You

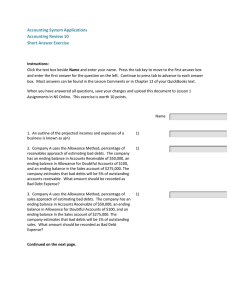

advertisement

ACCOUNTING FOR RECEIVABLES STUDY OBJECTIVES After studying this material, you should understand: Types of receivables Recognition of A/R Valuation of A/R F/S Presentation & Analysis TYPES OF RECEIVABLES Receivables are amounts due from individuals and other companies. There are three major classes of receivables: A/R Owed by customers on account, from credit sales, due in 30-60 days. N/R Other Claims supported by a Loans to company formal credit instrument. officers, employee Due in 60-90 days, with advances, refundable interest. income taxes. PRIMARY ACCOUNTING ISSUES Recognition Valuation Disposition RECOGNIZING A/R A classic general journal sequence for credit sales. Date July 1 Description A/R—Polo Company Debit Credit 1000 Sales 1000 (sales on account) July 5 Sales returns & allowances 100 A/R—Polo Company 100 (merchandise returned) July 11 Cash 882 Sales Discounts A/R—Polo Company (collection of A/R) 18 900 VALUATION OF A/R • Receivables are current assets on the balance sheet • They are stated at net realizable value, the amount expected to be received in cash. • Uncollectible A/R are accounted for using two methods Direct Write-Off Method Allowance Method DIRECT WRITE-OFF METHOD • No entries are made for bad debts until an account is determined to be uncollectible at which time the loss is charged to bad debts expense. • Bad debt expense shows only actual losses. • Not acceptable for financial reporting purposes unless losses are insignificant. Bad debts expense Operating expense on the income statement DIRECT WRITE-OFF METHOD General Journal Date Dec. 12 Account Titles Bad Debts Expense Accounts Receivable – M.E. Doran Debit 200 Credit 200 Warden Co. writes off M. E. Doran’s $200 balance as uncollectible on December 12. When this method is used, Bad Debts Expense will show only actual losses from uncollectibles. ALLOWANCE METHOD • The allowance method is required when bad debts are material. • Uncollectible accounts are estimated • The expense is matched against sales in the same accounting period. Uncollectible accounts expense = bad debts expense ALLOWANCE METHOD RECORDING ESTIMATED UNCOLLECTIBLES General Journal Date Dec. 31 Account Titles Bad Debts Expense Allowance for Doubtful Accounts Debit 12,000 Estimated uncollectibles are debited to Bad Debts Expense and credited to Allowance for Doubtful Accounts at the end of each period. Credit 12,000 ALLOWANCE METHOD RECORDING A WRITE-OFF General Journal Date Account Titles Mar. 1 Allowance for Doubtful Accounts Accounts Receivable - R. A. Ware Debit Credit 500 500 Actual uncollectibles are debited to Allowance for Doubtful Accounts and credited to Accounts Receivable at the time the specific account is written off. ALLOWANCE METHOD RECORDING A RECOVERY To recover an account that has been written off: 1 reverse the write-off entry. General Journal Date July 1 Account Titles Debit Accounts Receivable – R. A. Ware Allowance for Doubtful Accounts Credit 500 500 2 record the collection in the usual manner. General Journal Date July 1 Account Titles Cash Accounts Receivable Debit Credit 500 500 ALLOWANCE METHOD BASIS FOR ESTIMATING UNCOLLECTIBLES Two methods of estimating uncollectible accounts comply with GAAP. Percentage of Sales Percentage of Receivables Matching Cash Realizable Value Sales Bad Debts Expense Emphasis on Income Statement Relationships Accounts Receivable Allowance for Doubtful Accounts Emphasis on Balance Sheet Relationships Uses aging schedule ALLOWANCE METHOD PERECENTAGE OF SALES BASIS • Bad debt expense is based on a % of current credit sales estimated to be uncollectible, based on past experience. • Matches expenses with revenues. • No consideration given to existing balance in the allowance. General Journal Date Dec.3 1 Account Titles Bad Debts Expense Allowance for Doubtful Accounts Debit Credit 8,000 If net credit sales for the year are $800,000, the estimated bad debts expense is $8,000 (1% X $800,000). 8,000 ALLOWANCE METHOD PERECENTAGE OF RECEIVABLES BASIS • Bad debt expense based on % of the ending balance in A/R. • The adjusting entry is the difference between the required balance and the existing balance in the allowance account. • Estimates NRV of receivables. General Journal Date Dec. 31 Account Titles Bad Debts Expense Allowance for Doubtful Accounts Debit Credit 1,700 1,700 If the existing balance in the allowance account is $500 credit, and the required balance is $2,200, the journal entry to increase the allowance will be for the difference between the required balance and the existing balance. If the existing balance in the allowance account is $500 debit, and the required balance is $2,200, the journal entry to increase the allowance will be for the sum of the required balance and existing balance. General Journal Date Dec. 31 Account Titles Bad Debts Expense Allowance for Doubtful Accounts Debit Credit 2,700 2,700 REVIEW QUESTION Which of the following approaches for bad debts is referred to as a balance sheet method? A. Percentage of receivables method B. Direct write-off method C. Percentage of sales method D. Both a and b Answer: (A) Percentage of receivables method. FINANCIAL STATEMENT PRESENTATION & ANALYSIS • In the balance sheet, short-term receivables are reported in the current assets section below short-term investments. • Report both the gross amount of receivables and the allowance for doubtful accounts. Accounts receivable Less: allowance for doubtful accounts Accounts receivable, net $1,200,000 (48,000) $1,152,000 A/R TURNOVER RATIO • Financial ratios are computed to evaluate the liquidity of a company’s accounts receivable. • The accounts receivables turnover ratio is used to assess the liquidity of the receivables. • The data below is from Cisco Systems: Net Credit Sales $18,878 / / Average Net Receivables = Accounts Receivable Turnover ( $1,105 + $1,351)/2 = 15.4 times AVERAGE COLLECTION PERIOD • The average collection period in days is a variant of the turnover ratio that makes liquidity even more evident. • This is done by dividing the turnover ratio into 365 days. • The general rule is that the collection period should not exceed the credit term period. • Cisco System’s turnover ratio is computed as: / Days in year 365 / A/R Turn Ratio 15.4 = Average Collection Period 23.7 days