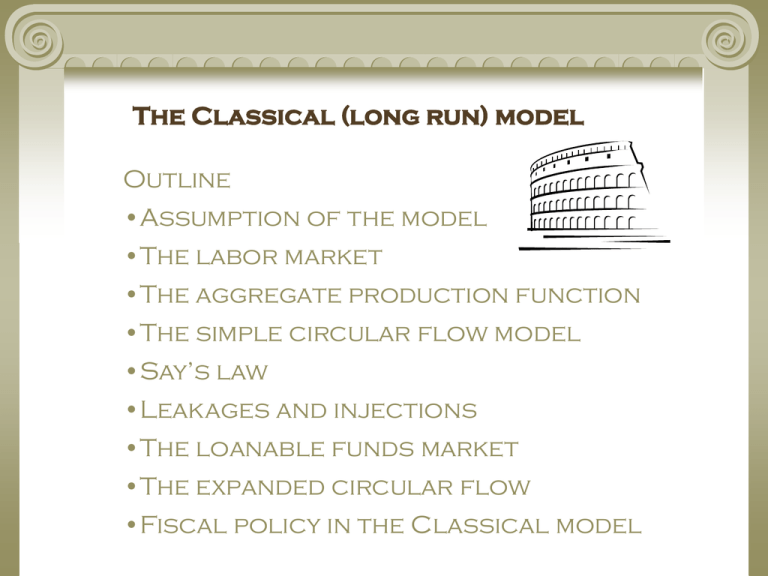

The Classical (long run) model

advertisement

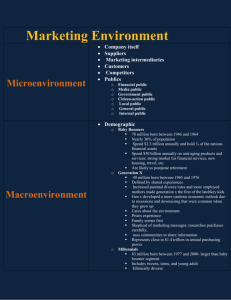

The Classical (long run) model Outline •Assumption of the model •The labor market •The aggregate production function •The simple circular flow model •Say’s law •Leakages and injections •The loanable funds market •The expanded circular flow •Fiscal policy in the Classical model The Classical model dominated the economics profession prior to the publication of the General Theory of Employment, Interest, and Money by J.M. Keynes in 1936 The Classical view: Laissez faire All would be for the best if we would just leave well enough alone. Assumption of the Classical Model: Markets Clear •Prices in markets converge quickly to their equilibrium value. •ALL markets clear— markets for goods, factors of production , and loanable funds S P* D 0 Q* Quantity The issues 1. How is total employment determined? 2. How is total Output determined? 3. What role does spending play in the determination of employment and output? 4. What happens when things change? Think of the Classical model as an application of the principles of supply and demand to the problem of total employment and total output.We see this coming next with the labor market The Classical Labor Market Let •LS denote the supply of labor, which is presumed to be a positive function of the real wage. •LD denote the demand for labor, which is presumed to be a negative (or inverse) function of the real wage. As the real wage increases, the opportunity cost of leisure rises as well. Hence, people substitute work for leisure. Plato’s Vineyard (1) (2) (3) (4) (5) = (3) • (4) Output (Units) Marginal Output (Units) Price per Unit ($) Value of Marginal Output ($) Number of Workers 0 --- 0 $0.25 $0.00 1 70 70 $0.25 17.50 2 135 65 $0.25 15.25 3 187 52 $0.25 13.00 4 222 36 $0.25 9.00 5 238 16 $0.25 4.00 Diminishing Returns Plato’s I couldn’t afford to pay more than $15.25 for the second worker LD $17.50 $15.25 0 1 2 Number of workers Real Hourly Wage The Classical Labor Market Excess Supply for Labor $20 LS B A 15 E H 10 Excess Demand for Labor 0 J 100 million = Full Employment LD Number of Workers According to the Classical view, the economy will achieve full employment naturally—that is, on its own. The Aggregate Production Function •This function shows the relationship between total output (or real GDP) and employment, holding all other factors constant •Factors held constant include: Land, capital, and technology. Output (dollars) The Aggregate production function Aggregate Production Function $7 Trillion = Full Employment Output 0 Recall this was determined in the labor market 100 million Number of Workers Goods and Services Purchased Households $Consumption Spending Goods Markets $Income Factor Markets The Circular Flow $Firm Revenues Goods and Services Sold Resources Sold $Factor Payments Firms Resources Purchased Say’s Law •“Supply creates its own demand.” •By producing goods and services, firms create a total demand for goods and services equal to what they have produced. Say’s law apparently rules out the possibility of a widespread glut of goods. Spending in a more realistic economy 1. Household don’t spend all their income. Rather, some is saved and some goes to pay taxes. 2. Households are not the only spending units. Firms and government units buy new goods and services too. 3. In addition to goods and factor markets, there is a loanable funds market where saving is made available to borrowers. Leakages •Income received by households but not spent for new domestically produced goods and services in a year. •Leakages include saving (S) and Net Taxes (T) •Net Taxes (T) are equal to total taxes minus transfer payments Injections •Spending in the domestic goods market by agents other than domestic households. •Injections include planned investment and government expenditure. •Total investment spending has a planned (Ip) and an unplanned component. Aesop’s Bottles B.C. 400 Investment Plans Planned spending on buildings, equipment, and tools 20,000 drachmas Planned inventory investment 0 drachmas Value of inventories on Dec. 31, 401 B. C. 11,000 drachmas Value of inventories on Dec. 31, 400 B.C. 13,500 drachmas Unplanned inventory investment in 400 B.C. 2,500 drachmas Actual investment in 400 B.C. 22,500 drachmas Leakages and injections in classica T ($1.25 Trillion) G ($2 Trillion) IP ($1 Trillion) $7 Trillion $7 Trillion C ($4 Trillion) Total Output Total Income G ($2 Trillion) IP ($1 Trillion) C ($4 Trillion) Total Spending