Measurement Focus And Basis Of Accounting

advertisement

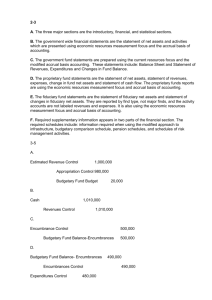

Learning Objective 5 Understand and explain the basic differences in the measurement focus and basis of accounting between governmental and private sector accounting. 12-1 Measurement Focus And Basis Of Accounting (MFBA) Measurement Focus What flows to measure for operations. Basis of Accounting When should transactions and events be recognized in the financial statements. 12-2 Measurement Focus And Basis Of Accounting (MFBA) 12-3 Measurement Focus And Basis Of Accounting (MFBA) 12-4 MFBA: Governmental Activities Measure flow: Current financial resources Basis of Accounting: Modified accrual basis of accounting • Present a Statement of Revenues and Expenditures and Changes in Fund Balance - shows financial resources received and spent. - shows change in net financial resources available for spending in the near future. 12-5 MFBA: Current Financial Resources Current financial resources: Cash, property tax receivables, prepaids, and supplies inventories. Claims against current financial resources: Wages, payroll taxes, payables to vendors, and liabilities expected to be paid in the near future (typically within 60 days after the year-end). 12-6 MFBA: Proprietary and Fiduciary Activities Measure flow: All economic resources Basis of Accounting: Accrual basis of accounting • Present a Statement of Revenues and Expenses - shows the change in the economic condition • Also present a Statement of Cash Flows 12-7 Measurement Focus and Basis of Accounting The modified accrual basis is used in funds that have a flow of current financial resources measurement focus The five governmental funds have this focus The accrual basis is used in funds that have a flow of economic resources measurement focus Proprietary funds and fiduciary funds have this focus The government-wide financial statements are based on the accrual basis 12-8 Measurement Focus and Basis of Accounting Modified Accrual Basis Revenues: Recognize in period in which they become available and measurable. Available means: Collectible within the current period or soon enough thereafter to be used to pay current period liabilities. Expenditures: Recognize in the accounting period in which the liabilities are both measurable and incurred and are payable out of current financial resources. One exception exists for interest on general longterm liabilities. 12-9 Measurement Focus and Basis of Accounting Recognition of revenue: how revenues are recognized depends on the category 1. Derived tax revenues, resulting from assessments on exchange transactions )االيرادات الضريبية المتأتية (ضرائب الدخل – ضرائب المبيعات 2. The asset is recognized when the underlying transaction occurs or resources are received, whichever comes first. Revenue recognition depends on the accounting basis used to measure the transaction. Imposed nonexchange revenues, resulting from assessments on nongovernmental entities, including individuals – ضرائب عقارية غرامات The asset is recognized when the government has an enforceable legal claim to the resources or the resources are received, whichever comes first. Revenue recognition is made in the period when use of the resources for current expenditures is first permitted or required, or at the time the asset is recorded if no time restriction on the fund’s use of the 12-10 resources exists. Measurement Focus and Basis of Accounting Recognition of revenue: how revenues are recognized depends on the category 3. Government-mandated nonexchange transactions, resulting from one governmental unit’s provision of resources to a governmental unit at another level and the requirement that the recipient use the resources for a specific purpose التعامالت الحكومية غير التبادلية مثل التحويالت من جهة حكومية لجهة حكومية أخري لمساعدتها في تغطية تكاليف برنامج حكومي الزامي 4. Voluntary nonexchange transactions, resulting from legislative or contractual agreements, other than exchanges التعامالت غير التبادلية التطوعية مثل تحويل مبالغ من األفراد او جهات حكومية لتحقيق هدف اجتماعي معين غير الزامي 12-11 Practice Quiz Question #4 The modified accrual basis of accounting: a. recognizes revenues when earned and expenditures when incurred. b. recognizes revenues when they become available and measureable and expenditures when liabilities become measurable and incurred. c. recognizes revenues when earned and expenses when incurred d. recognizes revenues when they become available and measureable and expenditures when they become available and spendable. 