Enterprise Resource Planning April 25, 2007

advertisement

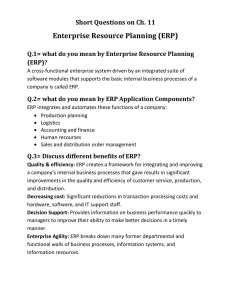

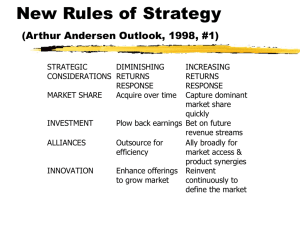

Enterprise Resource Planning Wisnu Cahyono Wenbin Li Erica Price Jurlian Sitanggang April 25, 2007 1 Overview Introduction Suppliers of ERP Implementation of ERP Case Studies 2 ERP Evolution The Evolution of ERP Systems: A Historical Perspective, 2002 3 What is ERP? ERP is a packaged business software system that enables a company to manage the efficient and effective use of resources (materials, human resources, finance, etc.) by providing a total, integrated solution for the organization’s information-processing needs. Fiona Fui-Hoon Nah et al, “Critical factors for successful implementation of enterprise systems” Business Process Management Journal, 2001 4 Before ERP Implementation Marketing and Sales Financial Management Human Resource Management Operations Management Customer Relationship Management (CRM) Customers Supply Chain Management (SCM) Suppliers Distributors Individualized Business Systems with no Central Database!!! Not Efficient!! 5 Witten Bentley Dittman, System Analysis and Design Methods, 6th, McGraw-Hill, 2004 After ERP Implementation The Evolution of ERP Systems: A Historical Perspective, 2002 6 Data Flow Before / After ERP Application Legacy System ERP System Logistics http://www.sei.cmu.edu/plp/EI_IRAD/ERP-Solutions.pdf Ordering Finance HP/Payrroll 7 ERP Modules mySAP ERP Demos 8 www.networkdictionary.com/software/erp.php and http://projects.bus.lsu.edu/independent_study/vdhing1/erp/ Typical Benefits of an ERP System Reductions: Inventory: ≥ 20% Material Cost: ≥ 5% Labor Cost: ≥ 10% Improvements Reduction Benefits of ERP % Reduction 25% 20% 15% 10% 5% Customer Service and Sales: ≥ 10% Accounting Control (Reducing the days of outstanding receivables): ≥ 18% Balance Sheet: Inventory Reduction and Accounts Receivable Income Statement: Inventory Reduction, Material Cost Reduction, Labor Cost Reduction and Increased Sales 0% Inventory Material Cost Labor Cost Based on Studies that surveyed manufacturers about the impact of ERP systems on firm performance. For all industries and company size 9 Maximizing Your ERP System, Scott Hamilton, 2002 Advantages of an ERP System These are the benefits that an industry standard ERP system may bring to an organization 10 The Evolution of ERP Systems: A Historical Perspective, 2002 Potential Pitfalls of ERP Implementation No executive sponsor Becomes a centralized implementation in 1 department when it is really needs to be adapted by all departments No full-time project manager Lack of training for employees Proper research of vendors before selection of ERP package Lack of Budget – need to consider software, consultants, employee training and upgrade costs Lack of thorough documentation when implementing the system Concentrating more on reengineering than Process Enhancement Biggest ERP Challenges Lack of Project Resources, 19% Lack of ERP expertise, 33% Too small of a budget, 10% Not enough executive support, 0% Lack of Employee Buy-In, 38% Web Poll survey conducted by Panorama Consulting Group, n~50, conducted on 11/7/06 Weekly Poll Results, Eric Kimberling, Panorama Consulting Group, 11/7/06 and The Top 8 Pitfalls of ERP Implementation and How to Avoid Them, 11 Paul Nation, eSG enterprise Solution Group Disadvantages of an ERP System 12 The Evolution of ERP Systems: A Historical Perspective, 2002 Market Share of Packaged Application SCM 6% CRM 18% eProcurement 6% PLM 5% ERP 65% ERP Software Market grew to $25.4 Billion in 2005!!! http://www.bptrends.com/publicationfiles/TB%20Wolf%20Pack%20Appl%20Market%20Size%204%2D5%2D0 31%2Epdf 13 ERP Market Share Within the Industries 14 Overview Introduction Suppliers of ERP Implementation of ERP Case Studies 15 Top 5 Revenue Share Other, 38% Growth Rate: / SAP, 42% Growth Rate, 12% Oracle, 20% Growth Rate: 110% ERP Software Market grew to $25.4 Billion in 2005!!! Source: AMR Research, 2006 16 Pilot Software Intention to buy Retek Inc. SPL (Nov. 2006) Hyperion Tangosol Lodestar Siebel (June 2006) Peoplesoft (Jan 7, 2005) http://new.quote.com/stocks/adv_chart.action?sym=ORCL Retek Inc (Apr.6, 2005 ) 17 http://www.sap-centric-eam.com/2007/cartoon_dec.html 18 Systems Applications and Products in Data Processing Founded in 1972 Based in Waldorf, Germany US Corporate Headquarters in Newtown Square, PA 39,300 employees in over 50 countries Supports more than 38,000 customers, with over 121,000 installations in more than 120 countries and 31 languages (over 12 million daily users) From small business to global enterprise (To-date: 65% of SAP customers are small & midsize companies) Revenue 2006 = € 9,402 million (+10%) ~ $ 12.2 Billion Net Income 2006 = € 1,871 million (+25%) ~ $ 2.4 Billion http://www.sap.com/germany/company/investor/reports/gb2006/en/business/financial-summary.html http://www.sap.com/usa/company/index.epx , http://www.nasdaq.com/asp/ 19 Products SAP Business Suite (CRM, ERP, SCM, PLM, SRM) SAP All-in-One (Mid-size company) SAP Business One (over 10,000 small businesses) Duet Provides access to SAP business processes and data via Microsoft Office SAP xApps Composite Applications Major business strategy of today: SAP Acquires Pilot Software (OLAP) on Feb 2007 To target mid-market companies to expand their market share All-in-One features integrated CRM, BI and analytics, and a redesigned user interface. IBM and SAP announce the expansion of their partnership to reach midsize companies in Europe and Asia-Pacific (Apr 23, 2007) http://www.sap.com/solutions/index.epx , http://www.forbes.com/markets/feeds/afx/2007/04/23/afx3640526.html http://www.computerworld.com/action/article.do?command=viewArticleBasic&articleId=9011563 20 Founded in 1977 World Headquarters in Redwood Shores, CA 55,000+ employees Used in 98 of the Fortune 100 companies First software company to develop and deploy 100 percent internet-enabled enterprise software across its entire product line Revenue 2006 = $14.38 billion (+21.87%) Net Income 2006 = $3.38 billion (+17.15%) http://www.oracle.com/corporate/story.html http://www.infoworld.com/article/05/06/29/HNoraclerevenuejumps_1.html http://news.com.com/Oracle+profit+rises+on+new+software+revenue/2100-1014_3-6087043.html http://www.nasdaq.com/asp/ 21 Products Oracle e-Business Suite (business applications for the enterprise) JD Edwards World (IBM iSeries platform, small businesses) JD Edwards Enterprise One (medium-end) PeopleSoft Enterprise (high-end) Retek Inc. - SCM (Apr.6, 2005, controls 92.8 percent of Retek shares) Siebel – CRM Solution (4,000 customers) Major business strategy of today: Project Fusion (merged suite, 2008) With strategic acquisitions, Oracle strengthens its product offerings, accelerates innovation, meets customer demand more rapidly, and expands partner opportunity. Hyperion - producer of business-intelligence software Tangosol Inc. - Memory Data Grid Leader: perform real time data analytics, grid based in-memory computations and high performance transactions LODESTAR Corporation - a provider of meter data management and energy solutions for the utilities industry (Oracle's 29th buy in less than 3 years). http://www.oracle.com/products/index.html#applications , http://www.oracle.com/corporate/acquisition.html http://www.oracle.com/products/index.html#applications http://www.itnews.com.au/newsstory.aspx?CIaNID=50355&src=site-marq http://news.com.com/Oracle+to+swallow+Siebel+for+5.8+billion/2100-1014_3-5860113.html , http://money.cnn.com/2004/12/13/technology/oracle_peoplesoft/ http://www.internetnews.com/bus-news/article.php/3582106 (Siebel) , http://new.quote.com/stocks/story.action?id=RTT704240824001488 (Lodestar) http://www.eweek.com/article2/0,1895,2099636,00.asp (Hyperion) , http://www.oracle.com/corporate/press/2007_apr/hyperion-clearances.html http://www.marketwatch.com/news/story/oracle-buy-hyperion-52-share-33/story.aspx?guid=%7BDD070F86-54F7-4709-A26A-12199FEB68B3%7D 22 Other Vendors : - Microsoft Dynamics (mid-large company) - Retail Management System (small and midsized retailers) : Industry tailored application (small-mid co) : Distribution and Logistics (start up – large co) : Industry solution (mid market) : Industry, control and transportation (high-end) : Manufacturers (mid market) http://www.microsoft.com/dynamics/default.mspx , http://www.lawson.com/ , http://www.sage.com/ http://www.epicor.com/www/products/enterprise/ , http://www.invensys.com/ , http://www.ssaglobal.com/ http://go.infor.com/docs/FINAL_Infor_Acquires_Extensity_and_Systems_Union.pdf 23 Overview Introduction Suppliers of ERP Implementation of ERP Case Studies 24 Cost and Time of ERP Implementation Average Cost: Average Time: Average Usage: $9.1 million at least 1 year 27.6% of ERP available functionality Cost Allocation Survey of 107 separate ERP applications http://www.standishgroup.com/chaos/beacon_243.php 25 Performance of ERP Implementation http://www.standishgroup.com 26 Critical Success Factors for ERP Implementation Four–Phase Model of ERP Implementation ------- developed by Markus and Tanis in 1999 Chartering: Decision define business case and solution constraints Project: Getting system and end users up and running Shakedown: Stabilizing, eliminating “bugs”, getting to normal operation. Onward and Upward: System maintenance, users support, system upgrading and extension. Critical Success Factors for Enterprise Resource Planning Implementation and Upgrade, Journal of 27 Computer Information Systems, 2006, Fiona Fui-Hoon Nah and Santiago Delgado Importance of Critical Success Factors Across the Phase of ERP Implementation 4 Importance Score 3.5 3 2.5 2 Survey in utility industry and non-profit organization 1.5 Chartering Project Shakedown Onward & Upward Phase Business Plan or Vision Communication TopManagement Support and Championship System Analysis, Selection and Technical Implementation Change Management ERPTeam Composition, Skills and Compensation Project Management 28 Survey of 500 Separate ERP Implementations Industry 30% Machinery Manufacturers 25% Automative 20% CPG/Food&Beverage Metals and Metal Products 15% High Tech Medical Devices Aerospace&Defence 10% 5% Other 0% Geography South America 1% Europe 17% Asia Pacific 14% Company Size (annual revenue) Middle East and Africa 2% North America 66% Small Enterprises (< US$ 50 million) 40% Larger enterpises ( > US$ 1 billion) 9% Mid-Sized Enterprises (US$ 1 billion US$ 50 million) 51% 29 Business Drivers for ERP Implementation Survey of 500 corporations 30 Software Selection for ERP Implementation 31 Main Methods used in ERP Implementation 32 Challenges and Responses of ERP Implementation 33 Performance Improvement with ERP Implementation Laggard(30%): ERP implementations that are significantly behind the average ---poor performance Average(50%): ERP implementations that represent the average or normal---average performance Best in Class(20%): ERP implementations that are superior to the industry normal---top performance 34 Expected and Actual ROI with ERP Implementation Laggard(30%): ERP implementations that are significantly behind the average ---poor performance Average(50%): ERP implementations that represent the average or normal---average performance Best in Class(20%): ERP implementations that are superior to the industry normal---top performance 35 Overview Introduction Suppliers of ERP Implementation of ERP Case Studies 36 FoxMeyer Drug Co. Case 1 – FoxMeyer Drugs FoxMeyer Drugs was the nation’s fourth largest Wholesale Distributor of Drugs and Beauty aids, based in Dallas Has 23 distribution centers Major Product: Wholesale distribution of drugs & beauty aids Customers/serves: Drugs stores, Chains, hospitals, care facilities Revenue (1995): $ 5 Billions => 1996 Sold for just$ 80 Millions The VP of IT Department report to COO Source: Gray, Paul, Manager’s Guide to Making Decisions about Information Systems, 1st, John Wiley & Sons, 2006 37 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Why they want to implement ERP? FoxMeyer expected high growth in drug sales To increase efficiency Their Unisys computer systems were reaching the end of their life and the vendor was discontinuing support. FoxMeyer expected the project to save $ 40 M annually (Promised benefits). Source: Gray, Paul, Manager’s Guide to Making Decisions about Information Systems, 1st, John Wiley & Sons, 2006 38 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Project Scope, Time, & Cost Project: The Delta III Project scope: ERP R/III Edition & Warehouse Automation System Time & budget estimation: - 18 Months - 15 Millions Actual project delivery date & cost: - 24 Months - Over 100 Millions Source: Gray, Paul, Manager’s Guide to Making Decisions about Information Systems, 1st, John Wiley & Sons, 2006 39 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Suppliers/Vendors SAP: Provide ERP Version R/3 Project Pinnacle: Provide Warehouse Automation System Anderson Consulting: Perform Integration Source: Source: Judy E. Scott, The University of Texas at Austin 40 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Which ERP Function Module are Applied? SAP R/3 Edition: Financials and Controlling (FICO) Human Resources (HR) Materials Management (MM) Sales and Distribution (SD) Source: Judy E. Scott, The University of Texas at Austin 41 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs ERP Implementation Source: delivery.acm.org 42 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Why this project is a failure? The customers less commitment The scope of the project was risky FoxMeyer was over expectations The new system initially could only process 100,000 orders/night compared to 420,000 orders with the previous system FoxMeyer management did not feel it knew enough to cope with the Consultant and the Vendors FoxMeyer did not have the necessary