Introduction to Economics Unified

THE FOUNDATION OF

ECONOMICS

SOCIETY HAS VIRTUALLY

UNLIMITED WANTS...

THE FOUNDATION OF

ECONOMICS

SOCIETY HAS VIRTUALLY

UNLIMITED WANTS...

BUT LIMITED OR SCARCE

PRODUCTIVE RESOURCES!

GOODS & SERVICES PROVIDE...

UTILITY

GOODS & SERVICES PROVIDE...

UTILITY

LUXURIES

GOODS & SERVICES PROVIDE...

UTILITY

LUXURIES vs. NECESSITIES

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

LAND

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

LAND

CAPITAL

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

Notes...

LAND

INVESTMENT

CAPITAL

CAPITAL

FINANCIAL

CAPITAL

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

LAND

CAPITAL

HUMAN RESOURCES

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

LAND

CAPITAL

HUMAN RESOURCES

LABOR

SCARCE RESOURCES

ECONOMIC RESOURCES

PROPERTY RESOURCES

LAND

CAPITAL

A/K/A

Factors

Of

LABOR

ENTREPRENEURIAL ABILITY

ENTREPRENEURIAL ABILITY

Takes The Initiative

Makes Policy Decisions

Innovator

The Risk Bearer

PRODUCTION POSSIBILITIES

Assumes...

Efficiency

Fixed Resources

Fixed Technology

Two Products

for example...

Assumes...

Efficiency

Fixed Resources

Fixed Technology

Two Products

for example...

Assumes...

Efficiency

Fixed Resources

Fixed Technology

Two Products

for example...

PRODUCTION POSSIBILITIES

What if we could only produce ...

10,000 Robot Arms

or

400,000 Pizzas

Using all of our resources, to get some pizza, we must give up some robot arms!

for example...

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands)

109 7 4 0

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES in table form

PIZZA 0 1 2 3 4

(in hundred thousands)

Robots

(in thousands) graphical form

109 7 4 0

Pizzas

(hundred thousands)

PRODUCTION POSSIBILITIES

Limited Resources means a limited output...

At any point in time, a full-employment, fullproduction economy must sacrifice some of product

X

to obtain more of product

Y

.

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

A

B

C

Attainable but

Inefficient

D

Unattainable

W

Attainable

& Efficient

E

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

A

Notes...

Unattainable

OPPORTUNITY COSTS

B

The amount of other

C products that must be

W forgone or sacrificed to obtain 1

D

Attainable the opportunity cost of that good.

Attainable

& Efficient but

Inefficient

E

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

Notes...

Unattainable

A

OPPORTUNITY COSTS

B

A graph of the production possibilities curve will be W

- bowed out from the origin.

D

Economic resources are not completely adapt-

Attainable but

Inefficient

E

Attainable

& Efficient

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

U

Unemployment &

Underemployment

Shown by Point

U

More of either or both is possible

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

Notes...

Unemployment &

Economic Growth

Underemployment

The ability to produce

Shown by Point

U

a rightward shift of

More of either or possibilities curve

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

Notes...

Unemployment &

Economic Growth

Shown by Point

U

2 - Better resource

U quality -

More of either or

3 both is possible advances

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

Q

PRODUCTION POSSIBILITIES

Q 14

13

12

11

10

9

8

7

4

3

2

6

5

1

A’

B’

Economic Growth

C’

D’

1 2 3 4 5 6 7 8

Pizzas

(hundred thousands)

E’

Q

PRODUCTION POSSIBILITIES

Two Examples of Economic Growth

FAVORING

PRESENT GOODS

CURRENT

CURVE

FUTURE

CURVE

CONSUMPTION

Goods for the Present

PRODUCTION POSSIBILITIES

Two Examples of Economic Growth

FAVORING

PRESENT GOODS

FAVORING

FUTURE GOODS

CURRENT

CURVE

FUTURE

CURVE

CONSUMPTION

Goods for the Present

CONSUMPTION

FUTURE

CURVE

CURRENT

CURVE

Goods for the Present

PRODUCTION POSSIBILITIES

Applications...

•

Unemployment and

Productive Inefficiency

PRODUCTION POSSIBILITIES

Applications...

