Isle of Man

advertisement

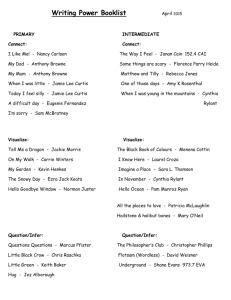

DOING BUSINESS IN THE ISLE OF MAN Stuart Foster – sfoster@burleigh.co.im Basil Bielich – bbielich@burleigh.co.im Browne Craine & Co The Isle of Man • Independent from UK but with strong links • 1000 year old Parliament makes its own laws • Diverse population of 80,000 • Traditional Industries – Farming & Tourism • Now – Browne Craine & Co International Financial Centre of Excellence About the IOM: Easily Accessible Serviced By Air: Travel By Air •16 Destinations •Over 100 flights a day •1 hour from London City Browne Craine & Co About the IOM: International Relations UK Europe Rest of World • Self governing • Independent • Financially independent • Sterling currency • Common Customs & Excise Agreement - VAT • EU Relationship • Strong feedback IMF, Browne Craine & Co governed by Protocol 3 • Free movement of goods •Free movement of people • No contributions to or receipts from EU •EU Savings Directive OECD, FATF • International standard regulation • Good international citizen • Strong business links • Independent international representation About the IOM: A Proud History • Oldest continuous parliament in the world – over 1,000 years • Open consultative government • Strong, stable economy – 25th straight year of economic growth • Infrastructure investment - over £1bn in health, education, water, communications, power, etc • Gaelic welcome – diverse population of languages and cultures Browne Craine & Co Why Locate In The Isle of Man “Simply put, we have all the elements that can support business. We believe in financial freedom, a strong but pragmatic regulatory regime and giving businesses freedom to flourish. We have a stable political system, excellent infrastructure, a strong economy and a flexible work permit system. People and businesses come to the Isle of Man because they are made welcome and because they can thrive.” IOM Government Finance Department Browne Craine & Co World Famous for TT Races World Class Economy: Business Friendly • Total Bank Deposits of £50billion – Dec 2007 • 30,000 registered companies • Well regulated financial industry • Common law jurisdiction • Zero percent corporate tax • Tax cap for individuals Browne Craine & Co Tax Regime – Smart Taxation • Tax system is EU Code of Conduct compliant • Zero % rate for majority of corporations • Low rates for individuals – maximum 18% • Budgeted and sustainable tax strategy in a robust economy • Standard & Poor’s and Moody’s AAA sovereign credit rating Browne Craine & Co Thorough Yet Pragmatic Regulation • Commitment to quality business and the reputation of the Isle of Man • Regulators work in partnership with industry to develop realistic best practices • Policies developed from close work with OECD, IMF, FATF etc. Browne Craine & Co International Profile of The Isle of Man • Only Offshore financial centre with top ratings from OECD, FATF and Financial Stability Forum • IMF reports 2003 and 2008 • Financial Times award for Best International Territory - 2001 • Winner - Best International / Offshore Finance Centre Awards 2006 • Winner - European Financial Centre of the Future Awards 2005 (The Banker) • Standard & Poor ‘AAA’ Rated • FBI Compliments Island – February 2001 “…a well-regulated financial industry, money-laundering regulation and…demonstrates the need for global law enforcement cooperation” Browne Craine & Co IOM: A Competitive Location Cayman Dublin Channel Islands Isle of Man 22 12 150 225 40,000 1.5 million 160,000 75,000 £1.2 million £750,000 £600,000 £300,000 £55,000 £40,000 £40,000 £30,000 N/A 50% 30% 7% 3 months N/A 1 month 4 days Zero 12.5% 20% (Changing) Zero Square Miles Population Detached House Price Average Fund Accountant Salary Staff Turnover Average length of time for work/housing permit Corporate Tax Rate Browne Craine & Co Summary A World Class Economy • Self Governing Crown Dependency • Stable & diversified economy • Standard & Poor’s and Moody’s AAA Sovereign credit rating • Political stable for 1000 years • Diversified Sectors A Place for Business • Easy access to London & EU • Common VAT area with UK and EU • Tax neutral with 0% taxation for all corporations except banking activity 10% rate • Corporate Re-Domicile provisions • Leading Non UK AIM listing with GBP9.3bn • Excellent IT and power • Financial Assistance Scheme for