise in future, resulting in boosting the company’s revenues and profits.(Annual Reports, 13) Cement industry of Pakistan imports major share of coal in order to meet energy needs.The prices of coal have declined in international market.Coal prices have declined by 18% alone in first 10 months in year 2013 due to weak global demand.The drop in coal prices is a positive sign for cement industry, leading to an increase in the margins of cement companies running in the country (Zaheer, 2013) Lucky Cement Limited can take advantage of its strong financial position by undertaking new expansion plans and investments in new projects.Currently, the company is engaged in various projects in Africa and Middle East and it also expects its joint venture investments in cement plants in Democratic Republic of Congo and a cement grinding facility in Iraq. (Mehdi, 13) Threats The anticipated increase in utility costs, weakening of home currency against the US Dollar, interest rate hike by the State Bank of Pakistan are some of the key challenges for the company incoming years.(Anis, 13) 26 3. d. PEST Analysis Political Factors Pakistan remained politically stable during FY11and FY12; however, during financial year 2013 the political situation was not stable in Pakistan because 2013 was an election year and the general election was held on May 2013. It was expected that the rising political temperature in the country will affect the company’s operating performanceduring 2013 but the company’s better management policies have effectively overcome this issue. The government policies proved to be remarkable for the cement industry of Pakistan. Higher spending by the Government towards PSDP led to the upsurge of cement demand in Pakistan.The public sector projects under this program includes the construction of large and small dams, powerlands, highways, roads, irrigation canals, rapid transit systems and flyovers etc. Most of the ongoing projects were already in the pipe line when Government of Pakistan People’s Party, took control from the Government of General Pevaiz Musharraf in 2008.(Haq, 2013) Moreover, the Government decision including the increase of gas tariffs for captive power plant 17% also proved to be a beneficial for the cement sector as most of the cement companies in the industry meets its electricity demand through captive generation.(Business Recorder, 13) Economic Factors During the period under review, the economy of Pakistan faced and is facing several challenges like the gas and power shortage, the increase of circular debt, rising inflation and unprecedented rise in oil prices the world economic slowdown of 2008, which shocked the developing as well as developed sectors of the world, Pakistan with no exception felt the heat. Moreover, ongoing war against extremism and terrorism in Pakistan also impacted adversely causing imperial loss to the economy of the country. Despite of the above mentioned problems, the cement sector is on the way of improvement, growth rate recorded was 52% in FY13 as compared to 32% in FY12.(Ministry of Finance, 2013) Social Factors Lucky Cement being socially responsible also led the way in social development and growth by indulging itself in various educational and health programs. The educational efforts by the company includes granting numerous scholarships to students on merit and the construction of various schools. Lucky Cement is one of the few companies in Pakistan to report its sustainability initiatives and was granted an A+ ranking by the GRI Institute of Netherlands for its Sustainability Report 2012.(Daily Times, 2014) 27 Technological Factors The entire process of manufacturing cement from collection of raw material to the production of end product depends on technology. Lucky Cement Limited has allocated a considerable amount of its resources towards technology in order to remain ahead of its competitors in the market.The company’s IT department focuses on strategic direction of the company in terms of technology, ensure adequate information security and business continuity management including disaster recovery.