Sourcing processes (Once the decision to outsource has

Samenvatting Sourcing

A general introduction into purchasing management

1. What is purchasing?

We define purchasing as ‘everything associated with an incoming invoice’.

- One of the first things to notice is that invoices are not only associated with buying, but with renting and leasing as well.

- Second, this definition does not distinguish between the kinds of items that are purchased, it states ‘everything’ associated with an incoming invoice. It applies to goods as well as services and works.

- Thirdly, both purchases for primary and supporting processes are considered. A distinction can be made between primary (or BOM) and indirect (or MRO or NPR) purchasing, but when looking at the purchasing function, both primary and indirect purchasing categories have to be included.

· Primary purchasing is also referred to as BOM (Bill Of Material) purchasing.

· Indirect purchasing is also called MRO (Maintenance, Repair and Operations) or

NPR (Non Product Related) purchasing.

- A fourth point that we would like to emphasize is that some forms of purchasing are not always regarded as such because of their ‘disguise’ but they do fall under our definition.

· One of them is outsourcing of entire tasks or departments.

· Another one is the internal expense accounts.

These are often booked as general, unclassified costs, but are definitely purchases and can actually represent a wide range of purchasing categories and add up to large amounts.

· A third one are contract extensions that are often agreed to tacitly. These mean a commitment based upon which purchases will done.

- A last example of purchases is investments.

- When looking at the purchasing function fixed costs such as taxes and obligatory, government dictated insurances

(e.g. social security fees) are usually left out. These expenses can’t be influenced.

1.1. Basic purchasing process

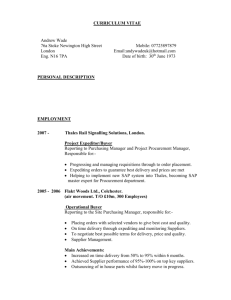

The purchasing process consists of a number of activities that can be combined and laid out in six main steps. These steps are represented in a simple but effective way by Van Weele’s model that is shown in the illustration below.

Specifying

The result of this step is the Program of Requirements, listing all requirements a supplier has to meet in its offer.

These are not only all requirements for the goods or services to be purchased, but may also include requirements for the relationship with the supplier and additional services he has to provide, such as maintenance and supply of spare parts.

The specifications are of key importance to the entire purchasing process. It will not be easy to find a suitable supplier when the initial requirements were incomplete or even not right. A common mistake is also to over-specify, which is often done out of insecurity of the buying organization about getting the right offer. A distinction is made between functional and technical specifications.

- Functional specifications describe what the good or service actually has to do or provide.

- Technical specifications describe in a very detailed manner which product or service is looked for.

The last part of the specification stage is to draw up selection criteria against which supplier proposals will be evaluated in a later stage.

Selecting

Selecting is first of all selecting the suppliers that are invited to submit their offer and second it is selecting out of these the supplier with the best offer.

The first selection is an important step. It can be done in several ways.

- Make a public announcement of planned purchases so that all interested suppliers can submit their proposal

- The other option is to invite suppliers.

Suppliers are invited to compose their proposal based upon the Program of Requirements and all other relevant information such as a description of purchaser’s organization, the proposed legal terms and conditions, and the desired format for the offer. To make the initial selection it is necessary to define supplier selection criteria. These are derived from the Program of Requirements.

The difference between selection criteria and award criteria is important to note.

· The selection criteria all relate to the supplier and its organization, like size, geographical presence, and experience.

· The award criteria all relate to the content of the proposal, such as quality of the offer and price.

Contracting

Contracting is the stage entered into once the supplier(s) has been selected and a contract is going to be signed. The contract includes the Program of Requirements, the terms and conditions and agreed pricing.

Once a contract has been concluded its content has to be communicated to the parties in the organization that will be affected by the new contract.

- The legal department will file the contract and may be assigned the task of monitoring the contract’s validity in terms of duration period and correctness

- Accounts payable has to be informed so they can set up a new supplier in the financial system and arrangements about payments (e.g. collective invoices) can be briefed.

- End users of the new product or service may need information, a demonstration or a course to work with it

- logistic services, technical maintenance and facility management, depending on the kind of product or service purchased.

Ordering

Ordering is the actual requesting of a delivery. An order can be a one-off or frequently repeated.

In most organizations, an order is preceded by a requisition that is initiated by the end user and is to be approved before an order can be issued.

Monitoring

Firstly is monitoring the order once it has been placed. This includes the processing of the incoming invoices and related payments, as well as the follow up of late and faulty deliveries and invoices that have been received but are not correct.

Second, monitoring is about checking whether the operational purchasing process is executed conform agreed standards. This includes surveying whether the performance internally corresponds with the implemented quality system as well as surveying whether the supplier’s performance corresponds with contractually agreed terms and conditions.

Monitoring the operational performance of the suppliers generates important information that can be used to evaluate suppliers’ overall performance and helps to improve this.

Servicing

Servicing is necessary when situations occur during the operational purchasing process that need to be resolved. This kind of situation can be identified during the monitoring stage but can just as well come up during the ordering stage of the purchasing process. Servicing usually concerns occasional problems with a specific order or delivery. Servicing usually involves talking to the supplier, not necessarily to complain but to learn why things went differently and decide on how to do things better next time.

A lot of people still think that the most important activities in purchasing are ‘negotiating’ and ‘concluding favorable contracts’ to squeeze out the last possible percent points of discount. With regard to cost control, influence is definitely greatest during the specification stage. This is where is decided what exactly is going to be purchased.

Changing a specification will usually have a much larger effect on the purchasing price than negotiating about discounts. The following graph visualizes this theory.

The individual steps of the purchasing process not always get the same amount of attention. Purchases with a high financial or strategic importance such as capital goods get a lot of attention during the tactical stage because of the apparent risks involved. The tactical and operational purchasing often coincide as deciding on the supplier is in fact the same thing as placing the order, so the operational process takes up virtually no time at all.

1.2. Elements of the purchasing function

The purchasing function is more than just the purchasing process. A number of elements have to be organized properly to support the purchasing process and adequately facilitate a successful purchasing practice.

Clients and suppliers

Clients of the purchasing function are all employees that make use of the products and services purchased. This means that the entire organization is a client of the purchasing function.

Suppliers define the market that the purchasing function has to deal with. Suppliers are purchasers’ main external counter part. The relationship with suppliers is an important element in the purchasing function.

Methods and procedures

Methods support the execution of steps in the purchasing process by providing a standard approach. A method describes how a certain activity has to be done and hence helps to increase the effectiveness of this activity and sets a standard that helps to realize uniform working practices and quality.

Procedures prescribe the way of working to standardize this throughout the organization. A procedure describes which actions have to be done by whom. Standardization aims at maintaining a certain level of quality and efficiency.

Both procedures and methods have a large influence on the quality of the purchasing processes. The design of these is an important part of implementing a professional purchasing function.

