credit score percentage - Mansfield University of Pennsylvania

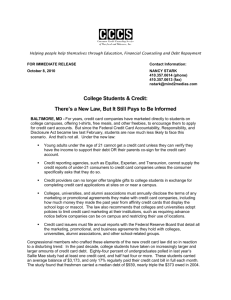

advertisement

Managing Credit Mansfield University TRiO Melissa Wise -First Citizens National Bank Credit TOPICS Credit Credit Scores Using Credit Wisely Credit Cards Credit Programs According to Citibank, “There are presently 5 to 7 million Americans who are financially overextended.” WHAT IS CREDIT? Credit is when goods, services, or money is received in exchange for a promise to pay a definite sum of money at a future date. CREDIT ADVANTAGES DISADVANTAGES Convenient Paying Useful Additional for emergencies Often required to hold a reservation Ability to purchase expensive items sooner Eliminates the need to carry large amounts of cash interest fees are common Temptation to overspend Can cause large amounts of debt Identity theft CREDIT SCORES What is a credit score or FICO® score? A prediction of how likely you are to pay your bills A number between 300 and 850 derived from many different factors A number that drives the approval of credit extensions and the interest rate you pay on those extensions CREDIT SCORE KEY FACTORS The FICO® scoring model looks at more than 20 factors in five categories. How you pay your bills (35%) Amount of money you owe and the amount of available credit (30%) Length of credit history (15%) Mix of credit (10%) New credit applications (10%) RANGE OF CREDIT SCORES The following are some basic guidelines for interpreting a credit score: 620 and below – Poor credit 621-690 – Fair credit 691-720 – Good credit 721-750 – Good to excellent credit 751-800 – Excellent credit 801 and above – Nearly perfect credit Fair Isaac reports that the American public’s credit scores break out along these lines: CREDIT SCORE PERCENTAGE 499 and below 500-549 550-599 600-649 650-699 700-749 750-799 800 and above 2 percent 5 percent 8 percent 12 percent 15 percent 18 percent 27 percent 13 percent THINK OF YOUR CREDIT REPORT AS A SECOND RESUME! A credit report contains information about where you work, live, how you pay your bills, whether or not you have filed bankruptcy and even if you have ever been arrested or sued. You can check your credit score for free up to three times annually at http://www.annualcreditreport.com!! USING CREDIT WISELY For decades, society has promoted the idea of “BUY NOW, PAY LATER.” This is a good concept for some types of purchases and a bad concept for many other types of purchases. USING CREDIT WISELY Good Credit Purchases Buying a house on credit is a smart move as home values rise quickly and you can gain equity through appreciation. Financing an education is a good investment in the future. Your earning potential will eventually outweigh the cost of tuition, and educational loans are usually at a very low interest rate. Buying a car can also be a good credit purchase. It is important to not get caught up in buying a car for more than you can afford. USING CREDIT WISELY Bad Credit Purchases Credit card debt and other consumer debt is the worst type of debt. Interest rates and fees on borrowing money this way will be the highest of all, mostly because there is rarely a tangible item as collateral. Financing a car for longer than the life of the vehicle can also be an unwise credit decision. CREDIT CARDS Credit cards are a great concept, but they end up bringing financial ruin to many people who do not use them properly. TIPS WHEN USING CREDIT CARDS Never use credit cards as extra money. Always allocate money from your current funds or monthly income in order to immediately payoff whatever you finance. Read the fine print on the agreement to make sure you are getting the best terms available. American consumers ages 20-29 carry an average of $5,781 in revolving debt. This would take 11 years and 4 months to pay off assuming an average interest rate of 13% and that minimum payments are made. Review… Please review these few websites before proceeding… Open and browse them for subject matter in order to use them as resources for completing some credit questions. Web Pages: http://www.federalreserve.gov/creditreports/ Read this story and draw from the examples given: http://www.themintgrad.org/learn/lifestyle-planning/real-flc-lifewith-zero-debt/ Short synopsis of why debt is costly: http://www.americasaves.org/for-savers/set-a-goal-what-to-savefor/debt-and-credit/get-out-of-debt/what-is-debt-and-why-is-toomuch-debt-costly Apply… ***Please answer these questions in 3-4 complete sentences citing the PowerPoint slide or website where the information pertaining to the question was found*** What is credit and what are the advantages/disadvantages of credit? What are credit scores and how are they determined? How can you use credit and credit cards wisely? What is the average amount of revolving debt of someone in their 20’s and why do you think this is the case? Explain. What are the key factors of a good credit management program? Last but not Least… Take the lifeValues Quiz in the link provided: http://www.smartaboutmoney.org/ToolsResources/LifeValues-Quiz.aspx Your results will educate you on your thought process when you spend your own money. Please provide some feedback and explain if you though the quiz was correct in describing your thought process during spending. (3 sentences minimum)