•

Unemployment and

Productive Inefficiency

•

Tradeoffs and

Opportunity Costs

PRODUCTION POSSIBILITIES

Applications...

•

Unemployment and

Productive Inefficiency

•

Tradeoffs and

Opportunity Costs

•

Shifts and the Production

Possibilities Curve

ECONOMIC SYSTEMS

THE MARKET SYSTEM

Pure Capitalism

Laissez-faire

ECONOMIC SYSTEMS

THE MARKET SYSTEM

Pure Capitalism

Laissez-faire

THE COMMAND SYSTEM

Socialism

Communism

CIRCULAR FLOW MODEL

RESOURCE

MARKET

BUSINESSES HOUSEHOLDS

PRODUCT

MARKET

CIRCULAR FLOW MODEL

RESOURCES

RESOURCE

MARKET

INPUTS

BUSINESSES HOUSEHOLDS

PRODUCT

MARKET

CIRCULAR FLOW MODEL

$ INCOMES $ COSTS

RESOURCES

RESOURCE

MARKET

INPUTS

BUSINESSES

GOODS &

SERVICES

PRODUCT

MARKET

GOODS &

SERVICES

HOUSEHOLDS

CIRCULAR FLOW MODEL

$ INCOMES $ COSTS

RESOURCES

RESOURCE

MARKET

INPUTS

BUSINESSES

GOODS &

SERVICES

PRODUCT

MARKET

GOODS &

SERVICES

HOUSEHOLDS

CIRCULAR FLOW MODEL

$ INCOMES $ COSTS

RESOURCES

RESOURCE

MARKET

INPUTS

BUSINESSES HOUSEHOLDS

GOODS &

SERVICES

$ REVENUE

PRODUCT

MARKET

GOODS &

SERVICES

$ CONSUMPTION

CIRCULAR FLOW MODEL

$ COSTS $ INCOMES

RESOURCE

MARKET

INPUTS

BUSINESSES

Conclusions

HOUSEHOLDS

GOODS &

SERVICES

GOODS &

SERVICES

PRODUCT

MARKET

$ REVENUE $ CONSUMPTION

Chapter 3

INDIVIDUAL MARKETS

DEMAND & SUPPLY

Coming Soon…

Understanding Macroeconomics

-- Our Game Plan

• A model is like a road map. It illustrates inter-relationships.

• We will use the circular flow of output and income between the business and household sectors to illustrate macro-economic inter-relationships.

• As our macroeconomic model is developed, initially, we will assume that monetary policy

(the money supply) and fiscal policy

(taxes and government expenditures) are constant.

Four Key Markets

• Goods and Services Market:

Businesses supply goods & services in exchange for sales revenue. Households, investors, governments, and foreigners (net exports)

demand goods.

• Resource Market:

Highly aggregated market where business firms

demand resources and households supply labor and other resources in exchange for income.

The Circular Flow Diagram

• Four key markets coordinate the circular flow of income.

• The resource market coordinates the actions of businesses demanding resources and households supplying them in exchange for income.

• The goods & services market coordinates the demand for and supply of domestic production

(GDP).

• The foreign exchange market brings the purchases (imports) from foreigners into balance with the sales (exports plus net inflow

of capital) to them.

• The loanable funds market brings net household saving and the net inflow of foreign capital into balance with the borrowing of businesses and governments.

What Shall We Give Up?

Opportunity Cost

• Opportunity cost :

The highest valued activity sacrificed in making a choice.

• Opportunity costs are incurred when a choice is made.

• They are subjective and vary across persons.

• If an option becomes more costly, an individual will be less likely to choose it.

• The opportunity cost of college:

• Monetary cost: tuition, books.

• Non-monetary cost: forgone earnings.

• If the opportunity cost of college rises

(e.g. tuition rises) , then one will be less likely to attend college.

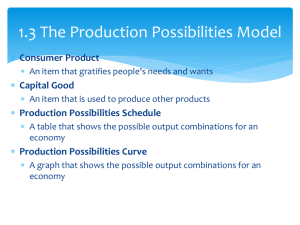

Production

Possibilities Curve

Production Possibilities Curve for Susan’s grades in English and Economics (10 hrs of study)

• Susan is a student who only has 10 hours of study to divide between her economics and English classes.