Methods and procedures can either be manual or automated. Electronic procurement is basically about automating the execution of procedures.

Personnel and organization

As stated before, the quality of the people working on purchasing tasks largely defines the quality of the purchasing function. It is important to determine the purchasing tasks and assign them to the right people. This involves deciding how these people will work together, in which structure they will be organized and who reports to whom.

This is called the purchasing organization.

One of the main questions is whether or not to establish a separate purchasing department and where to position such department in the overall organizational structure. It is important to realize that not all purchasing tasks will be assigned to purchasing personnel.

Information services

Information is necessary and useful in all steps of the purchasing process. It serves different objectives and can be used by several people and departments to better perform their task. Information can be either qualitative or quantitative. Very important aspects of information are the availability and the accessibility of information.

Purchasing policy and performance indicators

The purchasing policy states the way an organization wants to profile itself towards external parties, such as suppliers, by providing principal guidelines.

Performance indicators are those measurable indicators of the purchasing function that have been identified as representative for purchasing performance as a whole. These indicators are directly derived from the purchasing strategy

The racecar model

All steps of the purchasing process and all elements of the purchasing function are comprised in a model as illustrated below. Because of its shape, it is called the racecar model.

2. Purchasing function and purchasing department

Not all organizations have a purchasing department. Most organizations with a considerable spend however do have a purchasing department. The responsibilities of this department vary largely, and the department can vary from an operational ‘order processing unit’ to a highly professional tactical purchasing function.

Whether an organization has a purchasing department or not, purchasing is never done by just one person or one

(purchasing) department. Some examples show that a lot of different parties are involved in different steps of the purchasing process:

· A group representing the users of the products and services, e.g. maintenance staff, product manager, end user, decides on the specifications.

· Internal auditors screen the financial stability of a supplier that has shown interest.

· The legal department draws up the contractual terms and conditions;

· A team of users and subject matter experts evaluates supplier proposals.

· The board of directors makes the financial decision in large investments.

· Ordering is often delegated to the logistics department or to end-users.

· A key user group is asked to evaluate a supplier’s performance.

- Decentralized responsibilities also add to the number of people involved in purchasing. People will need things in several places in an organization and as getting these things is their own responsibility, purchasing activity in the organization as a whole will increase.

- Another reason why purchasing, especially the operational part, is increasingly done by other people than the purchasing department are the growing number of possibilities of information technology and the Internet. It becomes easier for people to look for and find suppliers and place orders themselves.

- Important to note is that segregation of tasks is required in every organization to avoid subjective or even fraudulent decisions. Ordering, receiving, registering and paying of items should be done by at least four different parties.

3. The importance of purchasing

3.1. Importance of purchasing

The importance of purchasing is large and increasing. The purchasing function is a very interesting area of attention from a financial perspective. The share of purchasing spend in an organization’s revenue or total cost is often a lot bigger than expected

- The share of purchasing spend in the overall revenue is increasing because of developments such as ‘back to core business’, outsourcing and specialization. All of these trends lead to contracting out of activities that were done internally up till then or buying products that were previously manufactured by the organization itself.

- Another reason is the emerging popularity of the integrated management concept. The creation of smaller work units or business units with their own responsibilities puts purchasing forward as an area of financial control.

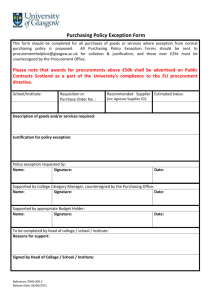

The importance of purchasing in governmental organizations and utility companies has been given a boost by the in introduction of legislation on public tendering, laid down in the EU directives on public procurement.

An interesting signal that shows management’s concern with purchasing is the use of a Purchasing Managers Index

(PMI). This index reflects the intention to spend of a number of purchasing managers that represent the industry. A rising index indicates an improving economy, as more orders will be placed, a declining index shows vice versa.

3.2. Marketing the purchasing function

Purchasing can have a lot of added value to organizations because of its impact on an organization’s financial, logistical and operational performance. One of the tasks of purchasing professionals is to market the purchasing function.

Seizing opportunities to show that the involvement of a purchasing professional in a purchasing process adds value can market the purchasing function well. Because purchasing is not a primary, independent function in any organization it should never be forgotten that achieving success is a joint undertaking and a success should be communicated as such.

4. Differentiations in purchasing

There is a huge variety in purchasing circumstances, and all of these require a specific strategy and approach. It will not so much influence the way the purchasing function itself is organized internally, but will influence the way tactical purchasing is done.

4.1. Purchasing in different sectors

The most distinct difference is the difference between commercial and not-for-profit organizations. - - Commercial companies have recognized the importance of purchasing some time before governmental and institutional organizations because their performance is largely judged by financial performance.

- In not-for-profit environments it is often more vague which performance indicators are key, but they are rarely financial. Therefore it seems harder to measure purchasing performance and create added value by purchasing.

- Some sectors have their own legislation with regards to purchasing. Governmental organizations and utility companies have to adhere to the EU-directives. These organizations also have to be aware of their public responsibilities because they are spending community money.

- Another distinction between private and public organizations concerns secondary interests. These are interests that go beyond the contract at hand.

4.1.1. Procurement developments in the public sector

Whereas the situation in public procurement differs across countries and jurisdictions any situation is just a snapshot in the development of the public procurement function over time. The path this development follows is a result of internal (from the people involved, from within the organization) and external pressure (from the general public, the press or even the professional body)

- In a first stage (serving the organization) the main issue is to get what is needed in the right quantity at the right time at the right place: availability is the objective.

- In a second stage (appropriate use of public funds) the main issue is to prevent fraud and corruption. It is still reactive, but now not only the result (availability), but also the process is important.

- In the third stage (efficient use of public funds) the focus shifts to not spending more than required or getting the most for a fixed amount of money, in addition to goals of the previous stages. The commercial aspects enter the scene, even though the attitude is still reactive.

- In the fourth stage (accountability) the public procurement function’s main issue shifts towards being able to explain that it is doing its job well. In addition to the aspects of previous stage also the transparency of the process plays a role.

- In the fifth stage (value for money) the scope is broader than before. It is not only that is important in public procurement, but also the value the items and services procured contribute to the organization. The focus starts to change from reactive to proactive.

- In a sixth and final stage (policy delivery) the public procurement function is contributing to the goals of the organization. It is seen as a lever for change/reform; it is aiding policy delivery. Based on Sykes (2005) we suggest the following policy areas as increasingly more difficult to contribute to from public procurement:

- Job creation and employment

- Strengthening the industry

- SME / regional involvement

- Diversity

- Stimulate innovation

- Sustainability and environment

- Development aid

The final stage is the one where public procurement can be employed as a lever of economic/social change. In this stage the issue for the public procurement function is to get alignment with government policy.

4.2. Purchasing on different markets

Every market has its characteristics.

- One very important characteristic is the balance between overall supply and demand, in terms of the number of parties. The number of buyers and suppliers and their interdependencies is valuable knowledge when defining how to position the demand on the supply market.

