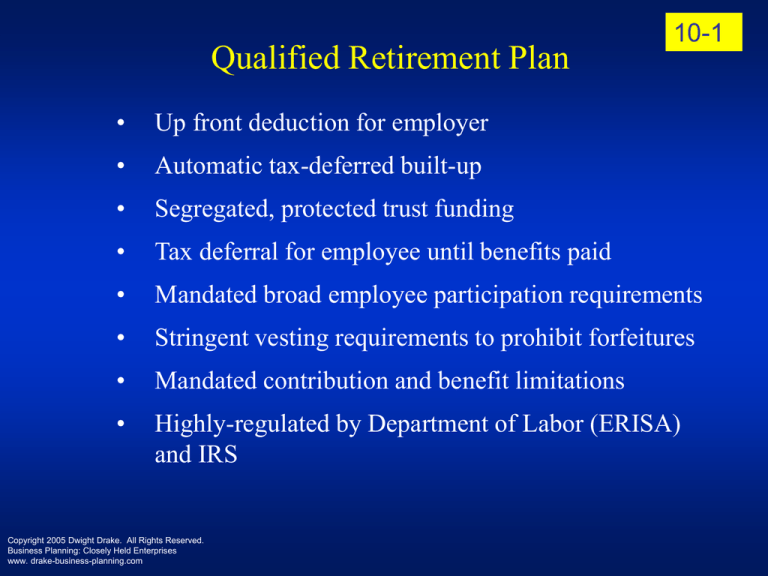

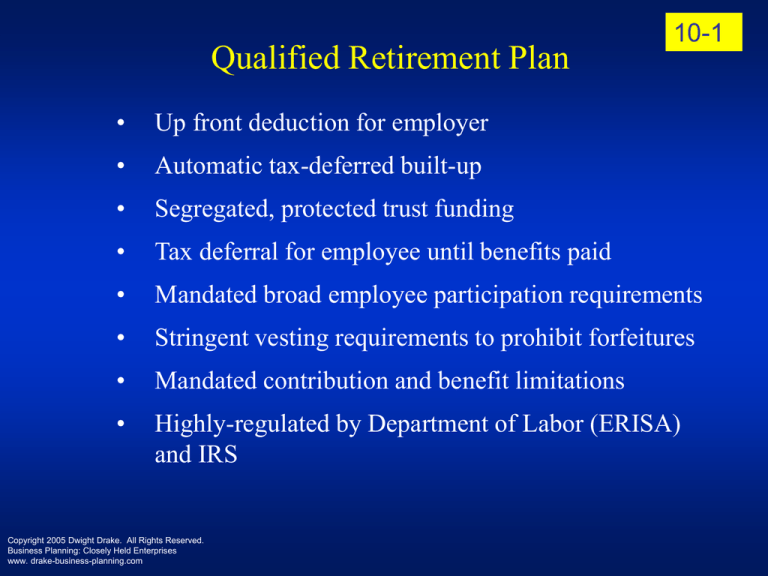

Qualified Retirement Plan

10-1

•

Up front deduction for employer

•

Automatic tax-deferred built-up

•

Segregated, protected trust funding

•

Tax deferral for employee until benefits paid

•

Mandated broad employee participation requirements

•

Stringent vesting requirements to prohibit forfeitures

•

Mandated contribution and benefit limitations

•

Highly-regulated by Department of Labor (ERISA)

and IRS

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Non-Qualified Deferred Compensation

10-2

•

No up front deduction for employer

•

No automatic tax-deferred built-up

•

No segregated, protected trust funding

•

Yes tax deferral until benefits paid (If done right)

•

No mandated broad employee participation requirements

(Exact opposite – limited only to highly-compensated)

•

No stringent vesting requirements to prohibit forfeitures

•

No mandated contribution and benefit limitations

•

Not highly regulated by Department of Labor and IRS.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-3

Non-Qualified Deferred Comp Plan Lingo

.•

“Elective Deferral Plan” or “Salary or Bonus Deferral

Plan”: Executive makes election to defer income to later period.

Pre-tax savings program.

