22AcctChanges

advertisement

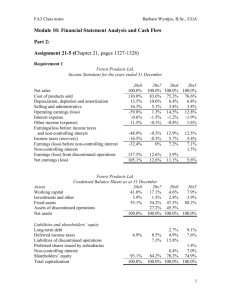

Intermediate Financial Accounting Accounting Changes and Error Corrections by Professor Hsieh Objectives of the Chapter I. To learn the types of accounting changes. II. To study the accounting treatments of accounting changes. III. To analyze the accounting errors and to learn the accounting treatments of errors. Accounting Changes & Error Corrections 2 I. Types of Accounting Changes A. Changes in Accounting Principle (Method). B. Changes in Accounting Estimate. C. Changes in Reporting Entity. Accounting Changes & Error Corrections 3 Examples of Changes in Accounting Principle (Method) Changes from one acceptable accounting method to another acceptable accounting method. Examples: adopting a new accounting standard. changes in inventory method. changes from P-O-C method to C-C method for long-term construction projects. Accounting Changes & Error Corrections 4 Examples of Changes in Accounting Estimates Changes in the estimates of: a. useful lives and salvage values of depreciable assets; b. uncollectible accounts expense; c. liabilities for warranty costs, and income taxes. Note: Under SFAS 154,changes in depreciation method is considered as changes in accounting estimates. Accounting Changes & Error Corrections 5 Examples of Changes in Reporting Entity 1. Presenting consolidated statements for the first time to replace individual statements. 2. Changing subsidiaries that are included in consolidated F/S. Accounting Changes & Error Corrections 6 II. Accounting Treatments for Accounting Changes Three approaches had been suggested: 1.Current-Period Approach (eliminated by SFAS 154). 2.Retrospective Approach (applied to voluntary accounting method changes and changes in reporting entity). 3.Prospective approach (applicable for accounting estimate change). Accounting Changes & Error Corrections 7 1. Current-Period Approach (Eliminated by SFAS 154) The cumulative effect of all prior years resulting from adoption of the new method is reported in the current year’s income statement. F/S of prior years should not be restated. Net income and earnings per share, computed on a pro-forma basis (as if the new method were adopted) are shown on the I/S for all periods that appear on the I/S. Accounting Changes & Error Corrections 8 Current Period Approach (Eliminated) This approach has been eliminated by SFAS 154. SFAS 154 was issued in May 2005, and became effective for fiscal years beginning after 12/15/2005. Accounting Changes & Error Corrections 9 Current-Period Approach (contd.) (skip) Advantages a. Less costly. b Will not affect the financial ratios of prior years. c. No change in prior years’ earnings. Disadvantages a. It has significant impact on current year’s income. b. Loss comparability among financial statements (F/S) of different years. Accounting Changes & Error Corrections 10 2. Retrospective Approach A retrospective adjustment of the F/S (i.e., restatement of F/S) is made for prior years as if the new method were used. Cumulative effect for the non-restated prior years is reported in the statement of retained earnings (not income statement) as an adjustment. Accounting Changes & Error Corrections 11 Retrospective Approach (contd.) Advantages a. It results in comparable F/S. b. It has no significant impact in the current year’s income statement. Disadvantages a. It is costly to restate F/S. b. It has a potential in violating loan covenant. Accounting Changes & Error Corrections 12 3. Prospective Approach No cumulative effect is reported in any financial statements (F/S). No prior statements are restated. The new method is applied to the f/S of the current year and future years. Accounting Changes & Error Corrections 13 The Treatments for Changes in Accounting Method (skip) Prior to APB Opinion No. 20 (Accounting Changes, effective 7/31/1971), all three approaches were acceptable for changes in accounting method. APB 20 only allows the current period approach and the retrospective approach for accounting method changes (except for five situations in which the retrospective approach must be used). Accounting Changes & Error Corrections 14 The Treatments for Changes in Accounting Method (contd.) Under SFAS 154 (effective 2006), the only acceptable treatment for voluntary accounting method changes is the retrospective approach. SFAS 154 eliminated the current period approach except when proscribed by new accounting standards. Accounting Changes & Error Corrections 15 The Treatment for Changes in