Canada can offer - Ascension Publishing

advertisement

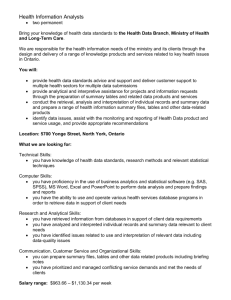

Prepared for: ABLC Next 2014 San Francisco, CA November 10 – 12, 2014 Prepared by: Jeff Passmore, CEO, Passmore Group Inc. For early commercial plant rollout Assuming the project sponsors have: demonstrated technology equity $$$ in the game Canada can offer: Feedstock Ag residue; Forest residue; MSW Sites Greenfield; Brownfield Partners Strategics; “Service providers” Capital Non-dilutive, subordinated debt (grants and loans) “Conventional” debt (market rates) Markets Fuels and Chemicals Canada Wheat (straw) growing areas NOTE: SW Ontario (lower left portion of large area in blue) also grows two million acres of corn (stover) Map – Courtesy, Agriculture Division, Statistics Canada / Foreign Agricultural Service, USDA Canada Wheat area harvested (red) versus yield in tons/hectare Canadian Agriculture Total crop & pasture land: Canada - 160 million acres Saskatchewan Alberta Ontario ~62 million acres (39% of total farm area in Canada) ~50 million acres (31% of total farm area in Canada) ~12 million acres Gross farm receipts in 2010: Alberta - $11.4 billion Saskatchewan - $9.4 billion Ontario - $11.9 billion From a feedstock perspective, the best locations for a cellulosic sugars bio-refinery in Canada are: - the black soil zones of Alberta and Saskatchewan - SW Ontario Canada Forest cover (10% of global) Co-develop, co-locate, co-produce Numerous sites have serviced land suitable for chemical and/or fuels production facilities Site locations in good feedstock basins that could be appropriate for a brownfield or colocated bio-refinery project: operating corn ethanol facilities (Alberta, Saskatchewan, Ontario) operating forest companies with “waste” wood and/or sawdust (Alberta, British Columbia) existing boilers, buildings, rail, and other infrastructure (Saskatchewan, Ontario) industrial zoned land so permitting will be straightforward supportive communities potential need to meet regulatory requirements Are not necessarily looking for Government funds if project returns are attractive For strategics, projects typically need to demonstrate: a 5-6 year simple payback a cost advantage over current practices a competitive edge over capital opportunities in other potential areas of investment Example Sarnia, ON Brownfield lands with shared resources in industrial parks Brownfield lands • Selection of available, privately-owned brownfield properties suited for chemical processing activities, many of which are situated within industrial parks • BioIndustrial Park Sarnia (BPS) is equipped with a privately-owned world class biological waste water treatment plant which has a capacity of 24,000 m3/day (7 million U.S. gallons) • The TransAlta Sarnia Regional Cogeneration Plant supplies Bluewater Energy Park and BPS tenants with “behind the fence” electricity, avoiding certain transmission and overhead costs charged when supplied from the grid • Long term steam energy contracts also available through TransAlta’s cogeneration facility in Sarnia, with infrastructure in place to supply a choice of 450, 165, 15 psi steam pressures • Strong network of firms providing crucial chemical industry support services, including: specialized engineering, machining shops, environmental services, metal fabricating, industrial pipefitting and boiler making firms • Highly accessible by road, rail, air and water, and located close to the U.S.