Analyst Contacts

Vibha Batra

vibha@icraindia.com

+91-124-4545 302

A M Karthik

a.karthik@icraindia.com

+91-44-4596 4308

Revathi Prasad

revathi.prasad@icraindia.com

+91-44-4596 4311

Relationship Contact

Jayanta Chatterjee

jayantac@icraindia.com

+91-80-4332 6401

Grading

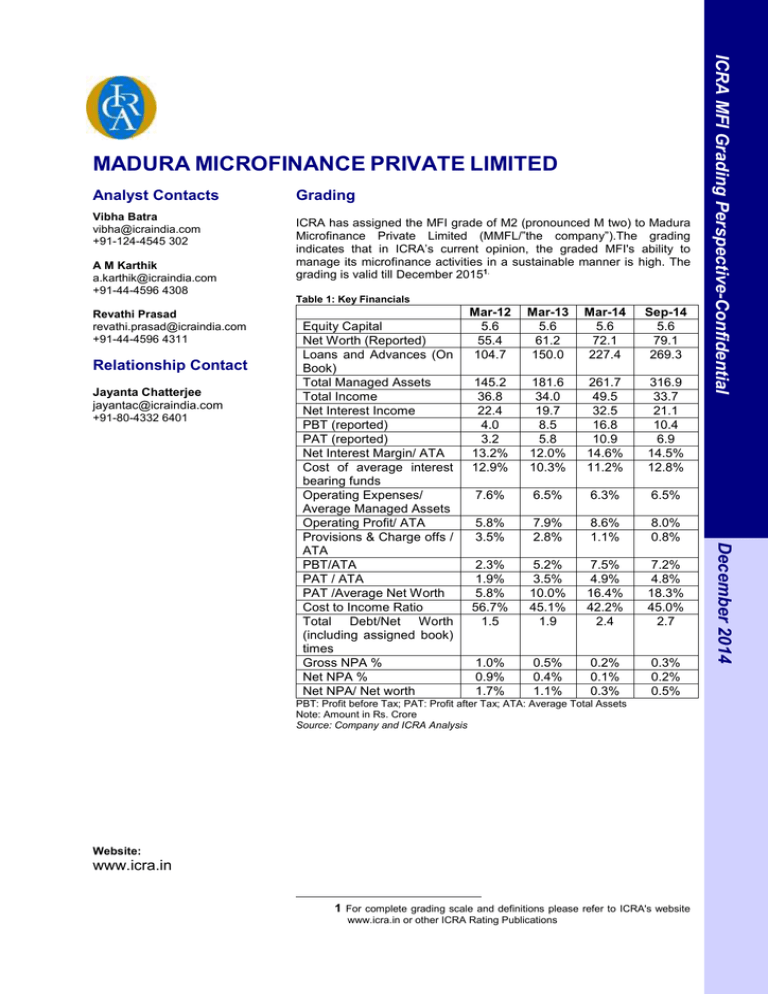

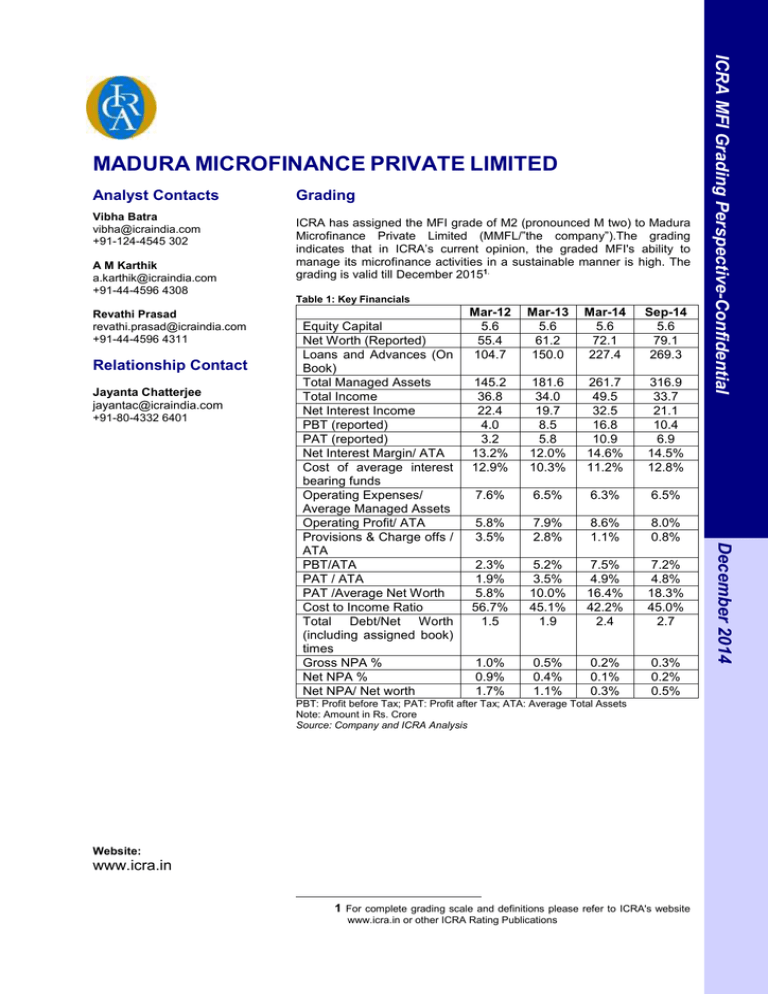

ICRA has assigned the MFI grade of M2 (pronounced M two) to Madura

Microfinance Private Limited (MMFL/”the company”).The grading

indicates that in ICRA’s current opinion, the graded MFI's ability to

manage its microfinance activities in a sustainable manner is high. The

grading is valid till December 20151.

