CHAPTER 1

ACCOUNTING:

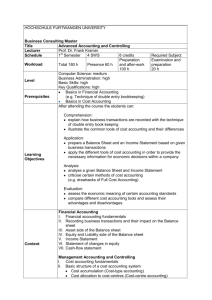

The Language of Business

CHAPTER

1

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick

Learning Objectives

After studying this chapter, you should be able to

1. Explain how accounting information assists in making decisions

2. Describe the components of the balance sheet

3. Analyze business transactions and relate them to changes in the balance sheet

4. Compare the features of sole proprietorships, partnerships, and corporations

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 2 of 43

Learning Objectives

After studying this chapter, you should be able to

5.

Identify how the owners’ equity section in a corporate balance sheet differs from that in a sole proprietorship or partnership

6. Describe auditing and how it enhances the value of financial information

7. Explain the regulation of financial reporting

8. Evaluate the role of ethics in the accounting profession

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 3 of 43

The Nature of Accounting

• Accounting is the process of identifying, recording, summarizing, and reporting economic information for decision makers

• Accountants present this information in reports called financial statements

Event

Accountant’s

Analysis and

Recording

Financial

Statements

Users

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 4 of 43

Accounting as an Aid to Decision Making

• Accounting information is useful to anyone making decisions that have economic consequences

• These decision makers include

– Managers

– Owners

– Investors

– Politicians

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 5 of 43

Financial Accounting

• Financial accounting serves external decision makers

:

– Stockholders

– Suppliers

– Banks

– Government agencies

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 6 of 43

Management Accounting

• Management accounting serves internal decision makers:

– Top executives

– Department heads

– College deans

– Hospital administrators

– Other managers within the organizations

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 7 of 43

The Annual Report

• The annual report is prepared by management and informs investors about the company’s past performance and future prospects

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 8 of 43

The Annual Report

• The annual report includes

– A letter from corporate management

– Management discussion and analysis

– Footnotes explaining many elements of the financial statements in more detail

– The report of the independent auditors

– A statement of management’s responsibility for preparation of the financial statements

– Other corporate information

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 9 of 43

The Annual Report

• A company’s financial statements can also be found in Form 10-K, which it files annually with the Securities and Exchange Commission

• The three major financial statements are the

– Balance sheet

– Income statement

– Statement of cash flows

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 10 of 43

The Annual Report

• The balance sheet focuses on the financial position of a company on a particular day

• The income statement and cash flow statement focus on the company’s performance over time

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 11 of 43

The Balance Sheet

• The balance sheet (also called the statement of financial position) shows the financial status of a company at a particular instant in time

• The left side lists the resources of the firm

• The right side lists the claims against those resources

Assets= Liabilities + Owners’ equity

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 12 of 43

The Balance Sheet

• Assets are economic resources that the company expects to help generate future cash inflows or reduce or prevent future cash outflows

– Examples: Cash, inventories, equipment

• Liabilities are economic obligations of the organization to outsiders (creditors)

– Example: A debt to a bank in the form of a note payable

• Owners’ equity is the owners’ claim on the organization’s assets

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 13 of 43

The Balance Sheet

• Open account – the practice of making most purchases on a credit basis instead of cash basis

• Accounts receivable are assets that result from the sale of goods or services on open account

• Accounts payable are liabilities that result from a purchase of goods or services on open account

• Inventories are assets held by the company for the purpose of sale to customers

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 14 of 43

Balance Sheet Transactions

• Every transaction of a company or entity affects the balance sheet equation

– An entity is an organization that stands apart from other organizations and individuals as a separate economic unit

– A transaction is any event that affects the financial position of an entity and that can reliably recorded in money terms

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 15 of 43

Balance Sheet Transactions

• An account is a summary record of the changes in a particular asset, liability, or owners’ equity item

• The double-entry accounting system records each transaction in at least two accounts

