FE5106 Advanced Numerical Methods

Lecture 1: Introduction to QF4102

Financial Modeling

Dr. DAI Min matdm@nus.edu.sg

, http://www.math.nus.edu.sg/~matdm/qf4102/qf4102.htm

Modern finance

• Modern Portfolio Theory

– single-period model: H. Markowitz (1952) optimization problem

– continuous-time finance: R. Merton (1969), P. Samuelson stochastic control

–

We take risk to beat the riskfree rate

• Option Pricing Theory

– continuous-time: Black-Scholes (1973), R. Merton (1973)

– discrete-time: Cox-Ross-Rubinstein (1979)

–

We eliminate risk to find a fair price

Option pricing theory

• Pricing under the Black-Scholes framework

– Vanilla options

– Exotic options

• Pricing beyond Black-Scholes

– Local volatility model

– Jump-diffusion model

– Stochastic volatility model

– Utility indifference pricing

– Interest rate models

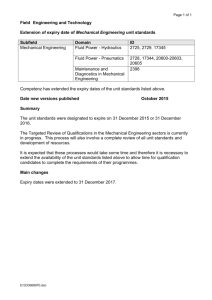

Lecture outline (I)

• Aims of the module

– The goal is to present pricing models of derivatives and numerical methods that any quantitative financial practitioner should know

• Module components

– Group assignments and tutorials: (40%)

• A group of 2 or 3, attending the same tutorial class.

• ST01 (Thu): 18:00-19:00, LT24; (MQF and graduates)

• ST02 (Wed): 17:00-18:00, S16-0304; (QF)

– Final exam: (60%), held on 21 Nov (Sat)

Lecture outline (II)

• Required background for this module

– Basic financial mathematics

• options, forward, futures, no-arbitrage principle, Ito’s lemma,

Black-Scholes formula, etc.

– Programming

• Matlab is preferred, but C language is encouraged.

• For efficient programming in Matlab, use vectors and matrices

• Pseudo-code: for loops, if-else statements

• Course website: http://www.math.nus.edu.sg/~matdm/qf4102/qf4102.htm

Numerical methods

• Why we need numerical methods?

– Analytical solutions are rare

• Numerical methods

– Monte-Carlo simulation

– Lattice methods

• Binomial tree method (BTM)

• Modified BTM: forward shooting grid method

• Finite difference

– Dynamic programming

– Handling early exercise

Brief review: basic concepts

• A derivative is a security whose value depends on the values of other more underlying variables

• underlying: stocks, indices, commodities, exchange rate, interest rate

• derivatives: futures, forward contracts, options, bonds, swaps, swaptions, convertible bonds

Forward contracts

• An agreement between two parties to buy or sell an asset (known as the underlying asset) at a future date

(expiry) for a certain price (delivery price)

• Contrasted to the spot contract.

• Long Position / Short Position

• Linear Payoff

Forward contracts (continued)

• At the initial time, the delivery price is chosen such that it costs nothing for both sides to take a long or short position.

• A question: how to determine the delivery price?

Options

• A call option is a contract which gives the holder the right to buy an asset (known as the underlying asset) by a certain date

( expiration date or expiry ) for a predetermined price ( strike price ).

•

Put option: the right to sell the underlying

•

European option

: exercised only on the expiration date

•

American option

: exercised at any time before or at expiry

Vanilla options

• The payoff of a European (vanilla) option at expiry is

( S

T

( K

K )

S

T

)

max( S

T

K , 0 ) ---call

---put where S

T

-- underlying asset price at expiry

K -- strike price

• The terminal payoff of a European vanilla option only depends on the underlying price at expiry.

Exotic options

• Asian options :

( A

T

K )

, where A

T

1

T

T

0

S t dt

• Lookback options : ( M

T

K )

, where M

T

max

0

t

T

S t

• barrier options: ( S

T

K )

I

{ S t

H , t

[ 0 , T ]}

• Multi-asset options:

( S

1 T

S

2 T

)

,

max( S

1 T

, S

2 T

)

K

Option pricing problem

European vanilla option:

At expiry the option value is

V

T

( S

T

( K

K

S

T

)

)

for call for put

Problem: what’s the fair value of the option before expiry,

V t

?

for 0

t

T

No arbitrage principle

• No free lunch

• Assuming that short selling is allowed, we have by the no-arbitrage principle

Applications of arbitrage arguments

• Pricing forward (long):

• Properties of option prices:

Binomial tree model (BTM): CRR (1979)

• Assumptions:

• Model derivation

– Delta-hedging

– Option replication

Risk neutral pricing

Continuous-time model: Black-Scholes (1973)

• GBM assumption

Brownian motion and Ito integral

Black-Scholes model (continued)

• Ito lemma

• Delta-hedging

Black-Scholes equation

• For Vanilla options

• Black-Scholes formulas:

Comments

• In the B-S equation, S and t are independent

• The B-S equation holds for any derivative whose price function can be written as V(S,t)

• Hedging ratio: Delta

• Risk neutral pricing and Feynman-Kac formula

Another derivation: continuous-time replication

Continued

Module outline

• Monte-Carlo simulation

• Lattice methods

– Multi-period BTM

– Single-state BTM

– Forward shooting grid method

– Finite difference method

– Convergence/consistency analysis

• Applications of lattice methods

– Lookback options

– American options

Module outline (continued)

• Numerical methods for advanced models (beyond Black-

Scholes)

– Local volatility model

– Jump diffusion model

– Stochastic volatility model

– Utility indifference (dynamic programming approach)