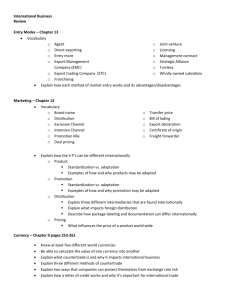

Notes for chapter 18

advertisement

International Marketing Chapters 18 Pricing for International Markets Introduction • • • • • • Pricing strategy forms another cornerstone of a global marketing program–it represents one of the most critical and complex issues in global marketing (due to economic, financial, and mathematical implications) Price is the only marketing mix element that generates revenues. All other elements entail costs Need to devote special care in pricing products as a manager’s fiduciary responsibility is to market products at a profit and increase shareholder wealth A company’s global pricing policy may make or break its overseas expansion efforts (due to foreign exchange complications) Firms also face significant challenges in coordinating (standardizing or adapting) their pricing strategies across various countries they operate in This chapter reviews the plethora of international pricing strategy issues Price Escalation • Price escalation refers to the added costs incurred as a result of exporting products from one country to another There are several factors that lead to higher prices: 1. Costs of Exporting: the term relates to situations in which ultimate prices are raised by shipping costs, insurance, packing, tariffs, longer channels of distribution, larger middlemen margins, special taxes, administrative costs, and exchange rate fluctuations Price Escalation (contd ..) 2. 3. Taxes, Tariffs, and Administrative Costs: These costs results in higher prices, which are generally passed on to the buyer of the product Inflation: Inflation causes consumer prices to escalate and the consumer is faced with rising prices that eventually exclude many consumers from the market Price Escalation (contd ..) 4. Middleman and Transportation Costs: Longer channel length, performance of marketing functions and higher margins may make it necessary to increase prices 5. Exchange Rate Fluctuations and Varying Currency Values: Currency values swing vis-à-vis other currencies on a daily basis, which may make it necessary to increase prices Approaches to Lessening Price Escalation Methods used to reduce costs and, thus, lower price escalation include: • Lowering Cost of Goods: Firms can lower costs by eliminating costly features in products or by manufacturing products in countries where labor costs are cheaper • Lowering Tariffs: Firms can lower prices by categorizing products in classifications where the tariffs are lower • Lowering Distribution Costs: Firms can design channels that are shorter, have fewer middlemen, and by reducing or eliminating middleman markup • Using Foreign Trade Zones: Firms can manufacture products in free trade zones where the incentive offered is the elimination of local taxes, which keep prices down Export Strategies Under Varying Currency Conditions When Domestic Currency is WEAK... When Domestic Currency is STRONG... Stress, price benefits Engage in nonprice competition by improving quality, delivery, and aftersale service Expand product line and add more costly features Improve productivity and engage in vigorous cost reduction Shift sourcing and manufacturing to domestic market Shift sourcing and manufacturing overseas Exploit export opportunities in all markets Give priority to exports to relatively strong-currency countries Conduct conventional cash-forgoods trade Deal in countertrade with weakcurrency countries Use full-costing approach, but use marginal-cost pricing to penetrate new/competitive markets Trim profit margins and use marginalcost pricing SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing," Business Horizons, May-June 1988, figure 2, p. 58. Export Strategies Under Varying Currency Conditions When Domestic Currency is WEAK... When Domestic Currency is STRONG... Speed repatriation of foreign-earned income and collections Keep the foreign-earned income in host country, slow collections Minimize expenditures in local, host country currency Maximize expenditures in local, host country currency Buy needed services (advertising, insurance, transportation, etc.) in domestic market Buy needed services abroad and pay for them in local currencies Minimize local borrowing Borrow money needed for expansion in local market Bill foreign customers in domestic currency Bill foreign customers in their own currency SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing," Business Horizons, May-June 1988, figure 2, p. 58. Parallel Importation or Gray Markets • • • • On account of competition, firms may have to charge different prices from country to country In international marketing, this causes a vexing problem: Parallel Importation or Gray Markets Parallel imports develop when importers buy products from distributors in one country and sell them in another to distributors who are not part of the manufacturer’s regular distribution system The possibility of a parallel market occurs whenever price differences are greater than the cost of transportation between two markets Parallel Importation or Gray Markets • • • For