Analysis - UBC Blogs

advertisement

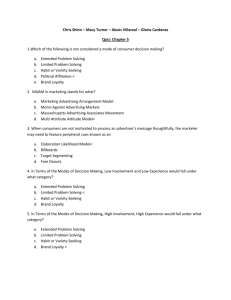

Tools Growth in short run, niche leader in long run Textbox Frame Risks Export Vertical Goal Text ABC Circle ✓ X Takeaway 1 6% CAGR Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financial Feasibility | Timeline March 16th, 2013 Presented to: By: Dominik Bundschuh, Kim Graves, Amelia Lak and Helge Ratvik Lauren Bruce – Pia Ghosh – Andy Nesta – Tim Tong Cirque du Soleil Presented to Daniel Lamarre CEO and President of Cirque du Soleil March 13, 2008 JDRC Consulting History Key Challenge Recommendations Financial Ready, Steady, Grow Presented to Bjorn Magnusson By Jedi Consulting History Key Challenge March 4th 2011 Recommendations Financial March 1st, 2013 Presented to: By: Lauren Bruce, Andy Nesta, Pia Ghosh and Tim Tong Executive Summary Mission to India Fonterra needs to develop a strategy to break into the Indian market both short-term and in the long-run, while accounting for key players Questions to consider How do you establish brand presence in India? How do you minimize industry and government reluctance? How do you match lack of supply and growing demand? Strategy Break into India with non-cooled products Co-ownership of plant with IFFCO in Nellore Develop own production in the long-run Where you want to be Capture a maximal market share in the rapdidly growing, largest dairy market in the world Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 7 Vision for Expansion Vision: Milk India’s true potential for Fonterra Break through rapid entry Strong brand presence Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline Leverage expertise in production and processing 8 How can you overcome these burdens? We need a solution that…. To account for all these barriers and capture a maximal piece of the pie, your strategy needs to fulfill several requirements: Rapid entry Strong brand presence Local support Reliable supply chain Breaking into the Indian market with strong brand presence and local support will secure Fonterra in a favorable and competitive position Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 9 Generation 2010 Fuel Breakdown Biomass Gas Oil Coal 2040 16% Need a solution that is: Clean 31% Reliable Profitable 19% Scalable 34% Biomass 67% Gas 33% Need a clean, reliable, profitable and renewable solution to achieve 2040 vision. Analysis Alternatives Recommendation Implementation Decision Criteria Clean Reduce CO2 and other emissions Reliable Flexible to match volatile demand Profitable Financially feasible Scalable Not depleted by use Scalable to match increasing population Analysis Alternatives Recommendation Implementation Recommendation 3 2 1 Enter with non-cooled products • Rapid market entry • Establish brand presence • Simplified channel system Right now Collaborate to form a coownership plant with IFFCO in Nellore • Government and industry support • Positive perception 2 - 5 years Milk the market by developing autonomous production, processing and distribution channel system in the long run • Permanent establishment as a strong market player in India 5 years onwards Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 12 Why enter with non-cooled products How? Export Quick implementation Low resource commitment Who? Middle Class Urban agglomeration Purchasing power Where? Urban centres Easier initial distribution system Product? Premium powder Less time-sensitive supply chain Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 13 Choosing cities to target middle class Goal: gain rapid entry and establish brand presence Indian Cities Within top 10 biggest Within top 10 wealthiest Near the coastline Rank Chennai ✓ ✓ ✓ 1 Pune ✓ ✓ ✓ 2 Delhi ✓ ✓ Punaji ✓ ✓ Greater Mumbai Mumbai ✓ 4 ✓ 5 ✓ 6 ✓ Chandigarh Bangalore 3 ✓ Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 7 8 14 Choosing the airports for travel retail expansion Top European Airports Total Airport Traffic (2012) Traffic CAGR % Retail EUR /Passenger Rank (mm) (2010-2012) (2012) Paris/Charles de Gaulle 60.7 (2) 5% (2) 4.15 (2) 1 London/Heathrow 69.4 (1) 4% (3) 3.71 (4) 2 Amsterdam/Schipol 49.7(4) 6% (1) 6.17 (1) 3 Frankfurt/Main 56.3 (3) 3% (4) 3.63 (5) 4 Munich 37.6 (6) 3% (4) 3.89 (3) 5 Madrid/Barajas 49.5(5) -8% (5) 3.53 (6) 6 Roma 37.4 (7) Na 1.24 (7) 7 Weight 50% 25% 25% 100% Charles de Gaulle, Heathrow, and Schipol are the most attractive airports for Toms to reach the widest international audience. Analysis Recommendation Implementation Results Short-term strategy A B C Idea in brief: • 3 year membership program • All access card to attend Cirque shows worldwide • Price: $700 Impact on company • Increase in occupancy rates • Increase in loyalty • Subsequent increase in profits Metrics for success: • 90% occupancy within two years • Increase in profits by over 10% • Sell pass to 8% of current visitors • Increase revenues for MGM History Key Challenge Recommendations Financial A brief history Revenues A B C 1980 1984 1987 future Le Grand Tour du Cirque du Soleil was a pivotal point in the company’s history History Key Challenge Recommendations Financial The Generosity Card The Generosity Card Value Proposition Compel guests Q1 Incent card usage Q2 Q3 Q4 X X Source: Paytronix, 2010 Financial goals 1. Offering a free Welcome Generosity gift to entire customers to join loyalty program. 