Goal 2 Review PPT

advertisement

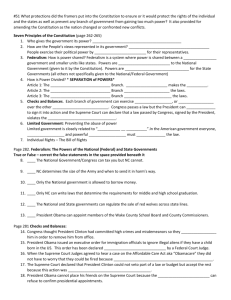

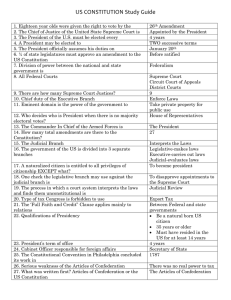

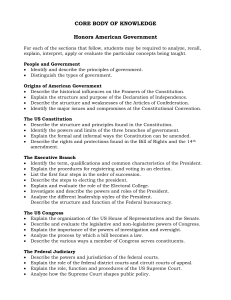

EOC Review Goal 2 Objective 2.01 Federal Powers ? State Powers • Which term best completes this diagram? a. Reserved powers b. Balanced powers c. Delegated powers d. Concurrent powers • The president’s authority to veto laws is an example of which principle of the U.S. Constitution? a. Separation of powers b. Checks and balances c. Federalism d.flexibility • Which power do state governments have under the U.S. Constitution? a. To control trade with foreign nations b. To coin and print money c. To declare war d.To conduct elections • The Constitution delegates specific powers to Congress, including which of the following powers? a. Regulating drivers’ licenses b. Conducting city council elections c. Providing for public schools d.Establishing post offices • Which principle in the U.S. Constitution means that all government power comes from the people? a. Checks and balances b. Separation of powers c. Popular sovereignty d.federalism Objective 2.02 • How is the separation of powers emphasized in the structure of the Constitution? a. By giving each branch of government its own article b. By describing all government powers in one article c. By writing a definition of government d. By establishing checks and balances • Which power of Congress would help it pay the bills for supporting the military? a. Regulate commerce b. Declare war c. Establish post offices d.Collect taxes • What is the role of the executive branch? a. To interpret the laws passed by Congress b. To make the government more powerful c. To limit the government’s ability to concentrate power in one place d. To carry out the laws passed by Congress • Under the Constitution, who has the power to declare war? a. The president b. The Supreme Court c. The Attorney General d.Congress Objective 2.03 • Which is the most likely reason that the Constitution limits the president’s power to conduct foreign affairs? a. To allow Congress to make some foreign policy decisions b. To prevent the president from acting entirely on his/her own c. To prohibit international trade d. To encourage treaties • Which term names a congressional check on presidential power? a. Power to declare war b. Power to override vetoes c. Power to impeach judges d.Power to raise taxes • What is the role of the judicial branch of government? a. To carry out laws passed by Congress b. To approve presidential appointments c. To rule of the validity of acts of the president d.To interpret the laws passed by Congress • Under the Constitution, which branch has the power to approve international agreements such as the North America Free Trade Agreement (NAFTA)? a. Judicial b. Executive c. Legislative d.President’s cabinet Objective 2.04 • Which of the following is the formal way of changing the U.S. Constitution? a. Congressional legislation b. Judicial interpretation c. Custom and tradition d.Amendment • What happens if a proposed amendment is not ratified by ¾ of the states? a. It could be ratified by 2/3 of the states b. The president could ratify the amendment c. Congress could ratify the amendment d. The amendment would not be added to the Constitution • Which parts of the government are involved in the amendment process? a. Congress and the states b. Congress and the president c. The president and the Supreme Court d.The Supreme Court and the states • Which article of the Constitution describes the amendment process? a. Article II b. Article V c. Article VII d.Article III • Which of these constitutional amendments was passed as a result of the Civil War? a. 14th Amendment b. 1st Amendment c. 12th Amendment th d.10 Amendment Objective 2.05 • The separate but equal doctrine in public facilities was established by which Supreme Court decision? – Plessy v. Ferguson – Gibbons v. Ogden – McCulloch v. Maryland – Korematsu v. U.S. • In Korematsu v. U.S. why did the Supreme Court declare the government’s action constitutional? a. It happened during wartime b. It involved navigable waters c. It concerned children d.It was an executive order • Which case best illustrates the idea that the Supreme Court sometimes changes earlier decisions regarding interpretation of what is the supreme law of the land? a. Gibbons v. Ogden b. Marbury v. Madison c. Swann v. CMS d.Brown v. Board of Education • Which Supreme Court justice most contributed to the establishment of judicial review? a. Thurgood Marshall b. Roger B. Taney c. John Marshall d.Earl Warren • Which Supreme Court case did not involve a law concerning racial segregation? a. McCulloch v. Maryland b. Plessy v. Ferguson c. Swann v. CMS d.Brown v. Board of Education Objective 2.06 • The Supreme Court addressed the issue of the free speech rights of students in which case? a. Stanford v. Kentucky b. Tinker v. Des Moines c. Gideon v. Wainwright d.Roper v. Simmons • What individual right was involved in Texas v. Johnson concerning the right to burn the U.S. flag? a. Freedom of religion b. Right to a jury c. Freedom of speech d.Right to an attorney • Which Supreme Court decision concerned the rights of persons accused of a crime? a. Miranda v. Arizona b. Plessy v. Ferguson c. U.S. v. NY Times d.Brown v. Board of Education Objective 2.07 • Which of the following has undercut the constitutional principle of popular sovereignty in recent years? a. Controversy over states’ rights b. Judicial activism c. Decline in presidential vetoes d. Low voter turnout • A candidate must win which of the following to be elected president? a. A majority in Congress b. A majority of the popular vote c. A majority of the electoral vote d.The popular vote in Florida • Opponents of the PATRIOT Act would most likely argue that it violates which part of the U.S. Constitution? a. Protection against unreasonable searches b. Guarantee of a republican form of government c. Freedom of speech d.Right to bear arms Objective 2.08 • What is the purpose of most U.S. tariffs? a. To give citizens tax exemptions b. To regulate trade c. To increase tax deductions d.To influence domestic policy • Which statement is true about a progressive tax? a. The higher the income is, the higher the tax rate is b. It benefits the wealthy more than the poor c. It is a tax on the sale of goods d.Interest is taxed at a higher rate • Which result is most likely when high tariffs are applied to foreign goods? a. Fewer imported goods b. Increased exports c. Lower prices for American-made products d.Low wages for American workers • What method do governments often use to borrow money for expensive projects? a. Raise taxes b. Increase fees c. Apply tariffs d.Sell bonds Objective 2.09 • Which of the following terms is used to describe government income? a. Profit b. Revenue c. Deficit d.Audit ? Meet foreign leaders Maintain embassies Negotiate treaties • Which executive department best completes the diagram above? a. Dept. of State b. Dept. of Energy c. Dept. of Defense d. Dept. of Agriculture • Under which circumstances does a government have a balanced budget? a. When income is greater than expenditures b. When income equals expenditures c. When the government increases revenue d. When the government reduces revenue • What power do all independent regulatory commissions have in common? a. Power to determine the national budget b. Power to make and enforce rules c. Power to approve new taxes d.Power to investigate Congress • Which is a frequent topic of debate concerning the federal budget? a. Whether to increase tariffs b. Whether to increase tax collection c. Whether to sell stocks d.Whether to change priorities