Financial Inclusion and Responsible Microfinance - Sa-Dhan

Financial Inclusion and Responsible

Microfinance: An Eclectic Assessment

S L Shetty

1. Serious Dichotomy Between Formal Financial

System and India’s Economic Structure

• While the economic structure is dominated by the massive poor and vulnerable groups, the financial system is geared to serve, directly or indirectly, the relatively small number of middle and high-income categories.

• Estimates have placed the poor and vulnerable groups at

76.7% of the population (or 836 million) in 2004-05.

• They call for more innovative measures to expand the credit base for farm and non-farm operations.

• There are estimated 58 million informal non-farm enterprises, of which 98% are tiny units and only about 4% receive institutional credit.

2. Complex Economic Structure and Growing

Institutional Vacuum

• Assetless households and tiny enterprises call for an expanding and dynamic institutional structure.

• An essential component consisted of regional and functional spread achieved after bank nationalisation. Studies by Pande and Burgess as well as in EPWRF have proved the positive effects of presence of bank branches in villages.

• The whole objective got jettisoned after the 1990s.

• An unhealthy result Huge banking system, sole depository of household savings in bank deposits is emotionally detached from the credit and other financial service needs of the poor and the vulnerable groups.

3.

Key Artefacts

(i) Persistent declines in bank offices.

An estimated closer of about 5,000 bank offices

(ii) Reductions in bank staff, particularly those posted in rural and semi-urban branches

Roughly 25,000 staff loss in rural branches and 30,500 in semi-urban branches.

In the range of 10-13% reductions, while urban/ metropolitan reductions of about 16%.

3.

Key Artefacts (Contd…..)

(iii) Erosion in the number of loan accounts for agriculture and small-scale industries.

Widely non-reductions – agricultural loan accounts 277 lakh in March 1992 and 198 lakh in March 2001.

Loan share from 18% to 11%

Small-scale industries have been much worse.

Losses in the shares of farm incomes and activities of industrial enterprises may have been responsible but the people dependent on the sector have remained too huge to be ignored.

(iv) Above all, sharp and steady drop in the number and share in total bank credit of small borrowal accounts of Rs 25,000 or less.

4. Decline of Bank Credit for Small Borrowers and other Vulnerable Groups (Contd...)

7000

6000

5000

4000

3000 2821

3214

Chart 1: Number of Small Borrowal Accounts*

(For Scheduled Commercial Banks)

3714

4162

4589

4972

5118

* With credit limits of Rs 25,000 or below.

5878

6255

5852

5581

5391

5190

5009

4683

4275

3928

3725 3732 3687 3677

3873

3842

3861

3830

2000

1000

0

Year

Source: RBI’s Basic Statistical Returns of Scheduled Commercial Banks in India, March 2008 (Vol.37) & earlier

Issues.

4. Decline of Bank Credit for Small Borrowers and other Vulnerable Groups (Contd...)

Overall, there has thus been an absolute reduction of as much as 24.25 million small-size borrowal accounts with credit limits of Rs 25,000 or less – a loss of 39% - between

March 1992 and March 2008. The decline has been persistent

(Table 5).

Period-End

Table 5: Trends in the Number of Small Borrowal vis-à-vis other Bank Loan Accounts

Total Bank Borrowal

Accounts

(In Lakh)

Number Increase over the previous period

Small Borrowal Accounts of Rs 25,000 or less

Number

(In Lakh)

Increase over the previous period

Other Bigger Accounts

(In Lakh)

Number Increase over the previous period

- Dec-1983

March 1992

March 2001

March 2004

March 2005

March 2006

277.48

658.61

523.65

663.90

771.51

854.35

-

381.12

(-) 134.95

140.25

107.61

82.84

265.21

625.48

372.52

367.66

387.33

384.19

-

360.27

(-) 252.96

(-) 4.86

19.67

(-) 3.14

12.27

33.12

151.13

296.24

384.18

470.16

20.85

118.01

145.11

87.94

85.98

March 2007 944.42 86.07 386.12 1.93 558.00 87.84

128.92 March 2008 1069.90 125.48 382.98 -3.14

Source : RBI’s Basic Statistical Returns of Scheduled Commercial Banks , various issues.

686.92

4. Decline of Bank Credit for Small Borrowers and other Vulnerable Groups (Concluded)

The most important step was one of the imposition of capital adequacy norms to be attained in stages by the end of

March 1993; the RBI also prescribed as a practical proposition

“that in respect of amounts of Rs 25,000 and less, aggregate provisioning to the extent of 2.5% of the total outstanding should be made rather than a case-by-case evaluation of a large number of small accounts” (RBI 1993, p.15).

5.

