money banking and fed ppt

advertisement

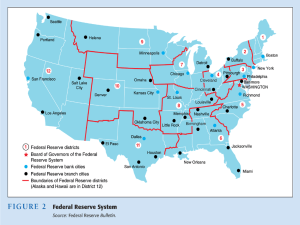

UNIT 5- MONEY, BANKING, FISCAL AND MONETARY POLICY Chapters 9-11, 12 and 15 Rev 7/11, © Robin Foster CHAPTER 15 THE FEDERAL RESERVE SYSTEM THE FEDERAL RESERVE The Federal Reserve (the Fed) was established in 1913 as America’s central Bank. It sets the nation’s monetary policy. The actions of the fed affect everyone daily. THE FEDERAL RESERVE ACT Mandates of the Act: Stable prices Moderate long term interest rates Maximum employment FED ACT-CON’TDECENTRALIZED STRUCTURE 7 member Board of Governor’s in Washington, DC who are appointed by the President and confirmed by the Senate. 12 regional Reserve banks with a separate board of directors and a President 25 branch banks Financial Independence Congressional oversignt THE FEDERAL RESERVE DISTRICTS The country is divided into 12 districts. Washington, DC is the headquarters. Each district has a main bank located in a major city. These cities were selected so they are no more than a 1 days train ride apart. Houston is in the 11th district. Dallas is the main Bank San Antonio and El Paso have branch banks for our region. THE FEDERAL RESERVE DISTRICTS ORGANIZATION OF THE FED. The Fed is a corporation member banks own stock. The Fed pays member banks a 6% annual dividend on Fed stocks. Any profit by the Fed is returned to the US treasury. In 2009, this amount was $47.4 billion. ORGANIZATION OF THE FED FUNCTIONS OF THE FED Maintain Stability of the Financial System Approve bank mergers Watch bank actions and lending Currency supplier Provide Financial Services Bank for U.S. Government accounts Clear checks FUNCTIONS OF THE FED Supervise and regulate banking industry Regulate foreign banks in the United States Regulate U.S. banks overseas Regulate military banks Conduct monetary policy Sets reserve requirement. Buy/sell bonds to raise/lower interest rates. FUNCTIONS OF THE FED Lender of Last Resort Loans money to member banks. THE FED IS A BANKER’S BANK Payment System Check processing Electronic funds transfer (EFT) Paid over $30 billion in checks in 2006 Issuer and distributor of currency Puts money in circulation Distroy’s old money By 2010 the Fed will have only 4 check clearinghouses-Atlanta, Dallas, Philadelphia and Cleveland FISCAL AGENT FOR THE US TREASURY Maintain the treasury’s bank account. Handle weekly actions of treasury securities. Issue and redeem savings bonds The bank for the US government REGULATOR AND SUPERVISOR Examine banks to foster a sound banking system Ensure compliance with all consumer protection laws Evaluate Community Investment performance MONETARY POLICYMAKER Major function of all central banks Monetary policy actions influence availability and cost of money and credit Focus on price stability Promote savings and investment Keep inflation and unemployment in check. EXPANDED ROLE OF THE FED. The fed will have expanded oversight of the banking and credit industry, including credit card interest rates. DIFFERENCE BETWEEN FED AND TREASURY The Treasury is the department in government which is in charge of revenue, taxation and public finances. They are the financial operations for the government. Jack Lew The Federal Reserve System is the nations bank. Its primary purpose is to regulate the flow of money and credit in the country. Janet Yellen SECTION 2: TOOLS OF MONETARY POLICY The Federal Open Market Committee (FOMC) meets 8 times a year in Washington, DC and announces any monetary action taken. Actions of the FOMC affect the country. SECTION 2: TOOLS OF MONETARY POLICY The Federal Open Market Committee (FOMC) meets 8 times a year in Washington, DC and announces any monetary action taken. Actions of the FOMC affect the country. RESPONSIBILITIES OF THE FOMC Assess National and regional economic and financial conditions using regional perspectives. Determine credit and interest rates policies. Target the Federal Funds rate. Direct open market operations conducted by the New York Fed to achieve goals of price stability and sustainable economic growth. SIX TOOLS OF MONETARY POLICY Open Market Operations Buy/sell government securities. This increases the money supply Discount rate Interest rate the Fed charges to member banks for loans. SIX TOOLS OF MONETARY POLICY Reserve Requirement Increase or decrease required reserves held by banks. Currently 10% Margin Requirements How much money is needed to purchase stocks. SIX TOOLS OF MONETARY POLICY Moral Suasion Chairman of the Fed gives his opinion on the economy. Selective Credit Controls Selective, specific goals usually in