Chapter 13

Multijurisdictional

Taxation

Taxation of Business Entities

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 3)

• VoiceCo, a domestic corporation, designs,

manufactures, and sells specialty microphones for use

in theaters.

• All of its activities take place in Florida

– But, it ships products to customers all over the United

States.

• When it receives some inquiries about its products

from foreign customers, VoiceCo decides to test the

foreign market and places ads in foreign trade

journals.

– Soon it is taking orders from foreign customers.

The Big Picture (slide 2 of 3)

• VoiceCo is concerned about its potential foreign

income tax exposure.

• Although it has no assets or employees in the foreign

jurisdictions, it now is involved in international

commerce and has many questions.

– Is VoiceCo subject to income taxes in foreign countries?

– Must it pay U.S. income taxes on the profits from its

foreign sales?

– What if VoiceCo pays taxes to other countries?

• Does it receive any benefit from these payments on its U.S. tax

return?

The Big Picture (slide 3 of 3)

• Suppose that VoiceCo establishes a manufacturing

plant in Ireland.

– VoiceCo incorporates the Irish operation as VoiceCoIreland, a controlled foreign corporation (CFC).

• So long as VoiceCo-Ireland does not distribute profits

to VoiceCo, will the profits escape U.S. taxation?

• What are the consequences to VoiceCo of being the

owner of a so-called CFC?

• Read the chapter and formulate your response.

U.S. International Tax Provisions

(slide 1 of 2)

• Concerned primarily with two types of

potential taxpayers:

– U.S. persons earning income from outside the

United States, and

– Non-U.S. persons earning income from inside the

United States

5

U.S. International Tax Provisions

(slide 2 of 2)

• Can be organized in terms of:

– Outbound taxation

• Refers to the U.S. taxation of foreign-source income

earned by U.S. taxpayers

– Inbound taxation

• Refers to the U.S. taxation of U.S.-source income

earned by foreign taxpayers

6

Sources of Law

(slide 1 of 3)

• U.S. individuals and companies

– Subject to both U.S. law and laws of other

jurisdictions in which they operate or invest

• The Internal Revenue Code addresses the tax

consequences of earning income anywhere in the world

• Must also comply with the local tax law of the other

nations in which they operate

• For non-U.S. persons, U.S. statutory law is

relevant to income they earn that is connected

to U.S. income-producing activities

7

Sources of Law

(slide 2 of 3)

• Tax treaties exist between the U.S. and many

other countries

– All tax treaties are organized in the same way

• Include provisions regarding the taxation of:

–

–

–

–

Investment income

Business profits from a permanent establishment (PE)

Personal service income, and

Exceptions for certain persons (e.g., athletes, entertainers,

students, and teachers)

8

Sources of Law

(slide 3 of 3)

• Tax treaty provisions generally override the

treatment otherwise called for under the

Internal Revenue Code or foreign tax statutes

9

Authority to Tax

(slide 1 of 2)

• The U.S. taxes U.S. taxpayers on “worldwide”

income

– The U.S. allows a foreign tax credit to be claimed

against the U.S. tax to reduce double-taxation

(U.S. and foreign) of the same income

10

Authority to Tax

(slide 2 of 2)

• Foreign persons may be subject to tax in the

U.S.

– Generally, subject to tax only on income earned

within U.S. borders

11

Sourcing of Income

• Determining the source of income is critical in

calculating the U.S. tax consequences to both

U.S. and foreign persons

– Numerous tax provisions address the incomesourcing rules for all types of income

• These sourcing rules generally assign income to a

geographic source based on the location where the

economic activity producing the income took place

12

The Big Picture – Example 8

Income Sourcing (slide 1 of 2)

• Return to the facts of The Big Picture on p. 13-2.

• Assume that VoiceCo makes an overseas

investment and generates $2 million of gross

income and a $50,000 expense, all related to

real estate sales and rental activities.

• The expense is allocated and apportioned using

gross income as a basis.

The Big Picture – Example 8

Income Sourcing (slide 2 of 2)

Allocation and Apportionment of

Deductions (slide 1 of 2)

• Deductions and losses must be allocated and

apportioned between U.S.- and foreign-source

income

– Deductions directly related to an activity or

property are allocated to classes of income to

which they directly relate

– Then, deductions are apportioned between

statutory and residual groupings

15

Allocation and Apportionment of

Deductions (slide 2 of 2)

• Interest expense is allocated and apportioned

to all activities and property regardless of the

specific purpose for incurring the debt

– Allocation and apportionment is based on either

FMV or tax book value of assets

16

The Big Picture – Example 9

Apportionment Of Interest Expense

• Return to the facts of The Big Picture on p. 13-2.

