Il mercato elettronico della P.A.

advertisement

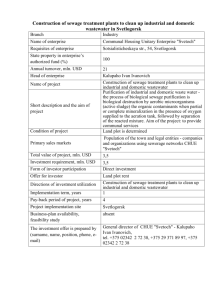

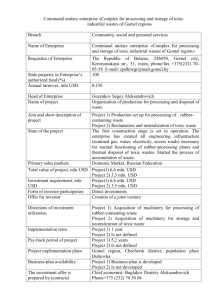

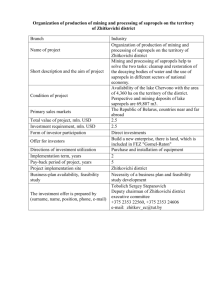

The Italian e-Procurement System Luca Mastrogregori Head of e-Procurement Strategies Consip Spa luca.mastrogregori@consip.it Tirana, 23 May 2012 Status of eprocurement in Italy: role of the operators 5096 Mln + 58% 660 Mln Private Operators 2050 Mln Regions and other Public operators 2386 Mln Consip 3220 Mln 1232 Mln 1141 Mln 252 Mln 76 Mln 2004 2005 2006 2007 2008 2009 2010 Results of the Observatory on eProcurement in PA - School of Management – Politecnico of Milan Consip’s eProcurement system Eprocurement portal - www.acquistinretepa.it 2000 2002 2004 e-Marketplace - On line tenders eshops Purchases within frame contracts Large volumes Demand aggregation Standardized goods Low price volatility Frame contracts or ASP Large volumes Demand aggregation Standard /Specialized goods High price volatility MEPA Direct order or RFQ Low cost goods Spot purchasing Highly fragmented offer ecatalogue Above and Below EU Threshold • • • 2011 results transaction value 2.600 mln € orders num. 78.000 active buyers 11.000 2 Only Below • • • 2010/2012 FAs and DPS On-line tenders in a structured and managed environment (two-stage procedures) Standardised procedures for commonly used goods & services with customisation Above and Below 2011 results trans. value 240 mln € orders num. 74.000 active buyers 5.600 NFCs = National Framework Contracts / FAs = Framework Agreements / DPS = Dynamic Purchasing System The PA Marketplace: buying options Public users may buy in 2 different ways: • making a direct purchase selecting goods and services from the catalogue • negotiating the product quality and service levels with qualified suppliers (Request for Quotation), handling on-line the entire purchasing process and digitally signing the order Public user Supplier Direct purchase Request for Quotation Available product categories Furnitures IT HW and SW Electric Gas material and providing air condit. svcs equip. Stationery Surgical instruments Individual protection devices Electric maint. svcs Elevators maint. svcs Training & Education svcs Cleaning products Print & Copy equipment Laboratory equipment TLC products Office and road signals Office cleaning svcs MEPA – Main Results Achieved 2004 2005 2006 2007 2008 2009 2010 2011 Orders value (M€) % growth vs previous year number % growth vs previous year 8,3 - 3.143 - 29,8 259% 9.677 208% 38,2 83,6 172,2 28% 119% 106% 230,6 34% 11.468 28.173 63.245 72.796 19% 146% 124% 15% 254,2 10% 243 -4% * 77.132 74.397 6% -4% * 309 597 868 1.156 2.088 3.027 4.556 5.100 324 771 1.146 1.809 3.692 5.406 6.640 6.300 on line Catalogues on line Articles 113.207 190.484 226.748 332.465 540.000 540 1.100 1.255 2.748 4.288 1.331.915 1.490.818 1.190.000 on line Demand Active buyers Value orders: 67% RfQ Average value: RfQ: 10.800 € Direct Order: 1.500 € Enterprises Offer Enterprises N. orders: 20% RfQ 5.070 5.339 5.600 72% micro (<10 ) 21% small 6% medium 2% big Choosing the appropriate e-Proc tool • Customised Dynamic Purchasing System Framework Agreement Buy side 1 supplier Demand side with negotiation 1 supplier fixed condition MEPA mult. suppliers with negotiation mult. suppliers fixed conditions Framework Contracts … • Standard • Concentrated • Standardized Supply side • Fragmented • Specialised • The adoption of different tools is related to the market (buy and supply side) characteristics • Wider offering of e-Proc tools • More business opportunities for SME’s trough e-procurement Evolution of Consip’s role • “Awarding Authority“ • “MARKET MAKER” Consip role Dynamic Purchasing System Framework Agreement 1 supplier Demand side with negotiation 1 supplier fixed condition MEPA mult. suppliers with negotiation mult. suppliers fixed conditions Framework Contracts Buyer authonomy Greater New e-Proc tools adoption calls for a strategic change in Consip’s role and capabilities A new “custom” e-procurement Platform for a key role of Consip From Central Awarding Authority to eproc “market maker” Change Management driver “Users’ oriented system” development and management Service Customization and Integration Back-end optimization User Assistance and Support 8 The new platform functional architecture Users Portal registration Catalogue mgmt Orders Negotiation CONNECTED WITH CRM email 9 DWH DMS Admin •New application architecture •Flexibility and scalebility •Web 2.0 •Portal e search engine oriented •Accessibility A change in the implementation approach •Evolution in: – Legislation – Users needs – Technology •2000 •2005 Full outsourcing 10 New e-proc platform •2011 •2008 Insourcing HW & base SW Insourcing Application SW