wartime. During WWII, no cars were produced. THE CHAIRMAN OF THE FED. Ben Bernacke Reappointed by President Obama for a 14 year term. PART 3MONETARY POLICY, BANKING AND THE ECONOMY Short run impact-of an increase or decrease in the money supply affects the price of borrowing. The prime rate is the interest rate at commercial banks charge their best customers. MONETARY POLICY, BANKING AND THE ECONOMY Long run impact- of a change in the money supply affects the general level of prices or inflation. The Quantity Theory of Money—example: the Continental Congress issued $250 million in currency causing 123% inflation. EASY MONEY POLICY A group of actions to increase the money supply, fight a “recession”—easy money. Buy government securities Lower discount rate Lower reserve requirement Interest rates fall Spending/borrowing increases Money supply increases TIGHT MONEY POLICY A group of actions by the Fed to cut the money supply to fight inflation—”tight” money. Sell government securities. Raise discount rate Raise reserve requirement Interest rates rise Spending/borrowing falls Money supply falls THE FED AND THE PRESIDENT Interest rates are political because Presidential elections are political. The actions of the fed are political because the chair of the Fed is appointed by the President. FEDERAL GOVERNMENT EXPENDITURESOR THE BUDGET The federal budget year is Oct. 1 to Sept 30 of each year. The budget is prepared by the by the Office of Management and Budget. The budget must be sent to Congress no later than Feb. of each year for Congressional approval. TWO KINDS OF GOVERNMENT SPENDING Mandatory Spending Spending authorized by law that continues without the need for government approval. Examples: social security, medicare, debt payments Discretionary Spending Programs that must receive annual authorization. Examples: military and welfare ENTITLEMENT PROGRAMS Entitlement is a guarantee of access to benefits because of rights or by agreement through law. Social Security, Medicaid, Medicare are large entitlement programs that take. These account for over $1 trillion of the federal budget. CHAPTER 10-GOVERNEMENT SPENDING IMPACT OF GOVERNMENT SPENDING Easy? Recessions-push government spending toward a deficit. Why? Expansionary periods-push government spending toward a surplus Why? TAX REVENUE VS EXPENSES Gov’t revenue surplus Gov’t spending deficit balanced budget. KEYNES-GENERAL THEORY ON EMPLOYMENT, INTEREST AND MONEY The level of employment needed is determined by the spending of Money. Which means-persons working cost the government less money and government collects more money. SECTION 4-DEFICITS, SURPLUSES AND THE NATIONAL DEBT. DEFICITS, SURPLUSES AND NATIONAL DEBT Deficit spending-is the amount by which a government, private company, or individual's spending exceeds income over a particular period of time, also called simply "deficit," or "budget deficit," the opposite of budget surplus. Federal Debt or surplus-The annual government deficit or surplus refers to the cash difference between government receipts and spending. Debt ceiling-limit on government spending currently-$14.294 trillion by H.J.Res. 45 was signed into law on February 12, 2010 NATIONAL DEBT National Debt What happens when the USA reaches the debt ceiling? No more money can be borrowed to finance government spending. There is no constitutional requirement that the USA have an anually balanced budget STATE OF TEXAS AND DEBT The State of Texas is required by the Constitution to have an annually balanced budget. This means Texas cannot have a budget deficit. What happens if they take in less money than they need to spend? IMPACT OF THE NATIONAL DEBT Taxes and tax burden-increase taxes, less money for consumers to spend. Larger the debt, the larger the interest payments; and therefore the more taxes to pay them. Increased taxes reduce incentive to work, save and invest. PART 1-FUNCTIONS AND CHARACTERISTICS OF MONEY What is money? Money is any substance used to pay for goods or services. Most people say they do not have enough money. History of money BARTER Barter is the trading of goods without money. Yes, barter still happens today. Pro’s of barter-no government, no taxes. Get what you need without money, if you have something to trade. Con’s of barter-products/services may not divide evenly. Comparable values may not exist. FUNCTIONS OF MONEY Medium of exchange-people must accept as payment for goods. Measure of value-measure of what a good is worth in dollars and cents. Store of value-place holder of an amount. EARLY MONEY CHARACTERISTICS OF MONEY