new business As • • • • • a Place to Live Low personal tax rate (max 18%) with generous allowances Excellent education systems Flexible work permit system Affordable housing Low crime Browne Craine & Co Business Structures • Companies – – – – Standard Company New Manx Vehicle Limited Liability Company Protected Cell Company • Trusts – Discretionary – Life Interest – Accumulation & Maintenance – Various Others Browne Craine & Co 1931 Company • The standard Isle of Man Company • Each company has a memorandum and articles of association (incorporation) • Types include – – – – – Public companies, which must file accounts Private companies, which cannot offer shares to the public Companies limited by shares Companies limited by guarantee Unlimited companies. • Commercial companies are usually limited liability companies having a share capital. Browne Craine & Co New Manx Vehicle • NMV, under the Companies Bill/Act 2005, will be possible – – – – – – – – minimal registry filings unlimited capacity, but restricted objects permissible no capital maintenance requirements (subject to solvency) no authorised capital shares of no par value possible redemptions and purchases of shares distribution of income and capital possible (subject to solvency) no financial assistance prohibitions • in general – – – – no annual return requirements requirement for a registered agent corporate directors permitted within certain limits no prescriptive accounting requirements Browne Craine & Co Limited Liability Company • • Based on the “Wyoming”legislation Main purpose was for tax reasons • Popular as a simple form of business vehicle • The main characteristics of the LLC – – Has limited liability and corporate personality but is taxed as if it were a partnership. – – the members can also manage the company no separation of ownership and management as with other forms of company. – – – – – Liability is limited to the amount of capital contribution made by the members there is no share capital as such. Members have the right to manage the LLC in relation to their capital contribution or they can appoint a manager There are no Directors Taxation – – – LLCs may exist for an unlimited period Automatically be wound up on the death, resignation or disqualification of a member If there are two or more members remaining then they can resolve to continue • • members pay income tax on their share of the profits, however if the LLC is owned by non-resident members and has no Manx-sourced income then it may be exempt from all Manx taxation. Browne Craine & Co UCTION Protected Cell Company CELL CELL CELL CORE CELL Browne Craine & Co CELL Protected Cell Companies (PCCs) • Basically a standard company limited by shares – Separated into legally distinct ‘cells – Each cell has its own proportion of the overall share capitalof the PCC, – Each cell’s assets, liabilities and tax liabilities are kept separate from each other cell. – Shareholders can own an entire cell but at the same time only own a small proportion of the PCC as a whole. • • • The PCC is a separate legal entity. The separate cells created by the PCC do not become legal entities separate from the PCC itself. Cells are created by the PCC for the purpose of protecting ‘cellular’ assets using the provisions contained in the PCC Act. Cellular assets are the assets represented by the proceeds of cell share capital, and all other assets attributable to the cell. Initial use – Captive insurance – Funds – Collective investment schemes – PCC structures can be particularly useful in allowing ring Useful – Ring fencing of individual client or intermediary assets – Provides a layer of risk management not afforded to these schemes previously, and this could prove to be attractive to high net worth clients. • • • Browne Craine & Co Accountancy and Auditing • Recognised bodies – The Institute of Chartered Accountants in England and Wales; – The Institute of Chartered Accountants in Scotland; – The Institute of Chartered Accountants in Ireland. – The Chartered Association of Certified Accountants; and – The Chartered Institute of Public Finance and Accountancy. • Financial Supervision Commission may authorise a person to act as an auditor of a private company. Browne Craine & Co Audit Exemption • Criteria is similar to those used in the United Kingdom. • A company can be an audit exempt company