My Resume

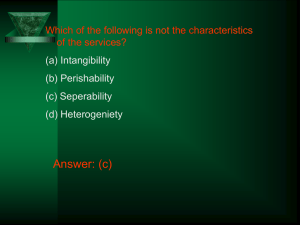

advertisement

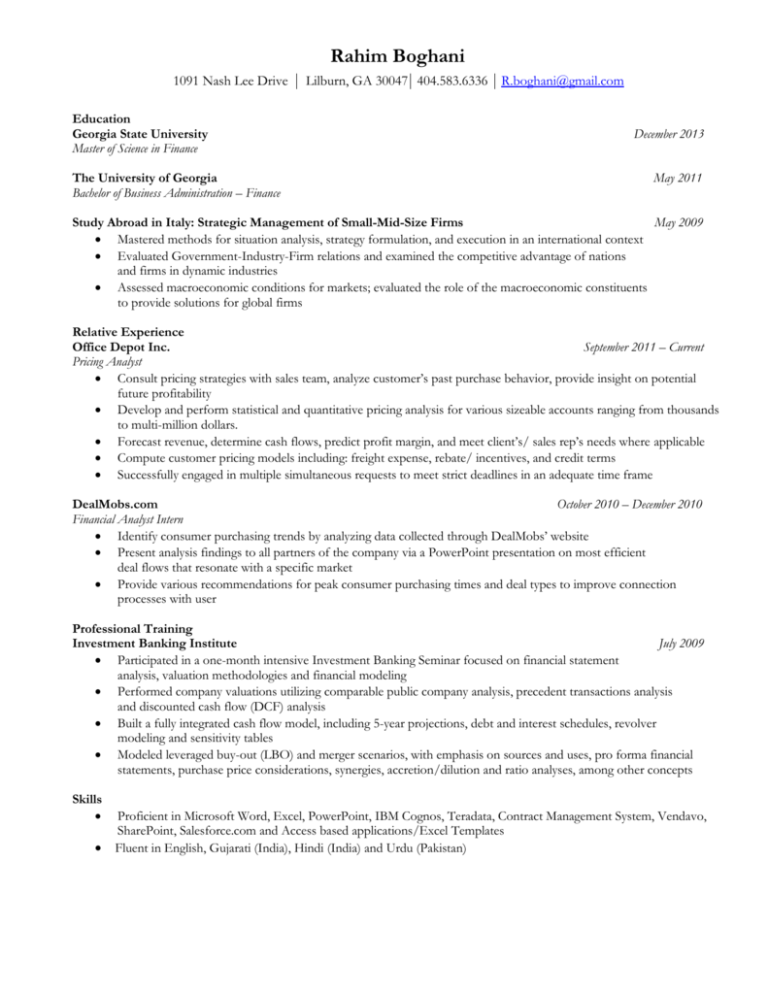

Rahim Boghani 1091 Nash Lee Drive Education Georgia State University Master of Science in Finance The University of Georgia Bachelor of Business Administration – Finance Lilburn, GA 30047 404.583.6336 R.boghani@gmail.com December 2013 May 2011 Study Abroad in Italy: Strategic Management of Small-Mid-Size Firms May 2009 Mastered methods for situation analysis, strategy formulation, and execution in an international context Evaluated Government-Industry-Firm relations and examined the competitive advantage of nations and firms in dynamic industries Assessed macroeconomic conditions for markets; evaluated the role of the macroeconomic constituents to provide solutions for global firms Relative Experience Office Depot Inc. September 2011 – Current Pricing Analyst Consult pricing strategies with sales team, analyze customer’s past purchase behavior, provide insight on potential future profitability Develop and perform statistical and quantitative pricing analysis for various sizeable accounts ranging from thousands to multi-million dollars. Forecast revenue, determine cash flows, predict profit margin, and meet client’s/ sales rep’s needs where applicable Compute customer pricing models including: freight expense, rebate/ incentives, and credit terms Successfully engaged in multiple simultaneous requests to meet strict deadlines in an adequate time frame DealMobs.com October 2010 – December 2010 Financial Analyst Intern Identify consumer purchasing trends by analyzing data collected through DealMobs’ website Present analysis findings to all partners of the company via a PowerPoint presentation on most efficient deal flows that resonate with a specific market Provide various recommendations for peak consumer purchasing times and deal types to improve connection processes with user Professional Training Investment Banking Institute July 2009 Participated in a one-month intensive Investment Banking Seminar focused on financial statement analysis, valuation methodologies and financial modeling Performed company valuations utilizing comparable public company analysis, precedent transactions analysis and discounted cash flow (DCF) analysis Built a fully integrated cash flow model, including 5-year projections, debt and interest schedules, revolver modeling and sensitivity tables Modeled leveraged buy-out (LBO) and merger scenarios, with emphasis on sources and uses, pro forma financial statements, purchase price considerations, synergies, accretion/dilution and ratio analyses, among other concepts Skills Proficient in Microsoft Word, Excel, PowerPoint, IBM Cognos, Teradata, Contract Management System, Vendavo, SharePoint, Salesforce.com and Access based applications/Excel Templates Fluent in English, Gujarati (India), Hindi (India) and Urdu (Pakistan)