12-12 Practice Quiz Question #4 The modified accrual basis of accounting: a. recognizes revenues when earned and expenditures when incurred. b. recognizes revenues when they become available and measureable and expenditures when liabilities become measurable and incurred. c. recognizes revenues when earned and expenses when incurred d. recognizes revenues when they become available and measureable and expenditures when they become available and spendable. 12-13 Learning Objective 6 Understand and explain basic budgeting concepts in governmental accounting. 12-14 Budgetary Aspects of Governmental Operations Budgets Used in governmental accounting to assist in management control and to provide the legal authority to levy taxes, collect revenue, and make expenditures in accordance with the budget Types of budgets: Operating budgets Capital budgets 12-15 Budgetary Aspects of Governmental Operations Appropriation: The statutory authorization for spending a budgeted amount during a coming year. تخصيص Annual Budgets for the General Fund and the Special Revenue Funds are always recorded in the general ledger for control purposes. Also done for Capital Projects Funds and Debt Service Funds if useful. Encumbrances: Commitments related to unperformed (executory) contracts for goods or services. االرتباط Special general ledger accounts are used to record encumbrances—the purpose is to prevent spending more than has been appropriated. Budget entries have no effect on reported operations. 12-16 Introduction: Budget / Expenditure Process 1. Budget—Recorded in the books CAPITAL LETTERS (legally binding) 2. Expenditures Appropriation (authorization of the expenditure) Encumbrance (set aside or reserve part of the budgetary appropriation) Expenditure Disbursement 12-17 Budgetary Aspects of Governmental Operations Recording the Operating Budget Assume that at January 1, 20X1, the first day of the new fiscal period, the city council of Barb City approves the operating budget for the general fund, providing for $900,000 in revenue and $850,000 in expenditures. Approval of the budget provides the legal authority to levy the local property taxes and to appropriate resources for the expenditures. The entry made in the general fund’s accounting records on this date is as follows: January 1, 20X1 (1) ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE—UNASSIGNED 900,000 850,000 50,000 Record general fund budget for year. 12-18 Budgetary Aspects of Governmental Operations The ESTIMATED REVENUES CONTROL account is an anticipatory asset. The APPROPRIATIONS CONTROL account is an anticipatory liability. The excess of estimated revenues over anticipated expenditures is the budget surplus and is recorded to BUDGETARY FUND BALANCE—UNASSIGNED. Some approved budgets have budget deficits in which expected expenditures exceed anticipated revenue. These budgets are recorded with a debit to BUDGETARY FUND BALANCE—UNASSIGNED. 12-19 Example: Budget / Expenditure Process Assume a municipality approves the following budged: $900,000 in Revenues $850,000 in Appropriations An appropriation of $15,000 is approved, but the final voucher is paid for only $14,000. 12-20 Example: Budget / Expenditure Process 1. Budget ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE—UNASSIGNED 900,000 850,000 50,000 2. Expenditures Appropriation Authorization of the expenditure (Annual Budget) Person with authority (each expenditure authorized) Encumbrance ENCUMBRANCES BUDGETARY FUND BALANCE—ASSIGNED FOR ENC. 15,000 15,000 12-21 Example: Budget / Expenditure Process 2. Expenditures Expenditure BUDGETARY FUND BALANCE—ASSIGNED FOR ENC. 15,000 ENCUMBRANCES 15,000 Disbursement Expenditures 14,000 Vouchers Payable Vouchers Payable Cash 14,000 14,000 14,000 12-22 Text Page 837 12-23 Practice Quiz Question #4 Why to state and local governments record encumbrances? a. To ensure that the entity earns sufficient revenues to achieve profitability. b. To ensure that the entity does not spend more than has been appropriated. c. To ensure that all sub-entities within the organization are not encumbered. d. To ensure that the entity spends at least as much as has been appropriated. 12-24 Practice Quiz Question #4 Why to state and local governments record encumbrances? a. To ensure that the entity earns sufficient revenues to achieve profitability. b. To ensure that the entity does not spend more than has been appropriated. c. To ensure that all sub-entities within the organization are not encumbered. d. To ensure that the entity spends at least as much as has been appropriated. 12-25 Learning Objective 7 Make calculations and record journal entries for the general fund. 12-26