• Assume that VoiceCo generates U.S.- source and foreign-source gross

income for the current year.

• VoiceCo’s assets (tax book value) are as follows.

Assets generating U.S.-source income

Assets generating foreign-source income

$18,000,000

5,000,000

$23,000,000

• VoiceCo incurs interest expense of $800,000 for the current year. Using the

tax book value method, interest expense is apportioned to foreign-source

income as follows.

$5,000,000 (foreign assets)

$23,000,000 (total assets)

X $800,000 = $173,913

Foreign Tax Credit

• Foreign tax credit (FTC) provisions are designed to

reduce the possibility of double taxation

– Allows a credit for foreign taxes paid

• Credit is a dollar-for-dollar reduction of U.S. income tax liability

– FTC may be “direct” or “indirect”

• The FTC is elective for any particular tax year

– If FTC is not elected, § 164 allows a deduction for foreign

taxes paid or incurred

• Cannot take a credit and deduction for same foreign taxes

• In most situations the FTC is more valuable to the taxpayer

18

Direct Foreign Tax Credit

• Available to taxpayers who pay or incur a

foreign income tax

– Only person who bears the legal burden of the

foreign tax is eligible for the direct credit

• Direct credit is not available to a U.S.

corporation operating in a foreign country

through a foreign subsidiary

19

Indirect Foreign Tax Credit

(slide 1 of 5)

• The indirect credit is available to U.S.

corporations for dividends received (actual or

constructive) from foreign corporations

– Foreign corp pays tax in foreign jurisdiction

– When foreign corp remits dividends to U.S. corp,

the income is subject to tax in the U.S.

20

Indirect Foreign Tax Credit

(slide 2 of 5)

•Foreign taxes are deemed paid by U.S. corporate

shareholders in same proportion as dividends bear to

foreign corp’s post-1986 undistributed E & P

–Indirect FTC =

Actual or constructive dividend

Post-1986 undistributed E & P

X

Post-1986 foreign taxes

•Corporations choosing the FTC for deemed-paid

foreign taxes must gross up dividend income by the

amount of deemed-paid taxes

21

Indirect Foreign Tax Credit

(slide 3 of 5)

• Example

– Wren Inc, a domestic corp, receives a $120,000

dividend from Finch Inc, a foreign corp. Finch

paid $500,000 of foreign taxes on post-1986 E & P

totaling $1,200,000 (after taxes)

22

Indirect Foreign Tax Credit

(slide 4 of 5)

• Example (cont’d)-Wren’s deemed-paid foreign taxes

for FTC purposes are $50,000

Cash dividend from Finch

Deemed-paid foreign taxes

$500,000 × $ 120,000 .

$1,200,000

Gross income to Wren

$120,000

50,000

$170,000

Wren must include $50,000 in gross income for the gross

up adjustment if FTC is elected

23

Indirect Foreign Tax Credit

(slide 5 of 5)

– Only available if domestic corp owns 10% or more

of voting stock of foreign corp

• Credit is available for 2nd and 3rd tier foreign corps if

10% ownership requirement is met at the 2nd and 3rd

levels

• Credit is also available for 4th through 6th tier foreign

corps if additional requirements are met

24

Foreign Tax Credit Limitations

(slide 1 of 3)

• Limit is designed to prevent foreign taxes

from being credited against U.S. taxes on

U.S.-source taxable income

– FTC cannot exceed the lesser of:

• Actual foreign taxes paid or accrued, or

• U.S. taxes (before FTC) on foreign-source taxable

income, calculated as follows:

U.S. tax

× Foreign-source taxable income

before FTC

Worldwide taxable income

25

Foreign Tax Credit Limitations

(slide 2 of 3)

• Limitation can prevent total amount of foreign

taxes paid in high-tax jurisdictions from being

credited

– Generating additional foreign-source income in

low, or no, tax jurisdictions could alleviate this

problem

– However, a separate limitation must be calculated

for certain categories (baskets) of foreign source

income

26

Foreign Tax Credit Limitations

(slide 3 of 3)

• For tax years beginning after 2006, there are

only two baskets:

– Passive income, and

– All other (general)

• Any FTC carryforwards into post-2006 years

are assigned to one of these two categories

27

The Big Picture – Example 14

Foreign Tax Credit Limit (slide 1 of 2)

• Return to the facts of The Big Picture on p. 13-2.

