Part I INTERNAL CONTROL GUIDELINES

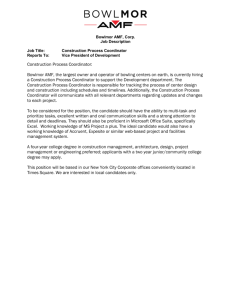

advertisement