- An additional factor of influence when defining the strategy for a certain purchasing category is the balance between supply and demand in quantitative terms.

- The market itself will have some characteristics as well. Is it a local, national, regional or global market, is it a seasonal market, is it a market in which certain financial constructions are common, is it a forward market? Which regulations are applicable, such as production norms, agreements, governmental regulations, and labor laws?

4.3. Purchasing of different goods and services

There are a number ways to look at goods and services. Usually they are assigned to ‘purchasing categories’.

Purchasing categories are combinations of goods and/or services for which competitive offers can be requested from suppliers.

Questions that can be asked to better understand a buyer’s position are:

· Is the product or service newly developed or ‘tested and tried, proven technology’?

· Is demand predictable or can it change unexpectedly, what is the stock policy?

· Is it something tailor-made or does it conform to standard specifications?

· What is the strategic importance of it to the organization and its operations, indicating risks that occur when it is not supplied, or late.

· What is the amount of money involved, indicating the financial risk?

· Has is just been launched and will it be purchased by more and more organizations or is the product in the last stage of its market life and will it be replaced soon?

Purchasing of projects is yet another example of a purchasing situation. Purchasing will not always be about individual categories. It requires much more than tactical purchasing skills only. Project management, people management, and communication skills are key as well.

E-procurement

Specifying

Electronic procurement (e-procurement) solutions can improve the performance of this part of the purchasing process. One main form of e-procurement that deals with specification is called an e-sourcing system. Such a system identifies new suppliers, products, and services using sourcing catalog systems (Harink, 2004).

Selecting

One main form of e-procurement that deals with selection is called an e-tendering system. This system can be described as follows (Harink, 2004):

1. Developing requests for proposals

2. Establishing the assessment criteria and assessment procedure

3. Determining the long list of suppliers that receive a request for proposal

4. Sending out the request for proposals to suppliers of the long list

5. Supporting question and answer sessions

6. Receiving and assessing proposals of suppliers

7. Selecting the best supplier(s) (short list) using an e-tendering system

Contracting

One main form of e-procurement that deals with this purchasing phase is called e-reverse auctioning. This form can be described as follows (Harink, 2004):

1. Determining the short list of suppliers that participate in an e-reverse auction

2. Inviting and briefing the suppliers of the short list

3. Starting the e-reverse auction by entering the first prices (by the suppliers)

4. Adjusting prices (by suppliers) based on the prices of the competitors that van be seen

5. Ending the e-reverse auction when prices are not adjusted anymore using an e-reverse auctioning system

Monitoring

One main form of e-procurement that deals with ordering and monitoring is called an e- ordering system. Such as system can be described as follows (Harink,2004):

1. Requisitioning products and services out of an electronic catalog by employees

2. Approving requisitions by managers

3. Sending out purchase orders to suppliers

4. Monitoring requisitions and purchase orders by employees

5. Registering receipts by employees using an ordering catalog system

Purchasing policy and performance indicators

The form of e-procurement that deals with performance measurement is called purchasing intelligence. It can be described as follows (Harink, 2004):

1. Defining KPI's and setting target values for the KPI's

2. Collecting data

3. Calculating realized values for the KPI's

4. Comparing target and realized values

5. Advising on actions to take using a purchasing intelligence system

Hoofdstuk 15 Chopra and Meindl

15.1 The role of sourcing in a supply chain

Offshores: a firm offshores a supply chain function if it moves the production facility offshore (even if it maintains ownership)

Outsourcing(vertical integration): A firm outsources if the firm hires an outside firm to perform an operation rather than executing the operation within the firm. (performing by a third party).

Outsourcing or offshores:

1.

Will the third party increase the supply chain surplus relative to performing the activity in-house?

2.

How much of the increase in surplus does the firm get to keep?

3.

To what extent do risks grow upon outsourcing?

Outsourcing make sense if it increases the supply chain surplus without significantly affecting risks.

Surplus: is the difference between the value of a product for the costumer and the total cost of all supply chain activities. So it is the total size of the pie that all supply chain participants (inc the customers) get to share.

Sourcing processes (Once the decision to outsource has been made)

1.

Supplier scoring and assessment: comparing suppliers based on their surplus and total cost.

2.

Supplier selection: identify the appropriate supplier(s) and making a good contract.

3.

Design collaboration: allows supplier and the manufactures work together when designing components for the final product.

4.

Procurement: is the process whereby the supplier sends product in response to orders placed by the buyer.

Het doel is voor de laagst mogelijkste prijs.

5.

Sourcing planning and analysis: analyze spending across various suppliers and component categories to identify opportunities for decreasing the total cost.

15.2 In-house or outsource

Various mechanisms that third parties can use to increase the surpus:

1.

Capacity aggregation. aggregating demand across multiple firms and gaining production economies of schale that no single firm can on its own.

2.

Inventory aggregation.

A third party can increase the supply chain surplus by aggrating inventories across a large number of customers. This works more by customers with fragmented and uncertain demand. It results to a less safety and cycle inventory in total.

3.

Transportation aggregation by transportation intermediaries.

4.

Transportation aggregation by storage intermediaries.

5.

Warehousing aggregation.

It it specially for small suppliers and companies that are starting out in a geoagraphic location. Warehouse aggregation is unlikely to add much to the surpus for a large supplier or customer whose warehousing needs are large and relatively stable over time.

6.

Procurement aggregation.

It increases the surplus for many small players and facilitates economies of scale, ordering, production, and inbound transportation.

7.

Information aggregation.

An example is a site for more manufactures. Information aggregation reduce search costs.

8.

Receivables aggregation.

A third party may increase the supply chain surplus if it can aggregate the receivables risk to a higher level than the firm or it had a lower collection cost than the firm.

9.

Relation aggregation.

The presence of an intermediary lower the number of relationships required to just over a million. It does not increase the surplus by being a relationship aggregation between a few buyers and sellers for which the relationships are longer term and large.

10.

Lower costs and higher quantity.

They are likely to be sustainable over the longer term. A common scenario is that the third party has a lowcost location that the firm does not. Lower labour and overhead costs are temporary reasons for outsourcing.

Zie tabel op blz 447 voor de invloed van de grootte van het bedrijf op de surplus bij een derde partij.

Risks of using a Third party

1.

The process is broken(losing control of the process).

2.

Underestimation(onderschatten) of the cost of coordination.

3.

Reduced customer/supplier contact.

4.

Loss of internal capability and growth in third-party power.

5.

Leakage of sensitive data and information.

6.

Ineffective contracts. hain visibility.

7.

Negative r

8.

Loss of supply c eputational impact.