Table 1: Key Financials

Mar-13

5.6

61.2

150.0

Mar-14

5.6

72.1

227.4

Sep-14

5.6

79.1

269.3

145.2

36.8

22.4

4.0

3.2

13.2%

12.9%

181.6

34.0

19.7

8.5

5.8

12.0%

10.3%

261.7

49.5

32.5

16.8

10.9

14.6%

11.2%

316.9

33.7

21.1

10.4

6.9

14.5%

12.8%

7.6%

6.5%

6.3%

6.5%

5.8%

3.5%

7.9%

2.8%

8.6%

1.1%

8.0%

0.8%

2.3%

1.9%

5.8%

56.7%

1.5

5.2%

3.5%

10.0%

45.1%

1.9

7.5%

4.9%

16.4%

42.2%

2.4

7.2%

4.8%

18.3%

45.0%

2.7

1.0%

0.9%

1.7%

0.5%

0.4%

1.1%

0.2%

0.1%

0.3%

0.3%

0.2%

0.5%

PBT: Profit before Tax; PAT: Profit after Tax; ATA: Average Total Assets

Note: Amount in Rs. Crore

Source: Company and ICRA Analysis

Website:

www.icra.in

1 For complete grading scale and definitions please refer to ICRA's website

www.icra.in or other ICRA Rating Publications

December 2014

Equity Capital

Net Worth (Reported)

Loans and Advances (On

Book)

Total Managed Assets

Total Income

Net Interest Income

PBT (reported)

PAT (reported)

Net Interest Margin/ ATA

Cost of average interest

bearing funds

Operating Expenses/

Average Managed Assets

Operating Profit/ ATA

Provisions & Charge offs /

ATA

PBT/ATA

PAT / ATA

PAT /Average Net Worth

Cost to Income Ratio

Total Debt/Net Worth

(including assigned book)

times

Gross NPA %

Net NPA %

Net NPA/ Net worth

Mar-12

5.6

55.4

104.7

ICRA MFI Grading Perspective-Confidential

MADURA MICROFINANCE PRIVATE LIMITED

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Grading Rationale

The grading factors in MMFL’s ability to scale up operations (loan book grew by 52% in FY2014 and18% in

H1FY2015, over March 2014 and stood at Rs 269 crore as on September 30, 2014) while maintaining good

profitability indicators ((PBT/ATA of 7.5% in H1FY2015 (provisional) and 7.2% in FY2014)) supported by improved

Net Interest Margin (NIM) and reduction in credit costs. The grading also factors in MMFL’s strong investor profile,

experienced Board of Directors (BoD) and management team, adequate loan monitoring and collection

mechanisms supported by strong Management Information Systems (MIS) and its ability to raise funds from about

18 lenders at competitive rates to fund its growth while maintaining a comfortable liquidity profile. The grading is

however constrained by MMFL’s geographically concentrated nature of operations with around 97% of the

portfolio being concentrated in the state of Tamil Nadu and relatively high expansion plans of the company (CAGR

of 30-35%) over the next three years.

Company Profile

Madura Microfinance Limited (MMFL) is a non-banking finance company (NBFC) established in 2005 and started

operations in early 2006. MMFL obtained a NBFC-MFI license in November 2013.The CMD of the company, Dr.

Tara Thiagarajan has a 48% equity stake in MMFL, while one MFI-focused private equity investor – Elevar Equity

– holds 22% stake. MMFL is engaged in providing credit to economically backward women through the Self Help

Group (SHG) mechanism. MMFL had a loan portfolio of Rs. 269 crore in September 2014 (Rs.175 crore in

September 2013), of which 97% of portfolio comprises of SHG loans and 3% accounted for asset backed retail

loans. As in Sep-14, MMFL operates in 33 districts of Tamil Nadu, 2 districts of Karnataka and one district of

Maharashtra across 217 branches and has over 2.47 lakh members.

For the year ended March 31, 2014, MMFL reported a net profit of Rs. 10.9 crore on a total asset base of Rs.

262.7 crore compared to Rs. 5.8 crore net profits on an asset base of Rs. 182.1 crore in fiscal 2013. MMFL

reported provisional profit before tax of Rs. 10.50 crore on a total asset base of Rs. 317.9 crore for H1FY2015.

Table 2: Share Holding Pattern as on September 30, 2014

Ms. Tara Thiagarajan

Mr. M. Narayanan

Mr. Marti Subramaniam

Mr. Ashok Mirza

Mr. M.V. Subbiah

Mr. M.R. Ramaraj

Employees’ Welfare Trust

Employees

Elevar Unitus Trust

Total

ICRA Rating Services

% of Paid up Capital

48.05%

5.76%

5.40%

3.60%

1.80%

1.80%

9.07%

2.79%

21.73%

100.0%

Page 2

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Strengths

Experienced board and management team.

Good loan monitoring and control systems; IT system is based on mobile technology and data is updated on

real-time basis.