• Assume that VoiceCo invests in the bonds of nonU.S. corporations.

• VoiceCo’s worldwide taxable income for the tax year

is $1,200,000, consisting of

– $1,000,000 of profits from U.S. sales, and

– $200,000 of interest income from foreign sources.

• All of the foreign income is in the passive basket.

• Foreign taxes of $90,000 were withheld by tax

authorities on these interest payments.

The Big Picture – Example 14

Foreign Tax Credit Limit (slide 2 of 2)

• VoiceCo’s U.S. tax before the FTC is $420,000

– $1,200,000 X 35%.

• Its FTC is limited to $70,000.

– $420,000 X ($200,000/$1,200,000).

• Thus, VoiceCo’s net U.S. tax liability on this income

is $350,000 after allowing the $70,000 FTC.

• The remaining $20,000($90,000 foreign tax paid $70,000 FTC benefit) of foreign taxes may be carried

back one year or forward 10 years, for use within the

passive basket.

Controlled Foreign Corporations

(slide 1 of 3)

• Pro rata share of Subpart F income generated

by a controlled foreign corporation (CFC) is

currently included in income of U.S.

shareholders

30

Controlled Foreign Corporations

(slide 2 of 3)

• Examples of Subpart F income include:

– Passive income such as interest, dividends, rents,

and royalties

– Sales income where neither the manufacturing

activity nor the customer base is in the CFC’s

country and either the property supplier or the

customer is related to the CFC

– Service income where the CFC is providing

services on behalf of its U.S. owners outside the

CFC’s country

31

Controlled Foreign Corporations

(slide 3 of 3)

• A CFC is any foreign corp in which > 50% of

total voting power or value is owned by U.S.

shareholders on any day of tax year

– U.S. shareholder is a U.S. person who owns

(directly or indirectly) 10% or more of voting

stock of the foreign corp

32

Transfer Pricing Example

(slide 1 of 3)

• §482 gives the IRS the power to reallocate

income, deductions, credits or allowances

between or among related persons when

– Necessary to prevent the evasion of taxes, or

– To reflect income more clearly

• The IRS can use this power to address

perceived abuses, as reflected in the following

transfer pricing example.

33

Transfer Pricing Example

(slide 2 of 3)

34

Transfer Pricing Example

(slide 3 of 3)

35

Inbound Issues

• Generally, only the U.S.-source income of

nonresident alien individuals and foreign

corporations is subject to U.S. taxation

– A person is treated as a resident of the U.S. for

income tax purposes if he or she meets either:

• The green card test, or

• The substantial presence test

– If either test is met, the individual is deemed a U.S.

resident for the year

– A foreign corp is one that is not domestic

36

U.S. Taxation of Nonresident Aliens

(slide 1 of 3)

• Non-resident alien income not “effectively

connected” with U.S. trade or business

– Includes dividends, interest, rents, royalties, etc

– 30% tax must be withheld by payor of income,

unless this rate is reduced by treaty with the

payee’s country of residence

• No deductions can offset this income

37

U.S. Taxation of Nonresident Aliens

(slide 2 of 3)

• Example: German resident earns $1,000

dividend from U.S. corporation

– Absent a U.S.-German treaty, $300 U.S. tax is

withheld, and the German resident receives $700

• Treaties frequently reduce the withholding rates on

dividends and interest

– The payor corporation remits the tax to the IRS

38

U.S. Taxation of Nonresident Aliens

(slide 3 of 3)

• Non-resident alien income effectively

connected with U.S. trade or business

– This income is taxed at the same rates that apply to

U.S. citizens

– Deductions for expenses related to the income may

be claimed

39

State Income Taxation

• 46 states and District of Columbia impose a

tax based on corp’s taxable income

– Majority of states “piggyback” onto Federal

income tax base

• Essentially, they have adopted part or all of the Federal

tax provisions

40

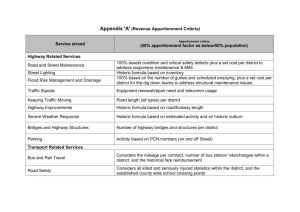

UDITPA and the

Multistate Tax Commission

• Uniform Division of Income for Tax Purposes

Act (UDITPA) is a model law relating to

assignment of income among states for

multistate corps

• Many states have adopted UDITPA either by

joining the Multistate Tax Commission or

modeling their laws after UDITPA

41

Nexus for Income

Tax Purposes (slide 1 of 2)