2. Year-round automated rewards scheme. €5 gift for every €100 spent. X X X X Effective execution X X X 3. Limited time offer seasonal promotions during holidays. 3. Limited time exclusive offers for high loyalty/high profit customers. Analysis Recommendation Implementation Results Moving into new markets Largest impediment to international growth is low bargaining power with distributors Use data to eliminate the barriers Unknown geographical market demand Distributors don’t know Toms’ brands Use push tactics in markets with high likelihood to buy Use data as evidence of customer loyalty in negotiations Increase the likelihood of success in international expansions by correctly applying data Analysis Recommendation Implementation Results Prorated first year financial results Variable Costs Incremental Revenue: DKK 39.7 Million 6% 42% Fixed Costs 26% 15% 4% Revenue EBIT COGS Promotions Airport Retail Space Other Costs 1% In-store Loyalty experience Card Launch 7% Customer Loyalty Costs Analysis Recommendation Implementation Results Resulting financial strengths and synergies Travel retail Availability Sampling strategy Preference Generosity Card Loyalty Ad Campaign Awareness Experience store Familiarity Affordable luxury Personality Fun, Danish, Luxury Associations Units Incremental Revenue Incremental Costs Incremental Profits Thousand DKK Increased sales in travel retail More loyalty cards Toms’ strategies form a positive feedback loop which can achieve scalable growth 2013 19847.8 18143.6 1,704.1 2014 46,485.9 39,701.6 6,784.3 2015 53,414.5 38,329.5 15,085.0 2016 60,485.4 42,352.8 18,132.6 2017 67,703.0 46,459.6 21,243.4 The total 5 year NPV of the travel retail and loyalty programs is DKK 44.1 Million Analysis Recommendation Implementation Results Pros and Cons of Toms Sales Channels Indirect Direct CONS PROS Boutique Stores -Full control over sales displays - Gives consumers the full experience - High fixed costs - Unproven revenue generation Online Traditional Retail Travel Retail Exports Standard Exports Tailored -Low capital investment -Widespread reach -Large volume - Targets desired segments -More accommodat ing sales displays - “Traveller exclusive” -Widespread reach -Exposure to world’s largest retailers -Little leverage of brand equity - Misses impulse nature of chocolate - Low bargaining power with customers - Little consumer insight - Limited ability to be frequent customer -Low volume -Standard batches -Limited in scope - Require large orders Timeline for Action A 1994 2008 2010 2012 2014 Las Vegas United States Macao China & Tokyo Japan Dubai Middle East London Europe Singapor e SE Asia B C • Partnerships with Las Vegas Sands and Dubai World • Sold 20% equity stake to Dubai investors Cirque has already begun expansion efforts abroad while forging select partnerships Finding partnership in London comparable to MGM’s Profitability? Historical IRR Capital needed 16%+ $100-200M Value proposition to funders: High return on capital Strong history in London Opportunity to be first hub in Europe History Key Challenge A B C Partnership options: • Official City of London funding Top Choice • London Cultural Olympiad • Major Hotel Chain • E.g. InterContinental, Ritznd 2 Choice Carlton • Private Investor 3rd Choice Recommendations Financial Leveraging the ability to test markets Travel Retail Export Market • Develop customer loyalty • Create brand awareness • Uncover customer data • Direct market access • Small commitment • Market testing Traditional Retail • Established presence • Stable revenue • Frequent customer touch points 6% CAGR Toms has the ability to use each sales method as a testing platform to make successive steps towards becoming a more integrated international player Analysis Recommendation Implementation Results Recap Step 1: Non-cooled products Question Solution Outcome How will you establish brand presence in the short-term? Export non-cool products to the middle class Middle class familiarization and adoption of Fonterra products Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 26 Win-win through co-ownership Fonterra • • • • Avoid tariffs Access to farmland Gain consumer knowledge Large scale market entry with shared risks Co-op • Pooling of technology • Reliability in product quality • Gain education to improve profitability and productivity Entry barriers can be reduced through government and industry support Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 27 Co-ownership Pros • Pooling of Resources & knowledge • Large-scale market entry without high risk • Avoidance of import tariffs • Lower foreign exchange risk • Stronger government support Cons • Shared profit • Investment cost • Lack of complete control increases quality risk • Limited flexibility • Politicking with other owners 28 CONTROLING