15.3 Third- and fourth-party logistics providers

Third-party logistics (3PL): performs one or more of the logistics activities relating to the flow of products, information, and funds that could be performed by the firm itself. ( vb zie blz 449)

Fourth-party logistics (4PL): is an integrator that assembles the resources, capabilities and technology of its own organization and other organizations to design, build and run comprehensive supply chain solutions. ( definitie van

Andersen Consulting)

Advantage 4PL : a 4PL may provide comes from greater visibility and coordination over a firm’s supply chain and improved handoffs between logistics providers.

15.4 Using total cost to score and assess suppliers

When making the outsourcing decision or comparing suppliers, many firms make the fundamental mistake of focusing only on the quoted price, ignoring the fact that many factors affect the total cost of using a supplier.

Example 15-1 op blz 452 illustrate a simple comparison of two suppliers with different prices and other performance characteristics.

15.5 Supplier selection – Auctions and negotiations

Single sourcing of multiple suppliers?

A good test of whether a firm has the right number of suppliers is to analyze what impact deleting or adding a supplier will have. Unless each supplier has a somewhat different role, it is likely that the supply base is too large. In contrast, unless adding a supplier with a unique and valuable capability clearly adds to total cost, the supply base may be too small.

Auctions in the supply chain

Mechanisms for auctions:

Sealed-bid-first-price auctions: require each potential supplier to submit a sealed bid for the contract by a specified time. These bids are then opened and the contract is assigned to the lowest bidder.

English auctions: The auctioneer starts with a price and suppliers can make bids as long as each successive bid is lower than the previous bid. The supplier with the last (lowest) bid receives the contract. The difference in this case is that all suppliers get to see the current lowest bid as the auction unfolds.

Dutch auctions: The auctioneer starts with a low price and then raises it slowly until one of the suppliers agrees to the contract at that price.

Second-price ( Vickrey) auctions: each potential supplier submits a bid. The contract is assigned to the lowest bidder but at the price quoted by the second lowest bidder.

Multiunit auctions is when the buyer wants suppliers to bid on a certain quantity of the supply chain function.

Multiunit dutch auctions: the buyer starts by announcing a low price and then raises it slowly until a supplier is willing to provide one unit of the goods or services. The price is raised slowly until a supplier have committed to all units of goods or services desired by the buyer. In this auction, each unit is supplied at a different price.

Multiunit English auctions= uniform-price auctions : The buyer starts at a high price and bidders announce the quantity they are willing to supply. If the total quantity that suppliers are willing to supply exceeds the desired quantity, the buyer lowers the price until the quantity for wich the suppliers bid equals the desired quantity. All suppliers then get to supply at this price.

Negotiation ( onderhandeling)

Using bargaining surplus = the difference between the values of the buyer and the seller.

The key to a successful negotiation is to make it a win-win outcome

Designing a contract

Three questions a manager should ask when designing a supply chain contract:

1.

How will the contract affect the firm’s profits and total supply chain profits?

2.

Will the incentives in the contact introduce any information distortion?

3.

How will the contract influence supplier performance along key performance measures?

15.6 Contracts, risk sharing, and supply chain performance

The three contracts that increase overall profits by making the supplier share some of the buyer’s demand uncertainty are:

1.

Buyback(retailer return any unsold units) or returns contracts.

Expected manufacturer profit = O(c − v) − (b − Sm) ∗ expected overstock at retailer c = wholesale price v = cost per unit produced b = buyback price

Co= c - b

Sm = $ for any units that the retailer returns

Cu = p - c

(Voor volledige berekingen zie blz 458)

Buyback contracts are most effective for products with a low variable cost. Bv krant, muziek,muziek, tijdschriften.

With holding-cost subsidies manufacturers pay retailers a certain amount for every unit held in inventory over a given period.

2.

Revenue-sharing contracts.

The manufacturer charges the retailer a low wholesale price c, and shares a fraction f of the retailer’s revenue.

Cu = (1-f)p – c

𝐶𝑆𝐿 =

𝐶𝑢

𝐶𝑢+𝐶𝑜

Co = c – Sr met Sr = salvage for any leftover units

(voor volledige berekeingen zie blz 460)

An advantage(comparing with buyback contracts) is that no product need to be returned, thus eliminating the cost of returns.

Revenue-sharing contracts are best suited for products with low variable cost and a high cost of return.

3.

Quantity flexibility contracts.

The manufacturer allows the retailer to change the quantity ordered (within limits) after observing demand.

These contracts are more effective than buyback contracts because they allow the supplier to aggregate uncertainties across multiple retailers and thus lower the level of excess inventory.

For expected quantity formula blz 262.

Quantity flexibility contracts are thus preferred for products with high marginal cost or when surplus capacity is available.

Contracts to coordinate supply chain costs

It is a quantity discount.The supplier can use a quantity discount contract to encourage the buyer to order in lot sizes that minimize the total cotsts.

Contracts to increase agent effort

Denk aan een auto dealer die verschillende merken auto’s verkoopt. De supplier maakt een contract met de autodealer dat de dealer korting krijgt als hij meer van zijn auto’s verkoopt. Examples are Two part tariffs and threshold contracts.

Two part tariffs: a two part tariffs offers the right incentives for the dealer to exert the appropriate amount of effort.

Threshold: it increases the margin for the dealer as sales cross certain threshold.

Contracts to induce performance improvement

It is a contract designed to encourage supplier cooperation results in a better outcome. To induce the supplier to reduce lead time, the buyer can use a shared-savings contract, with the supplier getting a fraction of the savings that result from reducing lead time.

This contract is also useful by improving the quality or by decreasing the use of these toxic chemicals.

15.7

Designing Collaboration

- Design collaboration can lower the cost of purchased material and also lower logistics and manufacturing costs.

- It is also important for a company trying to provide variety and customization, because failure to do so can significantly raise the cost of variety.

- Key themes that must be communicated to suppliers as they take greater responsibility for design are design for logistics and for manufacturability. It reduce transportation, handling, and inventory costs during distribution.

Packages can be designed so that transportation costs are lowered and handling is minimized.

- Modular customization: to provide modular customization, the product is designed as an assembly of modules that fit together.

- Adjustable customization: an example is a washing machine designed by matsushita that can automatically select from among 600 cylces. All inventory is thus maintained as a single product.

- Dimensional customization: is a machine that makes onsite custom house gutters that can then be cut to fit the dimensions of the house.

- Design for manufacturability: attempt to design products for ease of manufacture.

15.8 Procurement process

There are two main catogories of purchased goods:

1.

Direct materials= components used to make finished goods. E.g. memory, hard drives and CD are direct materials for a PC manufacturer.

2.

Indirect materials = goods used to support the operations of a firm. E.g. Pcs for a automotive manufacturer.

Most companies do not have one system for indirect materials.

An important requirement for the procurement for the procurement process for both materials is the ability to aggregate orders by product and supplier.

For the difference between materials zie table 15-7 op blz 469.

Product categorization by value and criticality

Critical Items Strategic Items

General Items Bulk Purchase Items

Zie table blz 470 voor juiste table.

Indirected materials are in general items.

