ch08_ans

advertisement

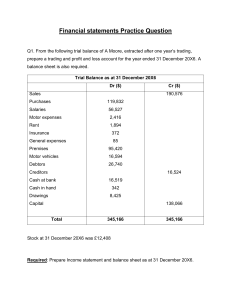

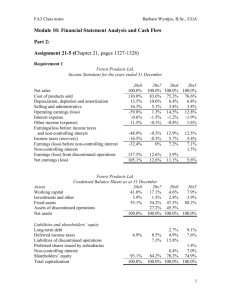

Chapter 8: Question Web 1 – Pinot Ltd (a) Profit and loss account for the year ended 31 December 20X6 Sales Cost of sales Working 1 Gross profit Administration expenses Working 2 Distribution expenses Operating profit Income from fixed asset investments Interest payable and similar charges (18,000 Deb + 3000) Exceptional costs Profit before tax on ordinary activities Tax on ordinary activities Profit after tax on ordinary activities Dividends Retained profit for year [2] [5] [6] [7] [8] [9] Working 1: Cost of sales Per question Less realisable on obsolescent stock Add depreciation Less capital item incorrectly posted £ 1,100,000 (5,600) 14,000 (10,000) 1,098,400 Working 2: Administration expenses Per question Less restructuring expense Less provision written back Audit fee Goodwill amortisation Depreciation 206,300 (150,000) (1,500) 7,000 2,500 6,750 71,050 1 £ 1,628,000 1,098,400 529,600 (71,050) (32,800) 425,750 6,000 (21,000) (150,000) 260,750 115,750 145,000 (54,000) 91,000 Balance sheet as at 31 December 20X6 Fixed assets Intangible Tangible Investments [1] [2] [3] Current assets Stock [156,360 + stock obsolescence realisable 5,600] Debtors [179,830 + 1,500 provision written back] Creditors – amounts falling due within 1 year [4] Net current assets Total assets less current liabilities Creditors – amounts falling due after 1 year [5] Share capital Revaluation reserve Profit and loss account [b/f 98,000 + 91,000] (b) Notes to the profit and loss account [1] Accounting policies General Depreciation Exceptional items [2] Operating profit is stated after charging audit fee £7,000 [3] Staff costs Purchasing Distribution Administration 6 3 1 10 40,000 341,250 130,000 511,250 161,950 181,330 343,280 (210,530) 132,750 644,000 (180,000) 464,000 250,000 25,000 189,000 464,000 £ 45,000 22,500 7,500 75,000 [4] Directors’ emoluments Chairman nil Highest paid director £19,800 Other directors earn salaries in the range £15,000 – £20,000 [5] Income from fixed assets investments £6,000 [6] Interest payable and similar charges Bank interest Debenture interest paid and payable £ 3,000 18,000 21,000 2 [7] [8] [9] Exceptional costs Restructuring Less tax relief 150,000 (45,000) 105,000 Taxation on ordinary activities Tax on profits (165,000 – 45,000 from Note 7) Overprovision 120,000 (4,250) 115,750 Dividends Interim at 3.6p Proposed at 7.2p £ 18,000 36,000 54,000 Notes to balance sheet Fixed assets: [1] Intangible assets – Goodwill Cost at 1 January 20X6 Amortisation At 1 January 20X6 Charge for year included in Administration expenses At 31 December 20X6 Net book value at 31 December 20X6 Net book value at 1 January 20X6 [2] 7,500 2,500 10,000 40,000 42,500 Tangible fixed assets Cost At 1.1.20X6 Additions Disposals Revaluation At 31.12.20X6 Depreciation At 1.1.20X6 Charge Disposals At 31.12.20X6 NBV 31.12.20X6 NBV 1.1. 20X6 [3] 50,000 Land/ Blgs Plant/ Machinery Fixtures 225,000 20,000 90,000 78,000 Total 25,000 250,000 110,000 54,000 323,000 90,000 (24,000) 25,000 414,000 9,000 3,000 16,000 11,000 12,000 238,000 220,000 27,000 83,000 4,000 37,500 6,750 (10,500) 33,750 20,250 40,500 62,500 20,750 (10,500) 72,750 341,250 260,500 (24,000) Investments Listed on recognised stock exchange £130,000 3 Notes relating to creditors, post balance sheet events and capital [4] Creditors – due within one year Bank overdraft 12,700 Trade creditors 32,830 Taxation 120,000 Dividends 36,000 Accrual – interest 9,000 210,530 [5] Creditors – due after more than one year 10% debentures redeemable 2003 £180,000 Provisions for liabilities – Lawsuit details Post balance sheet events – Details re investment in Diat d’or Share capital Details of authorised capital Reserves Revaluation At 1 January 20X6 Movement during year At 31 December 20X6 25,000 25,000 Profit & loss 98,000 91,000 189,000 Comments Provision is an amount retained from profit it provides for a loss or liability likely to be incurred but amount is uncertain shown in balance sheet after creditors or deducted from asset e.g. bad debt provision. Reserve a realised or unrealised gain which has not either legally or at the company’s discretion been distributed as dividends i.e. it is retained in the business e.g. retained profits, share premium, revaluation reserve it is shown in the balance sheet after share capital. Liability is an obligation in the future requiring the transfer of assets e.g. cash payment or provision of services to other entities it entails a probable future sacrifice it may also include the amount owed to the owners of the business it is reported under creditors within or after one year. Contingent liability is a condition that exists at the balance sheet date where the outcome will be determined by a future uncertain event 4 it appears as a note to the balance sheet. 5 Chapter 8: Question Web 2 – SEAS Ltd 1. The closure of the Garratt factory is a discontinuance of a business segment, as it was clearly a material and separately identifiable component of the company’s business operations. Under FRS 3, disclosure would be under discontinued heading. 2. The fraud is an adjusting event under SSAP 17, and as it has been discovered the financial statements will not show a true and fair view unless they are adjusted for it. The £30,000 should therefore be written off in the profit and loss account. 3. This is an exceptional item because it is material but arises from the ordinary activities of the business. It should be charged in arriving at the profit on ordinary activities, and should be separately disclosed. 4. The agreement to purchase this business relates to the period after the year-end and is therefore a non-adjusting event under SSAP 17, as knowledge of it does not affect the company’s position at 31 March 20X8. However, disclose the information by way of note. 5. This is also an exceptional item and should be treated as in 3 above. It is not a prior year adjustment because it arises from a change in trading conditions and not from a change in accounting policy or a fundamental error. 6. Under SSAP 17 this is an adjusting event as it provides evidence of conditions existing at the balance sheet date. The potential loss of £30,000 should be written off in the profit and loss account and deducted from the debtors in the balance sheet. 7. The rights issue relates entirely to the period after the year end, therefore it is a non-adjusting event under SSAP 17. This should be disclosed by way of note. One of the three marks should be given for noting share premium. 6