Exam

advertisement

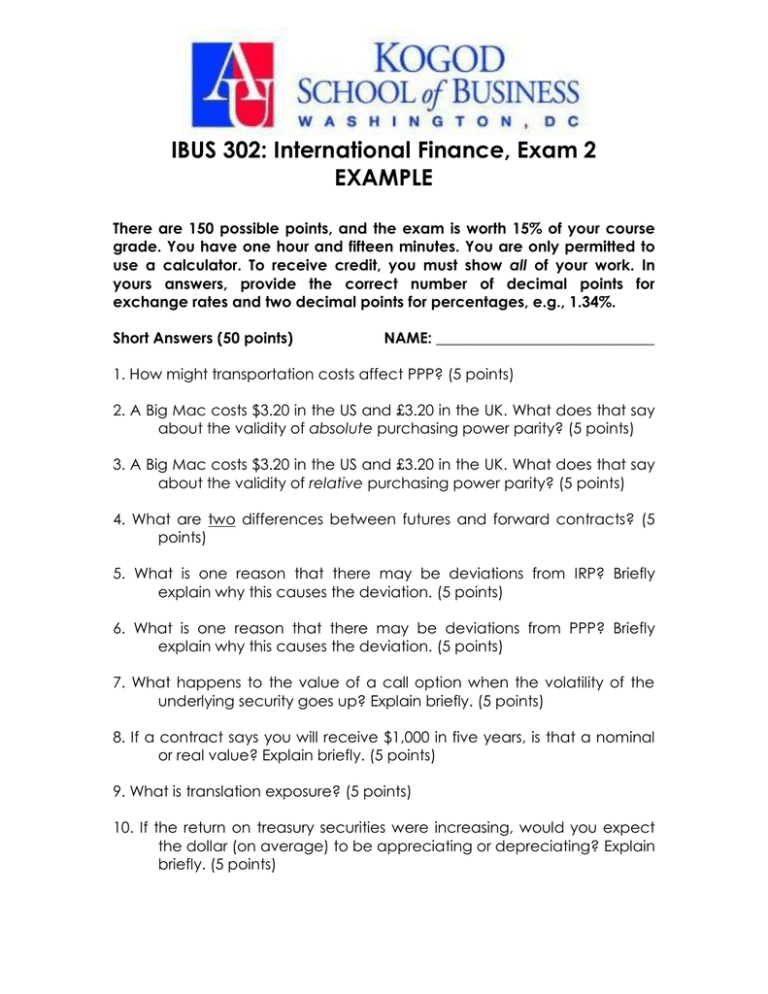

IBUS 302: International Finance, Exam 2 EXAMPLE There are 150 possible points, and the exam is worth 15% of your course grade. You have one hour and fifteen minutes. You are only permitted to use a calculator. To receive credit, you must show all of your work. In yours answers, provide the correct number of decimal points for exchange rates and two decimal points for percentages, e.g., 1.34%. Short Answers (50 points) NAME: _____________________________ 1. How might transportation costs affect PPP? (5 points) 2. A Big Mac costs $3.20 in the US and £3.20 in the UK. What does that say about the validity of absolute purchasing power parity? (5 points) 3. A Big Mac costs $3.20 in the US and £3.20 in the UK. What does that say about the validity of relative purchasing power parity? (5 points) 4. What are two differences between futures and forward contracts? (5 points) 5. What is one reason that there may be deviations from IRP? Briefly explain why this causes the deviation. (5 points) 6. What is one reason that there may be deviations from PPP? Briefly explain why this causes the deviation. (5 points) 7. What happens to the value of a call option when the volatility of the underlying security goes up? Explain briefly. (5 points) 8. If a contract says you will receive $1,000 in five years, is that a nominal or real value? Explain briefly. (5 points) 9. What is translation exposure? (5 points) 10. If the return on treasury securities were increasing, would you expect the dollar (on average) to be appreciating or depreciating? Explain briefly. (5 points) 3/23/2016 IBUS 302: International Finance, Exam 2 2 (of 3) Calculations (50 Points) Remember to show all calculations. Use the following data for all parity calculations: S($/£) = 1.5677 P$ = 90 i$ = 6% $ = 5% F12($/£) = 1.4966 P £ = 80 i£= 7% £ = 8% 11. Is covered interest arbitrage possible, i.e., is interest rate parity violated? If it is, what is the arbitrage profit and how would you capture that profit? (10 points) Arbitrage: Yes Arbitrage Profit: No (circle one) __________ Arbitrage Strategy: _______________________________________________ 12. Find the spot rate (SPPP) predicted by absolute purchasing power parity. Is the data consistent with absolute purchasing power parity? Briefly explain your reasoning. (10 points) SPPP: __________ Consistent: Yes No (circle one) Reasoning: ___________________________________________________ 13. Find the forward rate (FPPP) predicted by relative purchasing power parity. Is the data consistent with relative purchasing power parity? Briefly explain your reasoning. (15 points) FPPP: __________ Consistent: Yes No (circle one) Reasoning: ___________________________________________________ 14. Find the real exchange rate (q) and briefly describe what this value says about changes in international competitiveness between US and UK firms. (15 points) q: __________ Effect on International Competition: __________________________ 3/23/2016 IBUS 302: International Finance, Exam 2 3 (of 3) 15. You hold a forward contract to buy 100,000 euros in three month at 1.4455. What is your loss or gain if the spot rate in three months has the following values: (10 points) S3 = 1.4877, Gain/Loss from Contract = ___________________________ S3 = 1.4455, Gain/Loss from Contract = ___________________________ S3 = 1.4178, Gain/Loss from Contract = ___________________________