• A compound entry affects more than two balance sheet accounts

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 16 of 43

Balance Sheet Transactions

Transaction 1: Initial Investment of $400,000

Assets = Liabilities + Owners’ Equity

Cash Lopez, Capital

(1) + $400,000 = +$400,000

(Owner Investment)

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 17 of 43

Balance Sheet Transactions

Transaction 2: Loan of $100,000 from Bank

Assets = Liabilities + Owners’ Equity

Cash Note payable Lopez, Capital

(1) + $400,000 = +$400,000

(2) + $100,000 = + $100,000

Bal. $500,000 = $100,000 $400,000

$500,000 $500,000

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 18 of 43

Balance Sheet Transactions

Transaction 3: Acquire Store Equipment for Cash, $15,000

Assets = Liabilities + Owners’ Equity

Cash Store Equipment Note payable Lopez, Capital

Bal. $500,000 = $100,000 $400,000

(3) -15,000 +15,000 =

Bal. 485,000 15,000 = 100,000 400,000

$500,000 $500,000

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 19 of 43

Preparing the Balance Sheet

Biwheels Company

Balance Sheet January 3, 20X2

Assets Liabilities and Owners’ Equity

Cash $485,000 Liabilities (note payable) $100,000

Store equipment 15,000 Lopez, capital 400,000

Total assets $500,000 Total liabilities and owners’ equity $500,000

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 20 of 43

Types of Ownership

• Sole proprietorship – a business with a single owner

• Partnership – an organization that joins two or more individuals who act as co-owners

• Corporation – a business organization created under state laws in the Unites States

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 21 of 43

Corporation

– Publicly owned corporation – A corporation owned by the public through the sale of shares; it may have thousands of owners

– Privately owned corporation – A corporation owned by families or a small group of shareholders; shares are not publicly sold

– Corporation stockholders have limited liability

• Creditors have claims against the corporation assets only, not the personal assets of the owners

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 22 of 43

Advantages and Disadvantages of the Corporate Form

• Advantages

– Limited liability

– Easy transfer of ownership

– Ability to raise capital from hundreds or thousands of potential stockholders

– Continuity of existence

– Prestige

• Disadvantages

– Unfavorable tax laws

– Regulation

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 23 of 43

Accounting Differences Among

Legal Forms

• Proprietorships and partnerships

– Owners’ equities are labeled capital

– Owners’ equities are recorded in the capital account

• Corporations

– Owners’ equities are labeled stockholders’ equity or shareholders’ equity. Total capital investment is called paid-in capital

– Owners’ equity is recorded in two parts:

• Common stock at par value

• Paid-in capital in excess of par value

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 24 of 43

The Meaning of Par Value

• Par value (or stated value) – the dollar amount printed on the stock certificate

• Paid-in capital in excess of par value (or additional paid-in capital) – the difference between the total amount the company receives for the stock and the par value

• Common stock is recorded at the par value

• Common shareholders are owners who have a

“residual” ownership in the corporation through the purchase of common stock

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 25 of 43

Stockholders and the

Board of Directors

• Shareholders elect a board of directors to look out for their interests

• Members of a board often include CEOs and presidents of other corporations; university presidents and professors; attorneys; and community representatives

• The chairman of the board may also be the top manager, the chief executive officer (CEO)

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 26 of 43

Stockholders and the

Board of Directors

• The board’s duty is to ensure that managers act in the interest of shareholders

• When boards do their duty in monitoring management, the corporate form of organization is effective

Board of Directors Managers Stockholders

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 27 of 43

Credibility and the Role of Auditing

• The separation of owners and managers creates potential problems in getting truthful information about the performance of a company

• Shareholders must rely on managers to tell the truth

• The auditor examines the information that managers use to prepare the financial statements and provides assurances about the credibility of those statements

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 28 of 43

The Certified Public Accountant and the Auditor’s Opinion

• Third party assurance about the credibility of financial statements is provided by audit professionals called Certified Public

Accountants (CPAs)