Accounting Method (contd.) Reasons of eliminating the current period approach under SFAS 154: Toward global convergence of accounting standards; Improve the comparability of financial statements. Accounting Changes & Error Corrections 16 The Treatment for Changes in Accounting Estimates The prospective approach is only acceptable for changes in accounting estimates, NOT for changes in accounting method. However, a deprecation method change is treated as an estimate change under SFAS 154. Thus, the prospective approach is applied to deprecation method change. Accounting Changes & Error Corrections 17 Reasons for Changes in Accounting Method Reasons for changes in accounting method: 1. Changes in economic environment. 2. Mandated by a new accounting standard (i.e., recognition of post retirement benefit expenses on an accrual basis); 3. Changes in technology. 4. Economical Reasons (see p66 for details). Accounting Changes & Error Corrections 18 Change in Accounting Method - An Example On 1/1 20x2, Doherty Corporation purchased a machine for $110,000. A 10year economic life and zero residual value were expected for this machine. The sum-of-the-years’-digits method had been used for depreciation purposes starting 20x2. On 1/1/ 20x6, the depreciation method was changed to straight line method. The income tax rate is 30%. Accounting Changes & Error Corrections 19 Change in Accounting Method Example (contd.) – A Note SFAS 154 requires that the changes in depreciation methods be treated as an estimate change. Thus, a prospective approach should be applied for such a change. However, for illustration and comparison purposes, the current period, retrospective and the prospective approaches are applied for this change. Accounting Changes & Error Corrections 20 Example (contd.)-Depreciation Expense under the Old Method (SYD) vs. New Method (S-L) SYD 20x2 20x3 20x4 20x5 $20,000 18,000 16,000 14,000 $68,000 S-L Diff. $11,000 11,000 11, 000 11,000 44,000 Diff.(net) C.Eff.(net) $9,000 6,300 6,300 7,000 4,900 11,200 5,000 3,500 14,700 3,000 2,100 16,800 $24,000 16,800 Diff (net).= difference, net of income tax ;C.Eff (net)= cumulative effect, net of income tax. For 20x6, the depre. Expense is $12,000 and $11,000 under SYD and S-L, respectively. The difference is $1000 (or $700 net of 30% tax) Accounting Changes & Error Corrections 21 Example – A Current Period Approach (this approach has been eliminated by SFAS 154) Cumulative Effect= $68,000-44,000=$24,000 Net Cum. Effect = 24,000x (1-30%)= $16,800 JE to reflect this change applying the current period approach (assuming a 30% income tax rate): Accumulated Depreciation 24,000 Cumulative Effect of Change in Acct. Method-Depre. 16,800 Deferred Income Tax Lia. 7,200 Accounting Changes & Error Corrections 22 Example (contd.)- A Current Period Approach Comparative Income Statements* 20x6 20x5 20x4 Revenues $50,000 $50,000 $50,000 Depr. Exp. (Note A) (11,000) (14,000) (16,000) Other expe. (10,000) (10,000) (10,000) Income taxes (8,700) (7,800) (7,200) Income before changes in acct. principle $20,300 Cumulative effect 16,800 Net income $37,100 $18,200 $16,800 Earnings per share $3.71 $1.82 $1.68 Pro Forma (Note A) Net income $20,300 $20,300 $20,300 Earnings per share $2.03 $2.03 $2.03 *Assume a 30% tax rate and 10,000 shares outstanding. Accounting Changes & Error Corrections 23 Comparative Retained Earnings Assuming a retained earnings balance of $140,000 at the beginning of 20x4 and a dividends of $20,000 for years 20x4-20x6, the following statements of retained earnings will be in the 20x6 annual report: 20x6 20x5 20x4 Balance at beg.(R/E) $135,000 136,800 140,000 Net income4 37,100 18,200 16,800 Cash dividens (20,000) (20,000) (20,000) Balance at end of year 152,100 135,000 136,800 Accounting Changes & Error Corrections 24 Example (contd.)-A Current Period Approach Note A: Prior to 20x6, Doherty used sum-ofthe-years’-digits depreciation on its plant assets. In 20x6 Doherty changed to the straight-line method of depreciation, which management felt better represented the service expiration of its plan assets.. Accounting Changes & Error Corrections 25 Example (contd.)