Employment Law

advertisement

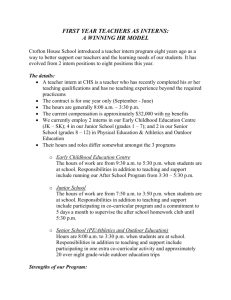

Employment Law Problem-Prevention for Employers Attorney Ruth-Ellen Post Office: 56 Stiles Road, Suite 103 Salem, NH 03079 Phone: 603-212-9004 Email: postlawoffice@comcast.net Home: 15 Stonehedge Road Windham, NH 03087 Cell: 603-557-5395 Professional Background • • • • • • Attorney for 35 years Rutgers Law School Licensed in NH, MA, and NJ Practice mainly serves local businesses Former law and legal studies professor Community Service: – – – – – Windham Planning Board, currently Chairman Founding Member, Windham Economic Development Committee SCORE Volunteer Small Business Mentor Greater Salem Chamber of Commerce Windham Women’s Club Outline 1. Introductions 2. The Dangers of Employee Misclassification: 1099Independent Contractor vs. W-4 Employee 3. Discrimination Traps for the Unwary 4. Using Interns: New Government Rules 5. When to Put In in Writing 6. Open Q & A Session* * The “Fine Print”: To protect your interests, please avoid disclosing confidential information , whether personal or business, in this public setting More Fine Print • This presentation and accompanying materials are NOT a substitute for personal legal advice, which may vary considerably depending the particular circumstances of your business situation. • For accurate legal advice on your own business decisions, it is important to consult a professional in a confidential setting. 1. Employee vs. Independent Contractor Federal (IRS) Implications: • Who is responsible for tax withholding, Social Security, etc. – you or your new hire? • Require new hire to complete a W-4, or not? • What to file at the end of the year: 1099 or W-2? State (NH) Implications: • Is your new hire eligible unemployment compensation? • Is your new hire eligible for workers compensation ? NH Cracking Down on Employee Misclassification • NH Unemployment Comp. Fund overwhelmed and almost depleted after 2008-09 recession • Law-abiding businesses suffer financial disadvantage • Misclassified workers left unprotected if injured or laid off • Stepped-up investigations and enforcement • New NH penalties on employers: up to $2,500 fine plus $100 per day, per employee (2010) • IRS pay-back and penalties imposed separately for noncompliance NH Guidelines on Employee Misclassification • Looks at 12 factors to justify “Independent Contractor” status (see NH DOL website) • Mainly: Is your new hire actually an independent business? For example: – Serves clients other than your business (or is free to do so) – Bills you per job, per hour, or per project – Structures own time, determines own work methods, and is judged by the product (not by work methods you regularly oversee) – May work off-premises – Pays own expenses, assumes all his/her own liabilities including taxes, Social Security, and insurance – Written employment contract not necessarily the deciding factor IRS Guidelines on Employee Misclassification IRS has a three-pronged test (see article at irs.gov website): 1. Behavioral: Who controls how job is done? 2. Financial: New hire pays own costs, own insurance, own tools or supplies, etc. 3. Nature of relationship: Indefinite vs. projectspecific; expectation of benefits or not 2. Discrimination Traps for the Unwary Trends beyond the “usual” categories: • EEOC complaints at a record high in 2010 (99,922) • Top category: employer retaliation, so care is needed in handling internal complaints objectively and fairly • Grounds for complaint may go beyond race, color, gender, age, religion, national origin, marital status – may also include sexual orientation, physical disability, medical conditions including pregnancy and obesity Avoiding Discrimination Claims General Rules for Job Interviews: • Ask only about matters clearly related to potential job performance • Example: Don’t ask “Are you pregnant?” Ask “Barring unforeseen circumstances, can you assure uninterrupted availability for this position for the next 2 to 3 years?” (and only if that is an important factor for the position involved). Avoiding Discrimination Claims Another Interviewing Example (marital status): Don’t ask, “Is your husband/wife also employed locally?” Say “Because we will invest ten weeks of training in whoever is hired for this position, we hope, in return for that training, for a reasonably firm commitment to remaining at this location, preferably for at least two years; are you able to make such a commitment if hired?” Avoiding Discrimination Claims • Another Interviewing Example: Don’t say, “You look a little young (old, etc.) to be applying for this kind of position.” Instead, say, “we are seeking someone with at least 5 years of experience in XYZ” or “knowledge of the latest applications … ” etc. MAKE ALL QUESTION EXPLICITLY JOB-RELATED OR DON’T ASK THEM Avoiding Discrimination Traps in Firing Have a regular performance-evaluation process in place for all employees. – Appraisals must be candid – not just “kind” – Appraisals should allow a chance for improvement plus clear instructions on what that requires. – The consequences of failure to improve must also be clear. – Create a “paper trail” of legitimate reasons for firing. New Rules About Using Interns • The US Department of Labor (DOL) noticed that unpaid interns were displacing paid workers at an alarming rate. • Unable to find paying work but eager for resume-boosting experience, interns were often an easy target for financial exploitation. • Many college-related internship experiences were reported to have no genuine educational component, benefitting only the employer. New DOL Rules for Unpaid Internships in For-Profit Settings • Internship similar to training in an educational environment • The experience is for the intern’s benefit • Regular employees are not displaced • Employer derives no immediate advantage from the intern’s activities • Internship does not necessarily lead to a job offer • Both intern and employer understand there are no wages for the intern’s time Protecting Your Business if Using Interns • Have close collaborative relationship with appropriate office of a reputable college or university; follow their guidelines closely. • Alternatively, pay your intern! Often, the minimum wage or something close to that is sufficient. This buys you the freedom to assign whatever work your business needs. • These rules only apply to for-profit businesses. When to “Put It in Writing” • All key events beg for a written agreement • Written agreement signed by both parties is your best protection. – Hiring (employee OR independent contractor) – Arrangements requiring trade secrets, confidentiality, or noncompetition – Agreed services for a client – Purchasing, leasing, licensing, storage – any arrangement with a third party – Pre-agreement offers often give rise to conflicting expectations if not in writing – A letter of confirmation or even email can serve as a “writing” where recipient’s signature is not an issue Questions and Answers