(Annual Reports, 13) 4. Conclusions and Recommendations Lucky Cement Limited is the Pakistan’s largest manufacturer of dry cement and the largest exporter of cement. Lucky Cement Limited is a public limited company, listed on all stock exchanges of Pakistan and its shares are also traded on the London Stock Exchange. The capacity production of LCL is 25000 tons per day of dry cement. Sales of the Lucky Cement Limited reported an increasing trend during the period under review. The main factors involved in the increase of sales were the sharp increase in the domestic sales because of the Government Public Sector Development Program and the increase in the selling prices by 26%. The competitor exhibited lower sales revenue in FY13 due to lesser volume sales as compared to the Lucky Cement Limited. The profitability margins of Lucky Cement Limited also increased during the period under review because of better operating performance and better sales revenue. DG Khan Cement Limited, showed lower profits because of the fact that DG Khan has much smaller revenue than LCL. Company’s illustrated negative working capital and a current ratio of less than one over the years. However, In FY12 and in FY13, current ratio clocked in at 2.64 and 3.38 respectively, which signaled towards impressive and improved liquidity position. DG Khan’s current ratio stood at 2.79:1 against 3.38:1 of Lucky Cement. The increasing trend for debtor collection days of the company over the years depicts that the company is increasing its investment in trade receivable. The fluctuating trend of the creditor payment period indicates that the company is not having an effective creditors’ payment policy and care must be taken in order to pay its suppliers promptly. Lucky Cement Limited’s debt to equity ratio represents the strong leverage position of the company and that the company is trying to finance its operations entirely by equity. DG Khan showed a high leverage position over the years. The colossal upsurge of EPS was solely because of better operating performance of the company revealing highest profits. 28 The strengths of the Lucky Cement Limited are: A part of one of the largest business group of Pakistan The largest cement producer of the country The only company that sells cement across the country The acquisition of 75% stake in ICI Pakistan Having own loading and shipping terminal and exclusive supply chain management system The largest cement exporter of Pakistan The main weakness of the company was its inconsistent payment period during the period. The rising domestic demand of cement, the drop of coal prices on internal level and new expansion plans and investments on new projects can provide the company a better opportunity to increase its operating growth. However, the anticipated increase in utility costs, weakening of home currency against the US Dollar, interest rate hike by the State Bank of Pakistan are some of the key challenges for the company in coming years. Recommendations The company must introduce an effective creditorsmanangement policy. Moreover, it should reduce the input costs. 29 Appendix Reference List Abduhu, S. (2012). Lucky Cement fails quality tests in South Africa market. The Nation. [online] Available at: http://nation.com.pk/business/06-Aug-2012/-lucky-cement-failsquality-tests-in-south-africa-market [Accessed 13 Oct. 2014]. Accountingexplained.com, (2014). Advantages and Limitations of Financial Ratio Analysis. [online] Available at: http://accountingexplained.com/financial/ratios/advantages-limitations [Accessed 16 Sep. 2014]. Anis, k. (2013). Lucky Cement Profit Rises 47% to Record on Higher Prices. Bloomberg. [online] Available at: http://www.bloomberg.com/news/2013-09-17/lucky-cement-profitrises-47-to-record-on-higher-prices.html [Accessed 17 Oct. 2014]. Apcma.com (2014). All Pakistan Cement Manufacturers Association. Available at: http://www.apcma.com/ [Accessed 23 Sep. 2014]. BPP. ( 2012) Paper P1, Governance, risks and Ethics. London: UK. Business Recorder, (2013). D G Khan Cement Limited. [online] Available at: http://www.brecorder.com/brief-recordings/s:/1248095:d-g-khan-cement-limited/ [Accessed 13 Oct. 2014]. Business Recorder, (2013). Lucky Cement Limited. [online] Available at: http://www.brecorder.com/brief-recordings/0/1246753/ [Accessed 18 Oct. 2014]. Code of Ethics and Conduct. (2011). 1st ed. London: ACCA. Daily Times, (2014). Lucky Cement records Rs 5.16bn profits for half year. [online] Available at: http://www.dailytimes.com.pk/business/27-Feb-2014/lucky-cement-recordsrs-5-16bn-profits-for-half-year [Accessed 18 Oct. 2014]. Dawn, (2012). Lucky Cement declares Rs6.78bn profit. [online] Available at: http://www.dawn.com/news/742506/lucky-cement-declares-rs6-78bn-profit [Accessed 13 Oct. 2014]. 