capital budgeting

advertisement

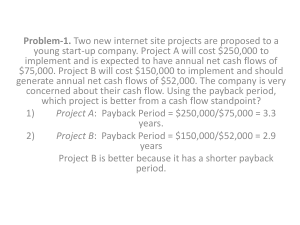

CAPITAL BUDGETING WHY DIDN’T I THINK OF THAT? What does every baseball player need to complete the uniform? A cap. What a business opportunity for C&C Sports! Or is it? 9 © Tomwang112 / iStockphoto CAPITAL BUDGETING DECISIONS Unit 9.1 Unit 9.2 Unit 9.3 Unit 9.4 91 . CAPITAL BUDGETING IS… ► ► ► 9 A systematic approach to evaluating an investment in a capital asset A process for evaluating long-range investment proposals for the purpose of allocating limited resources Different from cash budgeting because of the time horizon involved WHAT ARE CAPITAL ASSETS? ► ► 9 Equipment or facilities that provide productive services to the organization for more than one accounting period Also called depreciable assets or long-lived assets WHY DO YOU INVEST? ► For expected future returns • Return of investment • Return on investment 9 RETURN OF INVESTMENT VS. RETURN ON INVESTMENT Suppose you buy a share of a company’s stock today at $26 and sell it in one month for $32.50 9 $26.00 Return OF investment $6.50 Return ON investment SCREENING VS. PREFERENCE DECISIONS ► Screening Decisions • Which projects meet the hurdle rate? • Which of the projects are acceptable for the organization in light of its goals? ► Preference Decisions • Of the acceptable projects, which ones should be implemented? 9 SCREENING VS. PREFERENCE 9 IDENTIFYING PROJECT CASH FLOWS ► Cash receipts • Additional sales revenue • Salvage value of equipment • Cost savings ► Cash disbursements • Purchase price • Additional operating costs (DM, DL, MOH, SG&A) • DO NOT include interest from financing the acquisition of the asset 9 ► Identify when the cash flows occur CASH FLOWS OF THE TOPCAP SYSTEM Cash Flow Amount Timing $625,000 Years 1 – 10 Purchase and installation of TopCap system $ 50,265 Year 0 Purchase of direct materials (250,000 caps ×$2.00 per cap) $500,000 Years 1 – 10 Direct labor (3 employees×8 hours/day×$9.60/hour×5 days/week×50 weeks per year) $ 57,600 Years 1 – 10 Variable overhead (250,000 caps ×$0.15 per cap) $ 37,500 Years 1 – 10 Variable selling expense (250,000 caps ×$0.05 per cap) $ 12,500 Years 1 – 10 Fixed expenses $ 7,000 Years 1 – 10 Cash Inflows Sales revenue (250,000 caps ×$2.50 per cap) Cash Outflows 9 © Tomwang112 / iStockphoto TIME VALUE OF MONEY Unit 9.1 Unit 9.2 Unit 9.3 Unit 9.4 9.2 WHICH SHOULD YOU CHOOSE? $20,000 TODAY $22,000 A YEAR FROM NOW 9 WHY? WHICH SHOULD YOU CHOOSE? $20,000 TODAY $22,000 A YEAR FROM NOW 9 IT DEPENDS. PRESENT VALUE ► ► What you pay today to receive $22,000 five years from now? You can calculate this amount by “discounting” the future amount based on the expected interest rate you would earn over the 5-year period PV(n,i) = Future amount × 9 1 (1 + i)n PRESENT VALUE ► ► What you are willing to pay today to receive $22,000 five years from now is the present value You can calculate this amount by “discounting” the future amount based on the expected interest rate you would earn over the 5-year period PV(n,i) = Future amount × 9 1 (1 + i)n USING A PRESENT VALUE TABLE Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8928 2 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 3 0.8890 0.8638 0.8399 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 4 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 5 0.8219 0.7005 0.7473 0.7438 0.6806 0.6499 0.6209 0.5935 0.5674 $22,000 × 0.6209 = $13,659.80 9 ANNUITIES ► ► 9 A stream of cash flows (either receipts or disbursements) over a period of time For the TopCap System, the $625,000 additional revenue and the $500,000 spent for direct materials in each year are annuities PRESENT VALUE OF AN ANNUITY ► ► ► ► 9 What are you willing to pay today to receive $625,000 per year for the next 10 years? Can calculate the present value of each individual amount and then add them all together Or use the formula: 1 1(1 + i)n PVA(n,i) = Annual amount x i Or use the present value of annuity table PRESENT VALUE OF AN ANNUITY TABLE Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.9615 0.9504 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 2 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 3 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4868 2.4437 2.4018 4 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1698 3.1024 3.0373 5 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7907 3.6959 3.6048 6 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 7 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 8 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 9 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 10 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 9 $625,000 × 6.1446 = $3,840,375 © Tomwang112 / iStockphoto DISCOUNTED CASH FLOW TECHNIQUES Unit 9.1 Unit 9.2 Unit 9.3 Unit 9.4 9.3 FOUR STEPS TO CALCULATE NET PRESENT VALUE (NPV) 1. Identify the amount and timing of each cash flow 2. Determine the appropriate discount rate (cost of capital, hurdle rate, etc.) 3. Calculate the present value of each cash flow 4. Calculate the NPV of the project 9 TOPCAP SYSTEM CASH FLOWS Cash Flow Purchase and installation of TopCap system Year 0 Years 1-10 ($50,265) Sales revenue $625,000 Purchase of direct materials ($500,000) Direct labor ($ 57,600) Variable overhead ($ 37,500) Variable selling expense ($ 12,500) Fixed