Chapter Title

10-1

Adapted by Cynthia Fortin, CPA, CMA

Introduction to Managerial Accounting, Brewer,

Garrison,Noreen

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

http://video.wileyaccountingupdates.com/20

11/03/29/incremental-analysis-andmanagements-decision-making-process/

10-2

10-2

Costs and benefits that differ between alternatives

Costs that are avoidable

10-3

10-3

10-4

Incremental : added costs or revenues

Differential : difference of costs and revenue between alternatives

10-4

1.

only on relevant costs

2. Ignore sunk costs and future costs and benefits that do not differ between the alternatives.

10-5

10-5

3. Consider qualitative information is vital to decision-making.

10-6

10-6

10-7

Costs that are relevant in one decision situation may not be relevant in another context.

10-7

10-8

Each decision situation requires the manager to examine the data at hand and isolate the relevant costs.

10-8

10-9

1. Only rarely will enough information be available to prepare detailed income statements for both alternatives.

10-9

10-10

2. Mingling irrelevant costs with relevant costs may cause confusion and distract attention away from the information that is really critical .

10-10

10-11 or

1. Calculate Contribution margin that would disappear if segment is dropped . Put results as negative.

2. Calculate fixed costs that would disappear if segment is dropped.

3. Add (1) to (2). If result is negative

4. Evaluate significant qualitative consequences.

10-11

10-12 or

1. Calculate Contribution margin that would disappear if segment is dropped. Put results as negative.

2. Calculate fixed costs that would disappear if segment is dropped.

3. Add (1) to (2). If result is negative

4. Evaluate significant qualitative consequences.

10-12

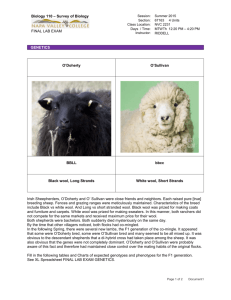

The management of Bayside Company is considering whether one of the departments in its retail stores should be eliminated.

The contribution margin in the department is $150,000 per year.

Fixed expenses allocated to the department are $130,000 per year .

It is estimated that $120,000 of these fixed expenses will be eliminated if the department is discontinued.

Part (a)

Which costs are irrelevant to this decision?

The common fixed costs of $10,000 (or

$130,000 - $120,000) are irrelevant to this decision.

10-13

10-13

Part (b)

If the department is eliminated, what will be the impact on the company’s overall net operating income?

CM that would be lost if department is discontinued $(150,000)

Less fixed costs that can be avoided if department is discontinued 120,000

Increase (decrease) in net operating income (30,000)

Based on this information alone, because the company’s net operating income would decrease by $30,000 per year, management should this department.

10-14

10-14

10-15

Outsourcing :

• Purchasing goods or services from outside vendor or supplier.

Insourcing :

• Producing goods or services within an organization

• May require expanding to increase capacity

10-15

10-16

1. Calculate total amount to pay supplier.

2. Calculate total differential costs if company chooses to make.

3. Calculate difference between the 2 options.

4. Select lowest cost option.

5. Analyze qualitative factors

10-16

10-17

• Logistical considerations

distance from plant

10-17

•

Dependance on supplier can increase risk:

10-18

10-18

10-19

10-19

10-20

Idle space (caused by outsourcing) that has no alternative has an opportunity cost of $ 0.

10-20

10-21

• No longterm implications

• There is existing idle capacity

• Usually the price is lower than the regular product

•There are variable and fixed relevant costs incurred

10-21

10-22

•Company must decide if the decision creates incremental net operating income

• Fixed costs are sunk costs, therefore irrelevant

• Absorption costing is not appropriate in the decision

10-22

1.

Calculate total revenue generated by special order

2.

Calculate total incremental costs

3.

3. (1) – (2) => if positive

accept

the order

10-23

10-23

4. Will this impact regular customers?

5. Is there potential future business?

10-24

10-24

10-25

Effectively managing the constraint is the key to success .

10-25

10-26

1. Identify the weakest link.

2. Allow the weakest link to set the tempo.

Only actions that strengthen the weakest link in the “ chain ” improve the process.

3. Focus on improving the weakest link.

4. Recognize that the weakest link is stronger.

10-26

10-27

1.

Calculate each product’s Contribution

Margin (CM) per unit.

2.

Identify constraining resource and the quantity of that resource that is consumed by the unit.

3.

Divide (CM) by unit of constrained resource.

10-27

10-28

4.

Rank products from highest CM to lowest CM.

5.

The CM must be viewed in relation to the amount of the constrained resource each product requires.

10-28

10-29

Increase the capacity of a bottleneck, called relaxing constraint, such as:

1. Working overtime on the bottleneck.

2. Subcontracting some of the processing that would be done at the bottleneck.

3. Investing in additional machines at the bottleneck.

10-29

10-30

4 . Shifting workers from non-bottleneck processes to the bottleneck.

