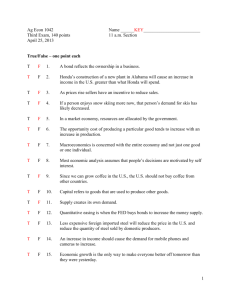

Word - Personal Pages Index

advertisement

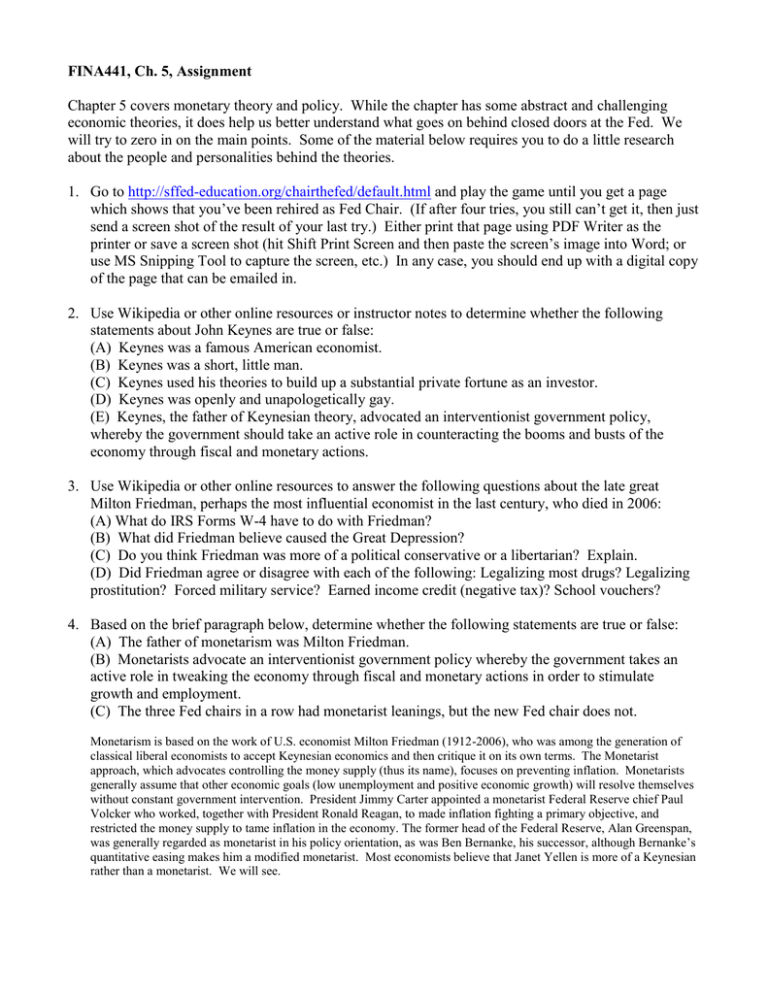

FINA441, Ch. 5, Assignment Chapter 5 covers monetary theory and policy. While the chapter has some abstract and challenging economic theories, it does help us better understand what goes on behind closed doors at the Fed. We will try to zero in on the main points. Some of the material below requires you to do a little research about the people and personalities behind the theories. 1. Go to http://sffed-education.org/chairthefed/default.html and play the game until you get a page which shows that you’ve been rehired as Fed Chair. (If after four tries, you still can’t get it, then just send a screen shot of the result of your last try.) Either print that page using PDF Writer as the printer or save a screen shot (hit Shift Print Screen and then paste the screen’s image into Word; or use MS Snipping Tool to capture the screen, etc.) In any case, you should end up with a digital copy of the page that can be emailed in. 2. Use Wikipedia or other online resources or instructor notes to determine whether the following statements about John Keynes are true or false: (A) Keynes was a famous American economist. (B) Keynes was a short, little man. (C) Keynes used his theories to build up a substantial private fortune as an investor. (D) Keynes was openly and unapologetically gay. (E) Keynes, the father of Keynesian theory, advocated an interventionist government policy, whereby the government should take an active role in counteracting the booms and busts of the economy through fiscal and monetary actions. 3. Use Wikipedia or other online resources to answer the following questions about the late great Milton Friedman, perhaps the most influential economist in the last century, who died in 2006: (A) What do IRS Forms W-4 have to do with Friedman? (B) What did Friedman believe caused the Great Depression? (C) Do you think Friedman was more of a political conservative or a libertarian? Explain. (D) Did Friedman agree or disagree with each of the following: Legalizing most drugs? Legalizing prostitution? Forced military service? Earned income credit (negative tax)? School vouchers? 4. Based on the brief paragraph below, determine whether the following statements are true or false: (A) The father of monetarism was Milton Friedman. (B) Monetarists advocate an interventionist government policy whereby the government takes an active role in tweaking the economy through fiscal and monetary actions in order to stimulate growth and employment. (C) The three Fed chairs in a row had monetarist leanings, but the new Fed chair does not. Monetarism is based on the work of U.S. economist Milton Friedman (1912-2006), who was among the generation of classical liberal economists to accept Keynesian economics and then critique it on its own terms. The Monetarist approach, which advocates controlling the money supply (thus its name), focuses on preventing inflation. Monetarists generally assume that other economic goals (low unemployment and positive economic growth) will resolve themselves without constant government intervention. President Jimmy Carter appointed a monetarist Federal Reserve chief Paul Volcker who worked, together with President Ronald Reagan, to made inflation fighting a primary objective, and restricted the money supply to tame inflation in the economy. The former head of the Federal Reserve, Alan Greenspan, was generally regarded as monetarist in his policy orientation, as was Ben Bernanke, his successor, although Bernanke’s quantitative easing makes him a modified monetarist. Most economists believe that Janet Yellen is more of a Keynesian rather than a monetarist. We will see. 5. Which policy do you think is general the best: Keynesian or Monetarist? Why? FROM TEXTBOOK: 6. What are the major indicators of economic growth monitored by the Fed? 7. In regards to economic indicators, what is meant by the terms leading, coincident and lagging? 