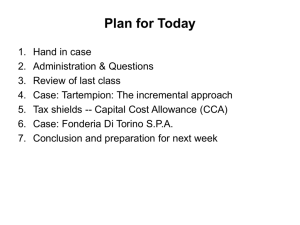

Using Subtraction to Find Incremental Benefits and Costs

Using Subtraction to

Find Incremental

Benefits and Costs

©2002 Dr. Bradley C. Paul, modified 2009

Herby Must Now Compare

Herby is comparing two alternatives that will both cost him money

One often used technique is to subtract one alternative from the other and look at the incremental value of choosing one alternative over the other

This then becomes a question of how much you gain (or loose by choosing one alternative over the other)

Application

Need to first decide which alternative we think we want to choose. - Oh yes the loan with the lower payments.

$3,535-$4,060=

-$525

$240.88 - $157.49 =

83.39 / month

$238.52 -

$297.48 =

-$58.96

-$50.56 -$41.40 -$31.43 -$20.56 -$7.71

$1630.95 - $6358.68 =

-$4,727.73

Now What Should Herby

Do?

He has a cash flow that represents the value of choosing the loan with the lower payments and interest rate

Naturally he could discount it back to his decision point (when he goes to bank or signs on the internet)

But What Rate?

Herby’s Interest Rate

Dilemma

Herby hopes to save some money by picking the lower monthly payments and interest rate

What will he do with the money he saves?

May very well use it for school. Herby may be looking at student loans for what ever he and wifey can’t get together

Herby’s incremental cost of money may be what student loans would cost

Herby may be playing the market on the side

What could Herby get on the market if he were to invest

More on Herby’s Dilemma

Herby might not know what the heck his cost or value of money is

Lets suppose Herby is clueless

With spreadsheet Herby can try different interest rates and see what the resulting flow is.

Lets identify our cash flow elements

$83.39

We have a

Present Value that needs no magic number

-$50.56 -$41.40 -$31.43 -$20.56 -$7.71

-

4727.73

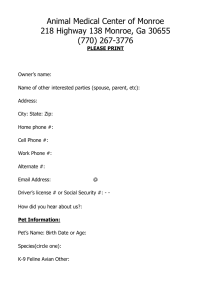

Put the Cash Flow in Class

Assistant

Enter the monthly

Cash flow in the

Yellow cash flow

Field.

(This will be the

Favorite Pony

Minus other

Pony cash flow)

Try an Interest Rate

Enter Your Annual Interest Rate as a %, but do not use the % key during data entry

Enter the number of compounding periods in one year 12

Period interest rate 0.001666667 (in decimal form)

2

Cash Flow Evaluation Index Values

(Warning IRR and Payback may not function properly on unconventional cash flows)

NPV 499.09708

Guess an interest rate – I guessed 2% with 12 compounding periods a year

(ie monthly compounding)

Note the NPV comes out positive – This means that our

Guess is working and we are saving money!

Try Another Interest Rate

Enter Your Annual Interest Rate as a %, but do not use the % key during data entry

Enter the number of compounding periods in one year

Period interest rate 0.006666667 (in decimal form)

12

8

Cash Flow Evaluation Index Values

(Warning IRR and Payback may not function properly on unconventional cash flows)

NPV 935.29179

Now I Tried 8% and the NPV is still Positive

(actually – I’m not working too hard to just plug in a bunch of numbers and check out

The result).

Observations

Notice that even where something is going to cost you money that subtracting one alternative from another will show an

NPV for the value of picking one alternative instead of the other.

If somethings going to cost you you usually have choices. This technique allows you to measure the value of one choice vs. the other

If you have only one choice you can still get the NPV of what it will cost you.

More Observations

In this case one of the reasons for choosing the spreadsheet was we were unsure of what interest rate to use.

Many activities and needs cost money.

Freeing up money from the activity brings other opportunities

They may be to eliminate debt or the need for debt

They may be to invest.

A Personal Life Interest

Rate

Herby may have several things that cost him money

(look for where your additional margin of dollars go and what interest rate or forgone interest rate opportunities there are)

School if you can’t pay as you go you have student loans

Credit Cards - if you have needs you are going to charge (or a credit card debt from previous needs)

If you have investment opportunities

If you could put money into CDs or a money market account

If you have an interest bearing checking account it may have a rate

The home loan itself has an interest rate - and most allow extra payment directly against principle.

Notes about NPV

The NPV of picking the internet loan over the local loan is positive for any positive rate of interest

(just cash flow total was positive)

The higher the interest the more discounted the home equity at the end is and the greater the savings on monthly payments and interest expenses.

Conclusion

Herby should pick the internet loan

Notice that this kind of calculation can be done to decide when to refinance a house or to choose between various borrowing options.

We’ve now decided which loan is best for the house - but not whether Herby should buy or rent.

Now That You Know the

Subtraction Technique

You Need An Opportunity to Use it

Do Homework #7

(Help Ned and Nelly Newcar decide how to finance their new car)