-A Current Period Approach Note A (contd): The cumulative effect of the change in accounting principle of $16,800 (net of I/T) has been included in 20x6 net income. The effect of this change on income of 20x6 was an increase of $700 (net of I/T). The pro forma data report what would have been had the straightline method been used prior to 20x6. Accounting Changes & Error Corrections 26 Example: A Retrospective Approach The F/S of prior years (i.e., two years) are restated on a basis consistent with the new method. The cumulative effect of the non-restated prior years is reported in the statement of retained earnings. This part of cumulative effect is treated as an adjustment of beginning retained earnings of the earliest year presented. Accounting Changes & Error Corrections 27 Example - A Retrospective Approach Using the example on page 19 except applying the retrospective approach, the following comparative I/S will be reported on the 20x6 annual report: 20x6 Revenues Depr. Exp.(Note A) Other Expe. Income Taxes Net Income Earnings per share $50,000 (11,000) (10,000) (8,700) $20,300 $2.03 20x5 20x4 (restated) (restated) $50,000 $50,000 (11,000) (11,000) (10,000) (10,000) (8,700) (8,700) $20,300 $20,300 $2.03 $2.03 Accounting Changes & Error Corrections . 28 A Retrospective Approach (contd.) Note A: Prior to 20x6, Doherty used sum-of- the-years’digits depreciation on its plant assets. In 20x6 Doherty changed to the straight-line method of depreciation, which management felt better represented the service expiration of its plan assets. The financial statements of 20x4 and 20x5 have been restated to reflect this change. Accounting Changes & Error Corrections 29 A Retrospective Approach (Contd.) Note A (contd.): The effect of this change on income of 20x6 was an increase of $700 (net of income tax) and on income of 20x5 and 20x4 was an increase of $2,100 and $3,500 (net of income tax), respectively. The balances of retained earnings of 20x4 and 20x5 have been adjusted for the effect of applying retrospectively the new method. Accounting Changes & Error Corrections 30 Example (contd.)-Depreciation Expense under the Old Method (SYD) vs. New Method (S-L) SYD 20x2 20x3 20x4 20x5 $20,000 18,000 16,000 14,000 $68,000 S-L Diff. $11,000 11,000 11, 000 11,000 44,000 Diff.(net) C.Eff.(net) $9,000 6,300 6,300 7,000 4,900 11,200 5,000 3,500 14,700 3,000 2,100 16,800 $24,000 16,800 Diff (net).= difference, net of income tax ;C.Eff (net)= cumulative effect, net of income tax. For 20x6, the depre. Expense is $12,000 and $11,000 under SYD and S-L, respectively. The difference is $1000 (or $700 net of 30% tax) Accounting Changes & Error Corrections 31 A Retrospective Approach (contd.) The entry to reflect this accounting change under the retrospective approach of 20x6 is: Accu. Depr. 24,000 Retained Earnings 16,800 Deferred Income tax Lia. 7,200 Accounting Changes & Error Corrections 32 A Retrospective Approach (contd.) Assuming a retained earnings balance of $140,000 at the beginning of 20x4 and a dividends of $20,000 for years 20x4-20x6, the following statements of retained earnings will be in the 20x6 annual report: 20x6 20x5 20x4 Balance at beg.(R/E) $135,0002 136,8001 140,000 Adjustment for the Cum. effect 3 16,800 14,700 11,200 Adjusted balance $151,800 151,500 151,200 Net income4 20,300 20,300 20,300 Cash dividens (20,000) (20,000) (20,000) Balance at end of year 152,100 151,800 151,500 Accounting Changes & Error Corrections 33 Example (contd.) 1. 140,000 + 16,800 - 20,000 = 136,800 (See p23 for unadjusted net income of x4.) 2. 136,800 + 18,200 - 20,000 = 135,000 (See p 23 for unadjusted net income of x5) 3. Cumulative difference (effect), see p31. 4. Restated net income to reflect the change of depreciation method made in 20x6, see p28 for restated net income for 20x4 and 20x5. Accounting Changes & Error Corrections 34 Change in Depreciation Method A Prospective Approach Under SFAS 154, a prospective approach should be applied to a change in depreciation method. Thus, the change from a SYD depreciation to a straight-line deprecation would not result in any restatement of prior years’ financial statements. The new depreciation method would only be applied for years of 2006 - 2011. Accounting Changes & Error Corrections 35 Change in Depreciation Method A Prospective Approach (contd.) The annual depreciation expense for 20062011 is: ($110,000-$68,000)/ (10-4) = $7,000 Note: Prior to 20x6, Doherty used sum-ofthe-years’-digits depreciation on its plant assets. In 20x6 Doherty changed to the straight-line method of depreciation, which management felt better represented the service expiration of its plan assets. Accounting Changes & Error Corrections 36 Change in Depreciation Method A Prospective Approach (contd.) Note (contd): The effect of this change on income of 20x6 is an increase of $3,500a (net of 30% income taxes). a. The depreciation expense of 2006 would