8. What are the major indicators of inflation monitored by the Fed? 9. How does the Fed correct a weak economy? High inflation? 10. Identify and define three specific lags that complicate monetary policy. 11. Briefly explain three limitations of monetary policy. 12. The Fed’s three main economic goals are stable growth, stable prices (low inflation), and stable employment (low unemployment). (A) Which of these three goals can be achieved simultaneously? (B) Which two of these goals cannot be achieved at the same time? (C) Use Google or another search engine to look for an image of “Phillips Curve.” Either paste a picture of the curve or describe in words what it looks like. In either case, explain what the curve means. (D) Explain why you think the following statement is true or false: “When the FOMC member are primarily concerned with either inflation or unemployment but not both, they tend to agree on the type of monetary policy that should be implemented. But when both inflation and unemployment are relatively high, there is more disagreement.” 13. Let’s explore inflation and unemployment data a little more (i.e. Phillips Curve!). (A) Go to http://data.bls.gov/PDQ/servlet/SurveyOutputServlet?data_tool=latest_numbers&series_id=LNU040 00000&years_option=all_years&periods_option=specific_periods&periods=Annual+Data and record the unemployment rates for 2009, 2010, and 2011 (see table below graph). (B) Go to http://www.inflationdata.com/Inflation/Inflation_Rate/HistoricalInflation.aspx. Record the annual inflation rate for 2009, 2010, and 2011. (C) Did the Phillips Curve hold true for 2009-2011? (D) Go to http://data.bls.gov/PDQ/servlet/SurveyOutputServlet?series_id=LNS14000000 and record the current unemployment rate (as of Dec/15) (E) Go to www.inflationdata.com and record the current inflation rate (see box). Should the Fed be worried about future inflation in your opinion? 14. Go to http://research.stlouisfed.org/fred2/series/FEDFUNDS?cid=118 and construct a chart of the effective Federal Funds Rate (H15) from 2000 until now. Use the date sliders at the bottom on the graph to change the date range. (A) What do the grey shaded areas mean on the graphs? Take a guess if you don’t know. (B) What was the general trend of the Fed Funds Rate during 2001-2003? Why were these changes in the rate made? (C) What was the general trend of the Fed Funds Rate during 2004-2007? Why were these changes in the rate made? (D) What was the general trend of the Fed Funds Rate during 2008-2009? Why were these rate changes made? (D) What was the general trend of the Fed Funds Rate during 2010-2015? Why did this pattern occur? 15. (A) What do you think the following expression has to do with the Federal Reserve? “Just when the party is getting good, they have to take the punch bowl away.” (B) Under what conditions do you think the Fed might disagree with the US President on monetary policy? 16. The Fed has now gone through several versions of quantitative easing (QE), which is ended in the Fall of 2014. QE is very controversial. Even the Chair of Baker Boyer Bank, Megan Clubb, who has served as a Fed official, strongly disagrees with QE. Go to http://www.youtube.com/watch?v=PTUY16CkS-k and https://www.youtube.com/watch?v=oGIvw7T0GPI and watch a few minutes or so of the video. (A) What is quantitative easing and how does the Fed accomplish this? (B) What are the main arguments against QE, according to these videos? 