skill in house The project spin out of control Source: Gray, Paul, Manager’s Guide to Making Decisions about Information Systems, 1st, John Wiley & Sons, 2006 43 FoxMeyer Drug Co. Case 1 : FoxMeyer Drugs Lessons Learned Respond to environmental and strategic changes at more tactical (project) levels Recognize the importance of organizational culture; foster an open culture and encourage open communication Take a realistic view of the role technology can play in supporting your firm’s strategy; engage in a strategy of “small wins” to leverage knowledge gained Manage the project; employ a strong project leader and well defined methodology. Source: April 2002/vol. 45 No. 4 Communications of the ACM 44 Case 2 – Schnucks Founded in St. Louis in 1939 Major Departments: Groceries, Bakery Goods, Florist, and Pharmacy Has more than 100 stores in Missouri, Illinois, Indiana, Wisconsin, Tennessee, Mississippi and Iowa 2006 Revenues – 2.4 Billion IT department has 90 people About 30 of the 90 are developers Mark Zimmerman is the VP of IT and he reports to the President of the company, Todd Schnuck . 45 Case 2: Schnucks Why they needed ERP Needed to upgrade their system to be Y2K ready and wanted to have a relational database (UNIX) to get off the mainframe system. Implemented PeopleSoft Financial (general ledger, fixed assets, AR, AP) – Financial Module of ERP Benefit: Provided single point of data entry for all of their financial information. Business Drivers: Standardization of processes and linking of operations Selected between Oracle and PeopleSoft Decision factors: ease of use and meeting IT needs PeopleSoft provided better ease of modification and had slightly better cost Project started in fall of 1998 and completed in October 1999 on time. Budget Estimate had 2 components – Purchase price of the software and the consultants 46 Case 2: Schnucks Implementation of the Financial Module Used a combination of PeopleSoft software, consultants and in-house personnel to implement the system Critical success factors used: Top Management Support Minimum Customization Focused on Training for Employees Used a full-time Project Manager Critical success factors not used: Sufficient prior ERP knowledge – underestimated budget and staff needed Cross-functional team for implementation Accurate documentation of implementation – need this for upgrades, especially if staff if lost 47 Case 2: Schnucks Improvements/Disappointments Biggest Improvements Provided more timely and accurate financial status and analysis with no wait for IT Provided a new technology for IT to learn and was easier to use Better access to data, query capacity and learned controls and provided Y2K compliance Biggest Disappointments On-going costs for software Underestimated the needs and costs for the infrastructure of the new software Not enough expertise at the time of implementation Need more training resources 48 Case 2: Schnucks Changes from Implementation Before ERP Implementation All financial data was running off a mainframe system (Legacy) Not Y2K Compliant Financial Status and Analysis was timely for executives to complete because of poor access to data IT had little knowledge of ERP systems After ERP Implementation All financial data came from a relational database (UNIX) System was Y2K Compliant Financial Status and Analysis was more efficient and accurate for executives because they had access to the data w/o IT’s help IT gained experience in Oracle technology 49 Case 2: Schnucks Our Lessons Learned Be aware of the on-going costs of an ERP system Take the time to research vendors, analyze your needs and understand ERP systems before starting implementation Keep accurate documentation during implementation to be used for upgrades Have sufficient staff before implementation of the system 50 Case 3 – PT. PLN (Persero) PT. PLN is the Indonesian state-owned electricity company. Has 25 regional units across all the 32 provinces in Indonesia 2005 Revenues – Rp 76,5 Trillion ( ~ US$ 8 Billion ) IT department in Head-office has 45 people The Deputy Director of IT Strategy reports to the Director of Marketing & Customer Service Source of case information: Poedji Wisaksono HR Information System Manager in the Head office and he reports to the Deputy Director of Human Resource Development System. One of the change agents for ERP Implementation in the company 51 ( Why implement ERP? ) 52 Case 3: PT. PLN Project Scope and Schedule Vendor selection in February 2004 - April 2005 Project started in May 2005 Go Live: Finance Module: April ‘06 & July ‘06 Material Module: April ‘06 & July ‘06 Human Resource