Amazon Financial Statement Analysis 2011-2012

advertisement

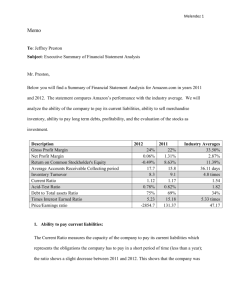

1 Brandon Osman Accounting 1120 Professor Paige Paulsen November 28th 2015 Amazon Financial Statement Analysis INTRODUCTION – The purpose of this analysis paper is to introduce several meaningful topics to help us better understand Amazon as a company for 2012 and 2011. We will discuss Amazon’s ability to pay its current liabilities, its ability to sell merchandise inventory and collect its receivables (money outstanding), its ability to pay long term liabilities/debt, its profitability and we will also evaluate its stock to see if it’s a good investment. Topic 1 – Amazon’s ability to pay its current liabilities. What is a Current Liability? A current liability is a liability that must be paid with cash or with goods and services within one year, or the entity’s operating cycle if the cycle is longer than a year. Accounts Payable, Notes Payable due within one year, Salaries Payable, Interest Payable, and Unearned Revenue are all current liabilities (pg. 211). Current liabilities are found on a classified balance sheet. In a classified balance sheet liabilities are classified into either current or long-term liabilities to show their relative liquidity. To determine if Amazon is able to pay its current liabilities we will have to use several tools of the accounting trade. We will look at Liquidity which measures how quickly and easily an item or account can be converted to cash (pg. 210) which is essential when paying current liabilities. We will also look at different account ratios to help us determine Amazon’s liquidity. The ratios are as follows: Acid-Test (or Quick) Ratio Current Ratio Acid-Test (or Quick) Ratio The acid-test ratio reveals whether an entity could pay all of its current liabilities if they were to become due immediately. The higher the acid-test ratio, the more able a business is to pay its current liabilities. This ratio is the sum of cash plus short-term investments plus net current receivables to total current liabilities (pg. 573) Amazon’s Acid-Test ratio for 2012 was 1:0.60 and in 2011 it was 1:0.53. Now we can see that this ratio did improve slightly from 2011 to 2012 which is a good thing but when we compare it to the industry average of 1:0.82 we can see that Amazon is falling behind. How do we read this ratio and what does it mean? It means that Amazon has $0.60 of quick assets to pay each $1 of current liabilities. 2 So what does this tell us? This tells us that if Amazon had to pay all its current liabilities tomorrow, they would have a difficult time doing so. Current Ratio The current ratio measures a company’s ability to pay its current liabilities with its current assets. We calculate this by taking the Total Current Assets and dividing them by the Total Current Liabilities. In Amazon’s case in 2012 its current ratio was 1:1.12 and in 2011 it was 1:17. We can see a slight decline from 2011 to 2012. If we take Amazon’s numbers and compare them to the industry average of 1:1.54 we can see that Amazon once again falls short in this category. As a rule of thumb a strong current ratio is 1:1.50 which indicates that the company has $1.50 in current assets for every $1.00 in current liabilities. A current ratio of 1.00 is considered low and somewhat risky (pg.224) and we can see Amazon trending towards the 1.00. Amazon’s ability to pay its current liabilities conclusion Using the accounting ratios to determine this topic we can conclude that even though Amazon is a giant in the retail industry, if their current liabilities were called in tomorrow to be paid Amazon would have a difficult time finding the funds to pay those current liabilities compared to the industry average. Topic 2 – Amazon’s ability to sell merchandise inventory and collect receivables I don’t know of a single person who hasn’t used Amazon at least once to buy an item they wanted. Amazon makes it extremely easy to find the product you are looking for through a very easy to navigate website but does this translate into their ability to sell merchandise inventory and collect receivables? Let’s look at the accounting ratios used for this topic. The ratios used are as follows: Inventory Turnover / Days in Inventory Accounts Receivables Turnover / Collection Period Inventory Turnover / Days in Inventory Inventory turnover measures how rapidly merchandise inventory is sold. It is calculated by taking Cost of goods sold / Average merchandise inventory. To get average merchandise inventory we take the (beginning merchandise inventory + Ending merchandise inventory) / 2. Inventory turnover is crucial in a retailer’s ability to pay its current liabilities. Amazons inventory turnover ratio for 2012 is 8.3 times and in 2011 it was 9.1. Once again we see a slight decline. If we compare it to the industry average of 4.8 times we can see that even though there was a slight decline from 2011 to 2012 Amazon is still well above the industry average. What does this mean? It means that a high rate of turnover, like Amazon has, indicates ease in selling inventory (pg. 384). 