BRAND IMAGE TRADITIONAL “REAL BEAUTY” Unilever’s Brand Management Team Unilever’s Brand Management Team Dove Brand Image Dove Brand Image Consumers Consumers Consumers Consumers With Internet as a marketing channel, Unilever can no longer have full control over Dove’s brand image How will you deal with corruption? Risks Mitigation Severity Medium Corruption Likelihood Ensure strict process controls, working with all levels of government Medium 30 Risk of Uncooperative International Retail Stores Risk International Retail Stores refuse to allow Toms to increase retail space Impact Loyalty Program: Smaller rollout Travel Retail Sales: Same as before Anthon Berg Brand: Uncertain Mitigation Move to the next most attractive airport Consider sharing a 2.5% spread in margin Educate Nellore’s farmers Educate farmers on On-farm management skills Milk quality Productivity Indian Farmers Fertiliser Cooperative Limited: • 40,000 farmers Stronger acceptance 32 Controlling the value chain Dairy supply Plant Cold Star Systems Large retailers Government Approval Warehousing Push towards middle class Build Plant Strong city connections Premium positioning IFCCO farms Feasibility Study Own farms, if needed National milk quality standards Retail Distribution Analysis | 1. Enter | 2. Collaborate | 3. Milk | Financials | Timeline 33 Where the Outputs Go 2. How it works Solid Fuel Biogas Fertiliser Recycled Products Transportation Method Land transport Pipeline Solid Transport Solid Transport Channel Partner Severn Power Station Severn Power Station FCC Environment FCC Environment Destination CHP Plant CHP Plant External Site External Site Analysis Recommendation Implementation Results An acquisition strategy would favour competitors Opportunities to expand through: Acquisitions Organic Retail Growth Trend of consolidation among confectionery producers bid up prices Suitable acquisitions are scarce Acquisitions force Toms to fight a battle it cannot win Recent 2012 acquisitions compromises financial flexibility Without deep pockets like its competitors, Toms’ 5 year strategy cannot purely rely on acquisitions Analysis Recommendation Implementation Results Detailed analysis of H&M’s competitive positioning Internal External Things to leverage Things to mitigate Strengths Weaknesses • High international brand awareness • High ROIC (35%) to sustain constant new store investment • Diversified brand portfolio with high growth potential • Strategic partnerships with high profile designers • Sales stronghold in Western Europe • Top 12 organic brand – focus on green initiatives • Consistent customer experience and uniform branding across all markets • Lease locations to enable flexibility • Experienced, talented employee pool • Weak position in high-growth Asia Pacific markets • Lack of integration across offline and online channels • Product cycles that are 5x longer than best-in-class benchmark • Lack of coordination in competitor identification • Lack of recruiting strategy for business students Opportunities Threats • Trends of trading up and trading down – disappearance of the middle market • Growing importance of expression and individuality in clothing choice • Growing popularity of e-commerce and online brand interaction • Demand for innovation in product dev’t • High growth in menswear and accessories • High growth in Asia-Pacific markets • Growing trend for sustainable products • Low switching costs and low brand loyalty in retail industry • Mature to declining growth in Western Europe and North American markets • Vertical integration of competitors decreases their lead time and cost pressure • Barriers to entry are low for new designers Source: BCG analysis, Team Jedi analysis, H&M annual report 2009 36 What does the recommendation accomplish? 3 Take Off International Grow Anthon Berg in travel retail markets while preparing for international, traditional expansion in the future 2 Chart your course Loyalty program 1 Build the foundation Capture the travel retail space Goal • Use loyalty programs • Gather customer data • Leverage Toms’ existing brand equity in Anthon Berg • Use International travel Retail Stores Growth in short run, niche leader in long run Analysis Recommendation Implementation Results Consolidation a result of highly competitive industry Suppliers • Supplier size and independence • Quality control • Switching cost Buyers • Direct to consumer • Indirect (eg. through a parent) • Available information about attributes Rivalry • Highly fragmented industry • Experiencing consolidation Threat of new entrants • Low cost of entry • Suppliers accessible • Low IP involved Unattractive market force Substitute products • None • (non-branded clothing) Attractive market force Implementation Timeline Months 0 3 Preparing for expansion Secure debt or internal financing Negotiate with channel partners Submit Environmental Impact Assessment Construction and beyond Break Ground in Severn Power Complete 1st commercial plant Reduce natural gas inputs Seek additional landfills and expand construction 6 9 12 15 18 21 24 27+