Capitalization levels presently comfortable; however, company would need external equity support for medium

term growth

Improvement in asset quality with significant reduction in delinquencies over past year; portfolio vulnerability

however, remains high owing to weak credit profile of the customer segment

Challenges

Geographically concentrated nature of operations as the entire portfolio is restricted to Tamil Nadu with 66%

of portfolio is concentrated in 5 districts

To overcome competition from other MFIs given the relatively high MFI penetration in Tamil Nadu

To diversify funding mix at competitive rates so as to be able to achieve the growth plans

Ability to recruit and train personnel to meet the expansion plans and attrition rates especially at field level

ICRA Rating Services

Page 3

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Business Risk Profile

Table 3: Highlights of MMFL’s Operations

No. of States

No. of Districts

No. of Branches

No. of Active Members (Lakhs)

Credit Portfolio (Rs. Crore)

Number of Field Officer

Active Borrowers per field officer

Active Borrowers per branch

Portfolio per branch(Rs crore)

Mar-12

1

29

212

2.13

142.20

656

324

1004

0.67

Sep-12

1

29

202

1.75

127.99

619

283

867

0.63

Mar-13

1

29

194

1.73

151.63

499

347

892

0.78

Sep-13

1

29

194

1.94

175.28

478

407

1002

0.90

Mar-14

3

33

201

2.09

230.11

453

461

1040

1.14

Sep-14

3

36

217

2.45

269.25

528

464

1129

1.24

Madura Microfinance Private Limited (MMFL) is involved in microfinance business, with presence in about 33

districts in Tamil Nadu, 2 districts in Karnataka and one district in Maharashtra. MMFL extends credit under the

Self Help Group (SHG) model, wherein the group members undertake the responsibility of forming the group, joint

liability, and repayments. The groups are formed and trained by the MMFL directly. The group size typically varies

from 15 to 20.The borrowers, who are women, come from a weak economic background with very limited access

to organised credit and credit history. While this makes the lending risky (the loans being unsecured), the group

dynamics is expected to be effective in curtailing shortfall in collections from any borrower. The borrowers typically

are involved in small trade, cottage industries, animal husbandry activities, and agricultural based activities.

MMFL focuses only on rural and semi-urban areas and offers loans of various ticket sizes in the range from Rs.

14,000 to Rs. 42,000 for group loans In September 2014, the proportion of loans with ticket size more than Rs.

15,000 stood at about 60% as in September 2014. MMFL offers group loan products with interest rate of

25.6%.The tenure of loans varies from 16-36 months. The company also provides an individual loan product to the

borrowers who are in the higher loan cycle and established a good repayment track record. The tenure of these

loans is 2 years and same interest rate as group loans.

In order to take advantage of the 15% bucket provided by the RBI Guidelines, the company has introduced asset

backed micro enterprise loans to small retail traders and also. The sourcing for these loans is done through retail

distributors like Pepsico, ITC etc. These loans would be on hypothecation of stocks. These loans are in the ticket

size range of Rs.25K to Rs. 50K and can go up to Rs.1 lakh depending on the size of the borrower with an interest

rate of 25.8%.The tenure for these loans are 6 months with weekly collections. Apart from loans, the company

also offers Micro Business Education (MBE) service scheme wherein the company provides a mini MBA certificate

program. Post completion of the course the certified individual is eligible to take an additional loan of Rs.

10,000. MMFL charges Rs. 500 for the above mentioned program. The course was developed in collaboration

with Dr. Madhu Viswanathan of the Marketplace Literacy Project and University of Illinois at Urbana Champaign

based on learning’s from over 100 case studies of subsistence marketplace entrepreneurs.

MMFL registered a portfolio growth of about 51% to Rs. 227 crore during FY2014 owing to improved access to

funding. The company’s portfolio as on September 2014(Portfolio of Rs.269 crore) comprised mostly (more than

97% of the total portfolio) of group loans with a member base of 2.5 lakh (1.7 lakh in March 2013) and 3% of

portfolio comprises of retail loan products.As for borrower vintage, owing to the high business growth, first cycle

loans accounted for about 36% of the total portfolio as on September 2014. This ratio is expected to remain high

in the medium term, owing to the high growth plans of the company. MMFL intends to grow its portfolio by at least

50% in FY2015. While the company is currently adequately capitalized to achieve this growth target, however it

would need equity infusions to meet its growth plans in the short to medium term (CAGR at 30-35% for next three

years). The ability of the company to raise funds would be a key consideration to be able to achieve the target

growth level. The company would also need to tap other debt market funding sources to diversify its resource

profile. It would also be important for the company to recruit and train personnel going forward, in line with the

planned expansion. In this context, the training procedures at MMFL are standardized and are provided by internal

staff. The company also has a well planned calendar for training existing employees on a quarterly basis.

In terms of geographical presence, almost 97% of the loan portfolio of MMFL remains concentrated in the state of

Tamil Nadu (TN) and Karnataka (2%) and Maharashtra (1%) as on September 14, ICRA takes note of the

initiatives taken by the company to geographically diversify their operations; the same however are still at early

stages. The company commenced operations in the state of Karnataka and Maharashtra in the current financial

year and proposes to expand into Madhya Pradesh, in the measured manner, by the end of the current financial

year.Going forward company continues to expand its presence in TN and along with the prudent expansion in the

other states.

ICRA Rating Services

Page 4

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Operating Environment

MFIs reported over 40% annualized growth during the two years ended March 2014 after the period of stress

post-AP crisis when funding sources had dried up. The growth was supported by better availability of funds, strong

branch expansion, and increase in ticket size. Significantly, even after the impressive growth during the last two

years, the untapped potential remains large. This, along with the expansion plans of MFIs and the expected fund

availability, is likely to enable a 30-35% annualized rate of growth over the next three years. Further, the RBI, in

June 2014, has allowed non deposit accepting NBFC-ND to be business correspondents (BC), which is likely to

provide a fillip to financial inclusion and to the business prospects of MFIs. However, while the growth prospects

for MFIs are favourable, recruitment, employee-training and employee-retention are likely to remain critical

performance-determining factors, given that the employee attrition rate in the industry remains high at an annual

30-40% even as most MFIs are into a significant expansion drive.