have been $12,000 under the SYD (the old method) while it is $7,000 under the straight-line method (the new method). Accounting Changes & Error Corrections 37 Change in Accounting Method - Inventory Cost Method Change Example (Example 20-1 of Spiceland, etc. with some revisions) Air Parts Corporation used the LIFO inventory costing method. At the beginning of 2006, Air Parts decided to change to the FIFO method. Under SFAS 154, the retrospective approach is applied for all voluntary accounting method change except for the change in depreciation method. Accounting Changes & Error Corrections 38 Changes in Inventory Cost Flow Assumption (contd.) Additional information: The company has paid dividends of $40 million each year beginning 1999. The income tax rate is 40%. Retained earnings on January 1, 2004 was $700 million. $Inventory on January 1, 2004 was $500 million. Accounting Changes & Error Corrections 39 Cost Flow Assumption Change (Contd.)-A Retrospective Approach The income statements of 2004, 2005 and 2006 are as follows (under LIFO assumption): ($ in millions) 20x6 20x5 20x4 Revenues $950 $900 $875 CGS (LIFO) (430) (420) (405) Operating expenses (230) (210) (205) Pre-tax Income 290 270 265 Income taxes (116) (108) (106) Net income $174 $162 $159 . Accounting Changes & Error Corrections 40 Cost Flow Assumption Change (Contd.)-A Retrospective Approach The statement of retained earnings of 2004 and and 2005 are as follows (under (LIFO)) ($ in millions): R/E (Beg. Bal.) Net Income Dividends R/E (End. Bal.) 20x5 $819 162 (40) $941 20x4 $700 159 (40) $819 . Accounting Changes & Error Corrections 41 Cost Flow Assumption Change (Contd.) cost of Goods Sold ($ in millions) LIFO FIFO Diff. C. D.. Net.C.D. PY $2,000 $1,700 $300 $ 300 180 20x4 405 360 45 345 207 20x5 420 365 55 400 240 $2,825 $ 2,425 $400 PY = previous years. C.D.=cumulative difference. Net C.D.= cumulative difference, net of income tax of 40%. For 2006, The CGS is $430 million and $370 million under LIFO and FIFO, respectively. The CGS difference is $60 million for 2006. Accounting Changes & Error Corrections 42 Change in Cost Flow Assumption (contd.) The cumulative difference of CGS from the change of LIFO to FIFO inventory method is equivalent to the impact of this change on the inventory. Accounting Changes & Error Corrections 43 Change in Cost Flow Assumption (contd.) Since the cumulative difference of CGS is $345 and $400 million lower for 20x4 and 20x5, respectively, the inventory for 2004 and 2005 would be $345 million and $400 million higher under FIFO than under LIFO, respectively. Accounting Changes & Error Corrections 44 Change in Cost Flow Assumption (contd.) For 2006, cumulative difference of CGS would be $460 million lower (i.e., $400 million + $60 million), the inventory of 2006 would be $460 million higher under FIFO than under LIFO. Accounting Changes & Error Corrections 45 Cost Flow Assumption Change –A Retrospective Approach The cumulative difference of CGS up to 2005 equals: $2,825-2,425 or 300+45+55 = 400 (million) The journal entry to record the change from LIFO to FIFO : 1/1 2006 Inventory 400 Retained Earnings 240 Deferred Income Tax Lia. 160 *assuming a 40% income tax rate Accounting Changes & Error Corrections 46 Comparative Income Statements-A Retrospective Approach 20x6 Revenues $950 CGS (FIFO) (370) Operating expenses (230) Pre-tax Income 350 Income taxes1 (140) Net income $210 20x5 20x4 restated restated $900 $875 (365) (360) (210) (205) 325 310 (130) (124) $195R $186R 1Assume a 40% tax rate. R. Restated net income for 20x4 and 20x5. Accounting Changes & Error Corrections 47 Comparative Retained Earnings Statement -A Retrospective Approach Assuming a retained earnings balance of $700 million at the beginning of 20x4, the following statement of retained earnings will be in the 20x6 annual report ($ in millions): 20x6 20x5 20x4 Balance at beg.(R/E)1 $941 819 700 Adjustment for the Cum. difference2 240 207 180 Adjusted Beg. Balance $1,181 $1,026 $880 Net income3 210 195 186 Dividens (40) (40) (40) Balance at end of year $1,351 $1,181 $1,026 Accounting Changes & Error Corrections 48 Comparative Retained Earnings Statement (contd.) Notes: 1.Begining Retained earnings under the old method (i.e., the unadjusted), see p41. 2.Cumulative difference, net of income tax, see p42. 