Portable-easy to carry and exchange Durable-lasts over time, withstands wear and tear. Divisible-divide into smaller units. *Stable in value-retains value over time. But, can lose value due to inflation. Scarce-limited supply. Accepted-Government or an agency must approve for use. You can’t just create your own money. MONEY IN EARLY SOCIETIES Commodity money-money with an alternative use. Wampum-sea shells used for money. Fiat money-money by government decree. Legal tender-currency that must be accepted. Representative money-an be exchanged for gold or silver. Specie-gold/silver coins from Europe. IN THE COLONIES Commodity and fiat money was used including: tobacco Gunpowder Coins Colonial paper money MONEY TODAY Our money today is: Inconvertible Fiat Money MONETARY UNIT a standard unit of currency. Unique to each country USA-dollar Mexico-Peso Japan-Yen France-Euro GOLD STANDARD Advantages Trade money for gold Trust in money Keeps government from printing too much money. Disadvantages Holds back economic growth. Increased demand for gold lowers reserves. Gold price must remain constant. GOLD STANDARD During the Depression the government gave up on the gold standard. People were encouraged to turn in their gold. Many did not due to their loss of faith in paper money. Having gold could result in fines, but people hid their gold. GOLD STANDARD After leaving the gold standard the US changed to inconvertible fiat money. People cannot demand gold or silver in return for their money. The government controls the money supply and issues a single currency. BANKS An organization, usually a corporation, chartered by a state or federal government, which does most or all of the following: receives demand deposits and time deposits, honors instruments drawn on them, and pays interest on them; discounts notes, makes loans, and invests in securities; collects checks, drafts, and notes; certifies depositor's checks; and issues drafts and cashier's checks. SAVINGS AND LOANS Savings and Loan (S&L)- A federally or state chartered financial institution that takes deposits from individuals, funds mortgages, and pays dividends. CREDIT UNIONS A non-profit financial institution that is owned and operated entirely by its members. When a person deposits money in a credit union, he/she becomes a member of the union because the deposit is considered partial ownership in the credit union. BANKS AND BANKING SERVICES Since deregulation-banks do not charge the same fees for all services they provide. Shop for the bank that is right for you. TYPES OF DEPOSITS Demand deposits-checking accounts Time deposits-savings accounts Money Market Accounts-a checking account that is invested in the stock market and can earn interest and is charged a fee based on market fluctuations. NOW account- Negotiable Order of Withdraw)-An interest-bearing checking account at a bank or savings and loan. OTHER BANKING SERVICES Overdraft protection-A checking account/debit card feature in which a person has a line of credit to write checks for more than the actual account balance. BANKING SERVICES Electronic Funds Transfer (EFT)- Any transfer of funds that is initiated by electronic means, such as an electronic terminal, telephone, computer, ATM or magnetic tape. Automated Teller Machines (ATM)-a machine at a bank branch or other location which enables a customer to perform basic banking activities (checking one's balance, withdrawing or transferring funds) even when the bank is closed. BANKING AND YOU Debit card- A card which allows customers to access their funds immediately, electronically. Unlike a credit card, a debit card does not have any float. Certificates of Deposit (CD’s)-CDs are low risk, low return investments, and are also known as "time deposits", because the account holder has agreed to keep the money in the account for a specified amount of time, anywhere from three months to six years BANKING AND YOU Safe Deposit Box-a lock box in a bank that is used to store valuable items and documents. Electronic Banking-banking done on line. This can be used to pay bills, transfer funds, etc. Service Charge-Bank fee charged for specific services or as a penalty for not meeting certain criteria TRUTH IN LENDING LAWS Legislation passed in some countries, such as the Home Mortgage Disclosure Act of 1968 and Consumer Credit Protection Act of 1969 in the US. Under these laws a lender must, clearly and conspicuously, reveal all the key details of a home mortgage or consumer loan before the borrower signs the loan agreement. Borrowers who mortgage their dwelling house as a collateral