MMFL’s operations are largely concentrated in the state of Tamil Nadu (TN). MFI penetration in TN is quite high

with presence of about 20 MFIs. The above is expected to result in high competitive pressures for the players with

TN concentrated portfolio profile, including MMFL.

As for the regulatory environment, RBI has put in interest rate caps as well as interest margin caps in place, which

have forced MFIs to take several initiatives to cut operating costs including optimization of branch costs and

manpower, increase in loan sizes and automation of processes, among others. Managing costs has become even

more important as the net interest margins for MFIs has been capped from April 2014 at 10% for MFIs with a loan

portfolio of more than Rs. 100 crore and at 12% for MFIs with a loan portfolio of less than Rs. 100 crore.

Further mandatory use of credit bureaus and debt ceilings have restricted overleveraging for borrowers and are a

positive for the sector in the long term. Since these regulatory changes were introduced, almost all the NBFCMFIs have started contributing data to the credit bureaus. This has helped in checking the number of loans,

quantum of loans and credit track record of a borrower. These checks have helped in reducing incidence of

overleveraging as well as filtering of delinquent borrowers-these measures are likely to have a good long term

impact on credit quality of the MFIs. However some banks which have ventured into microfinance and most of the

SHGs still donot contribute the data to credit bureaus.

Though the overall operating environment is improving, some MFIs are venturing into relatively riskier individual

loans and other secured and unsecured loan products, while remaining focused on politically and communally

sensitive borrower groups. The external factors such as occurrence of political or communal issues may also have

a long-term impact if they affect the credit culture of the borrowers at large. Though the potential remains huge,

maintaining control over asset quality by building strong systems without compromise on internal audit and

controls and building adequate cushions to absorb event risks would be important for NBFC-MFI’s credit profile.

ICRA Rating Services

Page 5

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Governance Structure, Management and Systems

Ownership and Board Structure

Table 4: Shareholding pattern as in September 2014

Shareholder Name

% Share

Ms. Tara Thiagarajan

Mr. M. Narayanan

Mr. Marti Subramaniam

Mr. Ashok Mirza

Mr. M.V. Subbiah

Mr. M.R. Ramaraj

Employees’ Welfare Trust

Employees

Elevar Unitus Trust

Total

48.05%

5.76%

5.40%

3.60%

1.80%

1.80%

9.07%

2.79%

21.73%

100.00%

The CMD of the company, Dr. Tara Thiagarajan has a 48% equity stake in MMFL, while one MFI-focused private

equity investor – Elevar Equity – holds 22% stake. The company is currently comfortable on capitalization and

considering its growth outlook the management is willing to dilute the stake as and when required.

Table 5: Board of Director as in September 2014

Shareholder Name

Dr. Tara Thiagarajan

R. Ramaraj

Ashok Mirza

N C Sarabeswaran

Rahul Verma

Sandeep Farias

Vipul Rawal

% Share

Chairman and Managing Director

Independent Director

Independent Director

Independent Director

Independent Director

Nominee Director (Elevar Equity)

Nominee Director (Elevar Equity)

The Board consists of 7 directors; of which one whole time director, two independent directors, one investor

director and 3 promoter directors which are people with vast industry experience. The company’s managing

director and chairperson, Ms. Tara Thiagarajan, has adequate experience in microfinance and rural sectors. The

board is supported by a three-member advisory committee, which comprises Mr. Karti Sandilya, Mr. M.V.

Subbiah, and Dr. Marti G Subramanyam Elevar Equity has two nominee directors on the board of directors. All the

board members have a rich experience from diverse fields including retail banking and accounting, IT &

microfinance. The composition if the Board has remained stable and there have not been any resignations at least

in the past 2-3 years. The board meets on a quarterly basis and if required it may meet more often. The Board is

involved to a large extent in strategy, policies and areas of improvement. An annual strategy meet is held to

discuss in detail the strategy for the forthcoming year. The operational performance is discussed with the Board in

every meeting.

Management

The Chairman and Managing Director of the company, Dr. Tara Thiagarajan is primarily involved in strategic

decision making; the senior management has vast experience in the lending business – mainly retail products in

state of Tamil Nadu – target market of MMFL. While the Board takes strategic decisions, the operational

management is handled by the Branch Managers and office staffs of MMFL. The Board members have a good

experience in various fields of business including banking, financial services, human resources etc. The Board

has been associated with the company for a considerable time period and has developed expertise in the

microfinance sector over this period.

Systems and Processes

MMFL’s overall systems and processes compare well with its peers. All collections and attendance pertaining to

the centers are updated on a real-time basis through a mobile application. There is an online portal developed,

“Shakthi Sangamam”, which provides a database of the transaction summary of all the borrowers within each

SHG across clusters. The company has an established system to perform pre-disbursal checks with Credit

Bureau in a centralized fashion.

Disbursements are made at the branch only by a Cluster Manager and house verification is done for all borrowers

prior to disbursal by the field officer and mentors. The cluster manager also verifies the residence of the borrowers

on a sample basis. A Credit Bureau (Hi-mark) check is carried out of all the borrowers prior to disbursement and

ICRA Rating Services

Page 6

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

only compliant borrowers are considered for credit. A post-disbursement end-use verification is carried out by the

mentor and cluster Manager. The loan utilization document is kept along with loan papers.