Direct materials can by classified into bulk purchase, strategic and critical items.

Bulk purchase: the same selling price: example is packaging materials and bulk chemicals.

Critical items: components with long lead times and specialty chemicals.

Strategic items: the buyer-supplier relationship is long term. Example is electronics for an auto manufacturer.

15.9 Designing a sourcing portfolio: tailored sourcing

Onshoring = producing the product in the market where it is sold, even when it is a high cost location.

Near-shoring = producing the product at a lower cost location near the market.

Most companies need to tailor their supplier portfolio based on a variety of products and market characteristics.

E.g. For Zara it is a combination of responsive and low-cost suppliers.

15.11 Making sourcing decisions in practice

1.

Use multifunctional teams.

2.

Ensure appropriate coordination across regions and business units.

3.

Always evaluate the total cost of ownership.

4.

Build long-term relationships with key suppliers.

Lees samenvatting op blz 474 voor kort geheel

A general introduction into the purchasing process

We take a closer look at the axis of the ‘racecar model’: The purchasing process.

1. Six basic activities can be distinguished in purchasing processes

1.1

Specification of the need.

What is actually to be obtained from an external supplier.

Specifying the need may comprise multiple dimensions

Nellore et al. (1999) explains that a purchasing specification may comprise multiple dimensions and that a buying company must choose which dimensions are most important in a given situation.

First Dimension: Covers the product requirements. These are the technical, physical attributes of the purchased product. For example: Should a particular material be used?

Second Dimension: comprises process requirements. For example: What kind of machinery should be used?

Third Dimension: Customer requirements.

Another important dimension: Choosing an appropriate mode of communication with the supplier(s). There are many situations where the supplier modifies the initial specification coming from the buyer, possibly in a series of iterations. This is not necessarily a good or a bad thing.

A dimension that is often neglected is: the one that contains the functional requirements of the product. ‘the counterpart of the dimension of the product requirements’. Functional requirements state what the product should do, the problem it is supposed to solve or the outcome that should result from using the product. It is not important

how the product achieves the desired outcome.

So far, we have discussed the various types of content (inhoud) in a specification. In addition to content, the form of the specification should also be considered. A widely used form to convey specifications to suppliers is by using drawings of the purchased item or product.

In addition to the product and process requirements in a specification a purchaser should also consider whether it is necessary or desirable to include explicit requirements regarding technologies that should be used – or not used! – in (producing) the product.

Finally, a purchaser must decide to what extent the specification can or should make use of standard specifications.

So far, we have not distinguished between specifications for products and services. Axelsson and Wynstra (2002) suggest four specific bases for specifying services: input, throughput, output and outcome. Clearly, the ‘input-throughput’ basis and the ‘output-outcome’ basis resemble the dimensions of product/process requirements and functionality requirements in Nellore’s classification.

In any given situation, a purchaser must consider which of the above dimensions should be used in specifying the need. Using fewer dimensions provides the supplier with more flexibility, which may be very beneficial. At the other hand, it may also have very severe and unwanted effects.

The importance of a proper specification of the need

The importance of a proper specification of need cannot be overstated. The entire purchasing process builds on what is decided in this first step.

1.2

Selection of suppliers.

Usually, once the specification of need has been established, the next step in the purchasing process commences: the selection of one or more suppliers for carrying out what has been specified.

Supplier selection comprises more than one decision

A general two-stage pattern can be discerned in supplier selection. In this pattern a distinction is made between:

(first) arriving at a set of acceptable suppliers which usually is added to a list of so-called approved suppliers and secondly the ultimate choice from this approved vendor list (=AVL, The AVL serves as a kind of 'stock' of basically acceptable suppliers.) for a particular supplier-product/service combination.

However, the final choice is made based upon quotations provided by the approved vendors. In that sense, there is a disconnection between

1.

selecting an ultimate supplier-product/service combination. This phase consists of ‘deciding’ or checking whether or not a certain problem is solved (or a purpose served) by selecting one or more suppliers.

2.

pre-selecting acceptable suppliers. Once the supplier selection problem has been defined, criteria for the selection of the supplier(s) are formulated

In addition, two other important phases should be included:

3.

The problem definition, involves the definition of the supplier selection problem. This phase consists of

‘deciding’ or checking whether or not a certain problem is solved (or a purpose served) by selecting one or more suppliers.

4.

The criteria formulation. Once the supplier selection problem has been defined, criteria for the selection of the supplier(s) are formulated. The criteria relate to the supplier and/or the product or service purchased.

Qualification and selection are subsequent phases.

Pre-qualification: bringing down the set of ‘all’ suppliers down to a smaller set of acceptable suppliers. It may result in a so-called ‘bidders-list’ (in one-off purchases) or an Approved Vendor list (for repeating purchases).

Workflow of supplier selection

Although supplier selection processes may differ strongly in terms of the number of successive stages and the number of suppliers involved, the workflow in terms of documents used is usually quite similar. Request

For Information (RFI), Request for Quotation (RFQ)

1.3 Negotiating

Once one or more suppliers have been – tentatively – selected, the next step will usually but not necessarily consist of a process of negotiation (onderhandeling) between the supplier and the buying organization.

An analytical view on business negotiations

A first important distinction can be made between so-called ‘distributive’ or ‘fixed sum’ negotiations and

‘integrative’ or ‘variable sum’ negotiations.

In the former, an improvement for one party necessarily means deterioration for the other party.

By changing an initial agreement, both parties can usually achieve improvements. Achieving such a ‘win-win’ situation is usually done by considering multiple issues, which brings us to a closely related distinction between single-issue negotiations and multiple-issue negotiations. Multiple issue negotiations are almost always integrative as both parties’ interests are usually not completely opposite on all issues under consideration.

Empirical observations: the use of reference points in negotiations

Kristensen and Gärling (1997) indicate that in practice negotiators find it difficult to simultaneously take into account multiple issues and make trade-off’s between them.

Aspiration price: From the buyer’s perspective, the lowest price that he thinks will be accepted by the supplier.

The reservation price: The highest price that the buyer would be willing to pay.

While the reservation price is usually a very important reference point, its role may change during the negotiation process and the other aforementioned points may become more important. In any case, it seems important to be aware of the ‘reference point mechanism’ in preparing and conducting negotiations

Careful preparations as the key for successful negotiations

Gelderman and Albronda (1998) present a typical blueprint for preparing for negotiations.

Their model contains five steps.

1.

They emphasize the importance of collecting facts, about the supplier as well as the product or service at hand.

2.

The relative power positions must be assessed: who is under most pressure to close a deal?

3.

Furthermore, the buying organization should consider who should represent the firm in the negotiations.

Many times, a team will be involved rather than just the purchaser. Recalling the multiple issues that may play a role in negotiations, experts on each issue may be needed in the process, e.g. legal experts, technical experts etc. The constellation of the team may change during the negotiations as well.

4.

