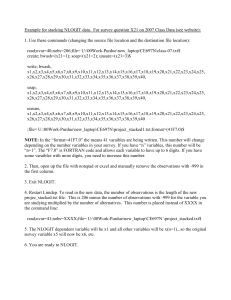

Virtual Network Operators (VNO)

advertisement

AUTOPAGE CELLULAR PRESENTATION To PARLIAMENTARY PORTFOLIO COMMITTEE ON COMMUNICATIONS 17 AUGUST 2005 Introduction Autopage Cellular welcomes this opportunity to present to the Members of the Portfolio Committee on Communications Full details of Autopage Cellular and other Altech companies which may be affected by the Convergence Bill, are included in our written submission We have included the contents of this presentation together with Altech Annual Report for your further information We progress to our commentary on the Draft Bill. 1 Objectives Of The Act Commentary on certain key objectives: (a) “Promote and facilitate the convergence of telecommunications and broadcasting signal distribution” In the telecommunications area, this primarily means the competitive bundling of communications services such as cellular, fixed line and broadband internet access In many European markets, this is achieved by independent Virtual Network Operators (VNO) which combine services from various operators to provide competitive offerings to consumers VNO’s purchase wholesale minutes and access in bulk from various operator networks, and resell these services competitively in bundled and re-tariffed forms to the market 2 Objectives Of The Act Commentary on certain key objectives: (a) “Promote and facilitate the convergence of telecommunications and broadcasting signal distribution” VNO’s have the ability to bill, re-tariff and service their own subscribers, and usually have extensive sales and distribution channels VNO’s are natural convergence entities As the largest independent service provider in the cellular industry, Autopage Cellular is highly capable of graduating to a VNO role in the industry. Autopage has 500 000 post-paid subscribers in the cellular industry, from all three networks: Cell C, Vodacom and MTN. 3 Objectives Of The Act Commentary on certain key objectives: (c) “Encourage investment and innovation in the Communications Sector” (e) “Promote competition within the Communications Sector” The de-regulation of the sector and the promotion of competition are critical to opening the sector to new players, technologies and investment, resulting in better, more competitive and widespread communications services A concern with the draft Bill, is that it seeks to broaden the license base by bringing a number of new license categories: - “Communications Service Licenses” (CSL) - “Application Service Licenses” (ASL) 4 Objectives Of The Act Commentary on certain key objectives: (e) “Promote competition within the Communications Sector” but effectively renaming a category for existing incumbents “Communications network service licenses” i.e. Telkom, Vodacom, MTN, Cell C, Sentech, WBS and USALS. The effect is to discourage the entry of new investors into the telecommunications sector at Network Operator level, preventing rollout of innovative services such as wireless broadband, VOIP, and self-provision of facilities by CSL (including existing VANS). The effect is also to over-license and over-regulate a competitive market at the Application Service Licenses level. (ASL) 5 Objectives Of The Act Commentary on certain key objectives: (e) “Promote competition within the Communications Sector” Communications Service licensees (CSL) gain licensed recognition, but no further rights and obligations, which would permit them to: - Interconnect to other CNSL - Have their own number range - Have the ability to obtain approval of tariffs by the Authority - Have the right to self-provide Regrettably the result is to further stifle innovation and investment through litigation and disputes, rather than to de-regulate the sector 6 Objectives Of The Act Commentary on certain key objectives: (f) “Promote an environment of open, fair and non-discriminatory access to communications networks” Together with (b) “universal connectivity …” (g) “empowerment of HDI persons …” (n) “promote consumer interests …” These objectives would be served by a healthy, competitive and lightly-regulated market De-regulation of the telecommunications sector, particularly at the CNSL and CSL levels will lead to: - greater competitiveness - wider availability of communications services - affordable and accessible communications for consumers 7 Objectives Of The Act Commentary on certain key objectives: (f) “Promote an environment of open, fair and non-discriminatory access to communications networks” New ventures will allow for further incorporation of empowerment at all levels o The Altech Group and its subsidiaries including Autopage Cellular fully support empowerment in its many facets o The Altech and Altron Groups have demonstrated a proud track record of successful BEE partnership and broad based empowerment achievements o Autopage Cellular is proud to count among its staff, significant and targeted demographic representation 8 Licensing Framework Commentary Licensing Framework – Chapter 3 3 levels of licensing are envisaged in the Bill i) Communications Network Services Licenses (CNSL) ii) Communications Services Licenses (CSL) iii)Applications Service