Investing for Your Future

advertisement

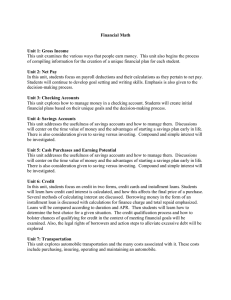

Investing for Your Future Personal Finance Chapter 11 Lesson 11.1 – Investing Fundamentals Lesson 11.2 – Exploring Investment Options Stages of Investing Goals for investing vary person to person As excess income grows, you can progress through different stages of investing Five stages of investing: Put-and Take Account Beginning Investing Systematic Investing Strategic Investing Speculative Investing Stage 1 • Put-and-Take Account • First savings account is a temporary account • Purpose is to pay for short-term needs with enough left over to cover unexpected expenses • Many financial advisers recommend that you have three to six months net pay set aside for this type of fund Stage 2 • Beginning investing • Investing is the use of savings to earn a financial return • Investing begins when your savings are permanent rather than temporary • Initial investment should be conservative and low-risk • Don’t have a lot of money to invest Stage 3 • Systematic Investing • After you become comfortable with your beginning investments, you can start investing on a regular and planned basis • Regularly set aside a certain amount each month for investing • Goals are long-range – investing for a financially secure retirement Stage 4 • Strategic Investing – The careful management of investment alternatives to maximize growth of your portfolio over the next 5-10 years • You invest in different types of securities to try to maximize your returns Stage 5 • Speculative Investing • Occurs when you are investing regularly but still have money available to take bigger risks • Can make – or lose – a large amount of money in a short period of time • Many investors never choose to speculate Reasons for Investing • Investing Helps Beat Inflation – When prices are rising rapidly, you may not be able to earn a return that beats inflation • Investing Increases Wealth – Over the long run, investments earn higher profits than savings do • Investing is Fun and Challenging Risk and Return • All types of investing involve some degree of risk • Diversification is one way to reduce risk – Spread the risk among many types of investments • Types of Risk – Interest-rate Risk – Political Risk – Market Risk – Company or Industry Risk Investment Strategies • Criteria for Choosing an Investment 1. Safety 2. High liquidity 3. High dividends or interest 4. Growth in value that exceeds the inflation rate 5. Reasonable purchase price 6. Tax benefits Wise Investment Practices • • • • • • • Define Your Financial Goals Go Slowly Follow Through Keep Good Records Seek Good Investment Advice Keep Investment Knowledge Current Know Your Limits Assignment • Chapter 11 Worksheet – Due Wednesday • If you want some extra credit points, you can do the questions for Chapter 11 on page 327. They must be placed in my drop box at the beginning of class on Wednesday. • Start thinking about companies you might be interested in investing in. Sources of Financial Information • • • • • • • Newspapers Investor Services and Newsletters Financial Magazines Brokers Financial Advisers Annual Reports and Financial Statements Online Investor Education Investment Options • Investments can be put into different groups according to their degree of risk and expected return: 1. Low Risk/Low-to Medium Return 2. Medium Risk/Medium Return 3. High Risk/High Return Low Risk/Low-to-Medium Return • Corporate and Municipal Bonds – Interest usually paid every six months – Principal repaid at maturity – Interest on gov’t bonds usually tax-free • U.S. Government Savings Bonds – Series EE Savings Bond (discount bond) – Series HH Savings Bond (exchange for EE Bonds) • Treasury Securities – T-bills – Treasury Notes – Treasury Bonds Medium Risk/Medium Return • Mutual Funds – Large, professionally managed group of investments – Fastest growing segment of financial services industry • Annuities – Sold by insurance companies • Self-Managed Retirement Accounts – 401(k), 403(b), IRA, Keogh Plan • Real Estate High Risk/High Return • • • • • Stocks Futures Options Penny Stocks Collectibles