File - Mr. P. Ronan

advertisement

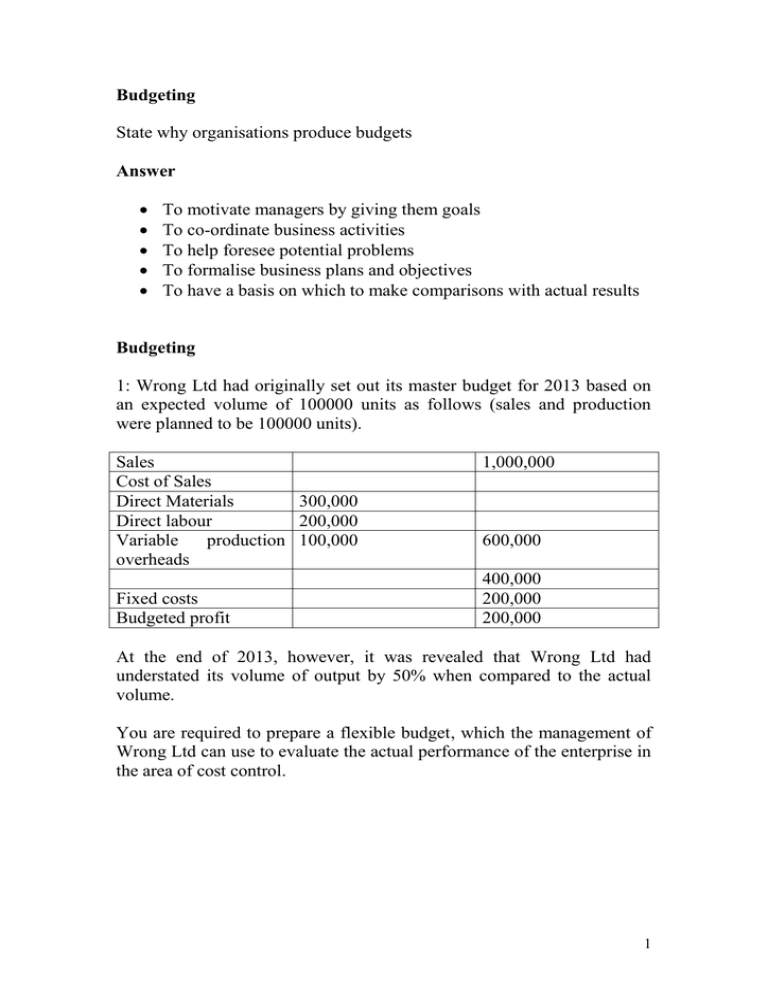

Budgeting State why organisations produce budgets Answer To motivate managers by giving them goals To co-ordinate business activities To help foresee potential problems To formalise business plans and objectives To have a basis on which to make comparisons with actual results Budgeting 1: Wrong Ltd had originally set out its master budget for 2013 based on an expected volume of 100000 units as follows (sales and production were planned to be 100000 units). Sales Cost of Sales Direct Materials 300,000 Direct labour 200,000 Variable production 100,000 overheads Fixed costs Budgeted profit 1,000,000 600,000 400,000 200,000 200,000 At the end of 2013, however, it was revealed that Wrong Ltd had understated its volume of output by 50% when compared to the actual volume. You are required to prepare a flexible budget, which the management of Wrong Ltd can use to evaluate the actual performance of the enterprise in the area of cost control. 1 Answer Sales Cost of Sales Direct Materials Direct labour Variable production overheads Fixed costs Budgeted profit 2: Orion Ltd plans to sell 50000 units in the forthcoming year. The selling price is estimated at $30 per unit. The unit cost comprises the following Direct Costs Direct Materials Direct labour Direct Expenses 1 unit at $2.50 4 hours at $2.00 per hour per unit = $8 $3 per unit Indirect Costs Administration Costs $220,000 Distribution Costs $60,000 Marketing Costs $300,000 Taxation is 30% of pre-tax profits. There is no interest payable or receivable. Design an incremental budget for Orion Ltd. 2 ‘Variance Analysis A key word to understand when you are looking at budgets is “variance” A variance arises when there is a difference between actual and budget figures Variances can be either: Positive/favourable (better than expected) or Adverse/unfavourable ( worse than expected) A favourable variance might mean that: Costs were lower than expected in the budget, or Revenue/profits were higher than expected By contrast, an adverse variance might arise because: Costs were higher than expected Revenue/profits were lower than expected Should variances be a matter of concern to management? After all, a budget is just an estimate of what is going to happen rather than reality. The answer is – it depends. The significance of a variance will depend on factors such as: Whether it is positive or negative – adverse variances (negative) should be of more concern Was it foreseen? Was it foreseeable? How big was the variance - absolute size (in money terms) and relative size (in percentage terms)? The cause Whether it is a temporary problem or the result of a long term trend “Management by exception” is the name given to the process of focusing on activities that require attention and ignoring those that appear to be running smoothly Budget control and analysis of variances facilitates management by exception since it highlights areas of business performance, which are not in line with expectations. 