A007/13 Schools Themed Review Bank Reconciliation 2012/13

advertisement

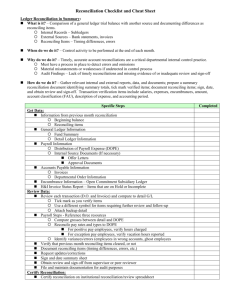

Internal Audit Schools Themed Review Bank Reconciliations 2012 / 13 December 2012 1 CONTENTS Page Overview 3 Key Findings 3 Other Weaknesses Identified 4 Risks from Key Findings 4 Actions which can be Taken to Address These Risks 5 Financial Regulations and the Wiltshire Schools Finance Manual 7 Sources of Best Practice Guidance 8 Appendix 1 – Bank Reconciliation Best Practice Notes 9 Distribution List Report to: Accounting and Budget Support Head Teachers Chairs of Governors 2 Overview Internal Audit have carried out financial health check audits and issued reports to 62 schools since September 2011. The schools visited provide for primary aged pupils with numbers on the school roll ranging from 50 to 300 plus pupils, and a secondary school. These financial health checks have covered a number of key areas of financial management and control, including: Financial Administration and Governance Financial Planning and Budget Setting Budget Monitoring Purchasing Income Banking In addition to financial health checks, Internal Audit is also required to report on a number of themed reviews. This report constitutes the findings of a themed review which focuses on the bank reconciliation process and how it is carried out at these schools. This report presents the key findings from the audits completed, together with a brief summary of other issues arising. In addition, this report includes guidance to schools on actions which can be taken to implement controls that ensure bank reconciliations comply with the requirements of financial regulations and are in line with best practice guidance. Key Findings Across the schools visited, a variety of practices and procedures were found to be in place. Many schools were found to comply with requirements of the Wiltshire Schools Finance Manual and employ best practice in control over their bank account. However, a number of notable weaknesses were also found to be prevalent across several schools. Of the 62 schools visited, 14 recommendations were made in respect of the bank reconciliation process, and 17 weaknesses in process were reported on as other issues arising. The key weaknesses found in practice were: Not carrying out monthly bank reconciliations. Separation of duties / independent checks not in evidence. Bank account balances not reconciled to the general ledger. Un-reconciled items not cleared within six months. 3 Other Weaknesses Identified In addition to the four key control weaknesses identified, other failures in best practice were found at some schools: Balancing adjustments for which no explanation is given. Un-reconciled items report not retained on file. Frequency of reconciliations insufficient. Missing bank statement. No evidence or signature to confirm review. High value income not banked on a timely basis. Risks from Key Findings Not carrying out monthly bank reconciliations. Failure to carry out a regular, bank reconciliation as soon as possible following receipt of the monthly statement risks going overdrawn at the bank and losing funds due to fraud or error. It also means that the accuracy of the accounts will not be assured. The governors will want to be assured that the underlying accounts are accurate when they are presented with financial reports for budget monitoring or statements of the school’s overall financial position. As the bank account is the core supporting document to the school’s accounts, and is affected by every transaction undertaken by the school, regular reconciling is key to maintaining up to date and accurate school accounts. Regular bank reconciliation will also assist with completing an efficient year-end close down of the accounts; accounts with un-reconciled amounts and / or unresolved banking items will delay year-end close down. Separation of duties / independent checks not in evidence. Where there is a lack of separation of duties, tasks and responsibilities will not be adequately separated to ensure that one officer does not have total control or responsibility for one system. In smaller schools, the bank balance is generally reconciled by an officer who carries out other financial processes, and so there is a requirement for an independent check to be undertaken. Ideally, this should be performed by the Headteacher as they are responsible for the day to day management of the school finances. The bank reconciliation is a key process to providing assurance to all the main financial systems (e.g. accounts payable, accounts receivable, payroll and petty-cash). Inadequate separation of duties means that independent checks are not being carried out to verify the accuracy, completeness and regularity of banking and the other 4 financial processes. This therefore presents a risk to the security of the financial assets from fraud or error, and places the officer carrying out the tasks in a vulnerable position. Bank account balances not reconciled to the general ledger. Some schools have been found to only print the Bank Reconciliation report from the SIMS Financial Management System for the period ending the same as the bank statement. Checks are then undertaken to verify that the closing balance at the bottom of the Bank Reconciliation report matches the final balance on the bank statement. This does not demonstrate that the bank statement reconciles to the general ledger and risks not verifying the accuracy of the accounts. Un-reconciled items not cleared within six months. Failure to resolve un-reconciled items risks presenting out of date accounts because they do not accurately reflect the actual transactions which have taken place. Leaving un-reconciled items unresolved for long periods, without updating the accounts or annotating the reason, increases the risk of not understanding the nature or purpose of the item as time progresses. At some schools, it was found that un-reconciled items reports are not printed or retained. Failure to print un-reconciled items reports risks not detecting un-reconciled items, and not retaining the report risks not being able to demonstrate that the items, such as un-cleared cheques, have been investigated and resolved. Actions Which Can be Taken to Address these Risks Not carrying out monthly bank reconciliations. Some schools have left the bank reconciliation for a number of months but it is a requirement of the Financial Regulations, as stated in section 6.4 of the Wiltshire Schools Finance Manual, to carry out bank reconciliations regularly – at least monthly. This allows for the interruption of school holidays. Separation of duties / independent checks not in evidence. In many schools, especially smaller schools, the officer who usually carries out the bank reconciliation also carries out many of the processes which feed into the bank reconciliation as part of other financial systems, such as cash receipting and banking. In order to demonstrate separation of duties, at least two officers should be involved in operating a system so as to break up a series of processes to enable one person to act as a check on another. This aids detection of errors and supports officers by ensuring that accountability is effectively allocated to the more senior, responsible verifying officer. 