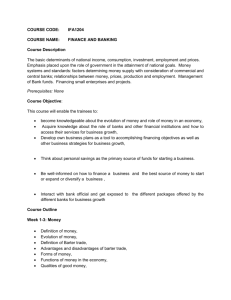

2. Stages of a banking crisis in Ukraine

advertisement

OTTO-VON-GUERICKE-UNIVERSITY MAGDEBURG Faculty of Economics & Management DONETSK NATIONAL TECHNICAL UNIVERSITY Faculty of Management Department of International Business Activity Bank system of Ukraine in conditions of world crisis Selyshchev Kyrylo 50 years of the USSR 143A/37 83100 Donetsk International Economics Specialisation "European Studies" Semester: 3 E-Mail: n1416@matrixhome.net Date of submission: 17.10.2010 Table of content Abbreviations............................................................................................ III Abstract ...................................................................................................... IV 1. Introduction ............................................................................................. 1 2. Stages of a banking crisis in Ukraine .................................................... 3 2.1 I stage. The beginning of the banking crisis. End of September October 2008 ............................................................................................ 3 2.2 II stage of the banking crisis. November-December 2008 ............. 4 2.3 III stage of the banking crisis. January-February 2009 ................ 4 2.4. IV stage of the banking crisis. March-June 2009.. ........................ 5 2.5 V stage of the banking crisis. July - August 2009 ........................... 6 3. Stabilization policies of the banking system of Ukraine during the financial crisis .............................................................................................. 7 4. Improvement of the Ukrainian banking system and its exit from the crisis............................................................................................................10 5. Conclusion. The future of the banking system of Ukraine, forecasts and fears.....................................................................................................14 References .................................................................................................. 18 II Abbreviations AUB Association of Ukrainian Banks bn. Billion GDP Gross Domestic Product JSC Joint Stock Company NBU National Bank of Ukraine UAH. Hryvnia III Abstract This paper describes the stages of a banking crisis in Ukraine during the financial crisis beginning in late September 2008 and ending August 2009. The mechanisms of stabilization of the banking system of Ukraine during the financial crisis. Discusses ways to improve the banking system and out of the crisis. The last section shows the future of the banking system of Ukraine. Keywords: banking system, the global financial crisis, stabilization mechanisms, the banks. IV 1. Introduction In the first half of 2007, the local mortgage market crisis began in the U.S. and very quickly transformed into a national financial crisis, including a banking crisis. In mid2008 grew into a global crisis. What was this? A meltdown in financial markets, the bankruptcy of leading banks in most developed countries, reducing the liquidity of banks and economies of most countries, caused by the rapid outflow of capital from countries that are developing, a decline in foreign investment and the devaluation of national currencies. The further deepening financial crisis, in order to further strengthen its impact on the real sector of the global economy, which produced up to a collapse in demand and prices, as well as unemployment, bankruptcy of mass campaigns, including the presenters. Not gone unnoticed and Ukrainian banks. The global financial crisis has not taken in the real sector and the Ukrainian banks side, which over the high openness of national economies have become too dependent on processes in global markets. The banking system of Ukraine was not ready to test the financial crisis. Before the global crisis, financial analysts gave a positive assessment, as happened the other way around. Has been developed and long-term vision of the banking system of Ukraine, and this despite the fact that in its formation, it is experiencing the third wave decline. Many scientific publications related to the question about the problems of Ukraine's banking system amid the global financial crisis. 1 Ensuring the stability of the banking system is the main guarantee of the effectiveness of counter possible negative effects of the global financial crisis. Analyze the state of the banking system needed in complex with the entire financial system. The financial health of the state as a whole - is the main factor for our business. In a crisis, the banking system in the public mind has lost status as the main engine of the economy. You can talk about a lot of problems that have accumulated in the banking sector: the large and small banks, the short-term liabilities, distressed assets, imperfect methods, obsolete products and much more. To increase the stability of banking systems should quickly establish a new reserve currency, albeit not as global as the dollar, but also capable of protecting the banks from the impact of the crisis. 