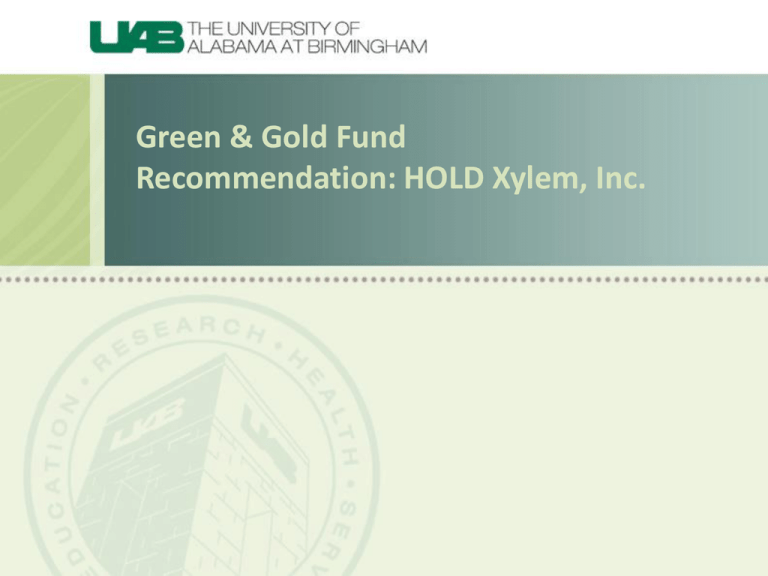

Xylem Position in Fund

advertisement

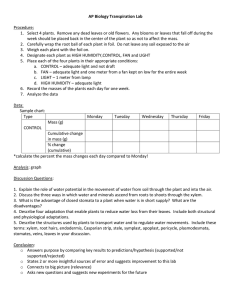

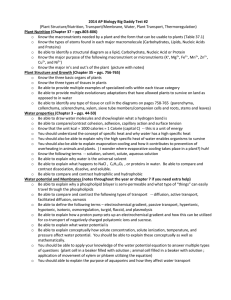

Green & Gold Fund Recommendation: HOLD Xylem, Inc. Xylem Position in Fund • Purchased 300 shares on February 23, 2012 @ 27.56 per share. ($8,268) • Currently @ 27.98 per share. ($8,394) • $126 gain High @ 28.73 on March 15 Low @ 23.16 on July 16 Water Industry Overview Global Water Sector Growth Drivers $425 Billion Population Growth 4% to 6% defensive long-term growth Supply Shrinking due to Pollution Movement towards Global Water Oligopoly Industrial Expansion Urbanization Infrastructure Replacement/Upgrade Technology Xylem Company Profile • Spun off from ITT in 2011 • Xylem (XYL) is a leading global water technology provider. • • • • • • Transport Treat Test Public Utility Industrial Agricultural • Operates in 150 countries • 12,500 employees worldwide Xylem Inc. Segments (% of Revenue) Geographic Mix Transport 3% Europe 16% 37% 11% 36% US Treatment 16% Test 45% Asia Pacific Other Building Services 19% 6% 11% Industrial Water Irrigation How does Xylem contribute to solving the water crisis? Challenges: XYL Solution: Making water from multiple sources safe to drink. Develop more water treatment systems. Growing scarcity and populations. Reuse and Recycle water. Using less energy to transport water. Modernize the water system. Financial Highlights (in millions) 2009 2010 2011 2012E 2013E Revenue 2,849 3,202 3,803 3,806 3,911 Net Income 202 286 358 303 366 Free Cash Flow 308 301 388 276 345 • XYL has continued to increase revenue over the past few years through strategic acquisitions, even with slower revenue growth in Europe. • Strong free cash flow opens the door for future acquisitions or an increase in the dividend payout. Comparables Analysis XYL PNR FLS WTR AVG Market Cap 5.80 B 12.26B 8.34B 5.37B 7.94B Forward PE 14.01 15.72 14.61 22.00 16.585 FCF (2013E) 344.70 335.9 621.39 -5.01 324.25M FCF (2012E) 276.10 249.59 475.96 -20.81 245.21 Debt to Equity 0.59 0.28 .46 1.26 0.65 Div Yield (2013E) 1.60% 1.82% 0.99% 2.71% 1.78% • XYL & PNR are strong compared to peer group. XYL Investment Information Xylem highlights from February 2012 to January 2013 • XYL stock has been fairly stationary since we bought the stock and is currently $0.42 above where we bought it. Why? • Revenue did not increase at the expected rate in developed markets, especially Europe. • Losses in foreign exchange conversions. • However, acquisitions, which did better than planned, are expected to continue throughout 2013. SWOT Analysis Strengths Broad Portfolio Water is >90% of total revenues Partnerships- GE, Zenon, Toro, Mono Established Brand Names (38) BBB Rating Weaknesses Lack of Available Information Ability to hedge foreign currency transaction risks Opportunities Acquisitions Growth into Emerging Markets Mergers Aging Water Infrastructure Threats Decelerated growth of global economies Increased costs of raw materials Regulatory Compliance Investment Thesis • In order to maintain exposure in the growing water sector, we should hold Xylem Inc. due to their use of technology and more than 90% of their revenues coming from water. The global recession has prevented the takeoff we originally expected. However, as economies recover and more nations require infrastructure upgrades, we expect XYL’s stock price to increase. Portfolio Placement • • • • • • Sector : Industrials and Materials Industry Group: Water Current Holdings: XLI, XME, GE, UPS, SAND, XYL Target Sector Allocation: 8.23%, $44,491 Current Sector Allocation: 10.98%, $59,357 Remaining Allocation: (2.75)%, $(14,866) • HOLD 300 shares of XYL. ($8,388, 1.49% of portfolio, 13.59% of sector) • year end target price: $32.00 One Year Stock Chart