• CPAs are public accountants who offer services including auditing, preparing income taxes, and management consulting to the general public on a fee basis

• Each state has a Board of Accountancy that sets standards of both knowledge and integrity

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 29 of 43

The Certified Public Accountant and the Auditor’s Opinion

• An audit is an examination of a company’s transactions and the resulting financial statements

• The auditor’s opinion describes the scope and results of the audit and a judgment that the financial statements prepared by management are accurate

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 30 of 43

The Accounting Profession

• Public accountants offer services to the general public for a fee

• Private accountants work for businesses, government agencies, and other nonprofit organizations

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 31 of 43

Public Accounting Firms

• The four largest public accounting firms are

– Deloitte Touche Tohmatsu

– Ernst & Young

– KPMG International

– PricewaterhouseCoopers

• 97% of the firms listed on the NYSE are clients of these four firms

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 32 of 43

Public Accounting Firms

• Each firm has annual billings in excess of $1 billion

• All firms must follow generally accepted accounting principles (GAAP)

– The broad concepts and detailed practices of preparing and distributing financial statements

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 33 of 43

Standard-Setting Bodies

• The Financial Accounting Standards Board

(FASB) is responsible for establishing GAAP in the United States by issuing FASB Statements

• The Securities and Exchange Commission

(SEC) is responsible for authorizing the GAAP for companies whose stock is held by the general investing public

• The FASB and SEC work closely together and seldom have public disagreements

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 34 of 43

Standard-Setting Bodies

• The International Accounting Board (IASB)

– Is responsible for developing high quality, understandable and enforceable global accounting standards

– Has 12 full-time and 2 part-time members

– Standards will be adopted by the European Union for financial statements prepared after 2005

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 35 of 43

Standard-Setting Bodies

• The American Institute of Certified Public

Accountants (AICPA) is the principal professional association in the private sector that regulates the quality of the public accounting profession

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 36 of 43

Sarbanes-Oxley Act

• Established the Public Company Accounting

Oversight Board to regulate public accounting and to set standards for audit procedures through the issuance of generally accepted auditing standards (GAAS)

• Prohibits public accounting firms from providing audit clients with certain non-audit services

• Requires rotation every 5 years of the lead audit or coordinating partner and the reviewing partner on an audit

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 37 of 43

Sarbanes-Oxley Act

• Provides regulation of corporate governance

– Requiring boards to appoint an audit committee composed only of “independent” directors

– Requiring CEOs and chief financial officers (CFOs) to personally sign a statement certifying the appropriateness and fairness of their companies’ financial statements

– Increasing criminal penalties for knowingly misreporting financial information

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 38 of 43

Professional Ethics

• Members of the AICPA must abide by a code of professional conduct

• The Institute of Management Accountants has a code of ethics for management accounts

• Auditors and management accountants have professional responsibilities concerning competence, confidentiality, integrity, and objectivity

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 39 of 43

Professional Ethics

• Ethical standards are personal and depend on the values of the individual

• A successful manager must recognize the ethical dimensions of a situation and act with absolute integrity

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 40 of 43

Professional Ethics

• Despite the criticism of accounting ethics, accountants were responsible for revealing the problems in many of the recent corporate scandals

• Companies often rely on accountants to safeguard the ethics of the company

• WorldCom and Enron whistle-blowers became two of the three 2002 Persons of the Year in

Time magazine

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 41 of 43

Career Opportunities for Accountants

• Accounting provides an excellent training ground for future managers and executives

• More CEOs started out in finance or accounting than any other area

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 42 of 43

Nonprofit Organizations

• Fundamental accounting principles also apply to nonprofit organizations

• The Governmental Accounting Standards

Board (GASB) regulates disclosures for governmental organizations

• The FASB regulates financial reporting for other nonprofit organizations

© 2006 Prentice Hall Business Publishing Introduction to Financial Accounting, 9/e Horngren/Sundem/Elliott/Philbrick 43 of 43