Cluster offices are computerized and all data entry and records are maintained at the cluster office. All cluster

offices are connected to the Head Office. The mentor centers are provided with cashiers with mobile phone with

GPRS connection and a printer, where the groups remit their collections. The Cashiers enter the details in the

mobile and prepare a receipt and handed over to the group members while collecting the money. The data is

transferred to the corporate office Server through GPRS immediately after the transaction is over. Cluster

Manager would report to Regional Manager at Head Office the day’s transactions (EOD status) in a daily report.

The company however faced some delinquencies in the past owing to misappropriation of funds by Member

Development Associate (MDA) who are responsible for group formation for the loan originated in FY2011. Since

FY2011 company has gradually removed the MDA layer in the employee hierarchy due to deterioration in the

credit culture in SHG group formed by MDA. Presently, Member Welfare Associates (field officers) are responsible

for even group formation and training. Having the MDA layer have been removed currently, the company has

been able to minimize the delinquencies to the extent. The management indicated that above change has

minimized the delinquencies and helps in filtering the bad credit.

Internal Audit Systems

The internal audit processes of the company are strong wherein a comprehensive audit is conducted for every

branch on a quarterly basis covering the key business aspects. The company’s operational audits are being done

by an external audit team comprising of 7 members with experience in banking and financial services industry.

Apart from the above, the company has a 12 personnel borrower-quality audit team to verify the quality of the

members/borrowers enrolled before the disbursal of the entry level loan and, to verify the process implementation

at the group level, of the groups which are in the repeat cycle. ICRA takes note of the initiatives takes by the

company to augment its internal audit processes by adding the borrower-quality audit team, however believes that

the scope of overall operational audit could be enhanced further. The company has also formalized training

procedures and manuals at all levels. MMFL has also put in a formal grievance redressal mechanism in place.

Accounting Policies

MMFL’s accounting policies are generally in-line with the accepted accounting norms for microfinance companies.

The company has a conservative provisioning policy and, the aggregate provisions held by the company are

higher than those mandated by RBI for NBFC-MFIs.

Scalability

Largely dependent on bank funding; however company is expected to diversify the same over in the near

to medium term

Table 6: MMFL’s Capitalisation Indicators

Rs. Crore

Mar-12

Net worth

55.4

Borrowings

Term Loan from banks

Term Loan from FI

Total Borrowings

Gearing

73.8

8.5

82.3

1.5

%

Mar-13

%

61.2

90%

10%

100%

105.5

11.8

117.3

1.9

Mar-14

%

Sep-14

provisional

79.1

%

81%

19%

100%

150.9

64.7

215.6

2.7

70%

30%

100%

72.1

90%

10%

100%

141.9

33.4

175.3

2.4

MMFL demonstrated a healthy growth in the business, with disbursements of about Rs.223 crore in FY2014 and

Rs.138 crore in H1FY2015 as compared to Rs.141 crore in FY2013. During FY2014, the company was able to

secure fresh funds of about Rs.107 crore from the banks which supported healthy business growth in the previous

year at an incremental cost of 14-14.5%.MMFL has access to large number of lenders, although primarily

banks/NBFCs for meeting its funding requirements. As on September 2014, its borrowings comprised loans from

fourteen banks (70% of total borrowings), one financial institution (7%), and loans from three NBFC (23%).The

company is taking initiatives to diversify its funding profile, by securing funds via NCD and the ECB route. Going

forward, MMFL’s ability to consistently raise funds from diverse sources and at competitive rates as the business

expands would be important from a grading perspective.

Based on the current sanctions in hand, the company would be able to meet incremental planned disbursements

for about 3 months, however regular flow of funds would be crucial to maintain as well as grow business

operations over longer term

ICRA Rating Services

Page 7

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Capitalization profile moderated due to sharp business growth;

Table 7: MMFL’s Capitalisation Indicators

Rs. Crore

Tier I Capital (%)

Tier II Capital (%)

Total Capital (%)

Gearing (on managed assets basis2) (times)

Mar-12

46.5%

0.0%

46.5%

1.5

Mar-13

34.1%

0.0%

34.1%

1.9

Mar-14

27.8%

0.0%

27.8%

2.4

Sep-14

26.2%

0.0%

26.2%

2.7

Capitalisation levels were comfortable (Net Worth of Rs 82.5 crore, gearing including off balance sheet book of 2.6

times as on September 30, 2014) supported by healthy internal generation of about 15-16% .However

capitalization profile was moderated during FY2014, as the company grew its portfolio at a very strong pace of

about 52% during the year, although the internal generation was good at about 16%. Consequently, the gearing of

the company increased to 2.6 times as in September 2014, as compared to about 1.9 times in March 2013

While the company is currently adequately capitalized (capital adequacy ratio (CAR) of 26.18% as in

September 2014) to meet its growth plans in the medium term. ICRA envisages the company to have

moderate internal accruals of 9%-12% and given its significant growth plan (30-35% CAGR for the next 3

years), they would require equity infusion of Rs. 40-50 crore in this period, to meet their growth targets in

line with their business plan, while maintaining adequate capitalization levels.

Human resources

With the scaling up of business, the company would also require trained employees to support its operations. At

the field officer level, the basic skills required are that they should have passed Class 10, with knowledge of the

local language. The training procedures are standardised. Every employee goes through 5 days of classroom

training, followed by a test and 15 days of field training, post which the loan officer can independently conduct

group meetings. The company has a well planned training calendar for the existing employees for training the

employees on soft skills as well as products. All the training provided is internal and the company has not tied up

with any external agency for any training.