3. Net income under the new method (i.e., LIFO) for 2006 and restated net income (i.e., under LIFO) for 2005 and 2004, see p47. Accounting Changes & Error Corrections 49 Change to LIFO Method (An Exception) When change from other inventory method to LIFO, a prospective approach is applied when a retrospective adjustment is impractical. No cumulative effect will be reported in the income statement and no restatement of prior years’ F/S. Accounting Changes & Error Corrections 50 Change to LIFO Method –contd. The base-year inventory for all subsequent LIFO calculations is the cost of opening inventory in the year the method is adopted. The base-year inventory needs to be adjusted back to the cost. Accounting Changes & Error Corrections 51 Examples of Changes in Accounting Estimates Changes in: a. useful lives and salvage values of depreciable assets; b. uncollectible accounts expense; c. liabilities for warranty costs, and income taxes; d. periods benefited by deferred costs; Accounting Changes & Error Corrections 52 Examples of Changes in Accounting Estimates (contd.) e. inventory obsolescence; f . liabilities of employee related benefits; Note (an exception): Under SFAS 154,changes in depreciation method is considered as an estimate change. Accounting Changes & Error Corrections 53 Changes in Accounting Estimate Accounting Treatment A prospective approach is applied for changes in accounting estimates. The effect of the change on current year’s income will be disclosed in the footnotes. SFAS 154 requires to apply the prospective approach for the changes in depreciation method. Accounting Changes & Error Corrections 54 How to Distinguish Changes In Estimates from an Error? Changes in estimate are changes made based on new information not available before, Not based on information overlooked in prior period (i.e., an error). Accounting Changes & Error Corrections 55 Changes in Estimates Example of Changes in Estimates Change the bad debt exp. estimation from 2% to 4% of the net sale in 20x6. The net sale of 20x6 amounts to $50,000. 12/31/x6 Bad debt exp. 2,000 Allow. for bad debt 2,000 Note: Due to the accounting estimate change, the bad debt expense is increased from $1,000 (at 2%) to $2,000 (at 4%). The net impact (net of income tax credit) from this change is a $700 decrease in net income of 20x6. Accounting Changes & Error Corrections 56 Changes in Estimates Example of Changes in Estimates (contd.) Machine costing $15,000 was purchased on 1/1/x4 with estimated life of 5 years and zero residual value. The straight-line method was used for depreciation. On 1/1/x6, the estimated life of the machine had been changed to 6 years and the residual value had been changed to $1,000 due to new information available. Book value of the machine on 1/1/x6: (15,000-6000) =9,000 Depreciation expense for 20x6, 20x7,20x8, and 20x9: ($9,000 -$1,000) / (6-2) = $2,000 Accounting Changes & Error Corrections 57 Example B (contd.) 12/31/x6 Depr. Exp. 2,000 Acc. Depr. 2,000 Note: Due to the accounting estimate changes on the estimated life and the salvage value of machine purchased on 1/1/x4, the depreciation expense of 20x 6 is decreased by $1,000. The net of income tax effect is a $700 increase in net income of 20x6. Accounting Changes & Error Corrections 58 Changes In Reporting Entity The treatment is to restate the F/S of all prior periods presented (for comparability). Accounting Changes & Error Corrections 59 Examples of Changes in Reporting Entity 1. Presenting consolidated statements for the first time to replace individual statements. 2. Changing subsidiaries that are included in consolidated F/S (i.e. with new mergers or spin offs). 3. A change in the accounting for investments (i.e., change to the equity method or change from equity to consolidation). Accounting Changes & Error Corrections 60 Examples of Changes in Reporting Entity (contd.) An example of changes in reporting entity: In adopting SFAS 94 (“Consolidation of All Majority-Owned Subsidiaries”), HewlettPackard Company (HP) consolidated the accounts of its wholly owned subsidiary, Hewlett-Packard Finance Company, previously accounted for under the equity method, with accounts of HP. HP restated its prior years’ consolidated financial statements to reflect this change for comparative purposes. Accounting Changes & Error Corrections 61 Motivations for Changes and Income Management Management often changes accounting methods not for conceptual reasons (i.e., to improve the fairness of financial statements), but rather for economic reasons (for economic consequence). Accounting Changes & Error Corrections 62 Motivations for Changes and Income Management The followings are possible reasons suggested by academic research in explaining why companies prefer certain accounting methods: 1. Political Costs. 