Licenses (ASL) Specific concerns with CNSL o Designed to limit licenses to existing incumbent operator licenses currently in place o It is clear that any new applications for CNSL will be protracted and discourage new investment and innovation at this level in the industry 9 Licensing Framework Commentary Licensing Framework – Chapter 3 Many privileges and obligations attach to CNSL, which are not available to smaller industry players: i) Provision of infrastructure – particularly wireless (This can revolutionize penetration through fast deployment and low capital cost) ii) Interconnection Prevented and over-regulated even between CNSL players If relaxed, would allow pervasive and free communication between licensees (CSL,CNSL) 10 Licensing Framework Commentary Licensing Framework – Chapter 3 Access and rights to Radio Spectrum - As proposed, this is also restricted to existing Operator licensees - Also prevents investment in and deployment of innovative wireless solutions - This stifles innovation and makes further investment complex and difficult Communications Facilities Provision and Leasing - A limited number of CNSL players will force an oligopolistic market to develop in the provision of leased facilities - A competitive market is essential to cut the ultimate cost and availability of communications to the consumer 11 We illustrate our case for de-regulation as follows: Case 1: Wireless infrastructure provision The process of obtaining CNSL needs to be opened up to allow for more and easier licensing - Specifically point-to-point and point to multi-point wireless where deployment is rapid and capital cost is low - Existing and Future VANS, fall into the category CSL They must lease capacity which limits their ability to compete effectively - Broadband Wireless infrastructure would need CNSL licensing to gain access to radio spectrum in terms of the Bill New investment in this sector is stifled by the Bill. The process of licensing would be protracted and slow Conclusion: The Bill should seek to de-regulate telecommunications, rather than entrench existing CNSL players 12 We illustrate our case for de-regulation as follows: Case 2: - Virtual Network Operators (VNO) This model is becoming increasingly popular internationally. VNO’s are ideally suited as convergence players, as well as promoting competition through own tariffs and bundling. VNO’s purchase wholesale services from CNSL licensees and resell services to the public - Typically VNO’s do not own or operate extensive Network facilities, but require the following CNSL rights and obligations: 1. Interconnection rights to CNSL licensees 2. Own Number range (subject to NP) 3. Right to submit own tariffs to the Authority 4. Right to wholesale tariffs and facilities (CSL) 5. Self provisioning of wireless or cable infrastructure 13 Examples: Typically highly successful VNO’s are: Tele 2 AB: - A Swedish VNO operator in 23 European Countries (Revenues of SEK 36.9 billion and 22 million subscribers) Virgin Mobile: - Highly successful UK VNO operator with 4million subscribers - Also Virgin/Sprint - USA (2million subscribers) - Virgin/Optus - Australia (600 000 subscribers) Debitel: - A successful European VNO operating in 5 countries (Revenues of €3 billion and 10.4 million subscribers) 14 VNO – Concept Diagram Fixed Line Mobile Mobile Switch (Optional) VIRTUAL NETWORK OPERATOR Broadband Interconnection rights to other networks Own number range Own tariffs and bundling Right to wholesale tariffs and facilities Self provisioning rights Subscribers 15 We illustrate our case for de-regulation as follows: Case 2: Virtual Network Operators (VNO) Conclusion: VNO players are well-suited to introduce greater telecommunications competitiveness. Existing independent cellular Service Providers such as Autopage Cellular are well-suited to become VNO’s. 16 Differences between SP and VNO: Category Service Provider SP/ESP Virtual Network Operator (VNO) Statutory Contract with Network/s Licensed by law Tariffing “One line, One tariff” Own tariffs and bundling (ICASA) Wholesale traffic Discount on Network Tariffs -outgoing calls only Wholesale rate per minute -Outgoing calls -Incoming calls Subscriber Interconnect Through Network and Telkom Direct to Network (Interconnect) 17 Differences between SP and VNO: Category Service Provider SP/ESP Virtual Network Operator (VNO) Handset Incentives Network and own funds VNO funds Number Range Allocated by Network (subject to NP) Allocated by license to VNO (subject to NP) Self-Provisioning Channels NO YES Switch Interconnect Traffic NO YES (Optional) 18 Conclusions: The Convergence Bill seeks to entrench existing CNSL players It defeats its own objective of “Promoting Competition within the sector.” And “Encouraging investment and innovation in the communications sector” It over-regulates by excessive layers of licensing without providing commensurate additional rights It should be restructured to de-regulate telecommunications and to encourage a vibrant and competitive industry As drafted, it has failed to do this **************** 19 THANK YOU G. Passmoor Group Executive Altech S.R. Blewett Managing Director Autopage Cellular