30 DG KhanCement Limited (2013).Annual Reports. Dgcement.com (2014). [online] Available at: http://www.dgcement.com/ [Accessed 22 Sep. 2014]. Directors’ Report (2012) . Company’s performance. Annual reports, Lucky Cement Limited 2012. Finance.gov.pk (2013). | Ministry of Finance | Government of Pakistan |. Available at: http://www.finance.gov.pk/survey_1213.html [Accessed 23 Sep. 2014]. Free-management-ebooks.com, (2014). Advantages and Disadvantages of SWOT Analysis. [online] Available at: http://www.free-management-ebooks.com/faqst/swot06.htm [Accessed 17 Sep. 2014]. Free-management-ebooks.com, (2014). Advantages and Disadvantages of PEST Analysis. [online] Available at: http://www.free-management-ebooks.com/faqst/pestle09.htm [Accessed 20 Sep. 2014]. Haq, R. (2013). Pakistan Construction Boom Drives Jan 2013 Cement Demand to Double Digits. Pakistandefense. [online] Available at: http://defence.pk/threads/pakistanconstruction-boom-drives-jan-2013-cement-demand-to-double-digits.233626/ [Accessed 17 Oct. 2014]. Ithaca College Library, (n.d.). Primary and Secondary Sources. [online] Available at: http://www.ithacalibrary.com/sp/subjects/primary [Accessed 16 Sep. 2014] khan, N. (2011). A tumultuous year for the cement industry. Pakistan Today, p.10. LSBF ACCA P3: Introduction to Ratio Analysis. (2014). [video] Youtube. Lucky Cement Limited (2011). Annual Reports. P1-129. Lucky Cement Limited (2012). Annual Reports. P1-116. Lucky Cement Limited (2013). Annual Reports. P1-195. Lucky-cement.com (2014). [online] Available at: http://www.lucky-cement.com/ [Accessed 22 Sep. 2014]. Mehdi, A. (2013). Lucky Cement performance. Dawn. [online] Available at: http://www.dawn.com/news/1044730 [Accessed 15 Oct. 2014]. n.k, (2011). Lucky Cement profit rises by 26.55pc. The Nation, p.11. n.k, (2013). Lucky Cement Limited. Business Recording, p.21. Quickmba.com, (2014). SWOT Analysis. [online] Available at: http://www.quickmba.com/strategy/swot/ [Accessed 17 Sep. 2014]. 31 Rizvi, F. (2012). Pakistan Cement Sector. 1st ed. [ebook ] CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS, pp.1-3. [online]. Available at: http://www.mrsecurities.com.pk/PakistanCementSector.pdf [Accessed 21 Sep. 2014]. Siddiqi, H. (2012). Cement industry poised for growth. Business Recorder, 01 August, [online] Available at: http://www.brecorder.com/articles-a-letters/626:/1222558:cementindustry-poised-for-growth/?date=2012-08-01 [Accessed 23 Sep. 2014]. Team FME, (2014). PESTLE Analysis. 1st ed. [ebook] pp.4-21. Available at: http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf [Accessed 20 Sep. 2014]. The Express Tribune, (2012). Cement industry’s profits grow seven times in fiscal 2012. 26 September, [online] Available at: http://tribune.com.pk/story/442471/cementindustrys-profits-grow-seven-times-in-fiscal-2012/ [Accessed 27 Sep. 2014]. Zaheer, F. (2013). Lucky cement’s lucky streak continues. The Express tribune, p.11. Bibliography List BPP. ( 2012) Paper F7, Financial Reporting. London: UK. BPP. ( 2013) Paper P3,Business Analysis. London: UK. Haq, R. (2012). Haq's Musings: Credit Suisse Bullish on Pakistan Cement Sector. [online] Riazhaq.com. Available at: http://www.riazhaq.com/2012/10/credit-suissebullish-on-pakistan.html [Accessed 28 Sep. 2014]. http://www.accaglobal.com, A. (2014). Project pass notes Research and Analysis Project | Student Accountant magazine archive | Publications | Students | ACCA | ACCA Global. [online] Accaglobal.com. Available at: http://www.accaglobal.com/ca/en/student/accaqual-student-journey/sa/study-skills/project-pass-notes-research-and-analysisproject.html [Accessed 16 Sep. 2014]. http://www.accaglobal.com, A. (2014). Why do students fail their RAP? | Student Accountant | Publications | Students | ACCA | ACCA Global. [online] Accaglobal.com. Available at: http://www.accaglobal.com/pk/en/student/acca-qual-studentjourney/sa/study-skills/why-do-students-fail-their-rap-.html [Accessed 16 Sep. 2014]. 32 Lucky-cement.com, (2014). Lucky Chronicles. [online] Available at: http://www.luckycement.com/newsletter/issue1/chronicles.html [Accessed 26 Sep. 2014]. Mehdi, A. (2013). Tepid growth in cement sector. Dawn. [online] Available at: http://www.dawn.com/news/1080191 [Accessed 26 Sep. 2014]. The Express Tribune, (2013). Corporate results: Lucky Cement’s lucky streak continues. [online] Available at: http://tribune.com.pk/story/605690/corporate-results-lucky-cementslucky-streak-continues/ [Accessed 28 Sep. 2014]. Zaheer, F. (2013). In fiscal 2014, Cement sector to solidify position as margins expected to grow further. The Express tribune, p.10. 33