2. Capital Structure (maintain D/E ratio). 3. Bonus Payments. 4. Income Smoothing. 5. Labor Renegotiation Costs. Accounting Changes & Error Corrections 63 III. Error Analysis Questions need to be addressed: 1. What type of error is involved? 2. What entries needed to correct the error? 3. How would the financial statements be restated when the error is discovered? Accounting Changes & Error Corrections 64 Correction of an Error Made in Prior Years (prior period adjustments, SFAS No. 16): Examples of accounting errors: 1. A change from an incorrect accounting principle (not GAAP) to a GAAP. 2. Mathematical mistakes. 3. Changes in estimates which were not prepared in good faith. 4. A misuse of facts (i.e., failure to consider salvage value in depreciation). Accounting Changes & Error Corrections 65 Correction of an Error Made in Prior Years (contd.) Examples of accounting errors (contd.): 5. An oversight (i.e., failure to accrue expense at year end). 6. An incorrect classification of a cost as an expense (i.e., improper capitalization). Accounting Changes & Error Corrections 66 General Treatments for Prior Years’ Errors The corrections of errors in previously issued financial statements are referred to as prior period adjustments. The corrections are made to Retained Earnings and are reported as adjustments to the beginning balance of current year’s retained earnings. Accounting Changes & Error Corrections 67 General Treatments for Prior Years’ Errors (contd.) If comparative F/S are presented, the prior affected statements should be restated to correct the errors. Accounting Changes & Error Corrections 68 Types of Errors 1. Balance Sheet Errors. 2. Income Statement (I/S) Errors. 3. Balance Sheet and Income Statement Effects. Accounting Changes & Error Corrections 69 1. Balance Sheet Errors Errors affect only the presentation of accounts on the B/S statement (i.e., classification of notes payable as accounts payable or inventory as plant assets). Procedures of correction: a. reclassification of the item to its proper position. b. If comparative statements that include the error year are presented, the B/S of the error year is restated correctly. Accounting Changes & Error Corrections 70 2. Income Statement (I/S) Errors Errors affect only accounts on the I/S (i.e, recording interest revenue as sales revenue, depre. exp. as interest exp., etc.) Impact: no impact on the net income or the B/S. Accounting Changes & Error Corrections 71 2. Income Statement (I/S) Errors (contd.) Accounting Treatment: a.If the error is discovered in the year it is made, just do a reclassification. b.If the error occurred in prior years, no entry is needed at the date of discovery because all accounts for the current year is correctly stated including the beg. balance of the retained earnings. . Accounting Changes & Error Corrections 72 2. Income Statement (I/S) Errors (contd.) Accounting Treatment (contd.): If comparative statements that include the error year are presented, the I/S for the error year is restated correctly. Accounting Changes & Error Corrections 73 3. Balance Sheet and Income Statement Effects The errors involve both B/S and I/S accounts (i.e., the accrued wages were overlooked at the end of the year). This type of errors can be further classified as: a. Counterbalancing errors. b. Noncounterbalancing errors. Accounting Changes & Error Corrections 74 a. Counterbalancing Errors Errors that will be offset or corrected over two periods. If books of the second year (the year following the error year) were closed, no adjustments are needed for the correction because the error has already been corrected in the second year. Most of B/S and I/S effect type of errors are counterbalancing errors. Accounting Changes & Error Corrections 75 b. Noncounterbalancing Errors These errors do not counterbalance over 2-year period (no self-correction in two years). Therefore, entries are needed even if the books have been closed for the year following the error. Accounting Changes & Error Corrections 76 Example 1 Counterbalancing Errors Failure to record accrued wages of $5,000 in 20x5. This error was discovered in 20x6. Impact of this error on wages expense, net income (N/I) and wages liabilities of 20x5 and 20x6 assuming this liability of $5,000 has been paid in 20x6: Wages Exp. N/I Wages Lib. 20x5 under over under 20x6 over under correctly stated 2-year correct correct correctly stated combined at end of 20x6 Accounting Changes & Error