2 2. Stages of a banking crisis in Ukraine 2.1 I stage. The beginning of the banking crisis. End of September - October 2008 The banking crisis in Ukraine began by raiders' attacks on Prominvestbank. From this bank had a run of money at first - legal entities, but after a while, and physical. If the National Bank of Ukraine has not entered a temporary administration in Prominvestbank, it would be declared bankrupt. But this did not happen. The Bank continued to function, due to the emergence of a new investor. They became Vneshneekonombank Russia. After five months of interim administration in the bank ceased its operation. But she did a lot of effective measures, such as full control over the bank's payment system, implementation of liquidity management, the new wage system. With these activities Prominvestbank back the confidence of customers. In early October, with the liquidity problem facing the bank "Nadra". He was unable to pay off its external obligations and they cannot be restructured. But not only Nadra was in a bad position. In other banks decreased level of loan repayment. Internal political divisions in Ukraine and in addition to the international financial crisis affected banks' activities in Ukraine. The media did not provide any information about the situation in the banks. Furnishing pumping and all this have led to mistrust. Customers of banks dramatically began to take their money. To maintain liquidity and solvency of the National Bank refinancing loans issued by banks under liquid collateral. In turn, banks had to provide a program of financial recovery. National Bank of Ukraine (NBU) has restricted the activities of banks in order to avoid risks in their activities. 3 2.2 II stage of the banking crisis. November-December 2008 By the liquidity crunch has been added to the currency crisis. There was a dramatic change of course in November. Some banks will not be able to cover credit risks. They just did not have enough capital. The level of administrative expenses relative to assets in 2008 was practical at the same level as in 2007. NBU actively pursued activities and acute liquidity problems of banks were lifted. Have also been introduced in some banks interim administration for the solution of problems such as stabilization of banks, as well as updating the solvency and liquidity. 2.3 III stage of the banking crisis. January-February 2009 Despite the problems with liquidity, banks have not been able to maintain its own without a new tranche of loans from the NBU refinancing. Decline in economic activity, significant contraction in domestic demand, these factors led to negative economic trends that impact on the liquidity of the banking system. Tense due to the liquidity of banks, as well as the level of highly liquid assets continued to decline. There were introduced by the interim administration in the bank "Nadra" and Ukrprombank. National Bank introduced the "Institute of coaching, in order to gain control over the banks. "Curators" to provide controls over the activities of banks, being in them. First and foremost, control the use of bank loan refinancing, as well as the program of financial rehabilitation and other items. 4 2.4 IV stage of the banking crisis. March-June 2009 Some positive changes have come in March, significantly reduced the rate of outflow of funds in the fall of the index of production of basic industries - to (-) 28.8% in annual terms compared to (-) 29.9% in February, which was due to improvement in the dynamics of certain industrial activities - in the food industry, coke, chemical and petrochemical industries. In March, accelerate the increase in agricultural production. This phase of the banking crisis has found a certain reversal. Gradually returned confidence in the banks to reduce the intensity of customer churn, and the level of liquidity started to rise. Stabilization of the exchange rate is well influenced by banks' customers, especially for banks with foreign capital. Macroeconomic situation in Ukraine remains difficult. For the II quarter of 2009, real Gross Domestic Product (GDP) declined by 18%, while investments in fixed assets for the I half of 2009 compared with the same period in 2008 decreased by 43.3%. The situation in the banking sector has remained heavy. In the context of high risk and the deterioration of solvency of the population development of retail lending has ceased to be a priority. The market situation has greatly affected the activities of banks. The sharp increase in risk, as well as the deterioration of bank assets in 2009 resulted in significant contributions to the reserves. At this stage the deterioration contributed to the increase of capital as the expense of making the owners of real money, and the capitalization of 50% profit for the year 2008. The authorized capital of the 1 half of 2009 increased by 10 billion (bn.) hryvnia 5 (UAH), or 12.2%.Level of capitalization increased by performing bank capitalization program. 