• Nexus is the degree of business activity which

must be present before a state can impose tax

on an out-of-state entity’s income

• Sufficient nexus typically exists if:

–

–

–

–

Income is derived from within state

Property is owned or leased in state

Persons are employed in state

Physical or financial capital is located in state

42

Nexus for Income

Tax Purposes (slide 2 of 2)

• No nexus if only “connection” to state is

solicitation for sale of tangible personal

property, with orders sent outside state for

approval and shipping to customer (Public

Law 86-272)

• Sales tax can still apply

43

Computing State Income Tax Liability

44

State Modifications (slide 1 of 2)

• State modification items come about because

each state creates its own tax base

– Some of the rules adopted may differ from those

used in the Internal Revenue Code

• State modification items reflect such

differences, for example

– The state might allow a different cost recovery

schedule

– The state might tax interest income from its own

bonds or from those of other states

45

State Modifications (slide 2 of 2)

• State modification examples (cont’d)

– The state might allow a deduction for Federal

income taxes paid

– The state might disallow a deduction for payment

of its own income taxes

– The state might allow a net operating loss (NOL)

deduction only for losses generated in the state

– The state’s NOL deduction might reflect different

carryover periods than Federal law allows

46

Allocation and Apportionment of

Income (slide 1 of 3)

• Apportionment is the means by which

business income is divided among states in

which it conducts business

– Corp determines net income for the company as a

whole and then apportions some to a given state,

according to an approved formula

47

Allocation and Apportionment of

Income (slide 2 of 3)

• Allocation is a method used to directly assign

specific components of a corp’s income, net of

related expenses, to a specific state

• Allocable income generally includes:

• Income or loss from sale of nonbusiness property

• Income or losses from rents or royalties from

nonbusiness real or tangible personal property

48

Allocation and Apportionment of

Income (slide 3 of 3)

• Typically, allocable income (loss) is removed

from corporate net income before the state’s

apportionment formula is applied

– Nonapportionable income (loss) assigned to a state

is then combined with income apportionable to the

state to arrive at total income subject to tax in the

state

49

Apportionment Procedure

• Business income is assigned to states using an

apportionment formula

– Business income arises from the regular course of

business

• Integral part of taxpayer’s regular business

• Nonbusiness income is apportioned or

allocated to the state in which the incomeproducing asset is located

50

Apportionment Factors

• Apportionment formulas vary among states

– Traditionally, states use a three-factor formula that

equally weights sales, property, and payroll

– Many states use a modified formula where sales

factor receives a larger weight

• Tends to pull larger amount of out-of state corporation's

income into the state

• May provide tax relief to corps domiciled in the state

51

Sales Factor (slide 1 of 3)

• Sales factor is a fraction

– Numerator is corp’s sales in the state

– Denominator is corp’s total sales everywhere

• Most states follow UDITPA’s “ultimate

destination concept”

– Tangible asset sales are assumed to take place at

point of delivery, not where shipping originates

52

Sales Factor (slide 2 of 3)

– Dock sales occur when delivery is taken at seller’s

shipping dock

• Most states apply the destination test to dock sales

– If purchaser has out-of-state location to which it returns with

the product, sale is assigned to purchaser’s state

53

Sales Factor (slide 3 of 3)

– Throwback rule

• If adopted by state, requires that out-of-state sales not

subject to tax in destination state be pulled back into

origination state

• Treats such sales as in-state sales of the origination state

• Also applies if purchaser is U.S. government

54

Payroll Factor (slide 1 of 3)

• Payroll factor is a fraction

– Numerator is compensation paid within a state

– Denominator is total compensation paid by the

corporation

55

Payroll Factor (slide 2 of 3)

• Compensation includes wages, salaries,

commissions, etc

– Some states exclude amounts paid to corporate

officers

– Some states require that deferred compensation

amounts be included in the payroll factor (e.g.,

401(k) plans)

56

Payroll Factor (slide 3 of 3)

• Only compensation related to production of

apportionable income is included in payroll

factor

– In states that distinguish between business and

nonbusiness income, compensation related to

nonbusiness income is not included

– Compensation related to both business and

nonbusiness income is prorated between the two

57

Property Factor (slide 1 of 3)

• Property factor generally includes average

value of real and tangible personal property

owned or rented

– Numerator is amount used in the state

– Denominator is all of corp’s property owned or

rented

58

Property Factor (slide 2 of 3)

• Property includes:

– Land, buildings, machinery, inventory, etc

– May include construction in progress, offshore

property, outer space property (satellites), and

partnership property

• Property in transit is included in numerator of

destination state

59

Property Factor (slide 3 of 3)

• Property is typically valued at average

historical cost plus additions and

improvements

– Some states allow net book value or adjusted basis

to be used

• Leased property, when included in the

property factor, is valued at eight times its

annual rental payments

60

Allocation, Apportionment Example

Total allocable income (State A)

$100,000

Apportionable income (States A and B)

800,000

Total income

$900,000

All sales, payroll, and property is divided equally between

states A and B. Both states use identical apportionment

formulas.