Corrections 77 Example 1 (contd.) Accounting Treatment: a. If the books of 20x6 have been closed, no entry is necessary. b. If the books of 20x6 have not been closed, the entry in 20x6 to correct the error is: 12/31/x6 Retained Earnings 5,000 Wages Expense 5,000 Accounting Changes & Error Corrections 78 Example 1 (contd.) Rational: When the accrued wages of 20x5 are paid in 20x6, an additional debit of $5,000 is made to 20x6 wage expense (i.e., instated of debit to wages payable, it was debited to wages expense). Thus, the wages exp. of 20x6 is overstated by $5,000. Also, because accrued wages expense of $5,000 was not recorded in 20x5, the net income of 20x5 was overstated by $5,000 and the retained earnings accounting of 20x5 were overstated by $5,000. Accounting Changes & Error Corrections 79 Counterbalancing Errors Example 2 Sanbor has failed to accrued wages payable at the end of the last three years as follows: 12/31/20x4 12/31/20x5 12/31/20x6 $1,600 $3,000 $2,400 Impact of these errors on net income of 20x4, 20x5, and 20x6: 20x4 20x5 20x6 Beg. ---(1,600) (3,000) Ending $1,600 3,000 2,400 Cum. Effect $1,600 1,400 600 Accounting Changes & Error Corrections 80 Example 2 (contd.) Entries to correct the errors of the last three years assuming the books of 20x6 are still open: 12/31/x6 a. No entry is necessary for the error of 20x4 because it has been counterbalanced by the end of 20x5 when the books of 20x5 were closed. b. To correct the error of 20x5 when the books of 20x6 have not been closed: Retained Earnings 3,000 Wages Expense 3,000 Accounting Changes & Error Corrections 81 Example 2 (contd.) Entries to correct the error of the last three years assuming the books of 20x6 are still open: (contd.) 12/31/20x6 c. To correct the error of 20x6 (the current year’s error): Wages Exp. 2,400 Wages Payable 2,400 a, b and c combined: Retained Earnings 3,000 Wages Exp. 600 Wages Payable 2,400 Accounting Changes & Error Corrections 82 Example 3 Counterbalancing Errors Failure to Record Prepaid Expense In 20x5, Hurley Enterprise purchased a 2year insurance policy costing $1,000. Insurance expense was debited and cash was credited. No adjusting entry was made at the end of 20x5. Assuming the books of 20x6 have not been closed, the entry on 12/31/20x6 to correct the error on 12/31/20x6 as follows is : Accounting Changes & Error Corrections 83 Example 3 (contd.) Insurance Exp. Retained Earnings 500 500 OR (1) + (2) (1)Prepaid Insurance Retained Earnings 500 (2)Insurance Exp. Prepaid Insurance 500 500 500 If the books of 20x6 have been closed, no entry is necessary to correct the error. Accounting Changes & Error Corrections 84 Example 4 Counterbalancing Errors Understatement of Unearned Revenue: On 12/31/20x5, Hurley received $50,000 as a prepayment for renting office space for the next year. A rent revenue account was credited on 12/31/20x5. No adjusting entry was made in 20x5. If the books of 20x6 are still open, the entry to correct the error is: Accounting Changes & Error Corrections 85 Example 4 (contd.) Retained Earnings Rent Revenue 50,000 50,000 OR (1) + (2) (1)Retained Earnings Unearned Rent 50,000 (2) 50,000 Unearned Rent Rent Revenue 50,000 50,000 If the books of 20x6 have been closed, no entry is necessary to correct the error. Accounting Changes & Error Corrections 86 Example 5 Counterbalancing Errors Overstatement of Accrued Revenue On 12/31/20x5, Hurley accrued interest revenue $8,000 that applied to 20x6. The entry made in 12/31/20x5 was: Interest Receivable 8,000 Interest Revenue 8,000 If the books of 20x6 have not been closed, the entry to correct the error is : Retained Earnings 8,000 Interest Revenue 8,000 If the books of 20x6 have been closed, no entry is necessary. Accounting Changes & Error Corrections 87 Example 6 Counterbalancing Errors Understatement of Ending Inventory On 12/31/20x5, the physical count of the inventory was understated by $25,000. Assuming the books of 20x6 are still open, the entry on 12/31/20x6 to correct the error is : Inventory (beg.) 25,000 Retained Earnings 25,000 OR Cost of Goods Sold 25,000* Retained Earnings 25,000 * if the beg. inv. has already been closed to cost of goods sold. Accounting Changes & Error Corrections 88 Example 6 (contd.) The impact of the understatement of ending inventory of 20x5 on the income of 20x5 and 20x6: Beg. inv. End. Inv. Net Effect 20x5 -------(25,000) (25,000) 20x6 25,000 ------25,000 2-year comb. ------------0 • Thus, if the books of 20x6 have been closed, no entry is necessary. When the books of 20x6 