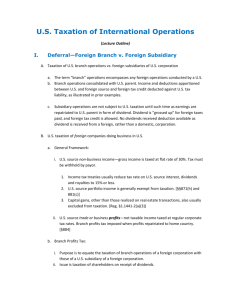

FOREIGN TAX CREDIT I. Foreign Tax Credit A. §275(a)(4): Corp

advertisement

FOREIGN TAX CREDIT I. Foreign Tax Credit A. §275(a)(4): Corp elects to claim FTC for all foreign income taxes paid or none. B. Taxpayer files new election each year (corporations use Form 1118). II. Types of Foreign Tax Credits A. §901—the direct credit. . 1. Claimed by whoever bears the legal incidence of the tax 2. Include gross foreign-source income B. §902—the indirect credit ("deemed paid" foreign taxes). 1. Allowed against U.S. tax at the time dividends actually or constructively received a. Actual receipt b. Certain income earned by CFCs and FPHCs 2. Computing deemed paid taxes: Foreign taxes of CFC X Dividend received from CFC E&P of CFC (after taxes and before dividend) 3. §78—Indirect credit requires "gross-up" approach. III. Foreign Tax Credit Limitations. [§904 and Reg. §1.904-4 through -6.] A. §904(d) —Overall limitation Total foreign-source taxable income Total taxable income from all sources X U.S. income tax before FTC B. §904(d)—Separate overall limit for passive vs. “general category” (all other) income C. §904(f) —Recapture of foreign losses 1. Foreign losses that reduce U.S.-source income for U.S. income tax purposes are recaptured in subsequent profit years by conversion of the profit from foreign-source to U.S.-source income 2 2. §904(f)(1)—Amount of recapture: a. Lesser of: 1) The amount of the overall foreign loss, or 2) 50% of the taxpayer's foreign-source income for tax year unless taxpayer elects to recapture a greater amount b. Example: D Corporation (U.S.) established a branch in Z country in early Y1. The results of D Corporation's activities for calendar years 1-4 are as follows: Taxable income (U.S.) Taxable income (foreign) Income taxes paid to Z Overall foreign loss Y1-Y4=$45M U.S. income tax for Y4 before FTC = $35M Y1 $50M (10M) -0- Y2 $50M (15M) -0- Y3 $40M (20M) -0- Y4 $60M 40M 12M Foreign Tax Credit Limitation, Y4: $40M (foreign-source income) – [lesser of (50% x $40M or $45M] $100M (worldwide taxable income) X $35M = $7M U.S. income tax for Y4 after FTC = $35M - $7M = $28M 3. Indefinite carryover of unrecaptured overall foreign losses D. §904(f)(5)(D)—U.S. losses: 1. Allocated among foreign income in different baskets on proportionate basis 2. Applies after allocation of any foreign losses and before foreign loss recharacterization rule E. §904(c)—2 year carryback and 5 year carryforward (FIFO). F. §986—Taxes paid in foreign currency translated at average exchange rate for year of accrual.