3 Days’ in Inventory is the ratio that measures the average number of days merchandise inventory is held by the company. A lower days’ sales in inventory is preferable because it indicates that the company is able to sell its inventory quickly, thereby reducing its inventory storage and insurance costs, as well as reducing the risk of holding obsolete inventory (pg. 384). To calculate Days’ sales in inventory we take 365 days / inventory turnover. Amazon’s ratio for 2012 is 44 days and in 2011 it was 40 days. Compared to the industry average of 75 days we can see that Amazon is selling its inventory quickly and much faster than the industry average. Accounts Receivables Turnover / Collection Period The accounts receivable turnover measures the number of times a company collects the average accounts receivable balance in a year (pg. 574). The higher the ratio, the faster a company can collect its outstanding funds. Amazon’s accounts receivables turnover ratio in 2012 is 21 times and in 2011 it was 23 times. If we take these numbers and compare them to the industry average of 10 times we can see that Amazon is doing very well. The collection period indicates how many days it takes to collect the average level of accounts receivables. We get this ratio by taking 365 days / Accounts receivable turnover ratio. The number of days’ sales in receivables, or collection period, should be close to the number of days customers are allowed to make payment, when credit is extended (pg. 574). The shorter the collection period, the quicker a company can use its cash. Amazon’s ratio for 2012 is 17.9 and in 2011 it was 15.8. Because this varies greatly there really is no industry average. Amazon’s ability to sell merchandise inventory and collect receivables conclusion Amazon does very well in this area especially in the Inventory Turnover category. Amazon absolutely is at the top its game when it comes to selling inventory and collecting its outstanding receivables. Topic 3 – Ability to pay long-term debt What is long-term debt/liability? Long-term debt/liability are all liabilities that do not need to be paid within one year or within a company’s operating cycle, whichever is longer (pg.211). Many notes payable are long-term liabilities an example of this would be a mortgage on a building. We know that Amazon would have a difficulty paying its current liabilities but let’s see if they would have a hard time paying a long-term debt. In 2011 Amazon’s current liabilities were $14,896,000,000 compared to its long-term of $255,000,000. In 2012 Amazon’s current liabilities were $19,002,000,000 compared to its long-term of $3,084,000,000. We can clearly see that Amazon has done an excellent job at keeping its 4 long-term debt down in comparison. If we look at Amazon’s average net income it can be concluded that they should have no difficulty paying their long-term debts. Topic 4 – Profitability The fundamental goal of any business is to turn a profit. Ratios that measure profitability is what we most often see reported in the business press. Let’s focus on the 3 main ratios to help us determine Amazon’s profitability. The ratios are as follows: Profit Margin (gross) Rate of Return on total Assets Asset Turnover Rate of Return on Common Stockholders’ Equity Earnings per Share (EPS) Profit Margin (gross) The profit margin ratio shows us the percentage of each net sales dollar earned as net income. Basically the profit margin ratio shows us how much net income a business earns on every $1.00 of sales. To determine this we take Net Income / Net sales. Amazon’s profit margin for 2012 is 24.8% and in 2011 it was 22.4%. We can see a positive increase from 2011 to 2012 but compared to the industry average of 33.5% Amazon has a little catching up to do but if Amazon continues its upward trend we should be around the industry average in a few years. Rate of Return on total Assets The rate of return on total assets measures a company’s success in using its assets to turn a profit. There are two ways a company can finance its assets. A company can either use debt