-Canada border with direct access to the commercial, industrial and agricultural heartland of North America Wastewater Electricity Steam Support services Transport Infrastructure 8 Sarnia area showing proximity to US markets • Industrial Heartland of North America – 52% USA GDP within 10 hours trucking • Secure Raw Materials • High Quality Labour • Tax Advantages Combined federal and state/provincial manufacturing income tax rate (2014) Ontario US Weighted Avg. Great Lakes States Avg. 25.0% Ontario’s corporate tax rate is 11% lower than in the U.S. for manufacturers 36.0% 36.4% Ontario 25.0% Ohio 32.0% Texas 32.5% Louisiana 35.3% North Carolina 35.9% Michigan 35.9% Georgia 35.9% Illinois 37.7% New Jersey 38.0% Pennsylvania 38.0% Iowa 38.2% Minnesota 38.5% Note: Ohio rate includes the state’s Commercial Activity Tax rate which is levied on gross receipts in Ohio; a CIT equivalent is not available. Texas rate includes the state’s 1.0 per cent franchise tax, which is based on gross revenue; a CIT equivalent is not available. Source: Ontario Ministry of Finance, based on legislation as of May 31, 2014. 10 Canadian Govts’ project support is unique and generous Scientific Research and Experimental Development (SR&ED) Tax Credits - large Corporation can claim a 20% tax credit on eligible research expenses - in combination with Ontario tax credits, cut cost of $100 R&D expenditure to ~$40.11 Sustainable Development Technology Canada (SDTC)** Next Gen Fund* - up to 40% of capex (max $200mm), plus 20 % stacking - “repayable contribution” from free cash flow (last in line) * all funds must be spent by March 31/’17 Tech Fund - development and demonstration grant funding (typically ~$2 – 12m) Agriculture Canada - Growing Forward Two - up to $10m interest free loan (other financing / term sheets must be in place) Ministry of State for Science & Tech - SW Ontario projects - up to $20 million interest free 10 year loan (includes R&D, engineering, labour and capital costs) - Western Economic Development - $2 – 4 million interest free loan (British Columbia, Alberta, Saskatchewan, Manitoba) - ACOA – up to ~$1 million ** Most other federal and provincial funding Programs will rely on SDTC tech due diligence Canadian Govts’ project support is unique and generous Export Development Canada - financial support (loan) for inbound foreign direct investment - partners with other financial institutions - minimum 50% of the facility’s production must be exported Ontario Ministry of Economic Development and Trade - Jobs and Prosperity Fund: 10-Year, $2.5B program: Support to large, strategic investments that provide unique benefit to Ontario (Discretionary grants and loans) - Southwestern Ontario Development Fund: Grant up to 15% of eligible expenses to a max of $1.5m + interest-free loans up to $3.5m - OPA Industrial Accelerator Program: up to $10 million per project for energy-efficiency Alberta - Climate Change and Emissions Management Corporation – Grants up to $10 million (Role is to reduce Alberta GHGs, and assist with deployment of clean technology Funds raised from a $15/tonne carbon tax on the Province’s major large GHG emitters) - Alberta Treasury Branch – “patient” loans up to $50m, can invest outside the Province (market based interest rates, could lead a syndicate including US Investment banks) - Agriculture Financial Services Corp. - max $5 million, 20 year loans at 3% - 5% interest Hypothetical Bare Bones Capital Stack Private Equity Private Debt SDTC FedDev Growing Forward Jobs and Prosperity EDC TOTAL PROJECT $30m 50 --$80 $15m 18 9 8 --$50 $20m $150mm Renewable fuels / renewable chemicals markets • National etoh mandate - 5% ethanol “on average” (Biodiesel mandate - 2%) • Canada consumes about 40 billion litres (10 billion gallons) of gasoline/year = Obligated parties required to blend ~2 billion litres of ethanol annually • This blending obligation is currently met with conventional grain based ethanol from Canada (~1.8 billion litres) or the US, or from small amounts of sugar cane ethanol from Brazil • There is no “set aside” or “carve out” for 2nd generation cellulosic ethanol • Build in Canada (take advantage of government capital assistance), export finished product: • Fuels to the US (take advantage of the higher value proposition) • Chemicals to the world – FTAs with US, Mexico and Europe • Makes the project eligible for EDC financing North American CN Rail connections Contacts: Email jeff@passmoregroup.ca Web www.passmoregroup.ca Mobile +1 613 614 8568 Land +1 613 821 0495