2021 Practice Exam 1-4 - AC211M-CCSU

Practice exam for ACG 2021 Chapters 1-4

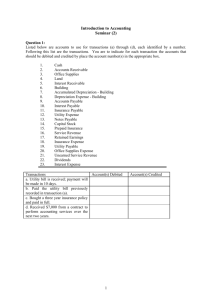

1. Indicate below whether each of the following accounts is a Current Asset (CA), Investment

(INVT), Property, Plant, & Equipment (PPE), Intangible Asset (IA), Current Liability (CL), Longterm Liability (LTL), Contributed Capital (CC), Retained Earnings (RE), a Revenue (R), Cost of

Goods Sold (COGS), Operating Expenses (OE), Other Revenues & Expenses (ORE), or Income

Taxes Expense (ITE) AND indicate below whether each account would be shown on the income statement (IS), a statement of retained earnings (RE), or the balance sheet (BS). Hint: some accounts may be on more than one Financial Statement.

CA, INVT, PPE, IA, CL, LTL, CC, RE,

R, COGS, OE, ORE, ITE

IS, RE, BS ACCOUNT

Automobile

Accounts payable

Cash

Sales Returns and Allowances

Dividends

Fares Earned

Rent Expense

Utilities Expense

Supplies

Retained Earnings

Sales

Delivery Expense

Interest Expense

Unearned Revenue

Cost of Goods Sold

Depreciation Expense

Accumulated Depreciation

Trademark

Marketable Securities

Investment held more than 1 year

2. Using T-accounts for: Accounts payable, Cash, Common stock, Dividends, Rent expense, Repair equipment, Repair fees earned, Salaries expense, and Supplies; record the following transactions for the month of June directly into the T-accounts. Use the letter to identify the transaction.

Determine the balance in each account. a. Michelle D. opened the Eastmoor Repair Service by investing $4,300 in cash and $1,600 in repair equipment for shares of common stock. b. Paid $400 for current month's rent. c. Purchased repair supplies on credit, $500. d. Purchased additional repair equipment for cash, $300. e. Paid salary to a helper, $450. f. Paid $200 of amount purchased on credit in c. g. Paid $600 dividends from business. h. Accepted cash for repairs completed, $860.

3. Prepare the year-end adjusting entries for each of the following: a. Office Supplies had a balance of $168 on January 1. Purchases debited to Office Supplies during the year amount to $830. A year-end inventory reveals supplies of $570 on hand. b. Depreciation of office equipment is estimated to be $4,260 for the year. c. Property taxes for six months, estimated at $1,750, have accrued but have not been recorded. d. Unrecorded interest receivable on U.S. government bonds is $1,700. e. Unearned Revenue has a balance of $1,800. Services for $600 received in advance have now been performed. f. Services totaling $400 have been performed; the customer has not yet been billed.

4. Arrange the following activities in the correct order: a. The transactions are entered in the journal. b. The financial statements are prepared. c. The transactions are analyzed from the source documents. d. The accounts are adjusted. e. The closing entries are prepared. f. The transactions are posted to the ledger.

5. Using the following T-accounts: Cash, Accounts payable, Accounts receivable, Common stock,

Prepaid rent, Hauling revenue, Truck, Gasoline expense; record the following transactions. Label each entry with the appropriate letter. a. Owner contributed cash of $5,000 and a truck worth $6,000 into the business in exchange for common stock. b. Paid two months' rent in advance, $300. c. Agreed to do a hauling job for a price of $800. d. Performed the hauling job. e. Received payment of $250 on the hauling job. f. Purchased gasoline on credit, $20.

6. The Janeway Company had a balance of $180,000 in Retained Earnings on December 31, 20X1.

During 20X2, the company had a net income of $15,000, and dividends of $12,000. Prepare the company's statement of retained earnings for the year ended December 31, 20X2.

7. Use the following information to calculate at, or for the year ended, December 31, 20XX (a) cash,

(b) net income, (c) retained earnings, and (d) total assets.