are still open, the beg. inv. of 20x6 is understated for $25,000 and the beg. balance of 20x6 retained earnings is understated for $25,000 (due to the net income of 20x5 was understated for $25,000). Accounting Changes & Error Corrections 89 Example 7 Counterbalancing Errors Overstatement of ending inventory On 12/31/20x5, the ending inv. was overstated by $10,000. Assuming the books of 20x6 have not been closed, the following entry is to correct the error of 20x5: 12/31/20x6 Retained Earnings 10,000 Inventory (beg.) 10,000 OR Retained Earnings 10,000 * Cost of Goods Sold 10,000 * if the beg. inv. has been closed to cost of goods sold. Accounting Changes & Error Corrections 90 Example 7 (contd.) The impact of overstatement of end. inv. of 20x5 on the net income of 20x5 and 20x6: 20x5 20x6 2-year Comb. Beg. Inv. ---(10,000) ------End. Inv. 10,000 -----------Net Effect 10,000 (10,000) 0 • Thus, if the books of 20x6 have been closed, no entry is needed to correct the error. • When the books of 20x6 are still open, the beg. inv. of 20x6 is overstated for $10,000 and the beg. balance of the 20x6 retained earnings is also overstated for $10,000 (because the net income of 20x5 was overstated). Accounting Changes & Error Corrections 91 Example 8 Counterbalancing Errors Over or Understatement of End. Inv. Assuming inv. at the end of 20x4 was overstated $11,000. At the end of 20x5, it was overstated for $20,000 and at the end of 20x6, it was understated for $19,000. 20x4 Beg. Inv. End. Inv. Net Effect 20x5 20x6 (11,000) (20,000) 11,000 20,000 (19,000) 11,000 9,000 (39,000) Accounting Changes & Error Corrections 92 Example 8 (contd.) If the books for 20x6 have not been closed, the entries to correct the error are as follows: 12/31/20x6 for the inv. error of 20x4: no entry for the inv. error of 20x5: Retained Earnings 20,000 * Cost of Goods Sold 20,000 for the inv. error of 20x6: Inventory 19,000 * Cost of Goods Sold 19,000 *Assuming inventory has been closed to the cost of goods sold account. Accounting Changes & Error Corrections 93 Example 8 (contd.) Thus, the combined entry is (when the books of 20x6 are still open): 12/31/20x6 Inventory 19,000 Retained Earnings 20,000 Cost of Goods Sold* 39,000 *or Income Summary if cost of goods sold has been closed to the income summary account. If the books of 20x6 are closed, the entry to correct the errors is : 12/31/20x6 Inventory 19,000 Cost of Goods Sold 19,000 Accounting Changes & Error Corrections 94 Example 9 Counterbalancing Errors Overstatement of Purchase Hurley’s accountant recorded a purchase of $9,000 in 20x5 which applied to 20x6. The inventory account of 20x5 was correctly stated. The entry on 12/31/20x6 to correct this error (assuming the books of 20x6 are still open): 12/31/20x6 Purchases 9,000 Retained Earnings 9,000 If the books of 20x6 are closed, no entry is needed to correct the error. Accounting Changes & Error Corrections 95 Example 10 Counterbalancing Errors Overstatement of Purchases and Inventories Assuming the purchases of 20x5 are overstated by $9,000 and the ending inv. is overstated by $7,000. Accounting Changes & Error Corrections 96 Example 10 (contd.) If the books of 20x6 are not closed, the entries to correct the error: 12/31/20x6 Purchases 9,000 Retained Earnings 9,000 Retained Earnings 7,000 Inventory (Beg.) 7,000 (or Cost of Goods sold) Combined Entry: Purchases 9,000 Retained Earnings 2,000 Inventory 7,000 If the books of 20x6 are closed, no entry is needed. Accounting Changes & Error Corrections 97 Noncounterbalancing Errors These errors do not counterbalance over 2-year period. The correcting entries are needed even if the books of the year in which the error is discovered have been closed. Accounting Changes & Error Corrections 98 Example Assume that on 1/1/20x5, Hurley purchased a machine for $10,000 that had an estimated life of 5 years. The accountant incorrectly expensed this machine in 20x5. The error was discovered in 20x6. Assume the company uses straight line depreciation on the asset, the entry to correct this error given that the books of 20x6 have not 99 been closed: Accounting Changes & Error Corrections Example (contd.) 12/31/20x6 Machine 10,000 Retained Earnings 10,000 Retained Earnings 2,000 Accu. Depre. 2,000 Depre. Exp. 2,000 Accu. Depre. 2,000 Combined: Machine 10,000 Depre. Exp. 2,000 Retained earnings 8,000 Accu. Depre. 4,000 If the books of 20x6 have been closed, the entry is: Machine 10,000 Retained Earnings 6,000 Accu. Depre. Accounting Changes & Error Corrections 4,000 100