•

“Supplemental Executive Retirement Plan” (SERP):

Company funds a special retirement benefit for key employee(s).

•

“Excess Benefit Plan”: Provide benefits in excess of 415

qualified plan limitations to key employees.

•

“Short-Term Plan”: Executive elected deferral to accumulate for

specific purpose – college, home balloon mortgage, etc.

•

“Death Benefit Only”: Benefit paid only on death of employee.

Equivalent of life insurance. Can be structured to avoid estate tax

inclusion. Escapes 2039 inclusion.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

The Old Tax Traps

.•

10-4

Constructive Receipt Trap of 451. Key is to make deferral

election before compensation earned and avoid pay-out elections after

point of accrual.

•

Economic Benefit Trap. Employee taxed on economic benefit

received. Key is to confer no economic benefit – keep promise

unfunded, no power to assign rights. Keep as unfunded promise with

rights no greater than general creditor of corporation.

•

Section 83 Trap. Property transferred as compensation taxable

now if not subject to substantial risk of forfeiture. Good news:

unfunded, unsecured promise to pay deferred compensation not

“property” under 83.

•

“Reasonable Compensation” Trap. Risk factor when employee

is also shareholder. Company deduction at stake.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

The New Tax Trap – 409A

10-5

• . Fixed Distribution Events. Disability, separation from service,

death, specific schedule, change of control, or unforeseen emergency.

•

No Distribution Accelerations. Very limited exceptions – domestic

relations orders, forced divestiture, to pay FICA taxes on deferred

amounts.

•

Deferral Election Before Year Earned. Exceptions for first year

(election within 30 days of eligibility) and performance-based bonuses

(election at least 6 months before year end)

•

Tough to Extend Deferral. At least 12 months in advance before

effective date and first payment begins and for at least 5 yrs more.

•

No Assets Outside U.S. Foreign assets used to pay benefits deemed

property under section 83.

•

No Employer Financial Health Triggers. Any related assets

deemed property under section 83.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

The Pain of 409A

.

•

Immediate Taxation of All Deferred

•

Interest Calculated at One Percent Above Normal

Underpayment Rate

•

Extra 20% Penalty on Deferred Amount

A Trap With Real Teeth!

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-6

10-7

Key Structural Issues

.

•

Mandatory or elective?

•

Who funds? Part of regular pay or something extra.

•

Any golden handcuffs – forfeiture provisions?

•

How does deferral grow – at what rate or based on

what index?

•

Payout options – retirement, death, disability, defined

date in future.

•

Hardship withdrawal rights.

•

General creditor risk – what can be done to hedge this?

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Deferred Comp – Collateral Issues

10-8

• . Financial statement impact – a real liability for the company

• Qualified plan benefits – may reduce if elective deferral out of executive’s pay.

•

Accrual on benefit not interest to company – just additional deferred

compensation. Albertson Case.

•

ERISA compliance can be handled with letter – employer info, plan for tophat group, number in plan.

•

Staying Top Hat – smaller the better, promote exclusivity, for only the very

privileged.

•

Shareholders (even big ones) can be included, but keep reasonable.

•

Tax implications at executive’s death – unpaid benefits included in estate;

may qualify for marital deduction; subject to income tax as IRD under 691.

•

Social security - If no substantial risk of forfeiture, taxable in year earned, not

paid. This good because executive probably already over cap in year earned.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-9

Key Deferred Comp Strategies

.

•

Indispensable Executive - SERP with golden

handcuffs

•

Owner Deferred Comp – Reflect real value against

company’s limited capacity to pay

•

Booster to Do-It-Yourself Retirement - Something

special for the privileged few

•

The financially irresponsible executive

•

The alternative to real equity

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Problem 10-A: Go Fly Delivery

10-10

Plan elements

.

•

Document deferral before year deferral begins – nothing

retroactive.

•

Specify payout options to comply with 409A – no

discretion or wiggle room.

•

Real economic benefit, plus tax deferral. Company gets

deduction when income recognized by Burt.

•

Golden handcuffs – hopefully not.