are generally allowed a cooling off period (usually three days) to rethink the implications of the loan agreement and to cancel it if they so decide. MONEY TODAY MONEY Currency Paper money. Coins metal money. DENOMINATIONS OF MONEY Currency $1, $2, $5, $10, $20, $50 and $100’s Coins $.01, $.05, $.10, $.25. $.50, $1.00 OUR MONEY: BY THE NUMBERS Facts about on how much each denomination represents in the 9.12 billion currency notes the Bureau of Engraving and Printing will produce in the current budget year and the average life for each note: $1 note: 45.5% of total note production; 21 months. $5 note: 15.4%; 16 months. $10 note: 0.9%; 18 months. $20 note: 21.6%; 24 months. $50 note: 4.7%; 55 months. $100 note: 11.9%; 89 months. COMPONENTS OF THE MONEY SUPPLY M1 money-currency, coins and travelers checks. Money is more liquid. M2 money-M1+checking and savings accounts +money market accounts and CD’s. Money is less liquid. FT. KNOX KENTUCKY HOLDS THE US GOLD FT. KNOX, KENTUCKY AND GOLD Not all currency is backed by gold. There are 147.3 million ounces of gold. The gold is held as an asset of the US Government at a book value of $42.22 per ounce. A gold bar is 400 ounces or 27.5 pounds MONEY IN CIRCULATION Approximately $829 billion in circulation. Most is held outside the USA. COUNTERFEIT MONEY Yes, printing your own money is a crime. The Secret Service investigates counterfeit money. SO YOU WANT TO OWN A BANK? How banks operate: Banks make money by accepting deposits and making loans Liabilities are the debt/obligations of the bank. Assets are the property/posessions of the bank. A balance sheet is a statement showing assets/liabilities of a bank. The net worth is the excess of assets over liabilities. STARTING A BANK Organize, obtain a charter. Buy into the Fed (like buying insurance) Make loans Excess reserves are deposits-reserves Reaching maturity deposits=loans=economic growth Loans=monetary growth---loans increase money for loans. BANKS IN ACTION Equity-investment against bankruptcy Bank liabilities-obligations to others Required reserves are the amount of money that a bank must set aside and not loan. The size of the reserve is set by the Fed. This is a fractional reserve system. BANKS IN ACTION Most of the deposits are returned to the community in the form of loans. Banks invest in bonds: they are a safe investment and are easily converted to cash. BANK BALANCE SHEETS Assets Liabilities Bonds Demand Deposits Reserve requirement Time Deposits Excess Reserves Capital Stock Loans CD’s Building/Equipment Total: Total: Assets and liabilities must always equal Notes page 16 BANK PROFIT For a bank to make a profit it must have a spread between what is paid out in interest and what it takes in on interest on loans over 3% BANKING A state bank is generally a financial institution that is chartered by a state. It differs from a reserve bank in that it does not necessarily control monetary policy (indeed, the state in question may have no legal capacity to create monetary policy), but instead usually offers only retail and commercial services. They oppose mandatory membership in the Fed. BRANCH AND ELECTRONIC BANKING Until the 1990’s branch banking was illegal (having more that one location of the same bank.) Banks are facing increasing competition. Electronic banks are putting pressure on brick and mortar banks due to lower costs. DEPOSITORY INSTITUTION DEREGULATION AND MONETARY CONTROL ACT ] Passed in 1980, gave the Federal Reserve greater control over non-member banks. It forced all banks to abide by the Fed's rules. It allowed banks to merge. It removed the power of the Federal Reserve Board of Governors to set the interest rates of savings accounts. It raised the deposit insurance of US banks and credit unions from $40,000 to $100,000. It allowed credit unions and savings and loans to offer checkable deposits. Allowed institutions to charge any interest rates they chose. FDIC Since the start of FDIC insurance on January 1, 1934, no depositor has lost a single cent of insured funds as a result of a failure. The FDIC receives no Congressional appropriations – it is funded by premiums that banks and thrift institutions pay for deposit insurance coverage and from earnings on investments in U.S. Treasury securities. FDIC AND FSLIC Your money is guaranteed by these groups. Look for the seal at your bank. IS YOUR BANK INSURED? WHY BANKS FAIL? Depositors lose money. Banks give bad loans Confidence is lost in banks The FDIC/FSLIC can put a bank on a watch list; if things do not improve the bank will be declared insolvent.