Defined-Benefit and Defined-Contribution Plans of the Future Don

advertisement

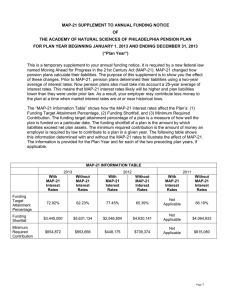

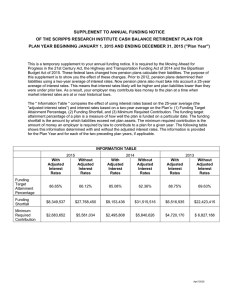

Defined-Benefit and Defined-Contribution Plans of the Future; Don Ezra, FAJ, 2007 •The Primary purpose; prompt new thinking by pension plan sponsors about DB plans • Decline of DB plans around the funded world •Decline in coverage •Decline in benefits •Frozen participation 1 What Went Wrong? •Modest beginning of DB plans in the late 19th century • Rapid expansion after WW II • Market competition required DB component 2 What Went Wrong? •Factor that caused the decline of DB Plans •Actuarial confusion between •What benefits are worth and •What constitutes a good funding target 3 What Went Wrong? •Consider the following example: •$1 of bonds and $1 equities have the same value •Over time, equities (higher risk) will have higher return. Investors unwilling to pay more until there is evidence of higher return. •Actuaries implicitly considered equities to be more valuable, used higher expectation to write down liabilities at a higher discount rate. • 70 cents in equities for every $1 in bonds. 4 What Went Wrong? • Employer contributes 70¢, risky investment strategy adds 30¢, pays off $1 benefits. •Before computers, actuarial calculations were laborious and expensive. Used as best estimate. •Actuaries rarely explained the difference between a funding target and the value of the benefits. 5 What Went Wrong? • The turning point of DB decline started in the 1980s •Low inflation •Actuaries lowered salary assumption but left the return assumption high •Increased the real discount rate – implicitly anticipating equity premium •Gradually the funding target fell below the value of the benefits 6 What Went Wrong? • 1980s : corporate raiders, shareholder value creation focus •Pension fund did not get its contribution automatically •Compete for capital •Equity premium became a source of funding •Pension accounting anticipation of equity premium on a no risk basis •Legislation allowed unfunded liabilities over extended periods 7 What Went Wrong? •Legislation allowed unfunded liabilities over extended periods •This rule reflected the sentiment that corporations were an everlasting entities •Pension benefit Guaranty Corporation (PBGC) looked after a failed institutions. •Since 1980s, huge unfunded liabilities and failing institutions 8 Next Generation DB Plans •DB plan – exception rather than rule •Few employers may offer to attract/retain good employees •Concern: Society will go through a whole generation with out DB plan and realize the current DC arrangements do not provide adequate retirement income 9 Next Generation DB Plans •Features of the next generation plan •Benefits promised will be transparent •Benefits will be based on today’s pay, not tomorrow’s •Career averaging benefits with periodic catch-up provisions •If the employee quits/dies before retirement, benefits will have the same value as the accrued retirement benefit. Transparency feature – similar to DC plans 10 Next Generation DB Plans •Features of the next generation plan •Benefits reasonably portable – knowledge workers, IT sector •Benefits will be valued as accurately as possible, without risk premium in the discount rate •The benefit will be fully funded at all times. Funding will also include additional reserve to cover the risk (best estimate value is wrong, or deliberate increase in risk) 11 Next Generation DB Plans •Consider US Air Pilot Plan •Taken over by PBGC in 2002 •Plan was 35% funded, compared to current liability funded ratio of 85% to 104% •US Air was never legally required to catch up on funding shortfall. •In the six years before PBGC takeover, US Air total contribution was $157m, compared with final unfunded liability of $2.2b 12 Improved DC Plans •Question – Why not cash balance plan? •A cash balance plan is a defined benefit plan that defines the benefit in terms that are more characteristic of a defined contribution plan. In other words, a cash balance plan defines the promised benefit in terms of a stated account balance. (www.dol.gov/ebsa) • If cash-balance plan funded like DB plan (70%) and discounting that includes equity risk premium, may not work •If cash-balance plans had to be fully funded, they may not be very popular with employers 13 Improved DC Plans •What is the next generation DC plan? •SMarT (save more tomorrow) or “autopilot” option •Enrollment is the default option •Employee makes increasing their contributions the default option every time they get a pay raise •Professionally managed life cycle investment option is the default choice •Asset allocation changing as the employee approaches retirement 14 Improved DC Plans •What are the benefits of this plan? • Increased participation •Contribution increase as employee ages •Employee gets sensible investment policy, professionally managed investment (individuals’ investment choices are the reason DC plans have lower returns) 15 Conclusions •Is the DB plan concept a failure? Has it become a part of the problem? • No, and NO •Tried to provide retirement income on the cheap (70¢ to a dollar) and complained when equity premium did not materialized. •Meddled with the plans’ legislation by allowing promises to run ahead of funding • Implementation of the plan, and, not the DB plan failed 16 Conclusions •The next generation DB plan can also be abused, but the assumptions are more realistic •The DC model can achieve many desirable goals for individual, employer and society. Outcome is not as straight forward as DB plan. Need to be adopted carefully •Retirement income guarantees are expensive 17