if it meets two of the following criteria: – its annual turnover is £5.6million or less; – its balance sheet total is £2.8million or less; – its average number of employees is 50 or fewer. Browne Craine & Co TAXATION Browne Craine & Co TAXATION - Principle Taxes • DIRECT TAX =INCOME TAX • Resident individuals and companies are subject to Manx income tax on their worldwide income. • INDIVIDUALS • Corporate » BASIC RATE AT » HIGHER PERSONAL RATE » CAPPED per individual » STANDARD RATE » BANKS » PROPERTY COMPANIES Browne Craine & Co 10% 18% £100,000-00 0% 10% 10% TAXATION - Indirect Taxes • Value added tax – – – – Basic rate Low rate Zero Rate Exemptions 17.5% 5% Outside United Kingdom • Customs and Excise duties Browne Craine & Co TAXATION - Other • Isle of Man does not levy: – Corporation tax or advance corporation tax – Capital gains tax – Capital transfer or gift taxes – Wealth taxes – Stamp duties – Death, estate or inheritance tax Browne Craine & Co Alternative Investment Market (AIM) • Isle of Man- over 50 companies listed on AIM • 15 companies in the AIM 100 • The Isle of Man has more high performing companies listed than any jurisdiction other than the UK (the next jurisdiction only has 6). Browne Craine & Co Alternative Investment Market (AIM) • • • • General rate of corporate income tax 0% No capital gains or stamp transfer taxes Not a regulated entity Shares can be traded through CREST without the need to use depositary receipts • NMV is a new simple and flexible corporate structure – Removal of capital maintenance requirements – Less prescriptive prospectus requirements • The Isle of Man is a common law jurisdiction in which company and trust law is closely aligned to that of England and Wales • Security concepts are the same as in England and Wales • The provision of company administration services is a regulated activity on the Isle of Man Browne Craine & Co The quality international AIM vehicle • • • • • • Lawyers increasingly using IOM Capacity for new business Speed and flexibility Highly cost effective Strong skill base/fund expertise Reputation for quality – key to Institutional Investors • ….a growing success story… Browne Craine & Co The Browne Craine Group Browne Craine & Co Browne Craine & Co • Newest member of TIAG – April 2008 • Over 25 years of success • Wide variety of services & clients • Based in the Isle of Man Browne Craine & Co Our Offices – Burleigh Manor, Douglas, Isle of Man PEREGRINE CORPORATE SERVICES PROVIDING HIGH QUALITY BESPOKE SERVICES TO COMPANIES AND TRUSTS SINCE 1986 Browne Craine & Co PEREGRINE CORPORATE SERVICES THE SERVICES • Companies – Incorporations – Fully managed – AIM listings • Trusts – Establishment – Provision of Trustees Browne Craine & Co COMPANIES Why Isle of Man? • Zero % Tax for majority • VAT registration as though UK • A strong reputation • Access to EU markets • IOM resident directors not required • Robust regulation Browne Craine & Co IOM COMPANIES - USES • TRADING • INTELLECTUAL PROPERTY • HOLDING • SHIPPING / YACHTS • CONSULTANCY • PRIVATE AIRCRAFT • PROPERTY • FINANCING Browne Craine & Co Consultant / Sportsperson / Entertainer IOM Company Invoice Funds Funds Non-resident Individual Browne Craine & Co Country X Case Study - Consultancy Performer / Sportsman / Consultant • Individual works on several short term contracts all over the world. • IOM company bills their clients – incl VAT if required. • IOM company pays no tax on income. • IOM company distributes profits as and when required to shareholders. • Depending on tax rules in home country, profits can accumulate tax free in IOM company. Browne Craine & Co Trading Company Country B GOODS Invoice Invoice Funds Browne Craine & Co Country A IOM Company Funds Case Study – Trading Company International Trading Company • Goods sold from Country A to Country B. • IOM company issues invoice Country B. • Country A invoices IOM company at lower price. • Profit is isolated in IOM Company at 0% tax on profits • Care required – Transfer Pricing / CFC’s Browne Craine & Co Property Company IOM Company Purchase Rental Income Finance IOM Bank Browne Craine & Co UK Property Case Study – Property Company Property Company UK Shareholder invests in an IOM company to purchase UK property as he plans to leave UK in future. • IOM company borrows from a bank in IOM – several major banks & many