Impact of Credit Contraction on

Poor Households

• The households covered under the SHG movement may also suffer losses of loan opportunities and such losses can hardly be filled by the tiny loans provided by the

SHG movement.

• Small borrowal accounts have a regional dimension.

• Only in three underdeveloped regions of north-east, east and central.

• Nearly 80% of small borrowal accounts have been in rural and semi-urban areas.

• About 22% of the number of small accounts and 18.1% of the amount outstanding of such accounts have been in respect of women borrowers.

5.

Impact of Credit Contraction on

Poor Households (Contd….)

• Such share had reached a peak of 25% in the late

1980s; fell to 10% in March 1999 and finally to as low a number as 1.9% in March 2008.

• If we expect at least 10% of the outstanding bank credit to be in fairness earmarked for small borrowers with credit limits of Rs 25,000 each or less hypothetically, the outstanding credit for such accounts ought to have been

Rs 241,700 crore at the end of March 2008 instead of Rs

46,420 crore as it has actually happened.

6. Imperatives of a Hierarchy of Developmental

Credit Needs Combined with Microfinance

• Focus is on micro loans

But, there is the hierarchy of developmental credit needs; they range in size from micro to small and to medium-size credit levels.

• Microfinance has been admitted incapable of solving the problem of poverty.

• With focus on micro-credit, banks have neglected the rest.

• all sections of the village - myriad small and marginal farmers, farm households in general, village artisans, unincorporated enterprises and other household enterprises – should partake the benefits of credit.

• Micro-credit system cannot be treated as a substitute for the whole rural credit structure – as is the impression that is sought to be created by policy planners as well as the sector’s players .

7.

Social Revulsions and Policy Initiatives

• Consequential social and political revulsions and policy responses

•

Not all healthy like - arbitrary doubling of bank credit for agriculture (in three years) and for small-scale industries (in five years).

• But there has been a number of other steps

•

Opening of bank branches so as to fill the institutional vacuum.

•

During the financial year 2008-09, the RBI has granted 785 licences to RRBs, of which 734 had already been opened

(RBI 2009:81).

7.

Social Revulsions and Policy Initiatives

(Contd……)

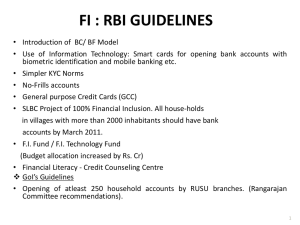

• For the major scheduled commercial banks, using intermediaries as agents under the Agency System consisting of business correspondents and business facilitators’ models

[more of it later].

• First, commercial banks (including RRBs) have been asked to provide access to bank credit to at least 250 hitherto excluded rural households at each of their existing rural and semi-urban branches .

• Second, to strengthen their operations of the Lead Bank

Scheme and draw up in each district a road map to provide banking services through a banking outlet (not necessarily through a brick and mortar branch) at every village with population of over 2,000 at least once a week on a regular basis.

7.

Social Revulsions and Policy Initiatives

(Contd……)

• New banking correspondents (BCs) in addition to the earlier list thus:

(i) individual kirana/medical/fair price shop owners; (ii) individual public call office (PCO) operators; (iii) agents of small savings schemes of Government of

India/insurance companies; (iv) individuals who own petrol pumps; (v) retired teachers; and (vi) authorised functionaries of well-run self-help groups (SHGs) linked to banks;

7.

Social Revulsions and Policy Initiatives

(Contd……)

Some of the regulatory steps in regard to BCs remain:

• BCs are prohibited from collecting any fees from the clients;

• For loans up to Rs 2 lakh, banks cannot charge more than their declared prime lending rates (PLRs) (which is expected to be rescinded soon);

• Command area of a BC is restricted to 25 Kms from the base bank branch for non-metropolitan areas and 5Km for metropolitan areas;

• Value limitation of about Rs 10,000 for a single ticket or transaction; and

7.

Social Revulsions and Policy Initiatives

(Contd……)

• Banks are allowed to receive reasonable service charges from customers and pay agency charges to

BF/BCs

• Progress achieved in regard to the ‘financial inclusion’ goal leaves much to be desired, if the RBI’s evaluation undertaken by independent agencies is of any guide.

• We know that until the recent past, the performance of banks in regard to broader issues of “institutional development” and (ii) credit delivery for agriculture and informal sectors, has left much to be desired. On the other hand, we do have data on microfinance performances (Table 7) which is impressive.

