Naturally Interesting Investigation

advertisement

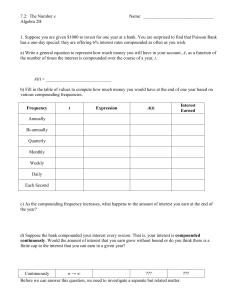

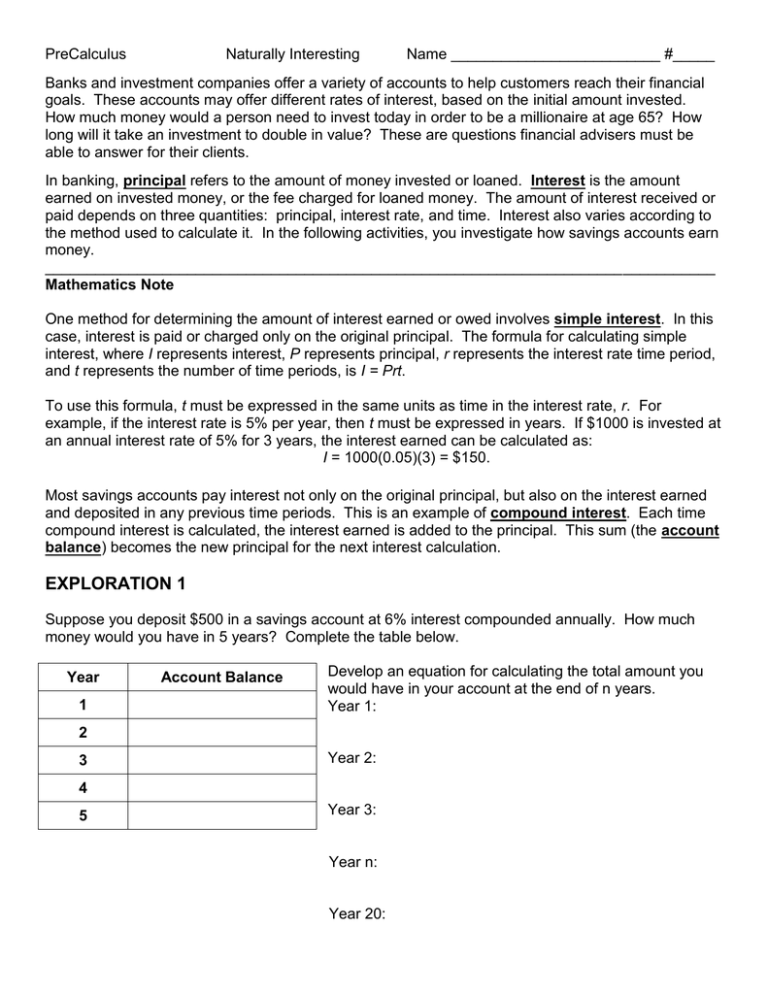

PreCalculus Naturally Interesting Name _________________________ #_____ Banks and investment companies offer a variety of accounts to help customers reach their financial goals. These accounts may offer different rates of interest, based on the initial amount invested. How much money would a person need to invest today in order to be a millionaire at age 65? How long will it take an investment to double in value? These are questions financial advisers must be able to answer for their clients. In banking, principal refers to the amount of money invested or loaned. Interest is the amount earned on invested money, or the fee charged for loaned money. The amount of interest received or paid depends on three quantities: principal, interest rate, and time. Interest also varies according to the method used to calculate it. In the following activities, you investigate how savings accounts earn money. ________________________________________________________________________________ Mathematics Note One method for determining the amount of interest earned or owed involves simple interest. In this case, interest is paid or charged only on the original principal. The formula for calculating simple interest, where I represents interest, P represents principal, r represents the interest rate time period, and t represents the number of time periods, is I = Prt. To use this formula, t must be expressed in the same units as time in the interest rate, r. For example, if the interest rate is 5% per year, then t must be expressed in years. If $1000 is invested at an annual interest rate of 5% for 3 years, the interest earned can be calculated as: I = 1000(0.05)(3) = $150. Most savings accounts pay interest not only on the original principal, but also on the interest earned and deposited in any previous time periods. This is an example of compound interest. Each time compound interest is calculated, the interest earned is added to the principal. This sum (the account balance) becomes the new principal for the next interest calculation. EXPLORATION 1 Suppose you deposit $500 in a savings account at 6% interest compounded annually. How much money would you have in 5 years? Complete the table below. Year 1 Account Balance Develop an equation for calculating the total amount you would have in your account at the end of n years. Year 1: 2 3 Year 2: 4 5 Year 3: Year n: Year 20: _______________________________________________________________________________ Mathematics Note When interest is compounded annually, the yearly account balances that result can be defined by the following formula (assuming that no withdrawals are made and any interest earned is deposited in the account): Pt = P0(1 + r)t Where Pt is the account balance after t years, P0 is the initial principal, r is the annual interest rate, and t is the time in years. For example, given an initial principal of $2000 and an annual interest rate of 4%, compounded annually, the account balance after 12 years can be determined as follows: P12 = 2000(1 + 0.04)12 ≈ 3202.06 EXPLORATION 2 Now we will examine how the number of compoundings per year affects the amount of interest earned in an account. Complete the following table. Investigate how the number of compounding periods affects the balance at the end of the year for $500 invested at 6% annually. Compounding Number per year Account Balance Annually 1 $530.00 Semiannually Quarterly Monthly