Taxable income:

State A

State B

1/2 Apportionable income

$400,000

$400,000

Allocable income

100,000

-0Total state taxable income

$500,000

$400,000

61

Apportionment Example

(slide 1 of 2)

Americo, Inc. operates in three states with the following

apportionment systems:

W's factors: average of four factors, sales double-weighted

X's factors: average of three factors, equally weighted

Y's factors: sales factor only

State:

Sales:

Factor

Payroll:

Factor

Property:

Factor

W

X

$400,000 $100,000

40%

10%

90,000 150,000

30%

50%

120,000

240,000

30%

60%

Y

$500,000

50%

60,000

20%

40,000

10%

Total

$1,000,000

300,000

400,000

62

Apportionment Example

(slide 2 of 2)

Taxable income for year (all states)

$100,000

State:

Sales

Sales

Payroll

Property

Total

Average

Taxable income

to each state

Total taxed in all states:

N/A=not applicable

X

10%

N/A

50%

60%

120%

40%

W

40%

40%

30%

30%

140%

35%

$35,000

$125,000

$40,000

Y

50%

N/A

N/A

N/A

50%

50%

$50,000

63

Apportionment Example Revisited

(slide 1 of 2)

Americo, Inc. moves most personnel and property to state Y.

State:

W

X

Y

Total

Sales:

$400,000

$100,000 $500,000

$1,000,000

Factor

40%

10%

50%

Payroll:

30,000

30,000

240,000

300,000

Factor

10%

10%

80%

Property:

40,000

40,000

320,000

400,000

Factor

10%

10%

80%

W's factors: average of four factors, sales double-weighted

X's factors: average of three factors, equally weighted

Y's factors: sales factor only

64

Apportionment Example Revisited

(slide 2 of 2)

Taxable income for year (all states)

$100,000

State:

W

Sales:

40%

Sales

40%

Payroll:

10%

Property:

10%

Total

100%

Average

25%

Taxable income

to each state

$25,000

Total taxed in all states: $85,000

N/A = not applicable

X

10%

N/A

10%

10%

30%

10%

$10,000

Y

50%

N/A

N/A

N/A

50%

50%

$50,000

65

Unitary Taxation

(slide 1 of 2)

• Theory: operating divisions are

interdependent so cannot be segregated into

separate units

– Each unit deemed to contribute to overall profits

– Unitary theory ignores separate legal existence of

companies: all combined for apportionment

66

Unitary Taxation

(slide 2 of 2)

• For multistate apportionment, all divisions or

entities are treated as single unitary base:

– Larger apportionment base (all companies’

activities)

– Smaller apportionment factors (each state’s %)

67

Refocus On The Big Picture (slide 1 of 3)

• Now you can address the questions about

VoiceCo’s activities that were posed at the

beginning of the chapter.

• Simply selling into a foreign jurisdiction may

not trigger any overseas income tax

consequences

– But, such income is taxed currently to VoiceCo in

the United States.

Refocus On The Big Picture (slide 2 of 3)

• When VoiceCo sets up a CFC in Ireland, it benefits

from deferral.

– As long as the income is not distributed to

VoiceCo and as long as the income is not

‘‘tainted’’ Subpart F income, VoiceCo can avoid

taxes on the profits of VoiceCo-Ireland.

– If VoiceCo receives dividends from its foreign

subsidiary, it can claim foreign tax credits, which

help alleviate the double taxation that would

otherwise result.

Refocus On The Big Picture (slide 3 of 3)

What If?

• VoiceCo is considering building a new manufacturing facility

in another state in the United States.

– How will VoiceCo’s expansion decision be affected by state tax

considerations?

• In making the decision to expand, VoiceCo should consider a

variety of state tax issues including:

– Whether the state imposes a corporate income tax at all and, if so,

– Whether the state requires unitary reporting.

• Other relevant issues affecting the tax calculation in the state

include:

– The apportionment formula used by the state, and

– Whether the state has a throwback rule.

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

71