expenses ($ 7,000) Annual net cash flow 9 $(50,265) $ 10,400 NPV OF THE TOPCAP SYSTEM Cash Flow Present Value PV Factor Year 0 Purchase and installation of TopCap system ($50,265.00) 1.0 ($50,265) 58,762.08 5.6502 Annual net cash flow Net present value 9 $ 8,497.08 Years 1-10 $ 10,400 HOW DO YOU KNOW IF A PROJECT IS ACCEPTABLE USING NPV? NPV Value What it means Project Acceptable? >0 Return on proposed project exceeds the discount rate YES =0 Return on proposed project equals the discount rate YES <0 Return on proposed project is less than the discount rate NO 9 ASSUMPTIONS OF THE NPV APPROACH ► ► ► ► 9 Timing and amount of all cash flows are known with certainty There is no inflation Cash flows occur at the end of each year All cash inflows are reinvested at the discount rate USING EXCEL TO CALCULATE NPV 9 THINGS TO REMEMBER ABOUT NPV ► ► ► ► 9 Changing the discount rate affects NPV (How so?) Changing the timing and size of cash flows affects the NPV (How so?) NPV is a good preference ranking tool for projects designed to perform the same function The higher the risk, the higher the discount rate to use INTERNAL RATE OF RETURN ► Internal rate of return calculations for projects with even annual cash flows • Find the PVFA using the formula below • Use PVA table to find the IRR • Or do trial and error NPV calculations until you get NPV = 0 PVF = 9 Initial Investment Net Annual Cash Flow IRR OF TOPCAP SYSTEM (Annual cash flow ×PVA10,i ) – Net initial investment = $0 ($10,400×PVA10,i ) – $50,265 = $0 PVA10,i $50,265 = $10,400 PVA10,i = 4.8332 9 IRR OF TOPCAP SYSTEM Periods 6% 7% 8% 9% 10% 11% 12% 14% 16% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8772 0.8621 2 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 1.6467 1.6052 3 2.6730 2.6243 2.5771 2.5313 2.4868 2.4437 2.4018 2.3216 2.2459 4 3.4651 3.3872 3.3121 3.2397 3.1698 3.1024 3.0373 2.9137 2.7982 5 4.2124 4.1002 3.9927 3.8897 3.7907 3.6959 3.6048 3.4331 3.2743 6 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.8887 3.6647 7 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.2883 4.0386 8 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.6389 4.3436 9 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 4.9464 4.6065 10 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 5.2161 4.8332 9 USING EXCEL TO CALCULATE IRR 9 USING IRR TO EVALUATE PROJECT ACCEPTABILITY IRR Value Compared to NPV Project Acceptable? > Discount Rate NPV > 0 YES = Discount Rate NPV = 0 YES < Discount Rate NPV < 0 NO 9 INTERNAL RATE OF RETURN ► ► ► ► 9 This is the rate that returns a NPV = 0 Assumes that cash flows can be reinvested at the IRR May give you different ranking from NPV calculation NPV is a magnitude return measure, IRR is a relative return measure PROFITABILITY INDEX ► ► Facilitates evaluation of projects requiring different levels of investment Higher profitability index is preferred Profitability Index = 9 Present Value of Annual Cash Flows Required Initial Investment © Tomwang112 / iStockphoto OTHER CAPTIAL BUDGETING TECHNIQUES Unit 9.1 Unit 9.2 Unit 9.3 Unit 9.4 94 . PAYBACK PERIOD ► ► 9 How long it will take to get back the return of investment for a particular project The amount of time it takes a project’s cash inflows to equal the original investment HOW IS PAYBACK PERIOD CALCULATED ► For even annual cash flows Payback Period = ► 9 Initial Investment Net Annual Cash Flow For unequal annual cash flows, calculate cumulative cash flow until you reach the initial investment amount PAYBACK PERIOD LIMITATIONS ► ► ► ► 9 Ignores the time value of money Ignores cash outflows after initial acquisition and cash inflows after the payback period The longer the payback period, the greater the project’s risk Best used as a screening tool rather than preference ordering tool LET’S PRACTICE John Dallas has been following the mortgage interest rate movement over the last several weeks and is trying to decide if he should refinance his house. The mortgage company has estimated that the cash needed at closing on the refinancing will be $5,000. The new interest rate on the refinanced mortgage will lower John’s monthly payments by $150. What is the payback period for the refinancing? 9 LET’S PRACTICE John Dallas has been following the mortgage interest rate movement over the last several weeks and is trying to decide if he should refinance his house. The mortgage company has estimated that the cash needed at closing on the refinancing will be $5,000. The new interest rate on the refinanced mortgage will lower John’s monthly payments by $150. What is the payback period for the refinancing? 9 $5,000 = 33.3 months $150/month ACCOUNTING RATE OF RETURN ► ► ► ► 9 This method uses net operating income, not cash flows This typically means to remember to consider depreciation expenses Also called simple rate of return or unadjusted rate of return Focus on additional net operating income generated by the project ACCOUNTING RATE OF RETURN Project revenues – project operating expenses Initial investment – salvage value of old equipment 9 ACCOUNTING RATE OF RETURN LIMITATIONS ► ► ► ► 9 Influenced by the choice of accounting methods (income differences) Ignores the time value of money Relies on accounting measures rather than cash flows Useful screening tool, but limited use for preference ranking (compared to hurdle rate)