17. The European Central Bank recently begun quantitative easing, just at the time the US stopped QE. According to the article below, why and how is this done? 18. Do the countries that adopt the Euro have a single central bank and monetary policy? Do the countries that adopt the Euro have a single unified fiscal policy? What are the implications of this on the future of the Euro? 19. An interesting book was published in 2012 entitled The Man Who Quit Money by Mark Sundeen. Read the excerpt below. In a short paragraph, state whether you agree with the conclusion that the Federal Reserve is a “grand counterfeiting racket” controlled by private banks. Provide a rationale for your answer. What is quantitative easing? Mar 9th 2015, 15:00 BY R.A http://www.economist.com/blogs/economist-explains/2015/03/economist-explains-5 TODAY the European Central Bank (ECB) launches its long-awaited programme of quantitative easing (or QE), adding lots of public debt to the private kind it has already been buying. Its monthly purchases will rise from around €13 billion ($14 billion) to €60 billion until at least September 2016. The ECB is just the latest central bank to jump on board the QE bandwagon. Most rich-economy central bankers began printing money to buy assets during the Great Recession, and a few, like the Bank of Japan, are still at it. But what exactly is quantitative easing, and how is it supposed to work? Central banks are responsible for keeping inflation in check. Before the financial crisis of 2008-09 they managed that by adjusting the interest rate at which banks borrow overnight. If firms were growing nervous about the future and scaling back on investment, the central bank would reduce the overnight rate. That would reduce banks' funding costs and encourage them to make more loans, keeping the economy from falling into recession. By contrast, if credit and spending were getting out of hand and inflation was rising then the central bank would raise the interest rate. When the crisis struck, big central banks like the Fed and the Bank of England slashed their overnight interest-rates to boost the economy. But even cutting the rate as far as it could go, to almost zero, failed to spark recovery. Central banks therefore began experimenting with other tools to encourage banks to pump money into the economy. One of them was QE. To carry out QE central banks create money by buying securities, such as government bonds, from banks, with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased—hence "quantitative" easing. Like lowering interest rates, QE is supposed to stimulate the economy by encouraging banks to make more loans. The idea is that banks take the new money and buy assets to replace the ones they have sold to the central bank. That raises stock prices and lowers interest rates, which in turn boosts investment. Today, interest rates on everything from government bonds to mortgages to corporate debt are probably lower than they would have been without QE. If QE convinces markets that the central bank is serious about fighting deflation or high unemployment, then it can also boost economic activity by raising confidence. Several rounds of QE in America have increased the size of the Federal Reserve's balance sheet—the value of the assets it holds— from less than $1 trillion in 2007 to more than $4 trillion now. The jury is still out on QE, however. Studies suggest that it did raise economic activity a bit. But some worry that the flood of cash has encouraged reckless financial behaviour and directed a firehose of money to emerging economies that cannot manage the cash. Others fear that when central banks sell the assets they have accumulated, interest rates will soar, choking off the recovery. Last spring, when the Fed first mooted the idea of tapering, interest rates around the world jumped and markets wobbled. Still others doubt that central banks have the capacity to keep inflation in check if the money they have created begins circulating more rapidly. Central bankers have been more cautious in using QE than they would have been in cutting interest rates, which could partly explain some countries' slow recoveries. At least a few central banks are now experimenting with stimulus alternatives, such as promises to keep overnight interest-rates low for a very long time, the better to scale back their dependence on QE.