Unit 1_5 Business - Coral Gables Senior High

advertisement

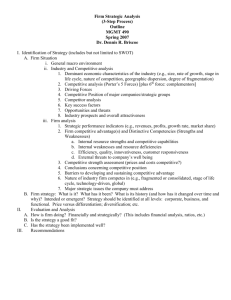

External Environment Unit 1.5 Internal Factors Definition: the constraints and opportunities within a firm’s own control. These limitations are usually dominated by the rules, policies and culture of the business. E.g.: 1. Finance: may not have enough money 2. People: poor working relations harms goals 3. Marketing: bad marketing campaigns 4. Production: techniques and stock control systems can be improved PEST Analysis Acronym for: Political- government legislation defines the boundaries in which business can operate Economic- Inflation, unemployment, economic growth and international trade can affect operation Social- Changes (social, cultural, demographic) may be opportunities or threats to a business Threats and Opportunities Threats: external factors that can harm a business Opportunities: external factors that can improve a business Variations of the PEST analysis are: PESTLE: add legal and environmental STEEPLE: add ethical 3 Steps to a PEST analysis Brainstorm. What will most likely affect the business? Discuss. Which factors will have the most significant impact on the business? Summarize: What to do with the business? Strategies? Advantages & Disadvantages The PEST analysis is useful for identifying advantages and disadvantages. If opportunities outweigh threats, the business should pursue the option. But some factors are unpredictable. KEY advantage of PEST: it’s simple to use. Promotes forward thinking instead of instinct. Social and Cultural Opportunities and Threats The attitude of society will affect what goods/services are provided. Demographic changes can affect recruitment practices, marketing strategies, and products. The acceptance and awareness of multiculturalism leads to more business opportunities. Technological Opportunities and Threats Technology has deeply affected business functions. Many tasks are completed online instead of on paper. The internet can provide opportunities and present threats: It is easy to access information, there are less language barriers, and costs of production are reduced. However, there is price transparency (customers can compare prices without leaving home), online crime, and higher costs of having to train employees in being tech-competent. Important Factors about Technology Managers should consider the following: Costs (of purchase, installation, maintenance, etc.) Benefits (efficiency improves) Human relations (more flexible working patterns) Recruitment and training (need to hire computerliterate people) Economic Opportunities and Threats Governments try to achieve 4 key macroeconomic objectives: Controlled inflation Economic growth Reduced unemployment Acceptable International trade balance Controlled Rate of Inflation The two main causes of inflation are: Demand pull inflation- Excessive aggregate demand in the economy (People want to spend money and buy things) Cost push inflation- Higher costs of production leading to rise in prices (E.g. It costs more to make item A, so to make a profit, the company will charge more for A) Level of Employment If aggregate supply is high, more national output is being produced= Higher level of employment If aggregate demand is high, there is a higher level of derived demand for labor, and there will be low unemployment Economic and social costs Economic costs- refer to the opportunity costs of unemployment (What could have been produced if unemployment was not a problem) Social costs- the effects on the unemployed themselves (stress, low self-esteem) Demand-side and supply-side policies Demand-side policies: directly target the increasing level of aggregate demand in the economy E.g. government may se expansionary fiscal policy (reduce taxes, increase gov't spending) to reduce unemployment E.g. expansionary monetary policy (reduce interest rate levels to encourage borrowing and spending) E.g. protectionist measures (protect domestic businesses from international competition) Types of unemployment Frictional or transitional unemployment: when people are changing jobs, there is a time lag between leaving a job and finding another. Seasonal: seasonal changes in demand for a product (e.g. hiring many employees for pre-Christmas period. Afterwards, they become unemployed) Technological: people lose jobs because there are labor-saving technologies (can cause mass- scale unemployment) Regional: rural areas have less employment than urban areas Structural: demand for products produced in a particular industry continually declines Cyclical or demand deficient: (most severe) Affects every industry in the economy. Caused by lack of aggregate demand in economy (i.e. recession) Economic Growth GDP (gross domestic product)- change in total output of the economy per year Trade/business cycle