3 Items of income or spending that show no or small variances require no action. Instead concentrate on items showing a large adverse variance. Are all adverse variances bad news? Here is a point that students often find hard to understand – or believe! An adverse variance might result from something that is good that has happened in the business. For example, a budget statement might show higher production costs than budget (adverse variance). However, these may have occurred because sales are significantly higher than budget (favourable budget). Remember, it is the cause and significance of a variance that matters – not whether it is favourable or adverse. Variances illustrated Consider the following budget statement: Item Sales Revenue Standard Product Premium Product Total Sales revenue Costs Wages Rent Marketing Other overheads Total Costs Profit Budget Actual 75 90 30 25 105 115 35 15 20 27 38 17 14 35 97 8 104 11 Variance 4 What do the numbers in the budget statement tell us? Looking at the sales revenue section, you can see that actual sales of standard product were £15k higher than budget – this is a positive (favourable) variance. Turning to the costs section, actual wages were £3k higher than budget – i.e. an adverse (negative) variance. Overall, the profit variance was positive (favourable) – i.e. better than budget.’ Source: http://www.tutor2u.net/business/accounts/variance-analysis.html [accessed Sunday 22nd March, 2015] 5 Flexible Budgeting 1: Bracken dale Ltd When the standards for the year ahead were set, it was expected that monthly output of units manufactured would be 10,000 units. By the time July was reached, output had fallen to 8000 units per month because of a fall in market sales. The original budget is based on the following information: (a) Direct Material Cost = $4 per kg of raw materials (b) Direct labour Cost = $5 per hour (c) Variable Cost rate of $3 per direct labour hour. (d) Fixed Overhead is $7000 (e) Each unit of output requires 0.5 kg of raw materials and 12 minutes of labour time. The actual cost of direct materials was found to be $4.40 per kg. The actual cost of direct labour was found to be $5.50 per hour. The actual variable overhead cost rate was $2.80 per direct labour hour. Fixed Overhead was actually $7500 3800 kg of materials were used and the actual labour hours worked were 2000 Complete the following table Units Manufactured Original Budget Actual for July 10,000 8000 Direct Material Direct Labour Variable Overhead Fixed Overhead Total Direct Costs 6 Now what if a flexible budget had been constructed earlier? This budget foresaw that output would be 8000 in July. Now calculate the figures for the flexible budget. You must use the original information to compute the figures Direct Material Cost = $4 per kg of raw materials Direct labour Cost = $5 per hour Variable Cost rate of $3 per direct labour hour Fixed overhead is $7000 Each unit of output requires 0.5 kg of raw materials and 12 minutes of labour time. Flexible Budget Units Manufactured 8000 Direct Material Direct Labour Variable Overhead Fixed Overhead Total Direct Costs Now calculate the flexible budget variances Original Budget (1) Flexible Budget (2) Actual for July (3) Variance (2) – (3) Units Manufactured Direct Material Direct Labour Variable Overhead Fixed Overhead Total Direct Costs 7 2: G Ltd produces and sells a single product. The budget for the latest period is as follows: Sales revenue (12600) Variable Costs Direct materials Direct labour Production overhead Fixed Costs Production overhead Other overhead Budgeted Profit 277200 75600 50400 12600 (138600) 13450 10220 (23670) 114930 The actual results for the period were as follows: Sales revenue (13200) 303600 Variable Costs Direct materials 78350 Direct labour 51700 Production overhead 14160 (144210) Fixed Costs Production overhead 13710 Other overhead 10160 (23870) Budgeted