5. Focusing business process improvement efforts on the bottleneck.

6. Reducing defective units processed through the bottleneck.

10-30

10-31

Colonial Heritage makes reproduction colonial furniture from select hardwoods.

Selling price per unit

Chairs Tables

$80 $400

Variable cost per unit $30 $200

Board feet per unit 2 10

Monthly demand 600 100

The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. Is this enough hardwood to satisfy demand?

a. Yes b. No

10-31

10-32

Colonial Heritage makes reproduction colonial furniture from select hardwoods.

Chairs Tables

Selling price per unit $80 $400

Variable cost per unit $30 $200

Board feet per unit

Monthly demand

2

600

10

100

The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. Is this enough hardwood to satisfy demand?

a. Yes b. No (2

600) + (10

100 ) = 2,200 > 2,000

10-32

10-33

Selling price per unit

Chairs Tables

$80 $400

Variable cost per unit $30 $200

Board feet per unit

Monthly demand

2

600

10

100

The company’s supplier of hardwood will only be able to supply 2,000 board feet this month.

What plan would maximize profits?

a. 500 chairs and 100 tables b. 600 chairs and 80 tables c. 500 chairs and 80 tables d. 600 chairs and 100 tables

10-33

10-34

Selling price per unit

Chairs Tables

$80

Chairs Tables

Selling price $200 80 $ 400

2

Monthly demand 600

Contribution margin

10

100

30

$ 50

200

$ 200

The company’s supplier of hardwood will only be able to supply 2,000 board feet this month.

10

$ 20

What plan would maximize profits?

a. 500 chairs and 100 tables

600

Board feet required 1,200 b. 600 chairs and 80 tables

Board feet remaining 800 c. 500 chairs and 80 tables d. 600 chairs and 100 tables

10

80

10-34

10-35

As before, Colonial Heritage’s supplier of hardwood will only be able to supply 2,000 board feet this month. Assume the company follows the plan we have proposed. Up to how much should Colonial Heritage be willing to pay above the usual price to obtain more hardwood?

a. $40 per board foot b. $25 per board foot c. $20 per board foot d. Zero

10-35

10-36

The additional wood would be used to make hardwood will only be able to supply 2,000 additional wood will allow the company to earn an additional $20 of contribution margin and willing to pay above the usual price to obtain more hardwood?

profit.

a. $40 per board foot b. $25 per board foot c. $20 per board foot d. Zero

10-36

When 2 or more products are produced from a common input.

Split-off point is when the diffferent products are separated.

10-37

10-37

10-38

Joint

Input

Oil

Common

Production

Process

Gasoline

Split-Off

Point

Chemicals

Petroleum refining industry, a large number of products are extracted from crude oil: gasoline, jet fuel, home heating oil, lubricants, asphalt, and various organic chemicals.

10-38

10-39

Joint

Input

Joint costs are incurred up to the split-off point

Common

Production

Process

Oil

Gasoline

Separate

Processing

Final

Sale

Split-Off

Point

Chemicals

Separate

Processing

Separate

Product

Costs

Final

Sale

Final

Sale

10-39

10-40

Joint costs

are

irrelevant

From the split-off point they cannot be avoided

.

Joint costs are common and should not be included in making decisions

10-40

10-41

1.Sales

value if processed further minus

Sales value at the split-off point.

2. Cost of further processing beyond the split-off point.

3. (1) – (2). If positive then Process further

10-41

10-42

10-42

Chapter 10: Applying Excel

Data

Exhibit 10-6 Santa Maria Wool Cooperative

Cost of wool

Cost of separation process

Sales value of intermediate products at split-off point:

Undyed coarse wool

Undyed fine wool

Undyed superfine wool

$200 000

$40 000

$120 000

$150 000

$60 000

Costs of further processing (dyeing) intermediate products:

Undyed coarse wool $50 000

Undyed fine wool

Undyed superfine wool

Sales value of end products:

$60 000

$10 000

Dyed coarse wool

Dyed fine wool

Dyed superfine wool

$160 000

$240 000

$90 000

Enter a formula into each of the cells marked with a ? below

Example: Joint Product Costs and the Contribution Approach

Analysis of the profitability of the overall operation:

Combined final sales value

Less costs of producing the end products:

Cost of wool

Cost of separation process

Combined costs of dyeing

Profit

$ 200 000

40 000

120 000

$ 490 000

360 000

$ 130 000

Analysis of sell or process further:

Final sales value after further processing

Less sales value at the split-off point

Incremental revenue from further processing

Less cost of further processing (dyeing)

Profit (loss) from further processing

The company would be better off selling the undyed coarse wool and processing further the fine and superfine.

Coarse

Wool

$ 160 000

120 000

40 000

50 000

(10 000)

Fine

Wool

$ 240 000

150 000

90 000

60 000

30 000

Superfine

Wool

$ 90 000

60 000

30 000

10 000

20 000

10-43

10-43