Field officers are part time employees with no fixed pay component. On an average, a MWA (field officer) is

expected to handle around 800 borrowers and paid a salary of about Rs. 2,000-5,000 per month which is relatively

lesser than other MFI’s salary payout. Salary depends on the number of SHG borrowers, groups formed and

quality of SHG borrowers. The company continues to follow part time employee structure in TN since the most of

the field officers are women’s who are erstwhile members of the company. Field officers have been deployed in

the location where they belong to. The company has employed filed officers as full time employees in newer

geographies i.e. Karnataka and Maharashtra. While a part time employee structure enables the company to keep

its employee expenses at relatively lower levels vis-à-vis peers, ability to maintain control over the employees

would be important to maintain its asset quality indicators.

At the field level, the field officers report to the mentors who in turn report to the Cluster Managers. Each cluster

manager handles 3-4 cluster centers and reports to a regional manager who. The regional manager reports to the

reports to the Head of Operations. The attrition rate of the company is 8%-10% as a whole. For the trainee field

officers, the attrition rate is higher about 10%-12%, while at the level of confirmed field officers it is relatively lower

and that at the senior level is very low at about 2-5%. Going forward, ability of the company to manage the growth,

recruit and train personnel in line with the planned branch and geographical expansion plans, while maintaining

the asset quality indicators in the newer geographies would be important from a grading perspective.

Asset Quality

Though the company faced with high delinquencies in the past (originations in FY2011 and FY2012) on account

of misappropriation of funds by field officer, however initiatives taken by the company to reduce the

delinquencies through strengthening of control mechanisms which has led to stabilization of asset quality

between Mar-13 till Sep-14(90+ dpd stood at 0.19% as on Sep-14 as compared to 0.38% as on Mar-13).

Loan originations over the last two years have demonstrated good collection efficiency

Nevertheless, the company remains exposed to asset quality related risks, as its operations are concentrated in

the 33 districts of Tamil Nadu,2 districts of Karnataka and one district of Maharashtra and ability of the company to

diversify operations while maintaining asset quality indicators remains to be seen.

ICRA Rating Services

Page 8

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Financial Performance

Profitability

Table 8: Trend in MMFL’s Profitability indicators

Effective Yield on Average Advances2

Effective Yield on Average Earning Assets1 (A)

Cost of interest bearing funds (B)

Gross Interest Spread (A – B)

Net Interest Margin3

Operating Expense/ Average Managed Assets

Cost-Income Ratio

Credit Provisions/ Average Assets

Net Profit / Average Assets

Return on Average Net Worth

Mar-12

12M

25.2%

21.3%

12.9%

9.3%

13.2%

7.6%

56.7%

3.5%

1.9%

5.8%

Mar-13

12M

22.5%

18.4%

10.3%

9.1%

12.0%

6.5%

45.1%

2.8%

3.5%

10.0%

Mar-14

12M

25.4%

22.4%

11.2%

12.3%

14.6%

6.3%

42.2%

1.1%

4.9%

16.4%

Sep-14*

6M

27.1%

24.6%

12.8%

13.2%

14.5%

6.5%

45.0%

0.8%

4.8%

18.3%

*Provisional numbers

As for earning profile, the profitability indicators (PAT/ATA) of MMFL improved from 3.5% in FY2013 to 4.9% in

FY2014 and 4.8% (provisional) in H1FY2015 on account of a steady portfolio growth during the year, which

resulted in the improvement in the company’s NIM and, due to the moderation in the credit costs. MMFL’s NIMs

improved from about 14.6% for FY2014 and H1FY2015 as compared to 12% in FY2013. The company’s credit

costs moderated to about 1.1% in FY2014 (0.8%, provisional, in H1FY2015) as compared to 2.8% in FY2013, as

the write-offs moderated and the company was also able to make recovery from the earlier written-off accounts.

Going forward, ICRA expects the company’s overall credit cost to moderate and stabilize at about 0.6-0.7% levels

as incremental write-offs are expected to be lower, than observed in the past, supported by good average

collections of over 99%. MMFL’s operating expenses after moderating from about 6.5 % in FY2013 to about 6.3%

FY2014 increased to about 6.6% (provisional) in H1FY2015 as the company is expanding operations to newer

geographies. ICRA however expects the operating costs to not exceed 7% due to the low cost of its operations in

Tamil Nadu and its measured expansion strategy in the newer geographies. The company reported a RoE of

16.4% for FY2014. Going forward, also ICRA expects the company to maintain a RoE of about 15-16% supported

by moderation in the overall credit cost although the operating cost could witness some increase.

2 Ratios are computed on managed assets basis – i.e., including assigned / securitized portfolio

3 Net interest margin = Net Interest Income / Average managed assets

ICRA Rating Services

Page 9

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

COMPANY PROFILE—MADURA MICROFINANCE PRIVATE LIMITED

Name of the Company

Constitution

Year of Incorporation

Registered office

Number of branches (Sep-14)

Number of active borrowers (Sep-14)

Balance Sheet size (Sep-14)

Share Capital Issued (Sep-14)-Provisional

Net worth (Sep-14) -Provisional

Capital Adequacy Ratio (Sep-14)

Managing Director

Auditors

Madura Microfinance Private Limited

Private Limited Company

2005

36, 2nd Main Road, Kasturba Nagar, Adyar ,

Chennai- 600 020

217

Rs.2.5 Lakhs

Rs.317.9 crore

Rs. 5.6 crore

Rs.79.1 crore

26.2%

Ms.Tara Thiagarajan

S.N.S Associates

Shareholding Pattern (September 30,2014)