• If she spends most of her time studying economics, she can earn and a D in her English class.

• If she splits her time between the two, she can earn a B in economics

… and a B in her English class.

• If she spends most of her time studying English, she can earn a and an A in her

English class.

• Mapping out all the possibilities of how Susan can divide her time

(limited resources) between these activities shows us her Production

Possibilities Curve ( PPC ).

Expected grade in

Economics 101

A

B

C

D

F

F D C

Production Possibilities

Curve ( PPC )

B A

Expected grade in

English 101

Production Possibilities Curve for a nation’s economy (given limited resources)

• Consider an economy which has limited resources to divide between the production of clothing and food.

• If it allocates all of its resources toward the production of clothing, then it can produce at point S.

• If the it allocates all of its resources toward the production of food, then it can produce at point T.

• Mapping out all the possibilities of how an economy can divide the use its resources gives us the economy’s

Production Possibilities Curve.

• Output combinations A, B, & C are all on the PPC and are, therefore,

efficient allocations of resources.

• D is within the PPC and represents an inefficient resource allocation.

Combination B delivers more food with the same output of clothing.

Only clothing is produced

Output of clothing

S

A

D

- Inefficiency -

Production Possibilities

Curve ( PPC )

B

C

All output combinations on the frontier curve are efficient.

Only food is produced

T

Output of food

Shifting the Production

Possibilities Curve Outward

• An increase in the economy’s

resource base would expand our ability to produce goods and services.

• Advancements in technology can expand the economy’s production possibilities.

• An improvement in the rules (laws, institutions, and policies) of the economy can increase output.

• By working harder and giving up current leisure, we could also increase our production of goods and services.

• This requires us to give up something else we value: leisure.

Investment and Production

Possibilities in the Future

• The long-term benefits of investment include greater output in the future. Thus, decisions we make today regarding how much to save

(investment) and consume determine the shape of the

PPC 10 years from now.

• If we choose to produce a mixture of consumption and investment goods which corresponds to bundle A … then the future PPC might move out to PPC 2015 with A

– due to the new buildings, equipment, training, and other forms of investment goods that I

A represents.

Investment goods

PPC 2005

PPC 2015 with A

I

A

C

A

A

Consumption goods

Investment and Production

Possibilities in the Future

• If we choose to produce a mixture of consumption and investment goods which corresponds to bundle B, with fewer consumption goods (C

B

< C investment (I

A

B

) and more

> I

A

) … then the future PPC might move out to PPC 2015 with B instead.

• The level of investment

(savings) in an economy is only one determinant of the movement outward (or inward) of the production

possibilities curve.

Investment goods

PPC 2005

PPC 2015 with B

PPC 2015 with A

I

B

I

A

B

A

C

B

C

A

Consumption goods

Trade, Output, and Living Standards

Division of Labor

• Division of labor: breaks down the production of a commodity into a series of tasks performed by different workers.

• Specialization and division of labor increase output for three reasons:

• Specialization permits individuals to take advantage of their existing skills.

• Specialized workers become more skilled with time.

• Division of labor allows for the adoption of mass-production technology.

Law of Comparative Advantage

• Law of comparative advantage:

The proposition that the joint output of trading partners will be greatest when each good is produced by the low opportunity cost producer.

• Implies that trading partners can gain by specializing in the production of goods they can produce at a relatively low opportunity cost and trade for goods they could only produce at a relatively high opportunity cost.

• The principle of comparative advantage is universal as it applies across individuals, firms, regions and countries.

Sources of Gains from Trade

• Trade is a key to prosperity because it:

• channels goods toward those who value them the most, and,

• makes it possible for people to produce more as the result of specialization and division of labor, large-scale production processes, and the dissemination of improved products and lower cost production methods.

• Economies of Scale: often, large scale production leads to lower per unit costs.

• Innovation: technological change is about figuring out how to get more from

• existing resources.

Is the Size of the Economic

Pie Fixed or Variable?

Economic Pie

• At any point in time, output is limited by the resource base. The production possibilities curve highlights this point.

• Over time, investment and improvements in technology permit us to increase output. Shifts in the production

possibilities curve highlight this point.

• Economic goods are the result of human ingenuity and action. Through time, the size of the “economic pie” is variable, not fixed.

