File

advertisement

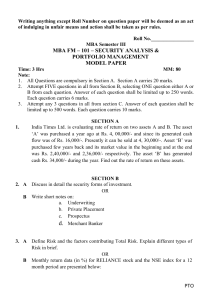

CHAPTER 5 Risk and Rates of Return Stand-alone risk Portfolio risk Risk & return: CAPM / SML 5-1 Investment returns The rate of return on an investment can be calculated as follows: Return = (Amount received – Amount invested) ________________________ Amount invested For example, if $1,000 is invested and $1,100 is returned after one year, the rate of return for this investment is: ($1,100 - $1,000) / $1,000 = 10%. 5-2 Risk The chance that some unfavorable event will occur. In case of investment it is the chance that return will fall. Risk is higher in stock investment than debt investment. 5-3 What is investment risk? Two types of investment risk Stand-alone risk Portfolio risk Stand-alone risk: The risk an investor would face if he or she held only one asset. Portfolio risk: The riskiness of assets held in portfolios. 5-4 Probability Distribution A listing of all possible outcomes, and the probability (chance of occurrence out of 1) of each occurrence. 5-5 Probability distributions Can be shown graphically. 5-6 Expected Rate of return The rate of return expected to be realized from an investment. The weighted average of probability distribution of possible results. Company IBM Rate of Return (Ki) -22% -2 20 35 50 Probability(Pi) 10% 20 40 20 10 5-7 Return: Calculating the expected return for each alternative ^ k expected rate of return ^ n k k i Pi i 1 ^ k IBM (-22%) (0.1) (-2%) (0.2) (20%) (0.4) (35%) (0.2) (50%) (0.1) 17.4% 5-8 Summary of expected returns for all alternatives IBM Market USR T-bill Shell Exp return 17.4% 15.0% 13.8% 8.0% 1.7% IBM has the highest expected return, and appears to be the best investment alternative, but is it really? Have we failed to account for risk? 5-9 Standard Deviation The tighter the probability distribution the lower the risk, since the range of possible returns become smaller. Standard deviation is a statistical measure of the variability of a set of observation. Using sigma we can see how much the return can deviate away from the expected or weighted average. This is the measure of stand alone risk. The smaller the standard deviation the tighter the deviating range of returns are and thus the lower the risk. 5-10 Standard Deviation Pi = Probability of outcome ri = Rate of return r^ = Expected rate of return N = number of observations ∑ = Summation √ = Square root 5-11 Risk: Calculating the standard deviation for each alternative Standard deviation Variance 2 n (k k̂ ) P i1 2 i i 5-12 Standard deviation calculation n (k i 1 ^ i k ) 2 Pi (-22.0 - 17.4) (0.1) (-2.0 - 17.4) (0.2) (20.0 - 17.4) 2 (0.4) (35.0 - 17.4) 2 (0.2) (50.0 - 17.4) 2 (0.1) 2 IBM IBM 20.04% T -bills 0.0% 2 1 2 Shell 13.4% USR 13.8% M 15.3% 5-13 Comments on standard deviation as a measure of risk Standard deviation (σi) measures total, or stand-alone, risk. The larger σi is, the lower the probability that actual returns will be closer to expected returns. The larger σi is, thus higher the risk. Difficult to compare standard deviations, because return has not been accounted for. 5-14 Comparing risk and return: Coefficient of Variation Lets compare two stocks Stock A: Stock B: Expected Return = 8% Standard Deviation = 15% Expected Return = 15% Standard Deviation = 29% Which stock to invest in? 5-15 Coefficient of Variation (CV) A standardized measure of dispersion about the expected value, that shows the risk per unit of return. Very useful in comparing the risk of assets that have different expected returns. Std dev CV ^ Mean k 5-16 Coefficient of Variation Coefficient of Variation is the ratio of stand alone risk and expected return. CV = σ/r^ Stock A (CV) = 15/8 = 1.875 Stock B (CV) = 29/15 = 1.933 So it is better to invest in Stock A since it has lower risk per unit of return compared to Stock B 5-17 Investor attitude towards risk Risk aversion – It is assumed that a rational investor is risk-averse. Risk-averse investors dislike risk and will not purchase risky asset unless compensated with higher rate of return. Risk premium – The extra amount of return expected from a riskier asset compared to a less risky asset is called risk premium, which serves as compensation for investors to hold riskier securities. 5-18 Portfolio Risk & Return In cases of stocks or shares, investors rarely invest in only one. They invest their money in a group of shares to create a portfolio. Risk and return of an individual stock should be analyzed in terms of how the security affects the risk and return of the portfolio in which it is held. So instead of stand alone risks and expected returns of each of the stocks, what becomes important is the entire portfolio’s risk and 5-19 return. Portfolio construction: Risk and return Assume a two-stock portfolio is created with $50,000 invested in IBM and $50,000 in Shell. Expected return of a portfolio is a weighted average of each of the component assets of the portfolio. 