Ms. Tara Thiagarajan

Mr. M. Narayanan

Mr. Marti Subramaniam

Mr. Ashok Mirza

Mr. M.V. Subbiah

Mr. M.R. Ramaraj

Employees’ Welfare Trust

Employees

Elevar Unitus Trust

Total

48.05%

5.76%

5.40%

3.60%

1.80%

1.80%

9.07%

2.79%

21.73%

100.00%

Board of Directors (September 30,2014)

Dr. Tara Thiagarajan

Mr. R. Ramaraj

Mr. Ashok Mirza

Mr. Rahul Varma

Mr. N C Sarabeswaran

Mr. Sandeep Farias

ICRA Rating Services

Chairman and Managing Director, MMFL

Advisor Sequoia Capital

Chairman Apcom Group

Chief Learning Officer, Accenture

Senior Partner Jagannath and Sarabeswaran

Managing Director Elevar Equity

Page 10

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

KEY FINANCIALS

PROFIT & LOSS ACCOUNT

Interest Income (Net of Business Origination Costs and incl. processing

fees)

Interest Expenses (including Preference Dividend)

Net Interest Income

Non Interest Income

Operating Income

Operating expenses

Operating Profits

Provisions including NPA provisions

Income from Securitization / Assignment

Net profit on sale of securities and assets

Profit Before Tax (before extraordinary items)

Extraordinary Items

Profit Before Tax (PBT)

Tax

Profit After Tax (PAT)

PAT (Reported)

Equity dividend

Accretion to reserves

SUMMARY ASSETS

Net Hire Purchase/ Loan/ Lease Assets

Investments - Strategic

Investments - Short Term Surpluses

Cash & Bank Balances

Collaterals for Securitization

Advance Tax paid

Other Current Assets

Net Fixed Assets

Total Assets

Off-balance sheet receivables

Total Managed Assets

SUMMARY LIABILITIES

Equity Share Capital

Reserves

Net Worth

Total Borrowings (including Preference Shares)

Interest Accrued but not due

Provisions for Tax

Other Current Liabilities & Provisions

Deferred Tax Liability

Total Liabilities

ICRA Rating Services

Mar-13

Mar-14

Sep-14

30.0

10.3

19.7

3.9

23.7

10.7

13.0

4.5

0.0

0.0

8.5

0.0

8.5

2.6

5.8

5.8

0.0

5.8

48.8

16.4

32.5

0.7

33.1

14.0

19.1

2.4

0.0

0.0

16.8

0.0

16.8

5.8

10.9

10.9

0.0

10.9

33.7

12.6

21.1

0.0

21.1

9.5

11.6

1.2

0.0

0.0

10.4

0.0

10.4

3.5

6.9

6.9

0.0

6.9

150.0

0.2

4.0

20.6

0.0

0.0

2.8

4.0

181.6

0.0

181.6

227.4

1.7

10.3

18.2

0.0

0.0

2.2

1.9

261.7

0.0

261.7

269.3

9.9

21.0

2.9

0.0

4.2

4.7

5.1

316.9

0.0

316.9

5.6

55.6

61.2

117.3

0.0

0.0

3.7

5.6

66.6

72.1

175.3

0.0

0.0

15.3

5.6

73.5

79.1

215.6

0.0

6.4

16.9

(0.6)

181.6

(1.0)

261.7

(1.0)

316.9

Page 11

ICRA MFI GRADING PERSPECTIVE

COMMON SIZE STATEMENTS

PROFIT & LOSS ACCOUNT (% of Operating Income)

Net Interest Income

Non Interest Income

Operating Income

Operating expenses

Operating Profits

Provisions including NPA provisions

Income from Securitization / Assignment

Net profit on sale of securities and assets

Profit Before Tax (before extraordinary items)

Extraordinary Items

Profit Before Tax (PBT)

Tax

Profit After Tax (PAT)

PAT (Reported)

Equity dividend

Accretion to reserves

SUMMARY ASSETS (% of Total Assets)

Net Hire Purchase/ Loan/ Lease Assets

Investments - Strategic

Investments - Short Term Surpluses

Cash & Bank Balances

Collaterals for Securitization

Advance Tax paid

Other Current Assets

Net Fixed Assets

Total Assets

Off-balance sheet receivables

Total Managed Assets

SUMMARY LIABILITIES (% of Total Liabilities)

Equity Share Capital

Reserves

Net Worth

Total Borrowings (including Preference Shares)