2.5 V stage of the banking crisis. July - August 2009 During July - August 2009 to restore lending to the economy. Loans that were granted to economic entities increased by UAH 2.4 billion, or 0.5%, while loans to individuals dropped by only 30 million (million) or the hryvnia at 0.01%. Capitalized three banks (Ukrgasbank, Rodovid Bank, Kyiv). At this time, maintained negative trend deterioration in the credit portfolio and assets in general. Trend deterioration in the loan portfolio quality, lower income from loan repayments have a negative impact on liquidity and remain one of the major challenges for the banking system of Ukraine. 6 3. Stabilization policies of the banking system of Ukraine during the financial crisis One important factor that ensures the further development of Ukrainian economy is the banking system. However, the mechanism for saving the stability of the banking system of Ukraine during the financial crisis is still poorly understood problem and therefore requires further study. In order to stabilize the banking system of Ukraine, to regain the trust of Ukrainians to domestic banks and the national currency. Let's look at how to do it: 1. Must regain the trust of Ukrainians in the national currency. According to Igor Lvov, the deputy chairman of the bank, "Finance and Credit, by far the NBU to stabilize the situation it is necessary to make foreign exchange intervention, introduce a rule for mandatory sale of foreign exchange earnings (5 days), stabilize the currency at 7.5 Hryvnia for dollar. 2. The stabilization of the banking system. Probably, the main challenge in dealing with the stabilization of the banking system of Ukraine is to maintain the liquidity of the banking system as a whole and of individual financial institutions. In early 2009, there was a significant deterioration of the solvency of a significant number of banks that have been provoked, first of all, the outflow of deposits and decrease the liquidity of working assets. Banking institutions had provided significant financial (in the form of loans to refinance NBU) and regulatory (NBU number of resolutions aimed at keeping the resource base) support the NBU. Starting from the second quarter of 2009 marked stabilization of the resource base, and the second half - an increase of deposits. 7 However, the question of confidence in the banking system of Ukraine, both from domestic investors and foreign creditors is still open, so over the coming year, the stability of the resource base will depend largely on the actions of the regulator for specific banks (including banks, in which currently there are temporary administration imposed NBU), as well as overall situation in the country (economic and political stability). 3. Cancel order of the Board of NBU № 413 of December 4, 2008, which was extended a moratorium on repayment of term deposits. A positive decision on this issue demonstrates the rule of law and allows commercial banks to restore investor confidence. But this requires good will of the NBU, which must admit a mistake and rescind its letter № 22-310/946-17250, which he drew the attention of banks on the fact that "banks are prohibited from carry early repayment of deposits, as they are invested in long-term debt other assets. " And then came that moment. May 15, 2009, it became known to abolish the National Bank of the moratorium on early repayment of deposits of individuals. Decree № 282 dated May 12, National Bank lifted paragraph 2 of Resolution № 413 of December 4, 2008, under which banks were obliged to "take all necessary measures to ensure the positive dynamics of growth of deposits in order to prevent the early return of funds placed with investors." In NBU consistently stated that this wording does not mean a moratorium which would contradict the Civil Code, but the bankers refused to early withdrawal of funds. "Moratorium on the withdrawal of deposits has never been. Perhaps the second paragraph of Resolution № 413 was interpreted as a ban, and some banks abused by this, - recognized Director of Legal Department of the NBU Viktor Novikov. - We have made a decision that lifted the second paragraph. Banks are not required to return deposits upon request of depositors. 