Period

End

Table 7: Outreach and Portfolio of Independent mFIs and SHG-BL

Number of

SHGs (in '000s)

Client

Outreach (in lakhs)

Outstanding

Loan Portfolio (Rs Crore)

NABARD

SHG-BL

(2)

Sa-

Dhan NABARD

(>200 mFIs) SHG-BL

(3) (4)

Sa-

Dhan

(>200 mFIs)

(5)

Total

(6)

NABARD

SHG-BL

(7)

Sa-Dhan

(>200 mFIs)

(8)

Total

(9) (1)

March

2007

March

2008

2,895 - 405 100 505 12,367 3,456 15,823

3,626 - 508 141 649 17,000 5,954 22,954

(+37.5) (+72.3)

March

2009 4,224 - 591

@

226 817 22,680 11,734 34,414

(+33.4) (+97.1)

@

Derived by us by multiplying the number of estimated SHGs by 14 the estimated average number of members per SHG

Note: (i) Figures within brackets are annual percentage variations

(ii) Client Outreach does not take into account the possible overlap

Source: Sa-Dhan (2009) and NABARD (2009a)

8. State Bank of India’s Strategic and

Wholesome Approach to Inclusive Banking

(i) For farmers :

(a) Collateral Free Lending: Collateral free production loan limit to Rs 1 lakh

(b) Cheaper Credit : Interest in all agri loan slabs upto Rs 25 lakh in SBI are at PLR ( 12.25%) or below . Draft circular has just been issued proposing to waive this; even these loans will come within the base rate instead of the PLR.

(c) New Customer Orientation : A target of financing minimum

100 new farmers per branch has been set.

(ii)Financial Inclusion

(i) Covering of one lakh unbanked villages by March 2010

(ii)The bank has volunteered to accept all underdeveloped districts (168 districts in 12 states and 2 UTs).

(iii) SHG-bank Linkage: Top-most position achieved; SHG credit card to provide working capital finance. SHG gold card to provide investment finance to SHGs, Sahayog Niwas to provide housing loans to SHG members, Grameen Shakti – the life insurance product for SHG members from SBI life.

(iv) A new scheme for financing NGOs/MFIs for on-lending

SHGs has been introduced.

(v) Cover all the villages with population of more than 2,000 in

SBI’s area of operation by opening a bank branch/CSPs of

BCs.

(vi) To increase its outreach, the Bank has opened about 481 new branches in rural and semi urban areas during FY-09.

(vii) The Bank has appointed about 18,000 Customer Service

Point (CSP)/outlets of Business Correspondents/Business

Facilitators (BC/BFs). Some of the national level BC/BFs are

India Post and ITC. During the year, the alliance with India

Post has been scaled up nation-wide and now covers more than

5,200 Post Offices across all States.

(viii) 6,234 Gram Panchayats (GPs) of Orissa.

SBI has roped in the Mumbai based Zero Mass Foundation

(ZMF) as Business Correspondent for the scheme (Business

Standard, September 22, 2009).

(ix) To help the rural youth, RUDSETI – type 30 training institutes (This was one of the drawbacks pointed out by

Abhijit Banerjee study, though impliedly).

( x)Multiple IT Enabled Channels for Financial Inclusion a) SBI Tiny - Smart Card based accounts b) Internet based kiosk channel c) Mobile based accounts d) Low cost biometric ATMs

9.The Institutional Strategy for Agency Banking

Calls for Serious Re-Examination

• As for acceptable models, diverse models have their use. But the question is one of nation-wide, systemic policy advocacy.

• I am convinced that there is the need for re-examining the list of intermediaries used as Business Facilitators and those used as Business Correspondents.

• BFs are intended to be essentially agents

• Insurance agents number near 3 lakh - 1,34,500 in respect of

LIC and 1,59,000 in respect of private insurance companies

.

• Individuals agents as BFs and not BCs

• As at the end of March 2009, there were just 85 BCs appointed by all public sector banks together.

• Of these, 24 by SBI and 14 by Punjab National Bank.

• Amongst the private sector banks, ICICI bank has been in the forefront but Axis Bank has also succeeded to an extent.

• What appears to be coming in the way of banks embracing the

BC model is their mind-set, their inability to allow others to handle banking business on their behalf; this is a traditional banking prerogative.

• Also, it should be recognised that there are some success stories like that of the ICICI Bank’s enrolment of 48 BCs, but they are unique attributable to the dedication and perseverance of individuals heading those institutions. Such models are not capable of being replicated on a systemic scale. Otherwise, traditional banking parameters and norms are the best satisfying the financial needs of the poor.

• In this respect, two institutions in the country, which have a long history, which are large in size, which are well-spread throughout the nooks and corners of this country, and which undertake tasks akin to banking, deserve to be vigorously tapped for the task of BCs for banks. They are:

• Primary Agricultural Credit Societies (PACs);

• The Post Offices

• Also, the current environment is conducive for attracting these institutions for para banking activities

• SBI has already succeeded in covering as many as 5,200 post offices as part of its strategy

• Insofar as the PACs are concerned, the authorities have been in the process of implementing the Vaidyanathan committee recommendations