Profit 135520 Prepare a flexible budget control statement and comment on the results 8 Answer Flexed/Flexible Budget Sales revenue (13200) Variable Costs Direct materials Direct labour Production overhead Fixed Costs Production overhead Other overhead Budgeted Profit 9 Flexible Budget Control Statement for the latest period Activity Sales Revenue Original Budget 12600 277200 Variable Costs Direct 75600 material Direct 50400 Labour Production 12600 overhead Flexed Budget 13200 Actual Results 13200 Variance 303600 78350 51700 14160 Fixed costs Production 13450 overhead 13710 Other 10220 overhead Total Costs 162270 10160 Profit 135520 114930 168080 10 3: The Arcadian Hotel operates a budgeting system and budgets expenditure over eight budget centres as shown below. Analysis of past expenditure patterns indicates that variable costs in some budget centres vary according to occupied room night (ORN), while in others the variable proportion of costs varies according to the number of visitors (V). The budgeted expenditures for a period with 2000 ORN and 4300 V were as follows: Budget centre Variable vary with Cleaning Laundry Reception Maintenance Housekeeping Administration Catering General overheads ORN V ORN ORN V ORN V ---- costs Budgeted expenditure 13250 15025 13100 11100 19600 7700 21460 11250 Budget expenditure includes $2.50 per ORN $1.75 per V $12100 fixed $0.80 per ORN $11000 fixed $0.20 per ORN $2.20 per V All fixed 112485 . In period 9, with 1850 ORN and 4575V, actual expenditures were as follows: Budget Centre Cleaning Laundry Reception Maintenance Housekeeping Administration Catering General overheads Actual Expenditure 13292 14574 13855 10462 19580 7930 23053 11325 114071 (a) Determine the flexible budget cost allowance for period 9 11 (b) What is the total budget allowance for the flexible budget, and calculate the total expenditure variance for period 9. Answer Activity Variable Variable Fixed cost per cost cost unit($) allowance allowance ($) Cleaning 1850 Laundry 4575 Reception 1850 Maintenance 1850 Housekeeping 4575 General --overheads Total budget cost allowance 4: Green Day PLC manufactures a component for the motor industry. The following flexible budgets have already been prepared for 50%, 60% and 75% of the plant’s capacity Output levels 75% Units 50% 60% 5000 6000 7500 Direct Materials Direct Wages Production Overheads Other overhead costs Admin Expenses $ 55000 35000 45000 14000 20000 $ 66000 42000 45000 14000 20000 $ 82500 52500 45000 14000 20000 169000 187000 214000 Profit is budgeted to be 25% of sales (a) Classify the above costs into fixed and variable costs. Give reasons for your choice 12 (b) Calculate the cost per unit for direct materials and direct wages (c) Prepare a flexible budget for 90% 5: Martone PLC manufactures components for the electrical industry. The following flexible budgets have already been prepared for 60%, 70% and 80% of the plant’s capacity. Output levels Units 60% 12000 70% 14000 80% 16000 Direct Materials Direct Wages Production overheads1 Other overheads2 Admin Expenses $ 84000 48000 60000 50000 30000 $ 98000 56000 66000 58000 30000 $ 112000 64000 72000 66000 30000 272000 308000 344000 Profit is budgeted at 20% of sales (a) Separate production overheads and other overheads into fixed and variable elements (b) Prepare a flexible budget for a 90% activity level 1 2 Production Overheads has a fixed and variable component Other overheads has a fixed and variable component 13