Interest Accrued but not due

Provisions for Tax

Other Current Liabilities & Provisions

Deferred Tax Liability

Total Liabilities

ICRA Rating Services

MADURA MICROFINANCE PRIVATE LIMITED

Mar-13

Mar-14

Sep-14

83.3%

16.7%

100.0%

45.1%

54.9%

19.1%

0.0%

0.0%

35.7%

0.0%

35.7%

11.2%

24.6%

24.6%

0.0%

24.6%

98.0%

2.0%

100.0%

42.2%

57.8%

7.2%

0.0%

0.0%

50.6%

0.0%

50.6%

17.6%

33.0%

33.0%

0.0%

33.0%

100.0%

0.0%

100.0%

45.0%

55.0%

5.8%

0.0%

0.0%

49.2%

0.0%

49.2%

16.4%

32.8%

32.8%

0.0%

32.8%

82.6%

0.1%

2.2%

11.3%

0.0%

0.0%

1.5%

2.2%

100.0%

0.0%

100.0%

86.9%

0.6%

3.9%

7.0%

0.0%

0.0%

0.8%

0.7%

100.0%

0.0%

100.0%

85.0%

3.1%

6.6%

0.9%

0.0%

1.3%

1.5%

1.6%

100.0%

0.0%

100.0%

3.1%

30.6%

33.7%

64.6%

0.0%

0.0%

2.0%

-0.3%

100.0%

2.1%

25.4%

27.6%

67.0%

0.0%

0.0%

5.9%

-0.4%

100.0%

1.8%

23.2%

24.9%

68.0%

0.0%

2.0%

5.3%

-0.3%

100.0%

Page 12

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

Mar-13

Mar-14

Sep-14

22.5%

5.0%

19.4%

10.3%

9.1%

25.4%

4.7%

23.5%

11.2%

12.3%

27.1%

0.0%

26.0%

12.8%

13.2%

Net profit on sale of securities and assets / Average Assets

Profit Before Tax (before extraordinary items)/ Average Assets

Tax / Profit Before Tax

Profit After Tax / Average Assets

Profit After Tax / Average Managed Assets

Equity Dividend / Profit After Tax

Profit After Tax / Average Net worth

18.3%

6.3%

12.0%

2.4%

6.5%

7.9%

0.0%

2.8%

0.0%

0.0%

5.2%

31.3%

3.5%

3.5%

0.0%

10.0%

22.0%

7.4%

14.6%

0.3%

6.3%

8.6%

0.0%

1.1%

0.0%

0.0%

7.5%

34.7%

4.9%

4.9%

0.0%

16.4%

23.2%

8.6%

14.5%

0.0%

6.5%

8.0%

0.0%

0.8%

0.0%

0.0%

7.2%

33.3%

4.8%

4.8%

0.0%

18.3%

EFFICIENCY RATIOS

Fee Based Income/Operating Expenses

Operating Cost/Operating Income

50.5%

45.1%

20.8%

42.2%

19.2%

45.0%

CAPITALISATION RATIOS

Net Worth/ Total Assets

33.6%

27.4%

24.9%

Total Debt / Net worth

Net NPA/Net worth

Capital to Risk Weighted Assets Ratio

Tier I Capital to Risk Weighted Assets Ratio

Capital to Risk Weighted Managed Assets Ratio

Tier I Capital to Risk Weighted Managed Assets Ratio

1.92

1.1%

34.1%

34.1%

34.1%

34.1%

2.43

0.4%

27.8%

27.8%

27.8%

27.8%

2.73

0.5%

26.2%

26.2%

26.2%

26.2%

ASSET QUALITY

Gross NPA/Gross Advances

Net NPA/Net Advances

0.5%

0.4%

0.3%

0.1%

0.3%

0.2%

182.1%

202.3%

182.8%

KEY FINANCIAL RATIOS

OPERATING RATIOS

Yield on Average Loans (Net of BO Costs)

Yield on Average Investments

Yield on Average Earning Assets (Net of BO Costs)

Cost of Average Interest Bearing Funds

Gross Interest Spread

PROFITABILITY RATIOS

Interest Earned / Average Assets

Interest Expenses / Average Assets

Net Interest Margin/Average Assets

Fee based Income/Average Assets

Operating Expenses /Average Managed Assets

Operating Profit / Average Assets

Write offs & Repo losses (net of recoveries)/Average Managed Assets

Provisions /Average Managed Assets

Income from securitization & assignment/ Average Assets

COVERAGE RATIOS

PBIT/ Total Interest

ICRA Rating Services

Page 13

ICRA MFI GRADING PERSPECTIVE

MADURA MICROFINANCE PRIVATE LIMITED

ICRA Limited

CORPORATE OFFICE

Building No. 8, 2nd Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002

Tel: +91 124 4545300; Fax: +91 124 4545350

Email: info@icraindia.com, Website: www.icra.in

REGISTERED OFFICE

1105, Kailash Building, 11th Floor; 26 Kasturba Gandhi Marg; New Delhi 110001

Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434

0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283

1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559 4065

Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373

5061/7251, Fax + (91 40) 2373 5152 Pune: Tel + (91 20) 2552 0194/95/96, Fax + (91 20) 553 9231

© Copyright, 2015, ICRA Limited. All Rights Reserved.

Contents may be used freely with due acknowledgement to ICRA.

ICRA ratings should not be treated as recommendation to buy, sell or hold the rated debt instruments. ICRA ratings are

subject to a process of surveillance, which may lead to revision in ratings. An ICRA rating is a symbolic indicator of ICRA’s

current opinion on the relative capability of the issuer concerned to timely service debts and obligations, with reference to the

instrument rated. Please visit our website www.icra.in or contact any ICRA office for the latest information on ICRA ratings

outstanding. All information contained herein has been obtained by ICRA from sources believed by it to be accurate and

reliable, including the rated issuer. ICRA however has not conducted any audit of the rated issuer or of the information

provided by it. While reasonable care has been taken to ensure that the information herein is true, such information is

provided ‘as is’ without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or

implied, as to the accuracy, timeliness or completeness of any such information. Also, ICRA or any of its group companies

may have provided services other than rating to the issuer rated. All information contained herein must be construed solely as

statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of this publication or its

contents.

ICRA Rating Services

Page 14

![Rating of [ICRA]AA(stable)](http://s3.studylib.net/store/data/008897864_1-997f5bded17492c22f64602061b0ebeb-300x300.png)