example, the ulcer drug Losec sells for only $18 in Spain but goes for $39 in Germany; and the heart drug Plavix costs $55 in France and sells for $79 in London Thus, it is possible for an intermediary to buy products in countries where it is less expensive and divert it to countries where the price is higher and make a profit Exclusive distribution, a practice often used by companies to maintain high retail margins encourage retailers to stock large assortments, or to maintain the exclusive-quality image of a product, can create a favorable condition for parallel importing Effects of Parallel Importation • • • • • Parallel imports can do long-term damage in the market for trademarked products Customers who unknowingly buy unauthorized imports have no assurance of the quality of the item they buy, of warranty support, or of authorized service or replacement parts If a product fails, the consumer blames the owner of the trademark, and the quality image of the product is sullied Companies can restrict the gray market by policing distribution channels In some countries firms get help from the legal system Gray-Market Process Dumping Economists define dumping differently • • One approach classifies international shipments as dumped if the products are sold below their cost of production The other approach characterizes dumping as selling goods in a foreign market below the price of the same goods in the home market • • World Trade Organization (WTO) rules allow for the imposition of a duty when goods are dumped A countervailing duty or minimum access volume (MAV), which restricts the amount a country will import, may be imposed on foreign goods benefiting from subsidies whether in production, export, or transportation Countertrade as a Pricing Tool • Countertrade is a pricing tool that every international marketer must be ready to employ • There are four distinct transactions in countertrading, which include: 1. 2. 3. 4. Barter: is the direct exchange of goods between two parties in a transaction Compensation deals: is the payment in goods and in cash Counter-purchase or off-set trade: the seller agrees to sell a product at a set price to a buyer and receives payment in cash and may also buy goods from the buyer for the total monetary amount involved in the first contract or for a set percentage of that amount, which will be marketed by the seller in its home market Buy-back: This type of agreement is made the seller agrees to accept as partial payment a certain portion of the output that are produced from the plant or machinery that are sold to the buyer Proactive Countertrade Strategy Answering the following questions is suggested before entering into a countertrade agreement: 1. 2. 3. 4. Is there a ready market for the goods bartered? Is the quality of the goods offered consistent and acceptable? Is an expert needed to handle the negotiations? Is the contract price sufficient to cover the cost of barter and net the desired revenue? Other Approaches to International Pricing • There are several approaches to pricing in international markets, which include: 1. Full-Cost Pricing: no unit of a similar product is different from any other unit in terms of cost, which must bear its full share of the total fixed and variable cost. • Prices are often set on a cost-plus basis, i.e., total costs plus a profit margin 2. • Variable-Cost Pricing: firms regard foreign sales as bonus sales and assume that any return over their variable cost makes a contribution to net profit This is a practical approach to pricing when a company has high fixed costs and unused production capacity Other Approaches to International Pricing 3. Skimming Pricing: This is used to reach a segment of the market that is relatively price insensitive and thus willing to pay a premium price for a product 4. Penetration Pricing: This is used to stimulate market growth and capture market share by deliberately offering products at low prices • It is used to acquire and hold share of market Transfer Pricing Strategy • Prices of goods transferred from a company’s operations or sales units in one country to its units elsewhere, which refers to intracompany pricing or transfer pricing, may be adjusted to enhance the ultimate profit of the company as a whole Four arrangements for pricing goods for intracompany transfer are as follows: 1. 2. 3. 4. Sales at the local manufacturing cost plus a standard markup Sales at the cost of the most efficient producer in the company plus a standard markup Sales at negotiated prices Arm’s-length sales using the same prices as quoted to independent customers Benefits of Transfer Pricing Strategy 1. Lowering duty costs by shipping goods into high-tariff countries at minimal transfer prices so that duty base and duty are low 2. Reducing income taxes in high-tax countries by overpricing goods transferred to units in such countries; profits are eliminated and shifted to low-tax countries 3. Facilitating dividend repatriation when dividend repatriation is curtailed by government policy by inflating prices of goods transferred