8 They should educate and offer better conditions. If the client does not agree, the bank must return the contribution. "Lifting of the ban was expected, as a recommendation to the Board of the NBU and the condition of the International Monetary Fund. Also in April for the first time since the crisis has increased the volume of deposits in UAH - on 1.1%, or 1.05 billion USD. From October 2008 to March 2009, it declined by 29 bn. UAH. Let us consider methods of stabilization policy, which suggested that Vladimir Bobylev PhD, Head of Risk Management Joint Stock Company (JSC) "Black Sea". To ensure the financial stability of the banking system in times of economic crisis, you must: 1) to increase capitalization of the banking sector by raising additional equity capital; 2) improve the methodology for calculating the volume and standards of regulatory capital and regulatory risk; 3) increase the transparency of financial institutions and the diversification of business areas banks; 4) improve procedures for rehabilitation, restructuring and liquidation of banks; 5) enhance the competitiveness of banking services by substituting cash payments for non-cash payment instruments; 6) increase the number of state-owned banks, their capital resources and strengthen the role of state banks to domestic financial and credit markets; 7) introduce incentives for commercial banks that lend to innovative projects; 8) to set limits the interest rate on loans and monitor compliance with this restriction; 9) to develop the program cover the budget deficit through domestic borrowing mainly. 9 4. Improvement of the Ukrainian banking system and its exit from the crisis The president of the Association of Ukrainian Banks (AUB) Alexander Sugonyako says: "The problem is very complicated and expensive. It should be thoughtfully and carefully "to bury the dead banks" that it does not raise a panic in the society. Currently, about 20 banks, or are in the process of liquidation, or they work the interim administration. A number of banks continue to delay payments, not fulfilling their obligations. This negatively characterizes the entire banking system and undermines its credibility. Therefore, we must take immediate steps to clear the banking system of unreliable banks. This - a task for the National Bank and the government. " Necessary to remove the theme of distressed assets. In the majority of Ukrainian banks is - a major concern. Most part - over 10% of the loan debt is delinquent and bad loans, which, moreover, tend to increase. Upon reaching a part of problem loans more than 25% of the portfolio, it becomes extremely dangerous. It is therefore necessary to find ways and mechanisms to reduce this debt. Such activities is the sale and reorganization of unreliable banks, sale of assets of negative specialized financial institutions, the establishment of remediation of the bank, the recapitalization of banks and the like. It is imperative to develop a strategy of power with respect to state-owned banks and strengthen their role in the economy. It should be noted that today, no strategic objectives in the operation and development of state-owned banks, we do not exist they work like regular commercial bank. But it is through the power of the state banks would have to implement its economic policies aimed at the resumption and 10 development of Ukrainian economy, the more that these banks are the State has invested over 45 billion hryvnia budgets. Extremely important to provide reliable guidelines and safeguards to protect the rights of creditors, investors and owners, the lack of which is a painful fact of our economy and society in general. This problem is particularly negative effect on the activity and stability of the banking system. This theme is there and, of course, overripe since 1917, after the expropriation expropriators. However, at the same time, Ukraine would have to determine the presence of foreign capital in the capital of the banking system and to establish proper control over foreign investment in Ukraine. The 2008 financial crisis has shown what a serious threat to the domestic economy and banking system is spontaneous and uncontrolled influx of foreign capital into the banking sector, as well as the use of these resources for lending to foreign economies due to the accumulation of debts in Ukraine, which was one of the factors of the deployment of the crisis. Consequently, the important task of government is to define the measures the presence of foreign capital into the banking sector and its direction on the real economy. Need to resume lending to the economy. Without this, it is impossible not only to resume its development but also improve the banking system and its assets. How to solve this problem? First, you must create the conditions for the recovery of the financial condition of the borrower, give him a chance to use the loans for the development of production and, therefore, returned to the borrowing period. Secondly, 11 we must also build reliable sources of credit. Both of these tasks should perform power - its economic bloc. And where can take the long-term national resources - deposits of physical persons and legal entities, the funds of financial institutions, including state pension funds? To attract them, not for one day, need to restore confidence in the government, its policies and concrete actions. In this regard, significant problems arise and the banking system. Its national challenge - to reduce costs. And the banks and the business entity