In addition, the buying organization should try to envisage what the consequences could be if no agreement would be reached with the supplier: is there a way out? What is the so-called Best Alternative To a

Negotiated Agreement (BATNA)?

5.

Last – but not least – the buying team should set explicit goals: what are the ultimate objectives and how far should the team go on each issue? Clearly, the latter point ties in with our discussion on reference points.

1.4 Contracting

Contract: formal description of a transaction agreement between a supplier and a buyer.

Getting to an agreement

As outlined by Gelderman and Albronda (1997) a formal deal between a supplier and a buyer requires the following conditions to be met:

Buyer and seller must be ‘capable of contracting’, i.e. they must be legally authorized to represent their company;

A situation of ‘consensus ad idem’ must be present, i.e. one party makes an offer which is subsequently accepted by the other party. There must be two expressions of will – one on behalf of the buyer and one on

behalf of the supplier – that are aimed at the same outcome;

The agreement should not violate existing law;

It must be possible to determine the substance of the deal. In other words: there must be a mechanism, which could be used to determine the characteristics of what is being purchased.

From these requirements it follows that a binding agreement can also be reached verbally!

Basic outline of a contract and types of contracts

Although contracts vary extensively, some common elements can be identified (Van Weele,

-

-

-

-

1997) which will usually be part of a contract:

- What is being exchanged, i.e. basically the specification used by the purchaser;

Conditions regarding price, delivery, payment and so on;

Where and when the products should be delivered (or service should be carried out);

General terms and conditions that apply;

Where and when the transfer of ownership takes place.

Monczka et al. (2001) specify a number of factors that determine the desirability of using a fixed price contract instead of a cost-based contract:

- Uncertainty about the market and process/technological developments;

- Degree of trust and length of the relationship with the supplier;

- Supplier’s ability to affect costs.

Klein Woolthuis (1999) found that the use of contracts may change over time and may also serve as a sign of trust and an instrument for further development of the relationship between companies, rather than a means for monitoring and safe-guarding.

1.5 Ordering

Stages in ordering

We may distinguish between three stages in the ordering process:

1.

The notification stage. sees an internal customer identifying the need for purchased items or service.

The notification stage consists of identifying again that what has already been specified before is required again.

2.

3.

The actual ordering stage. The actual ordering stage consists of the purchaser – or anyone in the buying organization for that matter – sending a signal to the selected supplier(s) to physically deliver the product and/or service as agreed upon in the negotiation and contracting phase.

Post-ordering activities. Post-ordering activities include a number of administrative, logistical and financial tasks such as comparing the actually delivered product with the ordered product, comparing the price and conditions mentioned on the supplier’s invoice with the prices and conditions agreed in the contract with the supplier. If all matches turn out satisfactory, a payment order can be created.

1.6 Expediting and follow-up

Expediting=making sure that the supplier will deliver the ordered product or service on the required time and day.

Usually, purchasers will only take action regarding the timely delivery of items of little significance to the buying company if the ultimate users of those items indicate that problems have occurred due to the late delivery.

2. A number of decisions are required about the basic purchasing activities

2.1 Which level to use when specifying the purchasing need?

This relates to the fact that whatever product or service an organization purchases, this product or service is – or becomes – part of a ‘bigger whole’. If we see the purchased product or service as a system, the organization must make a decision as to whether it specifies this system as one single system and starts a purchasing process for this system or whether it breaks the system down into smaller subsystems and specifies each subsystem. And at each point the firm must decide whether to fulfil the specification inside the firm or to leave this up to an external supplier.

Buying a product or a service at a high level is often called ‘system sourcing’. System sourcing has received a lot of attention in recent years. It seems to offer some clear advantages (Gadde and Jellbo, 2002):

It enables the buying firm to focus on what it believes are its core competences

Supplier handling costs can be reduced drastically since large number of component suppliers are replaced by one system supplier

It fosters joint innovation and mutual learning

Gadde and Jellbo (2002) developed a framework for understanding why system sourcing seems to work well in one situation but not in another. They identify three main factors that determine the potential for successful system sourcing:

The capabilities of both the buying firm and the

The modularity of the overall system in which the purchased system has to fit in

The degree of difficulty of separating development and production activities

It is very important to realize that:

1.

it is never given how any product or process should be designed – or specified – in terms of its smaller parts and subprocesses

2.

it is never given at what level the design – or the specification – becomes a purchasing specification and how much of the refinement of that specification into more detailed specifications should be left to the supplier(s)

2.2 Which kind of contract-type and pricing structure should be used?

In the section on the contracting and negotiating phase in the purchasing process we already concluded that companies can choose from a wide range of contract types. Again, it is not given which kind of contract should be used – or pursued – in a given situation

2.3 Which type of ordering system should be used?

The options to choose from are closely related to the basic options for controlling stock in a materials flow system:

A replenishment order – i.e. a purchasing order – is automatically generated once the stock level drops below a certain order level. A subsequent decision must be made regarding the inspection strategy: is the inventory level monitored continuously or only every so many time intervals? Also, the order amount must be decided upon. This can be a fixed quantity or a variable quantity.

A replenishment order is generated after a certain time interval has passed. Again, the ordered amount can be fixed or variable.

3. Purchasing processes evolve into different typical configurations

In practice, there is no single purchasing process. Many different configurations appear. In this section, we discuss

Faris et al. (1967) classical distinction into three of such configurations: a New Task configuration, a Modified Rebuy and a Straight Rebuy. It is important to understand why these different configurations occur and what the implications are of the differences between the configurations

3.1 New task – configurations

The configuration that precisely follows the basic steps of the purchasing process as we introduced them in this chapter. The organization has never before purchased anything similar. Therefore, all basic steps have to be performed and take place in the logical sequence.

3.2 Modified Rebuy – configurations

In most organizations, only a few purchases will qualify as New Task purchases. In many situations, the need that must be fulfilled by an external supplier is not new but more or less similar to a previously purchased product or service. In that case, the existing – known –supplier is often used to fulfill this revised need. In other words: the phase of supplier selection is ‘skipped’. Alternatively, there may not even be a change in the internal need but in the existing supplier’s willingness or capability to deliver the customer’s need. For example, the existing supplier may go bankrupt or may decide to no longer produce the product under consideration. Or, new suppliers may enter the market and convince the buying organization that their offerings are superior to the product of the existing supplier.

In the latter case, the specification phase is hardly carried out. Instead, the process ‘starts’ with searching and/or evaluating and selecting a new supplier to fulfill an existing need. Both configurations are called a Modified Rebuy, see again Table 2.3. Examples of categories in which one often finds Modified Rebuys are temporary labor, office furniture, and hotel services. Like Straight Rebuys, Modified Rebuys are largely defined upfront, which enables end users to place orders themselves.

3.3 Straight Rebuy – configurations

Many purchasing processes in a firm consist of completely copying the tactical phases, i.e. the specification and supplier remain unchanged and no new negotiations take place. In other words: many successive internal needs are fulfilled using a fixed specification, a known supplier and an already existing contract. Such purchasing processes are called ‘Straight Rebuy’. In a Straight Rebuy, only the ordering phase is really executed, see again Table 2.3.

