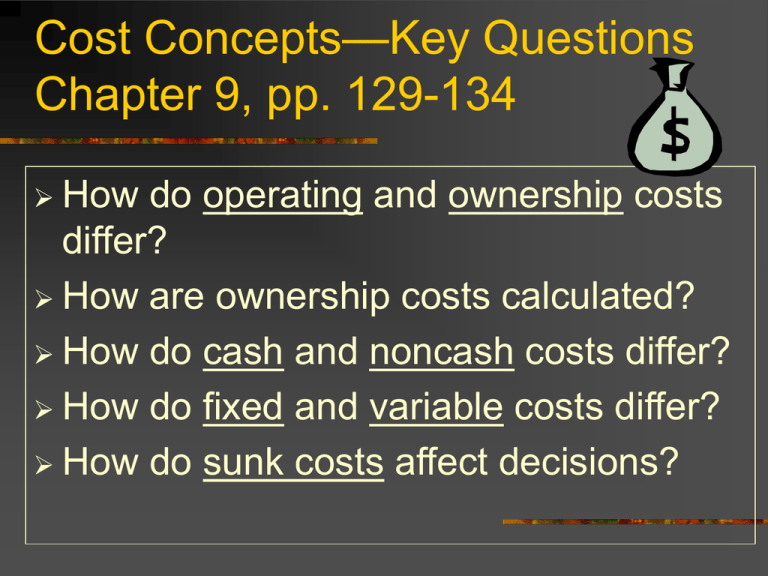

Fixed and Variable Costs

advertisement

Cost Concepts—Key Questions Chapter 9, pp. 129-134 How do operating and ownership costs differ? How are ownership costs calculated? How do cash and noncash costs differ? How do fixed and variable costs differ? How do sunk costs affect decisions? Operating Costs Cost of goods or services that are used up in one production cycle Seed, fertilizer, fuel, wages, rent, repairs, feed, etc. Ownership Costs Costs of goods that last more than one production cycle Machinery Equipment Breeding livestock Land “Capital Assets” Tractor Ownership Costs (pages 403 – 405) Current value = $50,000 Expected value in 10 years = $12,000 Depreciation: (current value - salvage value) years owned ($50,000 - $12,000) / 10 years = $3,800/ yr Interest: current value x interest rate $50,000 x 7% = $3,500 / year Insurance and taxes: 1% of current value 1% x $50,000 = $500 per year What Interest Rate to Use? Use weighted average cost of capital Example: $30,000 is owed on the tractor, at 9 % interest (60% debt capital) $20,000 of equity capital that could earn 4% in a savings account (40% equity) Cost of capital = (.60 x 9%) + (.40 x 4%) = 5.4% + 1.6% = 7.0% Average Ownership Costs over the Entire Ownership Period Depreciation is the same (50,000 – 12,000) / 10 = $3,800 per year Interest is based on average of beginning value and ending value Average value =(50,000+12,000) / 2= $31,000 Interest = 7 % x $31,000 = $2,170 per year Insurance & taxes = 1% x $31,000 = $310 Use this method for analyzing long-term investments. Average Ownership Costs Over Ownership Period $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 Depreciation Interest Ins & txs $0 1 2 3 4 5 6 7 8 9 10 Age Building Ownership Costs Depreciation (assume zero salvage value) $100,000 current value, 25 year life $100,000 / 25 yr. = $4,000 per year Interest (on current value) 7% x $100,000 = $7,000 / year Taxes and insurance (current) 1% x $100,000 = $1,000 / year Repairs.& maintainance.: 2-4% of value 3% x $100,000 = $3,000 / year Average Interest Cost over Life Average value of building = ($100,000 + 0) / 2 = $50,000 Interest cost = 7% x $50,000 = $3,500 Fixed and Variable Costs Variable costs occur only if a certain action is taken. Vary by acres or head produced. Fixed costs occur regardless of whether an action taken is taken or not, or how many units are produced. Fixed and Variable Costs Operating costs are usually variable. Ownership costs are usually fixed (at least in the short run) In the long run, ownership costs can be variable, also. Economic Principle If gross revenue exceeds variable costs, profit will be increased (or losses decreased) by producing. That is, when gross margin > 0 Example: Finishing Feeder Pigs Variable costs: feeder pig feed operating labor total v.c. Fixed costs (bldg, equip) Total costs $37.00 39.00 7.00 4.00 $ 87.00 $ 13.00 $ 100.00 Profit (250 lb. pig) Price $.44 $.36 $.28 Revenue $110 $ 90 $ 70 Produce $10 -$10 -$30 Do not -$13 -$13 -$13 Variable cost breakeven = $87 / 250 lb. = $.35 per lb. Higher Cost Facilities, Perm.Labor Variable costs: feeder pig $37.00 feed 36.00 operating + labor 5.00 total v.c. $ 78.00 Fixed costs (bldg, equip) $ 22.00 Total costs $100.00 V.C. breakeven = $78 / 250 lb. =$.31 Economic Principle If a higher proportion of a farm’s costs are fixed, it will continue to produce even at a lower price. Cash and Noncash Costs Cash Costs Seed, fertilizer, pesticides Fuel and repairs Hired labor Cash rent Interest on loans Etc. Noncash Costs Depreciation Opportunity Costs unpaid labor net worth capital feed produced on the farm Diminishing Returns Chapter 7 (pages 101-112) In an agricultural production process, how does adding more units of input change the units of output? How is the most profitable level of input use determined? Gary Burrack, Farmersburg: “I always thought that if you got too much nitrogen on, the yield stayed level. What really fascinates me is that corn yields peak at moderate nitrogen rates and come down at very high nitrogen application rates.” Corn Yield Response to Nitrogen Yield, Bu... Lb.N applied per acre 20 0 16 0 12 0 80 40 0 160 150 140 130 120 110 100 Law of Diminishing Marginal Returns As more units of input are used, output will increase. The rate of increase in output will eventually decline. It may even become negative at high levels of input. This response is due to biological limitations. Yield Response to Nitrogen Lb.of N per acre 0 Corn yield Value of bu/acre corn @$2 Cost of N @$.20 Net return over N cost 103 $206 $0 $206 40 128 $256 $8 $248 80 148 $296 $16 $280 120 154 $308 $24 $284 160 156 $312 $32 $280 200 153 $306 $40 $274 Definitions Marginal Product--Amount of added product for each unit of added input. Depends on biological factors. Marginal Revenue--Value of the marginal product. Depends on product selling price. Marginal Cost--Cost of additional input. Depends on purchase price of input. Example: Add N to Corn Increase N application from 0 to 40 lbs/ac Cost of N is $.20 per lb. Marginal cost = 40 lb. X $.20 = $8.00 Corn yield increases from 103 to 128 bu/a Marginal product = 128 – 103 = 25 bu. Price of corn is $2.00 per bu. Marginal Revenue = 25 bu. X $2.00 = $50.00 Yield Response to Nitrogen Lb. N Yield Marginal Marginal Marginal Per Corn Product Revenue Cost acre Bu/a Bu/acre Corn @$2 N @$.20 0 103 40 128 80 148 120 160 200 154 156 153 25 bu $50 > $8 20 bu $40 > $8 6 bu $12 > $8 2 bu $4 < $8 -3 bu -$6 < $8 Profit Maximization Rules As long as MR > MC, use more input. When MR < MC, do not use more input. Where MR = MC, profit is maximized. Other examples of diminishing marginal returns in agriculture? Diminishing Marginal Returns: Cattle Feeding $0.80 $0.75 $0.70 Price Cost of gain $0.65 $0.60 $0.55 $0.50 1050 1100 1150 1200 1250 1300 weight Go Beat the Hawks! ! Sunk Costs As the production cycle progresses,more and more costs become sunk. Sunk costs no longer affect decision making in the short run (within the production cycle)