5-20 Calculating portfolio Expected Return The weighted average of the expected returns on the individual assets held in the portfolio ^ kp n ^ wi ki i 1 ^ k p 0.5 (17.4%) 0.5 (1.7%) 9.6% 5-21 Calculating portfolio standard deviation Forecasted return Year IBM Shell 2004 2005 2006 2007 2008 8% 10 12 14 16 16% 14 12 10 8 Portfolio Return Calculation (.50*8%) + (.50*16%) (.50*10%) + (.50*14%) (.50*12%) + (.50*12%) (.50*14%) + (.50*10%) (.50*16%) + (.50*8%) Expected Portfolio Return (ki) 12% 12% 12% 12% 12% 5-22 Calculating portfolio standard deviation (cont.) Expected value of portfolio return, 20042008 12% + 12% + 12% + 12% + 12% KP = 5 = 12% 5-23 Calculating portfolio standard deviation (cont.) n P P (12% -12%) 2 (12% -12%) 2 (12% -12%) 2 (12% -12%)2 (12%-12%)2 / (5 1) i 1 (k i kp) 2 /n-1 0% 5-24 Alternative Formula for Calculating portfolio standard deviation p W12 12 W22 2 2 2W1W2 1 2r12 W1 Proportion of Asset 1 W2 Proportion of Asset 2 1 Standard Deviation of Asset 1 1 Standard Deviation of Asset 2 r12 Correlation Coefficient between the return of assets 1 and 2 5-25 Portfolio Risk Unlike expected portfolio return, portfolio risk is not the weighted average of individual stock’s standard deviation (stand alone risk). Portfolio risk depends on correlation between the stocks i.e. the tendency of two variables to move together. This gives an idea of the degree of diversification in the portfolio. Correlation coefficient (ρ) is a standardized measure, in between -1 and 1, for the degree of relationship between two variables. 5-26 Diversification Securities held in portfolio reduces the overall risk an investor is exposed to. This is due to the effect of Diversification. One stock can earn extra return to cover up the loss of another stock’s negative return. Since it is assumed that rational investors are risk averse thus most investments are done in portfolio of stocks 5-27 Graphical Presentation of Diversification 5-28 Returns distribution for two perfectly negatively correlated stocks (ρ = -1.0) Stock W Stock M Portfolio WM 25 25 25 15 15 15 0 0 0 -10 -10 -10 5-29 Returns distribution for two perfectly positively correlated stocks (ρ = 1.0) Stock M’ Stock M Portfolio MM’ 25 25 25 15 15 15 0 0 0 -10 -10 -10 5-30 Illustrating diversification effects of a stock portfolio p (%) 35 Company-Specific Risk Stand-Alone Risk, p 20 Market Risk 0 10 20 30 40 2,000+ # Stocks in Portfolio 5-31 Breaking down sources of risk Stand-alone risk = Market risk + Diversifiable risk Market risk – Market risk is the risk associated with the entire market and cannot be diversified away. It is the risk that remains after diversification and thus known as nondiversifiable, or systematic or beta risk. Caused by political and macroeconomic factors.(e.g. War, Inflation, High Interest Rates) Diversifiable risk–is that portion of a security’s standalone risk associated with random events, or news. It can be completely eliminated by proper diversification. Also known as company specific risk, unsystematic risk 5-32 5-33 Beta Measures a stock’s market risk, and shows a stock’s volatility relative to the market. Indicates how risky a stock is if the stock is held in a well-diversified portfolio. 5-34 Relevant Risk & Beta Coefficient Relevant risk the portion of an individual stock’s risk that contributes to the market risk of it’s portfolio. It is the extent to which a given stock’s returns move up and down with the market, measured by Beta Coefficient (ϐ). It is considered that all other risks are diversified away in a portfolio except the relevant risks of the individual 5-35 stocks. Comments on beta If beta = 1.0, the security is just as risky as the average stock. If beta > 1.0, the security is riskier than average. If beta < 1.0, the security is less risky than average. Most stocks have betas in the range of 0.5 to 1.5. The beta coefficient for the market = 1 Betas May be positive or negative. But, positive is the norm. 5-36 Finding Beta Coefficient Covariance of Returns between th e stock and the market Variance of the Market Returns Cov(R s R M ) Beta Var(R M ) Beta Covariance is a measure of the degree to which returns on two risky assets move in tandem. A positive covariance means that asset returns move together. A negative covariance means returns move inversely. Similar to Correlation Coefficient. Variance is the square of standard deviation Beta of Market = 1.0 5-37 Portfolio Beta Beta of a portfolio of securities is the weighted average of the individual securities’ beta. 5-38 An example: Equally-weighted two-stock portfolio Create a portfolio with 50% invested in HT and 50% invested in Collections. The beta of a portfolio is the weighted average of each of the stock’s betas. βP = w1 β1 + w2 β2 βP = 0.5 (1.30) + 0.5 (-0.87) βP = 0.215 5-39 Capital Asset Pricing Model (CAPM) Model based upon concept that a stock’s required rate of return is equal to the risk-free rate of return plus a risk premium that reflects the riskiness of the stock after diversification. Required rate of return on a stock = Risk-free rate of return + Risk premium of that stock. ri = rRF + (rM – rRF)bi CAPM : Ke= Rf + β(Rm – Rf) Rf = Risk free rate of return Rm = Market Return β = Beta Coefficient 5-40 Ke = Required Return Returns and Premiums 5-41 Security Market Line (SML) A graph of CAPM equation. It shows the relationship between risk as measured by beta and required rates of return on individual securities. 5-42 The Security Market Line (SML): Calculating required rates of return SML: ki = kRF + (kM – kRF) βi Assume kRF = 8%, kM = 15% and βi =1.3 The market (or equity) risk premium is RPM = kM – kRF = 15% – 8% = 7%. ki = 8.0% + (15.0% - 8.0%)(1.30) = 8.0% + (7.0%)(1.30) = 8.0% + 9.1% = 17.10% 5-43