Examples of such purchases are utilities, office supplies, and replenishment orders for spare part stocks. Because a

Straight Rebuy is completely defined upfront, such orders are usually done by end users or even automatically by an automated ordering system.

Time spent on purchasing is shortest and the number of decisions that have to be made is smallest in a Straight

Rebuy situation, increases for a Modified Rebuy situation and is highest for a New Task. Some Straight Rebuy situations do not take any time at all, for example the monthly ‘purchasing’ of utilities. The degree of routine in the activities is highest for a Straight Rebuy and lowest for a New Task.

4. Shaping appropriately programmed configurations of purchasing processes

In the final section of this chapter, we discuss the background and some of the implications of the different purchasing process configurations and to what extent (purchasing) management can or should try to influence the purchasing process types taking place in their organizations.

4.1 Different purchasing process configurations will appear naturally

Relying on standard operating procedures or routines is a basic element of the functioning of organizations in classic organization theory (e.g., see Cyert and March; 1963). Organizations cannot function without some sort of stability in the way it works. Only if a purchasing configuration consistently and over a period of time leads to an insufficient outcome, are slight changes in the configuration considered.

4.2 Striking a balance between differentiation and efficiency

Reasons why organizations standardize and fix much of their purchasing process and decisions regarding specifications, suppliers and contracts such ‘standardized’ purchasing configurations may differ for different categories of purchased items and services

1.

Realize that management of purchasing processes must be based on differentiation. In other words: there is no one ‘best’ purchasing configuration

2.

A second implication is however that in doing so the purpose of efficiency must not be ignored. Management has a number of options to standardize and ‘program’ each basic purchasing phase. Examples are:

Providing and prescribing standard specifications instead of newly designed solutions

Prescribing mandatory use of pre-qualified suppliers

Dictating the use of standard contract templates and texts

Purchasing management has some influence as to which configurations should be used for different situations and categories of purchased items and services

Purchasing must become supply management (Kraljic)

Instead of simply monitoring current developments, management must learn to make thing happen to its own advantage. This calls for nothing less than a total change of perspective: from purchasing (an operating function) to supply management (a strategic one).

The greater the uncertainty of supplier relationships, technological developments, and/or physical availability of those items, the more important supply management becomes.

Diagnosing the case

A company’s need for a supply strategy depends on two factors:

1. The strategic importance of purchasing in terms of the value added by product line, the percentage of raw materials in total costs and their impact on profitability

2. The complexity of the supply market gauged by supply scarcity, pace of technology and/or materials substitution, entry barriers, logistics cost or complexity and monopoly or oligopoly conditions.

Attractive new options, or serious vulnerabilities, or both, may come to light as the assessment explores questions like these:

1. Is the company making good use of opportunities for concerted action among different divisions and/or subsidiaries?

2. Can the company avoid anticipated supply bottlenecks and interruptions?

3. How much risk is acceptable?

4. What make-or-buy policies will give the best balance between cost and flexibility?

5. To what extent might cooperation with suppliers or even competitors strengthen long-term supply relationships or capitalize on shared resources?

Shaping the supply strategy

To minimize their vulnerabilities and make the most of their potential buying power, a number of European companies have successfully used a four-stage approach to devise strategies.

Phase 1: Classification

- The profit impact of a given supply item van be defined in terms of the volume purchased, percentage of total purchase cost, or impact on product quality or business growth.

- Supply risk is assessed in terms of availability, number of suppliers, competitive demand, make-or-buy opportunities, and storage risks and substitution possibilities.

Using this criteria, the company sorts out all its purchased items into the categories shown in Exhibit II.

Each of these four categories requires a distinctive purchasing approuach, whose complexity is in proportion to the strategic implications. The company may need to support supply decisions of strategic items with a large battery of analytic techniques, including market analysis, risk analysis, computer simultation and optimalization models, price forecasting, and various other kinds of microeconomic analysis.

Shifts in supply or demand patterns can alter a material’s strategic cetegory. Therefore, any purchasing portfolio classification calls for regular updating.

Phase 2: Market Analysis

Next the company weight the bargaining power of its suppliers against its own strength as a customer. The company then analyzes its own needs and supply terms it wants. Of the contrasting criteria of supplier and company strength listed in

Exhibit III.

Some criteria need some extra explanation:

Supplier’s break-even stability: A supplier that achiever break-even at below 70% capacity utilization can ultimately deliver at lower cost than one who breaks even at 80% utilization.

Uniqueness of suppliers’ product: If a product is unique, the probability is less that alternative sources or suppliers will appear or that suppliers competition will force cost reductions

Cost of nondelivery: Potential costs in the event of nondelivery or inadequate quality, the higher sucht costs and the greater the risk of incurring them, the less latitude the company had for rapidly shifting supply sources or delaying negotiations or contracts.

Careful definition of the criteria of both supplier and company strength is a prerequiste to accurate market analysis.

Phase 3: Strategic Positionong

Next the company positions the materials indentified in phase 1 as strategic in the purcchasing portfolio matrix.

It can then identify areas of opportunity or vulnerability, assess supply risks, and derive basic strategic thrusts for these items.

On items where the company plays a dominant market role and suppliers’ strength is rates medium or low, a reasonably aggressice strategy (‘exploit’) is indicated.

On items where the company’s role in the supply market is secondary and suppliers are strong, the company must go on the defensive and start looking for material substitutes or new suppliers (‘diversify’), the company neds its supply options.

For supply items with neither major visible risks nor major benefits, a defensive porture wouls be overconservative and costly. In this case, a company should pursue a well-balanced intermediate strategy

(‘balance’).

Phase 4: Action Plans

Each or the three strategic thrust has distinctive implications for the individual element of the purchasing strategy, such as volume, prie, supplier selection, material substitution, inventory plicy, and so on.

If the strategy is diversity, the company should consolidate its supply position by concentrating fragmented purchased volumes in a single supplier, accept high prices, and cover the full colume requirements through supply contracts. The company should also search vor alternative suppliers or materials or even consider backward integration to permit in-house production, to reduce long-term risk.

If the strategy is exploit, the company should explore a range of supply senarios in which it lays out its options for securing long-term supply and for exploiting short-term opportunities. The end product will be a set of systematically documented strategies for critical purchasing materials that specify the timing of and criteria for future action.

Strengthening the Organization

Few companies today can allow purchasing to be managed in isolation from the other elements of their overall business systems.

Greater integration, stronger cross-functional relations, and more top-management involvement are all necessary. Concrete changes in the organizational relations, provide adequate systems support, and meet the new staff and skills requirements.

