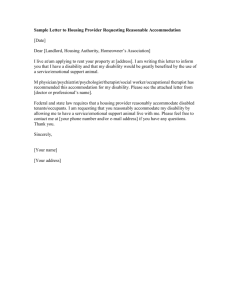

FaHCSIA Letterhead template - Department of Social Services

advertisement