The Importance of Economic Growth

• Economic growth is important because it is a necessary ingredient for both higher incomes and higher living standards.

• GDP is a measure of both output and income. Growth of output is necessary for growth of income.

• Per capita GDP is the nation’s GDP divided by its population. Growth of per capita GDP means more goods and services per person.

• In most cases, higher levels of per capita GDP will mean that the typical person has a better diet, improved health and access to medical services, a longer life expectancy, and greater educational opportunity.

The Importance of Economic Growth

• Economic growth expands the sustainable output rate Y

F of an economy.

• This can be illustrated by an outward shift in the production possibilities curve …

LRAS (from LRAS

1995 to LRAS or an increase in

2005

).

Consumption goods

B

Price

Level LRAS

1995

SRAS

1995

LRAS

2005

SRAS

2005

PPC

2005 A

PPC

1995

P

1

AD

2005 AD

1995

A B

Capital goods Y

F1995

Y

F2005

Real

GDP

The Importance of Economic Growth

• Cross country differences in growth rates over a few decades substantially alter relative income.

• From 1960-2002, per capita income growth in

Argentina and Venezuela was 0.5% and - 0.2% respectively . . .in contrast, the growth rates of Japan and Hong Kong were 4.2% and 5.3%.

• Note how the rapid growth rates of the two Asian economies dramatically altered their relative incomes compared to the other two economies.

Per-Capita Income

(in thousands of 1985 U.S. Dollars)

Argentina

Venezuela

2,954

4,462

5,585

6,338

5,683

1960

2002

Japan

16,271

Hong Kong

2,247

19,618

Source: Robert Summers and Alan Heston, Penn World Tables, Mark 5.6 (Cambridge: National Bureau of Economic Research, 1994); and World Bank, World Development Indicators, CD-ROM, 2004.

Differences in

Growth Rates among Nations

The growth of per-capita GDP for high-income industrial countries, high-growth LDCs, and low-growth LDCs, (1980–2002)

High-growth LDCs

China

South Korea

Taiwan

Ireland

Botswana

Thailand

Mauritius

Singapore

Hong Kong

India

8.1%

6.1%

6.0%

4.8%

4.6%

4.6%

4.4%

4.2%

3.7%

3.6%

High-income industrial

United Kingdom

Japan

Australia

United States

Netherlands

Italy

France

Germany

Canada

Switzerland

2.2%

2.1%

1.9%

1.9%

1.8%

1.8%

1.7%

1.7%

1.6%

0.7%

Low-growth LDCs

Congo (Zaire)

Sierra Leone

Haiti

Madagascar

Niger

Côte d’lvoire

Togo

Nicaragua

Venezuela

Nigeria

Sources: Derived from World Bank, World Development Indicators, CD-ROM, 2004; and Republic of China, Statistical Yearbook of the

Republic of China, 2004. Only countries with a population of 2 million or more in 2002 are included in this table.

• The growth performance of less-developed countries

(LDCs) is characterized by diversity.

• While the fastest growing countries in the world are

LDCs, other LDCs have negative real growth.

-4.9%

-3.3%

-2.8%

-2.1%

-2.0%

-1.8%

-1.7%

-1.4%

-1.3%

-1.1%

Questions for Thought:

1. Which of the following is true?

a. The fastest-growing economies in the world are mostly less developed countries.

b.The slowest growing countries in the world, many of which are experiencing declines in per capita GDP, are less developed countries.

2. “Other things constant, low income countries should be able to grow rapidly because they can either emulate or import at a low cost proven technologies from countries with higher incomes.”

-- Is this statement true?

Role of Government and Economic Progress

• The economic, political, and legal environment is a major determinant of economic growth.

• Governments help promote economic growth when they focus on two core functions:

• Provision of a legal, regulatory, and monetary environment that enforces contracts and protects people and their property from the actions of aggressors (both domestic and foreign) , and,

• Provision of a limited set of public goods like roads and national defense that are difficult to provide through markets.

Role of Government and Economic Progress

• As governments expand beyond these core functions, however, the beneficial affects will eventually wane and become negative.

The Size of Government and Economic Growth

• There are four major reasons why expansion in the size of government beyond the core protective and productive functions will eventually retard economic growth.