or Equity. If they choose debt a company borrows cash from creditors to purchase assets therefor creditors earn interest on the money they loan. If they choose Equity a company receives cash or other assets from stockholders. These stockholders that are invested in the company hope to receive a return on their investment but it is not guaranteed. To calculate the rate of return on total assets we take Net Income + Interest expense / Average total assets. Amazon’s return on assets for 2012 is -0.45% and in 2011 it was 5%. Between 2011 and 2012 we saw a significant drop on our rate of return compared to the industry average of 4.76%. Asset Turnover The asset turnover ratio measures the amount of net sales generated for each average dollar of total assets invested. This measures how well a company is using its assets to generate sales revenues 5 (pg.1031). To calculate this ratio we take our Net Sales / Average total assets. In 2012 Amazon’s asset turnover is 2.11 times and in 2011 it was 2.18 times. Even though we see a slight decline from 2011 to 2012 Amazon is still well above the industry average of 1.66 times. Rate of Return on Common Stockholders’ Equity A popular measure of profitability is rate of return on common stockholders’ equity. This can be shortened to return on equity. This ratio shows the relationship between net income available to common stockholders and their average common equity invested in the company. This rate of return on common stockholders’ equity shows how much income is earned for each $1 invested by the common shareholders (pg. 1031). To calculate this ratio we take Net Income – Preferred dividends / Average common stockholders’ equity. In 2012 the rate of return on common stockholder’s equity for Amazon is -0.49% and in 2011 it was 8.63%. We can see a sharp decline from 2011 to 2012 which is not a good sign for investors and could cause them to look elsewhere like something more along the line of the industry average of 11.39%. Earnings Per Share (EPS) Earnings per share are perhaps the most widely quoted of all financial statistics; EPS is the only ratio that must appear on the face of the income statement. EPS reports the amount of net income (loss) for each share of the company’s outstanding common stock (pg. 1032) we can calculate EPS by taking Net Income – Preferred Dividends / Weighted average number of common shares outstanding. In 2012 Amazon’s EPS ratio is $5.23 and in 2011 it was $15.18. Once again we see another sharp decline from 2011 to 2012 causing investors to look elsewhere. Profitability Conclusion If we take into consideration all of the 5 categories collectively Amazon’s profitability does not look good to future investors but if we look at the positive category of profit margin and go strictly off of that we can see a glimpse of a positive future for Amazon. Topic 5 – Evaluating stock as an investment This is the topic most people would be interested in if they were to evaluate just one topic. We can use several accounting ratios to help us determine Amazon’s viability for potential stock holders. The ratios are as follows: Rate of Return on Common Stockholders’ Equity Earnings per Share (EPS) Price/Earnings Ratio 6 Dividend Yield Dividend Payout Price/Earnings Ratio The price/earnings ratio is the ratio of the market price of a share of common stock to the company’s earnings per share. The price/earnings ratio shows the market price of $1 of earnings (pg. 1033). The ratio can be abbreviated P/E. To calculate P/E we take the Market price per share of common stock / Earnings per share. In 2012 Amazon’s P/E is -2,854.7 and in 2011 it was 131.37. This drop from 2011 to 2012 could cause investors to not even consider Amazon’s stock if they were just comparing these 2 years compared to the industry standard of 47.17. Dividend Yield and Dividend Payout We will combine these two ratios because there is really not much to say about them. The reason for this is Amazon did not pay out any dividends in 2011 or 2012. Final Conclusion After evaluating each individual category in each topic at this time investment in Amazon would not be recommended. The drops in almost every category from 2011 to 2012 do not leave investors wanting more. Of course Amazon is one of the largest online retailers in the world and there are a handful of categories that show promise I believe Amazon should be monitored closely by investors but until we stop seeing drops in almost every category I would not invest my money. 7 Work Cited Nobles, T., & Mattison, B. (n.d.). Horngren's accounting: The financial chapters (Tenth ed.).