phases: Peak/boom: economic activity at highest level Recession: dip in level of economic activity for two consecutive quarters (half a year) Slump/trough: bottom of recession. High level of unemployment, poor liquidity Recovery/expansion: when GDP starts to rise again. Everything gradually rises. Coping with a Recession Cost reduction: efforts to cut lighting and energy bills Price reduction: sustain or increase sales Non-pricing strategies: sustain/ revitalize volume of sales Branding: impact on sales and reduce degree of price and income elasticity of demand Outsourcing (production overseas) where costs of production are lower (Helps business gain price advantage, and increases profits) Growth via quality of factors of production Capital Goods: Greater the investment levels, the higher economic growth will be Education and training: A better educated and trained workforce is more productive and internationally competitive Health technology: helps ensure healthy workers, makes it more productive Growth via quantity of resources Changes in demography: Fall in birth rate leads to aging population and smaller workforce (and vice versa) Changes in participation rates: Measures the number of people who are employed as a percentage of the total labor force. Changes in net migration: the difference between immigration and emigration. If migration figure is positive, size of workforce will increase Possible barriers to economic growth Lack of infrastructure (communications and transport networks) Lack of technical knowledge and skilled workforce Rapid population growth High foreign debt repayments Balance of payments Balance of payments- record of a country’s money inflows and outflows per time period, made up of: 1. Current account- export earnings and import expenditure - a. visible trade balance: tangible goods international trade - b. invisible trade balance- foreign trade in intangible 2. Capital acct- flows of money for gov’t reserves, foreign currencies or investment reasons Examples of Protectionism Tariffs/customs duties: tax on imported products Quotas- quantitative limits preventing too many foreign products entering a country Subsidies- payments made by a gov’t to domestic firms as a form of financial aid Embargos- physical bans on international trade with a certain country Tech and safety standards- imposition of strict technical or health and safety standards being placed on the import of foreign products. Environmental opportunities and threats Without gov’t intervention, private sector businesses are unlikely to consider the external costs/negative externalities of production. Changes in the weather and season can be both. Political opportunities and threats Laissez-faire approach- if a gov't does not intervene significantly in business activity. ---Leaving business to their own devices should stimulate healthy competition and efficacy. Fiscal Policy- the use of gov't taxation and gov't expenditure policies to influence the economy. Two broad ways of taxation: 1. Direct - paid straight from income, etc Indirect - refers to tax paid on trade in good and services 2. Progressive- proportion of tax paid increases as income, wealth or profit of taxpayer rises Regressive- proportion falls as income of taxpayer rises Proportional- stays same, regardless of income 2 types of fiscal policy: 1. Deflationary- used when the economy is experiencing high rates of economic growth and inflation, so needs to be slowed down (I.e. by combo of higher taxes and reduced gov't expenditure policies) 2. Expansionary- used to boost economy, by combo of tax cuts and more public sector spending Common examples of taxes: Income tax Corporation tax Sales tax Capital gains tax- on surplus Inheritance Excise- on demerit goods like alcohol Customs duties- foreign imports Stamp duty- paid when commercial/residential property is bought Monetary policy Definition- designed to control the amount of spending and investment in an economy by altering interest rates to affect the money supply and exchange rates Businesses are charged varying levels of interest rates because: 1. Risk- greater risk of defaulting, greater interest 2. Time- longer the loan pd, more interest 3. Administration costs- higher these are, “” 4. Expectations- if gov't expects good economy, likely to announce interest rate hike to dampen effects on inflation in the economy Legal Opportunities and Threats Consumer protection legislation Employee protection legislation Competition legislation Social and environment protection legislation Ethical opportunities and threats Business ethics- moral principles that should be considered in business decision-making. Although there are compliance costs in ethically acting, businesses will benefit: Attract/retain good quality workers Attract new consumers, retain customers Generates good publicity