• High taxes & borrowing impose increasing deadweight losses on the economy.

• Diminishing returns cause the rate of return derived from government activities to fall.

• The political process is much less dynamic than the market process.

• A larger government becomes more heavily involved in the redistribution of income and regulatory activities.

Size of Government – Growth Curve

Growth rate of the economy

B

6%

3%

A

Size of government

(percent of GDP)

• If governments undertake activities in the order of their productivity, the growth of government will initially promote economic growth (move from A to B) .

• At some point, however, continued expansion of government will retard growth (moves beyond B) .

Govt Spending and Economic Growth

• The relationship between the size of government at the beginning of the decade and the growth rate of real GDP

• for each decade during the 1960-2000 period is shown

An increase in government spending of 10%

GDP) reduces annual growth by about 1%.

(as a share of

Growth rate

(respective decade)

Data are for the 23 long-standing member countries of the OECD

10 %

8 %

6 %

4 %

2 %

0 %

10 % 20 % 30 % 40 % 50 %

Total government expenditures (start of respective decade)

60 %

Source: OECD, OECD Economic Outlook (various issues) and The World Bank, World Development Indicators, 2001, CD-ROM.

Economic Growth:

Big vs. Small-Government Countries

Countries w/ government spending greater than 48% of GDP (1999-2003) Average annual growth rate of GDP, 1990-2003

Sweden

Denmark

France

Austria

Finland

Belgium

Italy

Average

58.2%

55.7%

53.3%

52.1%

50.2%

50.2%

48.3%

52.6%

1.8%

2.0%

1.8%

2.2%

1.7%

1.9%

1.5%

1.8%

Countries w/ government spending less than 37% of GDP (1999-2003) Average annual growth rate of GDP, 1990-2003

Australia

United States

Ireland

Average

36.2%

34.6%

33.8%

34.9%

3.3%

2.9%

4.3%

6.8%

• The average annual growth rate of OECD countries for the 1990 to 2003 period was greater for small government countries than for large government countries.

Questions for Thought:

1. “Most low income countries are poor because they lack the necessary natural resources for development.”

-- Is this statement true?

2. “In recent decades the highest rates of economic growth have been achieved by high income countries with the largest government expenditures as a share of GDP.”

-- Is this statement true?

Questions for Thought:

3. Which of the following is most important if a country is going to achieve and sustain rapid economic growth? a. large government expenditures as a % of GDP b.institutions & policies supportive of competition (open markets) and freedom of exchange c. free elections and political democracy

4. The growth records of Japan and Hong Kong during the last 50 years indicate that an economy can grow rapidly without: a. securely defined property rights b. abundant domestic resources c. significant capital formation d. adopting modern technology

Questions for Thought:

5. Which of the following is true? a. International trade makes it possible for a nation to use more of its resources producing items it can supply economically and less producing goods that can be supplied domestically only at a high cost.

b. Trade barriers such as tariffs and import quotas will protect domestic jobs, expand employment, and help a nation achieve a higher standard of living.

Measuring Economic Freedom

• Economic freedom is complex and difficult to measure.

• The Fraser Institute Index of Economic Freedom measures the presence of:

• rule of law,

• secure property rights,

• monetary stability,

• free trade, and,

• reliance on markets.

• To achieve a high economic freedom rating, a country must keep taxes low, avoid trade barriers, rely on markets to allocate goods, and provide secure protection of private property, unbiased enforcement of contracts, and a stable monetary environment.

The Most and Least Free

Economies of the World

Most free (1980-2000 summary rating)

• The Fraser Institute uses 38 different components to rate the economic freedom of more than than 120 countries.

economies during the 1980-2000 period are shown here.

• Both the per capita income levels and the growth rates of the free economies were substantially higher than for those less free.

designed to measure economic

freedom rather than political freedom, civil liberties, or the degree of democracy.

Source: James Gwartney and Robert Lawson,

Economic Freedom of the World: 2004.