Effective Relations

To exploit the company’s full buying and bargaining power, the purchasing function must reflect the overall corporate setup. In particular, top management must decide to what extent it should centralize or decentralize the function. Centralization augments a company’s purchasing clout, and it is also more inflexible. To find the right balance, companies must carefully consider trade-offs between clout and flexibility.

Another important issue is purchasing’s position in the corporate structure. Should the company treat it as a function of production or of operation divisions? It depends on factors such as volume and concentration of purchased goods as well as on the corporation’s structure and complexity.

The purchasing department’s structure should reflect supply-product market affinities and permit staff with specialized competence to take the lead in working out strategies for specific items.

System Support

Too often the purchasing department receives information on the company’s business plan andd objectives that is incomplete or improperly geared to the tasks and time horizons of strategic supply management. The purchasing department needs these data for negotiating prices, rescheduling supply quantities, and balancing raw material inventories in response to cyclical demand swings. In the absence of such data, supply bottlenecks, short-term demand fluctuations, and ad hoc purchasing decicions are inevitable.

Complex companies (with multiple products) are more vulnarable than simple companies, but in ether case, tailormade system support will be called for. Such support might include:

- Improvement of operational flexibility

- Improved efficiency

- Integration of purchasing systems with other corporate systems

- Introduction of proven purhcasing analysis approaches

Improved systems support fress buyers and management from preoccupation with day-to-day problems an enables them to focus on long-term analitic work and planning.

Staff&Skill Requirements

To meer the demands of the new supply strategy, the company must also upgrade the skill and experience it requires of key purchasing people.

Top managers should foster a contructive atmosphere and attitude among purchasing staff before undertaking any radical changes.

Lecture slides 3

Purchasing organization

There are three basic organisational models, based upon the choice to perform a task either at a central or a decentralised level. Defining the model always starts with drawing the management model for the entire organisation and then fitting in the purchasing department and/or organisational bodies that will be responsible for purchasing tasks. The management model will include things like mandatory principles and financial responsibilities that one has to adhere to. Also, the existing situation includes culture, an important factor in re-organisations that cannot be underestimated when changes are initiated.

Main question is ‘at which level, central or decentralised?’

• At central level when overall objectives are pursued. A central position will make it easier to gather information, to define a joint approach, to use one infrastructure, to make everyone buy from the same supplier and to keep control.

• At decentralised level will be appreciated by the organisation because there is more space to do things their own way.

• Roughly, organisations tend to assign strategic tasks at a central level and operational/(Business Unit) specific tasks at a decentralised (operational) level.

Commodity strategy

- Purchasing policy is about ‘all’ purchasing groups

- Commodity strategy is about 1 purchasing group

Basic attitude: different situations require different strategies

Have a public sector procurement policy which:

• emphasises the importance of transparent and broad-based need identification as the basis for efficient resource utilisation and procurement decision.

• institutes a mechanism for encouraging saving on annual procurement budget utilisation, thereby avoid the last-quarter procurement rush.

• First determine: what is the commodity (i.e. purchasing group)?

• Not given: can be determined by buyer

• Determines the market the buyer is operating on

Risk: Availability/number of suppliers/competitive demand/ make-or-buy opportunities/ storage risks/ substitution opportunities

Value: Volume purchased/ percentage of total purchased cost/ impact on product quality or business growth

Other strategic questions:

Different lots or all in one?

Contract duration?

How many suppliers to contract?

Technical or functional specifications?

Windmill model

Example strategic quadrant:

If the buyer position is strong and supplier weak: harvest

- secure access & prevent others

- long-term relationship

- joint venture?

- risk/reward sharing

- drive continuous improvement

Equilibrium

- selective approaches from harvest and diversify

If the buyer position is weak and supplier strong: diversify

- move to leverage

- raise attractiveness

- develop substitutes

- develop new entrants

- reduce barriers

- secure continuity

Purchasing control

What problems could there be for carying out a spend analysis?

Extra variable = purchasing group

Double /multiple entries because of name distortions / different names

Often, hundreds or thousands of code numbers are used and mistakes in coding are easily made. Although these mistakes do lead to a distortion of the picture on a detailed level, they do not influence the total performance of the organization whatsoever. Thus, mistakes remain unnoticed, until a spend analysis is made. Mistakes in the cost categories (use of the wrong code) are made by accident, but also on purpose, for example, because the budget has run out in one cost category, while it has not run out in another cost category.

Spend division

- The volume of facilities and services is often underestimated

- Demand management is key

Of course, the divison differs per org.

We are going to carry out a spend analysis

Vraagrationalisatie: Leg vooraf vast of en in welke mate externe inhuur bij verschillende diensten opportuun is en hoe er wordt ingehuurd; stel bijvoorbeeld een beslisboom (of een workflow) op, waarlangs externe professionals kunnen worden ingehuurd

(Her)aanbesteden: De grootste optimalisatieslag kan plaatsvinden door het (gezamenlijk) (her)aanbesteden van grote contracten en opvallende inkooppakketten, bijvoorbeeld met gebruik van raamovereenkomsten. Een selecte groep lev. bepaalt typisch de meeste spend -> focus hierop Het aantal facturen beïnvloedt de omvang van de proceskosten (maandfacturen, automatisch factureren, verzamelfacturen, etc.

Er zijn veel kleine facturen

Er zijn diverse mogelijkheden om het aantal kleine leveranciers te reduceren

Er zijn mogelijkheden voor bundeling (gives economies of scale and saves time on supplier management)

Some commodities typically have more suppliers than others

Een verdere concentratie van de leveranciers lijkt vooral mogelijk voor uitvoering en aanneming van werken

Raamcontracten

Framework contracts and compliance per purchasing

group

Management opportunity

through Telgen’s alpha

Alpha = I / (I+II)

Use as

- Link to bonus scheme

- Incentive for compliance

- Incentive for better contracts

Distinguishing between purchasing and management role:

Purchasing: tactical – making contracts

(blanket, window etc)

Management: contract compliance

There can be good reasons for low contract compliance; if low for several depts., is the contract OK?

Incentives generally result in two reactions:

Pointing out the existence of company-wide framework contracts to their own employees, which leads to an improved purchasing performance;

Requesting the Purchasing Department to conclude (better suitable) framework contracts for certain goods or services. This also leads to a better purchasing performance.

Can also be used for budget decreases or increases

Determine who should analyze the data, who ‘inspects’, and who gets the results

Purchasing?

Budget holders?

Management?

This leads to an important point of attention: by pursuing contract compliance, the purchasing control function will likely come across as an inspection body, as a kind of watchdog or police officer. This cannot usually be combined with the position of the interested party or with the party offering assistance. Therefore, it is not practical to position the purchasing control function within the Purchasing Department itself

What yields control purchasing

Periodic control over expenditure

Do people use framework agreements, etc.?

Indications for possible improvements

New tenders

Bundle and rationalize demand

Reduce process costs

Contract compliance, etc.

Hard data can be convincing and enables benchmarking

Indications should not be convictions!

Different conclusions for different purchasing groups

Further research often required