Daily Hourly By the minute By the second Predict the account balance after one year if interest is compounded continuously. _____________ Choose different values for the initial principal and the interest rate. Complete the chart below. How is the balance affected as the number of compounding increase? P0 r Compoundings 1 2 4 12 365 8760 525600 31536000 Balance Balance When compounding interest c times per year for t years, the formula for the account balance after n compounding periods is: 𝑟 𝑛 𝑟 𝑐𝑡 𝑃𝑛 = 𝑃0 (1 + ) = 𝑃0 (1 + ) 𝑐 𝑐 where 𝑃𝑛 represents the principal after n compounding periods, 𝑃0 represents the initial principal, and r is the annual interest rate. (Note: In this formula, n = ct). For example, consider an initial investment of $1000 at an annual interest rate of 5%, compounded quarterly. Assuming that no withdrawals are made and any interest earned is deposited in the account, the principal after 3 years (or 4 x 3 = 12 compounding periods) can be calculated as follows: 𝑃12 = 1000 (1 + 0.05 12 ) = $1160.75 4 EXPLORATION 3 With the development of calculators and computers, the determination of compound interest has become quick and easy. This allows banks to compound interest on an account balance up to the instant in which it is withdrawn. This method of calculating interest, known as compounding continuously, mean that the number of compoundings per year approaches infinity. As you have seen in previous explorations, the number of compoundings per year can affect the balance of the savings account. What happens to this balance when the number of compoundings increases without bound? In this exploration, you will investigate what happens as c, the number of compoundings, changes for specific values of Po, r, and t. Consider an investment of $1.00 at an annual interest rate of 100%, compounded continuously, for 1 year. Use the formula for account balance when interest in compounded c times a year to complete the table for such an investment. Number of Compoundings per year (c) 1 Account Balance at the end of the year ($) As the number of compoundings per year increases, what happens to the sequence of account balances? 10 100 1000 10000 100000 1000000 10000000 100000000 Since P0 = 1, r = 1, and t = 1 in this situation, a formula for this data is: In the context of this problem, c is a non-negative integer. However, this formula can be represented more generally as the function: 1 𝑥 𝑓(𝑥) = (1 + ) 𝑥 What are the domain and range of this function? Graph the function below on your calculator. As x increases, what limiting value does the graph appear to approach? 1 𝑥 The limiting value of 𝑓(𝑥) = (1 + 𝑥) is the irrational number e. The value of e can be represented mathematically as: Let’s explore how changing the interest rate affects the value of e. n 1 𝑛 𝑃𝑛 = (1 + ) 𝑛 2 𝑛 𝑃𝑛 = (1 + ) 𝑛 3 𝑛 𝑃𝑛 = (1 + ) 𝑛 Calculate e2 and e3. 1 10 100 1000 How do these values compare to the values in the table? 10000 100000 1000000 10000000 100000000 𝑟 𝑐𝑡 At the beginning of this activity, we use the formula 𝑃𝑡 = 𝑃0 (1 + ) to calculate an account balance 𝑐 based on initial deposit, interest rate, number of compoundings, and time. If we know the account is going to be compounded continuously, we can modify our account balance formula to: Consider an initial investment of $500 at an annual interest rate of 6%, compounded continuously. Assuming no withdrawals are made and any interest earned is deposited in the account, the account balance after 5 years can be calculated as follows: P5 = 500e(0.06)(5) = $674.93