and public relations Businesses traditionally report only figures for financial performance, but now also prepare to have external social audits conducted Differences between PEST and SWOT: SWOT analysis- strengths, weakness, opportunities, threats PEST is broader, SWOT is narrower PEST helpful to produce SWOT (NOT vice versa) PEST identifies opportunities and threats in SWOT PEST more useful and relevant with larger/ complex issues PEST doesn’t directly consider internal factors of issue considered. External environment and business strategy PEST gives managers overview of external business environment, activity-affecting factors, etc… Used to analyze decisions like: Potential costs and benefits of a joint venture, merger, or acquisition Marketing planning Business propositions Investment opportunities Policies to achieve macroeconomic objectives: Gov’ts will use range of policies that will be bad or good for some businesses. They will be affected by factors like: Size of business Ability of management Price elasticity of demand Degree of diversification Level of a firm’s gearing External factors affect international competitiveness of business. Review Questions: 1. What does the acronym STEEPLE analysis stand for? 2. Outline the purpose of a PEST analysis. 3. What are the three general steps needed to carry out a PEST analysis? 4. Explain how each of the PEST components can represent either opportunities or threats for a business. 5. What are the four key macroeconomic objectives of most gov'ts? Review (cont.) 6. What is meant by “trade cycle”? 7. State 3 ways in which a business may be able to cope with a recession. 8. Using examples, distinguish between ‘economic’ and ‘political’ opportunities and threats. 9. Distinguish between ‘fiscal policy’ and ‘monetary policy’. 10. How does the legal system present both opportunities and threats for businesses? Key Terms Balance of Payments- an annual record of a country's export earnings and its import expenditure. A surplus exists if the value of exports exceeds that of imports (vice versa for a deficit on the balance of payments). Deregulation- the removal of government rules and regulations which constrain an industry, thereby enhancing its efficiency. This should also encourage more competition within an industry. Direct tax- a levy that is paid from the income of individuals or businesses, such as personal income tax and corporation tax. Economic Growth- measures the change in the Gross Domestic Product of a nation over time. Growth is said to occur if there is an increase in GDP for two consecutive quarters. Ethics- the moral values and judgments (what is right and just) that society believes organizations should consider in their decision-making. Exchange rate- refers to the value of country's currency in terms of another currency External shocks, aka exogenous shocks- are unforeseeable and unexpected changes in the external business environment that tend to affect all businesses in the economy, such as natural disasters or wars. Fiscal policy- refers to government policies that deal with taxation and government expenditure in order to affect the level of economic activity Gross Domestic Product- the total value of a nation's annual output. It is used as an indicator of the level of economic activity in a country. Indirect tax- a levy placed on the purchase of goods and services, such as sales taxes and excise duties. Inflation- when the general price level in an economy continuously rises. It is calculated by measuring changes in the cost of a representative basket of goods and services purchased by the average household over a period of time. Interest rate- a measure of the price of money. It can be expressed in terms of the amount charged for money that is borrowed or how much is offered on money that is saved. Monetary policy- government policies concerned with changing interest rates in order to control the money supply, and the exchange rate. PEST analysis- a framework used to analyze the opportunities and threats of the political, economic, social, and technological environments on business activity. It is one of many tools that can be used in the decision-making process. Protectionism- refers to any measure taken by a government to safeguard its businesses from foreign competitors. This presents a threat or barrier to trade for businesses trying to operate in overseas markets. Tariffs- a method of protectionism whereby the domestic government taxes foreign imports, thereby giving domestic producers a relative price advantage. Trade cycle, aka business cycle- the fluctuation in the level of economic activity over time. Economies tend to move through the cycle of booms, recessions, slumps, recovery and growth. Unemployment- the number of people in the workforce who are willing and able to work but cannot find employment.