contacts. • IOM company pays no tax on rental income in IOM, but will pay tax in UK – Peregrine area of expertise. • Property sold in future when shareholder has left UK. • No capital taxes on disposal for IOM company. • Depending on tax rules in new country of shareholder, capital taxes may be avoided. Browne Craine & Co Shipping and Aircraft Registers Browne Craine & Co Shipping register • Historical shipping register, since 1786 • 1984 – established as an International Register • Developed and respected shipping sector • Steady growth of register and sector • 2003 – introduction of commercial yachts • Developing yacht sector • Centre of excellence – ships and yachts Browne Craine & Co Growth of shipping register 450 Superyachts No of Vessels Ships 400 350 300 250 200 150 100 50 Year 0 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Browne Craine & Co Why Isle of Man? • • • • • • • • • Political and Economic stability Secure financial Jurisdiction Quality of Register and shipping centre Low cost – no annual dues Corporate vehicles and tax structures Supportive and pro-active government Customer focused registry/survey teams Pragmatic approach to regulation British Flag which is not the UK Browne Craine & Co Aircraft Register • Planned in 2005 - to mirror and complement Isle of Man register for commercial yachts • Opened for business 1 May 2007 • Private & corporate only, not commercial air transport • Offers unique M-registration (e.g. M-MANX) • No insurance premium • European time zone • Helpful, flexible and pragmatic approach • Cost effective and high quality register Browne Craine & Co Where Next? • • Space industry – Public & Private • IOM owns satellite orbiting slots • Space University in IOM Forward-thinking attitude of Government & Industry Browne Craine & Co COMPANIES – OUR SERVICES • Incorporation of companies • Full management & control OR • Incorporation & support • Not just IOM, other international companies • 5 qualified accountants as directors of your company • Well regulated location with strong reputation • Provision of directors/services to AIM listed companies Browne Craine & Co TRUSTS - INTRODUCTION • Used since 10th Century • Wealth protection • Assets entrusted to associates = TRUSTEES • Trustees act for the benefit of the BENEFICIARIES • Legally recognised arrangement Browne Craine & Co TRUSTS - STRUCTURE SETTLOR Assets TRUSTEES Browne Craine & Co Can decide BENEFICIARIES TRUSTS – USES • Estate and inheritance planning – avoid probate • Provision for family members/employees • Protection of assets • Tax advantages if long term financial gains expected • Charitable reasons Browne Craine & Co TRUSTS - DIFFERENT TYPES • Discretionary - letter of wishes • Interest In Possession – life tenant • Accumulation & Maintenance – children & grandchildren • Purpose Trusts – Law since 1996, Independent enforcer required • Will Trusts – additional inheritance planning Browne Craine & Co TRUSTS – Case Study SETTLOR Grandparent Assets TRUSTEE Trust Fund Lifetime Income BENEFICIARY Children Browne Craine & Co Assets On Death BENEFICIARY Grandchildren TRUSTS – CASE STUDY • SETTLOR - Grandparents settle investments into Trust • TRUSTEES - Become legal owners and take responsibility for investments. • Settlor provides guidance to Trustees via a Letter of Wishes • Income from investments used to provide regular income to children during their life - BENEFICIARY • Upon death of children, assets pass to Grandchildren - BENEFICIARY Browne Craine & Co TRUSTS – WHY ISLE OF MAN? • • • • • • Trust service providers regulated High standards and expertise History of Trust law – Statute & Common law Foreign laws re transfer of assets excluded No statutory requirement to notify beneficiaries No Tax providing no Manx income or beneficiaries Browne Craine & Co TRUSTS – OUR SERVICES • • • • Establishment of Trusts Provision of Trustees Expertise & Experience Access to legal advice Isle of Man: - Supportive legislation - History of Trusts - Centre of expertise Browne Craine & Co MORE INFORMATION www.brownecraine.com www.peregrine-iom.com www.bces.co.im www.gov.im/dti/ Browne Craine & Co CONTACTS Basil Bielich – bbielich@burleigh.co.im Stuart Foster – sfoster@burleigh.co.im Craig Mitchell – cmitchell@burleigh.co.im Maurice Singer – msinger@burleigh.co.im David Craine – dcraine@burleigh.co.im Browne Craine & Co