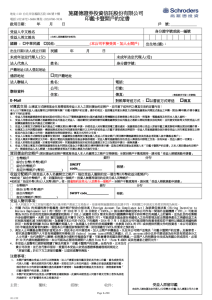

W-9 instructions

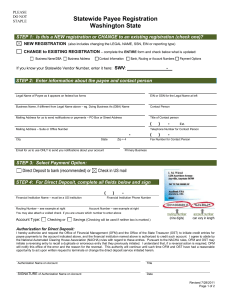

Instructions for completing a

Commonwealth of Virginia Substitute W-9 Form

.

1

2

3

4

1.

Tax Identification Number: a.

Must provide either a SSN or Federal TIN/EIN in the 9-digit blanks. If a SSN is provided, select the box for SSN Number. If an EIN is provided, select the box for EIN Number.

2.

DUNS Number: Enter your DUNS Number here, if applicable

3.

Legal Name: a.

Full legal name of individual or company. This name must be exactly what is on an individual’s Social Security card or the name a company used when it applied for a

Federal Tax Identification Number (Fed TIN) or an Employer Identification Number (EIN). b.

For a company name, the full spelling of all words should be used. Acronyms and abbreviations should only be used if they appear on documents used when applying for a

Fed TIN or an EIN. c.

For a company name, it should be clearly indicated if two words or letters are combined with no space in between. d.

For an individual, the first, middle, and last name should be included. If four names then clearly specify whether it is two last names or two middle names and also whether any names are hyphenated.

4.

Business Name: a.

If a company does business under a different name it can be included here (e.g. an alternate name appears on their invoices, or they want checks to be written out to different name). b.

Checks will only be written out to a Business Name if it matches the Fed TIN/EIN and is on the invoice, otherwise they will be issued to the Legal Name.

Документ1 1 of 4

5

Instructions for completing a

Commonwealth of Virginia Substitute W-9 Form

.

6 7

5.

Entity Type a.

Check the box that represents the federal tax classification. For Corporations and Limited

Liability Companies, make sure to also select the sub-classification box that is below those entity types.

6.

Entity Classification a.

Must check one and only one box that represents the entity classification.

7.

Exemptions: a.

You may claim exemption from backup withholding if you are a U.S. exempt payee. If applicable, you are also certifying that as a U.S. person, your allocable share of any partnership income from a U.S. trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income, and certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. b.

What is FATCA reporting? The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders that are specified United States persons. Certain payees are exempt from FATCA reporting.

Документ1 2 of 4

Instructions for completing a

Commonwealth of Virginia Substitute W-9 Form

.

8

9

10

11

12

13

8.

Legal Address: Enter your legal address, as recognized by the U.S. Postal Service.

9.

Remittance Address: a.

For payments, use the full mailing address as recognized by the U.S. Postal Service. b.

If an additional address line uses a unit indicator, the unit type should be specified

(e.g. APT, STE, BLDG, RM, etc.). c.

If the vendor is a Student, the address must be the permanent Home Address as listed in

the Student System.

10.

Name: For a company, the name of an individual should be provided.

11.

Email Address: A contact email address should be provided.

12.

Business Phone: A contact phone number should be provided.

13.

Fax Number, Mobile Phone, Alternate Phone: A fax number, mobile phone, or alternate phone number can be provided here, if applicable.

Документ1 3 of 4

Instructions for completing a

Commonwealth of Virginia Substitute W-9 Form

.

14

15 16

14. Printed Name: The individual’s name should be printed here.

15. Authorized U.S. Signature: The form must be signed in blue or black ink only or with an electronic

signature that includes a digital stamp; signatures that are typed or written in pencil will not be

accepted.

16. Date: The date the form is signed should be provided.

**

ADDITIONAL NOTES

Write legibly in pen (blue or black ink only) when completing a handwritten form.

For forms prepared on the computer, remember to sign and date the form in pen before sending

(if not using an electronic signature with digital stamp). Signature and date should be in blue or

black ink only.

If highlighting, only use a yellow colored highlighter. All other colors cause the writing to become unreadable when scanned.

Документ1 4 of 4