•

Growth on deferral – others may insist be modest.

•

Hardship withdrawal rights – others may object

•

General creditor risk – a given, business must succeed.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-11

Naked Deferred Comp Option

Company

Pay Benefits

Per Agreement

Executive

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

• Nothing funded

• Executive General

Creditor

• Executive taxed on

receipt of benefits

• Company gets

deduction when

executive taxed

Mitigating the Non-Payment Risk

10-12

• . Third Party Guarantee – parent company, majority

shareholder. Guarantor can not be in the business.

•

Surety Bond – only if obtained and funded by executive. If

company does it, will be considered funded plan.

•

Rabbi trust

•

Secular trust with Crummey type executive withdrawal

powers.

•

Company owned life insurance program.

•

Split dollar insurance funded program

•

Bonus insurance program

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-13

Rabbi Trust Option

Company

Agreement to

pay benefits

Company funds

Executive

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Insolvency Reversion

Rabbi

Trust

Benefits paid on

behalf of company

10-14

Rabbi Trust – Why?

•

Company’s will to pay fades – Rabbi helps

•

Company doesn’t plan for payment burden –

Rabbi helps

•

Company’s management doesn’t appreciate

costs of plan – Rabbi helps

•

Company goes under – Rabbi doesn’t help

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-15

Requirements of Rabbi Trust

•

Sole purpose to provide plan benefits, except revert on

company bankruptcy or insolvency.

•

Duty to notify trustee of bankruptcy or insolvency.

•

Trustee must stop all payments when notified.

•

State law can not grant executive any priority rights in

trust over other creditors.

•

Trust can’t be funded with securities of employer.

•

No insolvency trigger or other provision that could

frustrate rights of general creditors of company.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-16

Life Insurance Tax Benefits

•

Tax deferred inside build-up in policy – no income tax

on growth of amount in policy.

•

Tax-free borrowing privileges against cash surrender

value. Company can use to cover after-tax cost of

payments during retirement.

•

Tax-free death benefit – company can use to fund

after-tax cost of remaining benefit at employees death

or to recoup amounts already paid out under plan.

•

Mitigate financial statement impact – policy shows as

growing asset.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-17

Life Insurance Structuring Options

•

Straight Corporate Ownership

•

Rabbi Trust Ownership

•

Split Dollar – Executive has death benefit that can

be estate tax- protected through ILIT

•

Executive Bonus Insurance with Gross-Up

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-18

Company Owned Insurance Option

Policy Death Benefit

Company

Pay benefits

per agreement

Executive

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Policy loans

Premiums

Insurance

Policy

10-19

Rabbi Owned Insurance Option

Excess Policy Proceeds

Company

Agreement to

pay benefits

Insolvency reversion

Company funds

Rabbi

Trust

Death

Benefit

Pays benefits

Premiums

Executive

Policy

loans

Insurance

Policy

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

10-20

Split Dollar Insurance Option

Company

Policy Loans

Premiums

Pay benefits

during life to

executive

Imputed income

Gross-up?

Death benefit

over cash value

Executive

Imputed giftCrummey

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Insurance

Policy

Executive

ILIT

10-21

Bonus Insurance – Poor Person Trust

Company

Contingent

repayment

obligation

Restrictive endorsement –

pre-retirement

Comp for premiums

Plus gross-up

Executive

Insurance

Policy

Premiums

Loan withdrawals

Death benefit

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com

Problem 10-B: Jurden Windows

10-22

Plan elements

.

•

Company funded, all forward looking, fixed retirement

benefit for life (strong incentive)

•

Strong golden handcuffs – if Justin flakes, all is lost.

Ideal for company would be performance criteria – very

difficult to sell.

•

Deferral should be secure with close scrutiny to avoid

all traps.

•

“Teeth” to show benefits will be funded could be

handled with insurance. Company’s preference:

corporate owned policy. Justin preference: Split dollar

or bonus insurance. Possible compromise: Rabbiowned insurance.

Copyright 2005 Dwight Drake. All Rights Reserved.

Business Planning: Closely Held Enterprises

www. drake-business-planning.com