Salaries expense $4,000 Commissions Earned

Accounts payable $7,000 Retained Earnings December 31, 20XX

$20,000 c= ?

Dividends $6,000 Utilities expense

Accounts receivable $8,000 Inventories

Cash

Net income

Total assets a= ? Salaries Payable b= ? Retained Earnings January 1, 20XX d= ? Common stock

$2,000

$22,000

$1,000

$25,000

$1,000

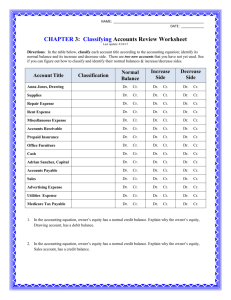

8. Selected ledger accounts used by Metromedia Advertising are listed along with identifying numbers. Following the list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited by placing the appropriate account numbers in the space provided.

1 Cash

2 Accounts receivable

3 Office supplies

7 Accounts payable 12 Fees earned

8 Mortgage payable 13 Salaries expense

9 Unearned fees 14 Office supplies expense

4 Prepaid insurance

5 Office equipment

6 Accumulated depreciation

10 Common stock 15 Insurance expense

11 Dividends 16 Rent expense

17 Depreciation expense

Transactions:

Paid rent on building.

Received an advance payment from a client for services to be rendered over next six months.

Account(s) debited

Account(s) credited

Paid salaries of employees

Bought a three-year insurance policy and paid in full.

Performed services for a client; received part of fee in cash, remainder to be collected in 30 days.

Purchased office equipment. Paid part in cash, balance payable in 60 days.

Purchased a large amount of office supplies on credit.

The owners invested cash in the corporation and received stock.

Made an adjusting entry for the portion of the insurance premium which has expired.

Paid off office supplies purchased earlier.

Made an adjusting entry for depreciation.

Made an adjusting entry for office supplies used during this period.

Made an adjusting entry to recognize that a portion of the fee received in advance had been earned.

9. Prepare year-end adjusting entries for each of the following situations: a. The Store Supplies account showed a beginning balance of $100 and purchases of $700. The ending balance was $200. b. Depreciation on buildings is estimated to be $4,200. c. A one-year insurance policy was purchased for $1,800. Nine months have passed since the purchase. d. Accrued interest on notes payable amounted to $50. e. The company received a $2,400 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed. f. Payroll for the five-day workweek, to be paid on Friday, is $2,500. The last day of the period is a

Tuesday. g. Services totaling $360 had been performed but not yet received or recorded.

10. What are the four closing journal entries and in what order do you prepare them?

11. What date are adjusting and closing entries prepared?

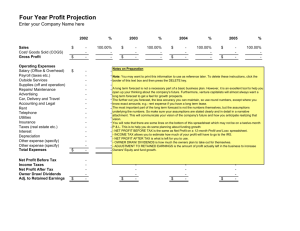

12. Prepare the closing journal entries from the following Adjusted Trial Balance?

Accounts Payable

Accounts Receivable

Accumulated Depreciation

Building

Cash

Common Stock

Depreciation Expense

Design Income

Dividends

Income Taxes Expense

Income Taxes Payable

Office Supplies

Office Supplies Expense

Prepaid Rent

Rent Expense

Unearned Income

Utilities Expense

Wages Expense

Wages Payable

Total

$50,000

$163,200

$220,480

$3,000

$28,000

$8,000

$36,600

$15,400

$16,000

$16,000

$6,800

$55,200

$618,680

13. List the formula for the following ratios. State if ratio an indicator of Liquidity, Profitability, or

Long-term Solvency.

Working Capital

Current Ratio

$62,800

$3,000

$400,000

$136,000

$8,000

$1,680

$7,200

$618,680

Profit Margin

Asset Turnover

Return on Assets

Return on Equity

Debt to Equity

14. What is the format of a Classified Balance Sheet?

15. What is the format of a Multi-step Income Statement?

16. What is the format of a Single-step Income Statement?

Chapter 3 Suggest P2 on page 220…both months

Chapter 4 Suggest SE 6,7,8,9,10, and E 5,7.