5 Wherever possible, the Headteacher should verify the bank reconciliation as they hold responsibility for the school’s finances. However, the Headteacher can delegate this task to another member of staff but whoever carries out the checks must understand the bank reconciliation process and be able to query any anomalies. To demonstrate adequate separation of duties, both the person who performs the bank reconciliation and the person who checks it should sign and date the paperwork. It should be noted that the Headteacher, or delegated member of staff, is signing to confirm that they have checked the bank reconciliation and that they are satisfied it is complete and accurate. Bank account balances not reconciled to the general ledger To ensure the bank balance also balances to the general ledger (the school’s Financial Management System), the un-reconciled items report should be generated and printed. The total figure for all items on the report can then be added / deducted, as appropriate, to the net figure from the bank statement. This should match the ledger balance. In the event of any discrepancy, schools should contact their Support Accountant / Accounting & Budget Support helpline. Note: The ‘Current Ledger Balance at time of printing’ as presented on the Bank Reconciliation report is also stated on the Bank Reconciliation – un-reconciled items report. Both reported amounts should be the same, when both reports are printed at the same time. Un-reconciled items not cleared within six months. All un-reconciled items should be cleared within 6 months so as to ensure that accounts accurately reflect all actual transactions which have occurred. Schools can review their un-reconciled items by generating an un-reconciled items report from the SIMs Financial Management System at the same time as the Bank Reconciliation report. The officer can then review any items arising, and especially any that are over three months old. Un-reconciled items are often cheques that the supplier has not yet presented for payment at the bank. In these cases, schools should ask the creditor if they have received the cheque and when they are going to present it and note this on the report. If schools are unsure about how to treat an unresolved item they should contact their Support Accountant through the Accounting & Budget Support helpline. 6 Financial Regulations and the Wiltshire Schools Finance Manual All schools under local authority control are required to comply with the Wiltshire Council Financial Regulations as they pertain to financial management and administration within schools. The Wiltshire Schools Finance Manual (September 2008) is the primary document to which schools should refer to when seeking guidance. For example, section 6 of this manual states that: 1. Schools must reconcile the balance on their bank or building society statement with the balance on their ledger account. 2. This reconciliation must be done regularly – at least monthly. The reconciliation should be signed by the Responsible Officer to signify that it is complete and accurate. 3. A full audit trail and explanation of differences between the bank statement and the ledger bank account must be retained. 4. The main elements within a difference between the bank statement and the ledger bank account are: 5. a. Items in the Ledger Bank Account not in the Bank Statement (unreconciled items)* b. Items in the Bank Statement not in the Ledger Bank Account – create appropriate ledger transactions to recognise payments and receipts in the ledger and these should be actioned before the next bank reconciliation *. To complete the reconciliation, the un-reconciled items report must be printed. The balance should be added / subtracted from the bank statement balance to reconcile to the current ledger balance. The unreconciled items report must include all items up to the date of printing. * Please note the full version is in section 6.4 of the Wiltshire Schools Finance Manual. If schools have any queries or require accounting advice they should contact their Support Accountant via the Accounting and Budget Support helpline. 7 Sources of Best Practice Guidance There are various sources of Best Practice Guidance available to Headteachers, Finance and Administration Officers, as well as Governors. These include: Schools Finance Manual Keeping Your Balance Financial Regulations / Wiltshire Schools Finance Manual Bedfordshire School Finance Manual (Section 14, paragraph 14)** ** Dated 1 November 2001, this was formerly available on the FMSiS website and now on the Internet. A review of these sources finds that there are themes and requirements which apply across all of these guidance tools. The principle requirements of these sources fall into 3 key areas: Regular bank reconciliation Regular oversight and review Separation of duties In the first instance, schools need to ensure that they have clearly defined and documented procedures for carrying out bank reconciliations. Example of a documented procedure ( ) is responsible for promptly reconciling the account on a monthly basis and ensuring it never becomes overdrawn. ( ) will carry out a regular, independent review to ensure this is carried out effectively. The bank reconciliation will be recorded and signed by ( name the compiler and reviewer ). 8 APPENDIX 1 BANK RECONCILIATION BEST PRACTICE NOTES Key Controls Bank statements should be obtained at least monthly. Keep bank reconciliations up to date. Reconcile the bank balance to the ledger balance. Investigate discrepancies and note them. Staff responsible for undertaking bank reconciliations should not be responsible for the processing of receipts or payments. All bank reconciliations should be signed and dated by the person performing the reconciliation. Reconciliations should also be reviewed and countersigned and dated by someone who understands the reconciliation process. 9