Hong Kong

Singapore

United States

Switzerland

Canada

United Kingdom

Netherlands

Luxembourg

Germany

Australia

Iran

Brazil

Syria

Ghana

Nigeria

Nicaragua

Uganda

Algeria

Myanmar

Congo

(Dem. Rep. of)

4.2

4.2

4.0

4.0

4.0

3.9

3.9

3.8

3.7

3.6

7.4

7.3

7.3

7.3

8.7

8.3

8.0

7.9

7.5

7.5

Least free (1980-2000 summary rating)

The Importance of Property Rights

Economic Freedom and Economic Growth

(a) Per-capita GDP

(2000 U.S. dollars)

$27,195

(b) Growth of real GDP per capita

( 1990–1999)

2.4%

2.0%

$16,737

0.8%

$5,288

$2,498

0.1%

< 5.0

5.0 - 5.99

6.0 - 6.99

> 7.0

< 5.0

5.0 - 5.99

6.0 - 6.99

> 7.0

–––––––––––––––––––– EFW Average Ratings 1980-2000 ––––––––––––––––––––––––

Source: James Gwartney and Robert Lawson, Economic Freedom of the World: 2001 Annual Report.

• The average income levels and growth rates at different levels of economic freedom are shown here for countries included in the Frasier Index.

• Note that countries with more economic freedom from

1980 to 2000 also had higher per capita income levels in 2000 and more rapid growth rates for the period.

Questions for Thought:

1. “Economic freedom is present if a country is a political democracy.”

-- Is this statement true?

2. "Sound institutions and policies are the key to economic growth. If a nation creates an environment conducive for economic growth, people will supply and develop the resources and technology."

-- Is this statement true?

Is the proper economic environment more important than the supply of resources?

Questions for Thought:

3. Adam Smith argued that the wealth of nations was dependent upon gains from a. specialization and trade, b. expansion in the size of the market, and, c. the discovery of better (more productive) ways of doing things.

Was Adam Smith right? Are there other factors that you would add to his list?

4. In order to achieve a high economic freedom rating, a country must … a. rely on a strong central government to make economic decisions. b. be a political democracy. c. refrain from the imposition of barriers that limit voluntary exchange.

Questions for Thought:

5. On average, countries that have a larger degree of economic freedom tend to have … a. higher per capita income levels, but slower rates of economic growth, than countries with less economic freedom.

b. lower per capita income levels, but more rapid rates of economic growth, than countries with less economic freedom.

c. both higher per capita income levels and more rapid economic growth rates than countries with less economic freedom.

d. both lower income levels and slower economic growth rates than countries with less economic freedom.

Private Property Rights

• Property rights :

The right to use, control, and obtain benefits from a good or service.

• Private property rights involve:

• the right to exclusive use.

• legal protection against invaders.

• the right to transfer to another.

Private Property and Incentives

• Private ownership is a key to prosperity because it provides people with a strong incentive to take care of things and develop resources in ways that are highly valued by others.

• Private owners can gain by using their resources in ways beneficial to others.

• They have a strong incentive to care for and manage what they own.

• They have an incentive to conserve for the future (especially if the property’s value is expected to rise).

Private Property and Incentives

• Private ownership is a key to prosperity because it provides people with a strong incentive to take care of things and develop resources in ways that are highly valued by others.

• With private property rights, owners are liable if their property is used in a manner that damages the property of others.

• Private ownership links responsibility with the right of control.

• In contrast, commonly owned property will be poorly maintained and over-utilized rather than conserved for the future.

Private Property and Markets

• When private property rights are protected and enforced, permission of the owner is required for use of a resource.

– If you want to use a good or resource, you must either buy or lease it from the owner.

– Individuals are faced with the cost of using scarce resources.

• Market prices provide a strong incentive for private owners to consider the desires of others and to use and develop resources that are highly valued by others.

Questions for Thought:

1. (a) Can private owners do anything they want with the things that they own?

(b) Why is private ownership important?

(c) Do the owners of land and buildings near your campus have an incentive to use those assets to provide things that students value highly? Why or why not?

2.

Does a 60 year old tree farmer have an incentive to plant and care for

Douglas fir trees that will not reach optimal cutting size for 50 years? Explain.

Questions for Thought:

3. Selling your organs is a violation of federal law, a felony punishable by up to five years in prison or a $50,000 fine. Because of this, in September 1999 eBay intervened when a person put one of his kidneys up for sale on eBay (the bidding reached $5.7 million before it was pulled).

Is the United States a better place to live because such transactions are prohibited? Why or why not?