Module: December ‘05, April ‘06 & July ’06 ERP Budget IT budget for the development of the ERP system is US$ 25 million. in which, $ 15.4 Million was allocated to 4 Pilot Project Units: ----- Head Office ----- Bali Distribution Unit ----- Jakarta Distribution Unit ----- Load Control Center (P3B) Unit 53 Case 3: PT. PLN Software Selection Vendor selection: February 2004 - April 2005 Accenture (Consultant) SAP (Application) HP (Hardware) Oracle (Database) Reason of Software Selection: Functionality Total Cost of Ownership Ease & Speed of Implementation Best Practice 54 Case 3: PT. PLN - ERP Application PLN - IT System Management Functional / Operational ERP Back Office All Employees Finance Module Material Module HR Module ESS (Employee Self-Service) SEM / BW (Strategic Enterprise Management / Business Warehouse) Direct information and services for employees - Financial Management Report - Material Management Report - HR Management Report 55 Case 3: PT. PLN Method Used Deploying through consultant agency After ERP Go-Live: Has a Helpdesk of 7 persons in Head Office User Support Has a developer team of 30 persons preparing for the Onward and Upward phase: System maintenance, system upgrading and extension 56 Case 3: PT. PLN Critical Success Factors Four–Phase Model of ERP Implementation ------- developed by Markus and Tanis in 1999 Shakedown: Stabilizing, eliminating “bugs”, getting to normal operation. Employees were not completely ready for the new system Not enough expertise at the time of implementation Need more training resources Still needs to implement both legacy and new system for Finance and Human Resources Change management Critical Success Factors for Enterprise Resource Planning Implementation and Upgrade, Journal of Computer Information Systems, 2006, Fiona Fui-Hoon Nah and Santiago Delgado 57 Case 3: PT. PLN Challenges Challenges: Customization Related Challenges Training Little flexibility in adapting to business processes Lengthy or incomplete integrations Responses to challenges: Aligning software capabilities to business processes Use external consultants Wrap existing applications with web services 360 degree assessment 58 Case 3: PT. PLN Changes from Implementation Before ERP Implementation Data are not standardized Data input redundancy Uses several applications for reporting After ERP Implementation (Still in the verge of implementing ERP) In the transition period: Still uses both ERP and legacy applications Better access to data Acquiring new technology Reduced FTE (Full Time Equivalent) Increase ITO (Inventory Turn over) Reduced Inventory Level (more control on inventory) Cuts transactions and administration works 59 60 61 ACCENTURE HUMAN CAPITAL DEVELOPMENT FRAMEWORK 62 Case 3: PT. PLN Lessons learned Replacing the legacy system cannot be done after the implementation of the pilot project Extensive training for employees Management Support is needed Changing application needed data cleansing Development of the Human Capital 63 Case Comparisons Case 1 – FoxMeyer Drugs (1993) Case 2 – Schnucks (1999) Case 3 – PLN (2006) FoxMeyer Drug Co. Revenue ~ $ 5 Billion ~ $ 2.4 Billion ~ $ 8 Billion Reason for ERP Increase the sales Increase the efficiency Replaced legacy system Increase profit To become Y2K compliant and replace legacy systems - Have a controlled and standardized environment - Implementing adopted Best Practices - Get a better operation and control mechanism Time 24 months ~ 1 year 18 months Vendor SAP PeopleSoft SAP Project Cost Over $100 million Unknown $15.4 million Modules Warehouse Automation Financial Human Resources Material Financial Methods used - ERP Vendor and consultant - ERP Vendor and consultant - ERP consultant Class Failure Average Average Outcomes COO Became Pilot project in 4 units Potential outcome : - Reduced FTE (Full Time Equivalent) - Increase ITO (Inventory Turn over) - Reduced Inventory Level Resign $ 34 M charge for inventory and order mix-ups Bankruptcy Sues Anderson Consultant Sues SAP Y2K compliant Financials became more timely and accurate – faster analysis IT gained new technology knowledge 64 Future of ERP Systems http://itmanagement.earthweb.com/erp/print.php/3643966 65 Future Goals of ERP There is a movement toward a global ERP system, which is a key factor shaping the future of ERP Companies want to have fewer and fewer ERP systems running – meaning eventually they only want to open one application to get any information they need. There is a shift toward creativity around product strategies rather than the current products http://itmanagement.earthweb.com/erp/print.php/3643966 66 Questions??? 67