should suddenly be particularly unproductive, cut. Large reserve - improved corporate governance. Needs fundamental changes and the status of bank management, especially in countering the risks. Necessary to increase the liability of shareholders and owners of banks' operating results. However, all of these events will give positive results only under the condition that Ukraine will have a real anticrisis budget management and crisis management program will be implemented austerity measures, in particular, avoidance of unnecessary social benefits. At the same time, the government should implement real structural reforms to ensure stability of the national currency - hryvnia and its dominance in the Ukraine. " July 24, 2009 Ukrainian President Viktor Yushchenko signed a law aimed at reviving the country's banking system amid the financial crisis. Provisions of the Act relate, in particular, a simplified procedure for reorganization of banks, transferring their assets 12 and liabilities, reducing the share capital when the financial recovery plan as part of the interim administration, in particular the moratorium on implementation of obligations to creditors. In addition, the law prior to January 1, 2013 extended the moratorium on nontaxable tax individuals' deposits in banks and nonbank financial institutions. 13 5. Conclusion. The future of the banking system of Ukraine, forecasts and fears. From the new year passed expect many new developments. Some experts say the end of the crisis, has traveled the bottom, on the economic recovery, resumption of bank lending, the return of customer confidence in banks. Other - give the apocalyptic predictions about the state of default, the elimination half of the banks and return the troubled nineties. Right the first and the other views. Ukraine is at the point of no return. By this phrase refers to such milestones, events and turning points in the movement, after the passage which return to earlier positions or situations is impossible, unprofitable or dangerous. What will happen in 2010? NBU will remain hostage to politics. And its liberty and character (or lack thereof) will depend on who will sit in the chair of the president and prime minister: will the central bank of the printing press, covering an unreasonable expenditure of power, or a catalyst for economic growth by providing financing of the most strategically important for the country's national producers. We are waiting for hard times. With their problems Ukrainians were left alone campaign slogan slogans and will remain on the support of the authorities cannot count, but NBU is not able to make volitional decisions. But we have become wiser and more experienced. And start thinking. We have become selective in choosing a bank and realized that no tariffs are important in this process. We are demanding the service, forcing banks to develop their hitherto uninteresting direction (Internet banking, mobile 14 banking, etc.). We even learned how to do and do without banking services, which invariably turn the bank market to market client. The main thing in this - not to succumb to provocation (depositors against borrowers), try to change the view (the opposite of "my business") and remember that only together we can achieve many great goals. Words: 3830 15 References Daily Ukrainian newspaper № 97, Tuesday, 8 June 2010, banks after the crisis. http://www.day.kiev.ua/297905 Newsru.ua, Economy Section. National Bank announced the lifting of the moratorium on early return of deposits. But investors will be disappointed. http://rus.newsru.ua/finance/18may2009/mor.html Anna Karcheva. Journal "Herald of NBU" November 2009. Especially the functioning of the banking system of Ukraine in terms of financial and economic crisis pages 12-15. Vladimir Bobylev. Journal of Banking Business in 2009 № 5, Mechanisms of stabilization of the banking system of Ukraine during the financial crisis, pages 25-30. Savluk S.M, Bregeda O.A Journal of Finance of Ukraine "2010 № 4. Development trends of global and home banking systems, page 27. OP Timoshenko. Journal «Economics and State » № 7 / 2009. Problems in the banking system of Ukraine: solutions page 21. Notes from the conference Anatoly Yepifanov, Alexander Litvinov, Alexander Kostyuk. Journal "Herald of NBU January 2009. Stability of the system - a reliable counter the financial crisis. Tristar, your financial navigator (2010). What awaits Ukraine's banking system in 2010. http://tristar.com.ua/2/art/chto_ojidaet_bankovskuu_sistemu_ukrainy_v_2010_godu_18 605.html The rating agency Credit Rating (2010). The banking system of Ukraine: test crisis. http://www.credit-rating.ua/ru/analytics/analytical-articles/12570 Banki.ua, prospects for investors in times of crisis. http://banki.ua/forum/post153112.html Ukrainian banks. Analytical Banking Journal (2009) http://www.ukrbanks.info/interview/Kakoi-by-slozhnoi-ni-byla-situacija-nafinansovom-rynke-panika-vsegda-strashnee.html 16