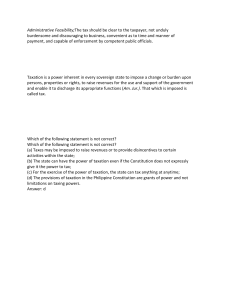

Quiz for Lesson 3 1. All property that is taxable must be subject to the same level of taxation uniformity. A businessman is an example of how the concept of uniformity in taxation requires that all taxable products or any sorts of property in the same class be taxed at the same rate. While the idea behind equitable taxation is that rates should be fair and determined by individuals' desire to pay. For instance, two households with equivalent incomes and family sizes may anticipate paying equal tax burdens under the idea of taxation in justice. 2. According to Kant, freedom is the capacity to exert control over one's behavior based on reason rather than desire. He contends that there is only one fundamental right, which is freedom (the absence of restrictions imposed by the choices of others), to the extent that both rights can coexist within the principles of universal law. As the state cannot lawfully impose any particular concept of happiness on its citizens, he further contends that the welfare of the people cannot be the basis of political power. As interfering with another's freedom is believed to be forcing the other to be happy as the former thinks fit, freedom highlights the autonomous right of all persons to conceive of happiness in their own way. 3. For me freedom is having the opportunity to do things that you want without any hindrances but knowing your limitations. Even voicing out your own opinion is freedom but know where you would stand. While morality for me is an awareness of the distinction between right and wrong when you are deciding for your own because you are aware of the consequences that your decision will cause. And justice is something that we can relate with equality, it involves the nature of human relationships which is more on how they are treating one another. And it is given to those who need to be treated right and fair and in accordance with laws which ensures no harmful act should fall upon others. And lastly, I can relate fairness with justice because you can give justice when treating people fair and without them feeling discriminated against and unfair treatment. 4. According to Article 6 Section 28 of the 1987 Philippine Constitution, charitable organizations, churches, mosques, non-profit cemeteries, as well as lands, buildings, and improvements are exempt from paying taxes. The President may set tariff rates, import, and export quotas, tonnage and wharfage dues, and other duties or imposts within the framework of the national development program. Also free from taxation are charitable institutions, churches, mosques, cemeteries, lands, buildings, and upgrades. A tax exemption cannot be approved without the support of all Congressmen.